Know When You Need Help

If you feel overwhelmed by all of this, you should absolutely get a tax pro to help you out. If you don’t understand what to look for or what things you can write off, two things could happen:

- You claim things you can’t claim, setting you up for a possible audit

- You don’t claim things you’re allowed to, costing you a significantly larger tax bill.

Silver Tax Group Can Help With Your Doordash Taxes

Working as a delivery driver gives you a lot of freedom and the chance to make good money, but it can be challenging to figure out your tax obligations. Silver Tax Group has an experienced team that can assist you in preparing your DoorDash taxes and taking advantage of any deductions available to you.

Our expert tax attorneys have a long record of success in getting the best tax outcomes for our clients and defending them in any disputes with the IRS. Contact our office today for a quick consultation about DoorDash taxes or any other taxation questions.

Learn More About Your Taxes

Ready to secure your financial future? Subscribe Today For Tax Knowledge Tomorrow

How To Pay Quarterly Estimated Taxes

People who work for an employer have a portion of their medicare and social security taxes taken out of each paycheck. Their employer pays the other portion on their behalf. Additionally, as part of their total tax withholding, employees pay taxes on their income as they earn it. Ideally, the total amount withheld will cover any income taxes owed. Since self-employed workers dont have withholding, youll need to pay your own taxes during the tax year.

If you expect to owe more than $1,000 in taxes , then you are required to pay estimated taxes. If you dont make estimated tax payments, you may be charged a penalty by the IRS.

You are required to pay 100 percent of the total of your last years income taxes or 90 percent of the current years taxes. If you make over $150,000 in self-employment income, you must pay 110 percent of last years taxes. If you are driving for the first time, estimate your yearly salary based on your weekly earnings.

Most self-employed workers pay quarterly estimated taxes, but you can find a schedule that works for you. For example, you can treat self-employment taxes like a bill and pay a portion every month when other bills are due.

Estimated payments are due four times a year on the following dates:

| Income from: |

Recommended Reading: How To Not Owe Taxes

How To Fill Out Schedule C For Doordash Independent Contractors

Posted on – Last updated: October 3, 2022

Sponsored:

Filling out Schedule C is possibly the most essential part of figuring out your Doordash taxes.

It’s even more critical than the Doordash 1099 you get early each year . That’s because your Schedule C, and not your form 1099-NEC, is the form that determines your taxable income.

Even more important: Schedule C is the form that lets you write off your business expenses and the mileage from your car even if you take the $12,950 standard tax deduction .

And the thing is, it’s a bit simpler than you might think. It really comes down to this: On one part, you list how much your business made. In the next part, you list your expenses. You subtract expenses from income, and that’s your net profit.

That net profit is the part that gets moved over to your 1040 form as income. Your net profit is added to other income to determine your income tax. It’s the total left after expenses that your self-employment taxes are based on.

We’ll look a bit deeper at Schedule C for Dashers. In this article we’ll look at:

How Do You File Taxes As A Doordash Driver

Even though you will not be getting a W-2, your income tax filing process will not be much different than those who have traditional employment. You will get a 1099 from DoorDash, which will list how much pay you received through deliveries.

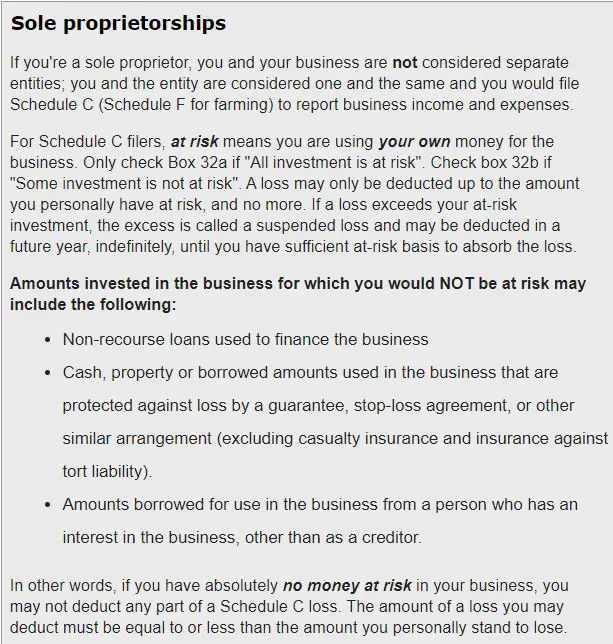

Most Dashers operate as a sole proprietor, meaning there is no legal structure to their work like there is with an LLC or S-corp. As such, they will still file a personal tax return. There is a section on the personal tax return called the Schedule C on Form 1040 where Dashers can write off their business expenses.

You May Like: When’s The Last Day To Do Taxes

There’s A Spot For The Home Deduction Can I Claim A Home Office

The IRS requires two things if you are going to claim space for a home office: 1) the space is dedicated to your business and is not used for personal purposes, and 2) a substantial part of your business operations happen in that space. In most cases, it’s difficult to make a case that a significant part of our operations as an on demand food delivery driver happen in your home office. We go into more detail on the home office deduction for Doordash drivers.

Schedule C Is The Form Where It All Happens

The most vital tax form for independent contractors is Schedule C: Profit or Loss From Business. Your Doordash Schedule C is where you write off your business expenses.

Here’s how it works: Schedule C has an income and an expense section. On the income part, add up your Doordash 1099 and total earnings from other food delivery companies such as Grubhub, Instacart, Uber Eats, etc.

The expense section lists several expense categories. For each category, enter the total spent on those expenses. There’s also a place for car expenses .

Next, subtract expenses from income to get taxable profits for your business. This taxable profit is used to determine self-employment tax and is added to other income for income tax purposes.

Schedule C is like our version of a W-2 form. Profit on this form, and not your 1099s, is what is added as income on your Federal tax return.

The Schedule C article in this series details all the things that must be entered on the form.

Read Also: How To Calculate Pay After Taxes

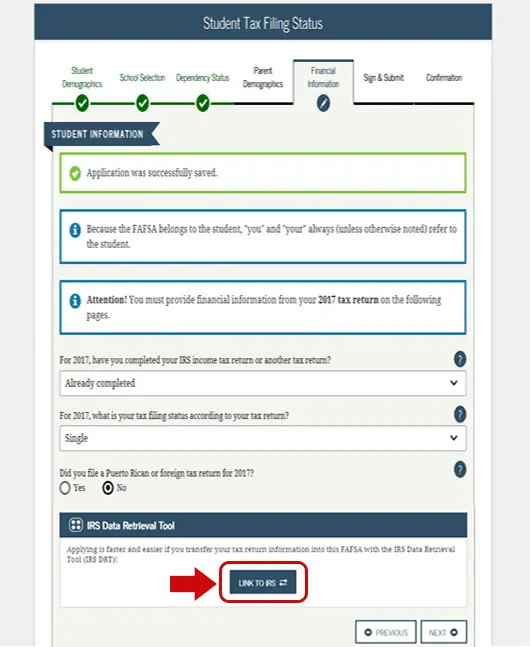

How Can I Change The Way I Will Receive My Doordash 1099

You can change the delivery preference any time up to one week before the due-date by using the payable app orfrom any browser. Follow our step by step tutorial:

Tracking Miles For Doordash Taxes

The IRS introduced an easy way to deduct vehicle expenses so they wouldn’t have to hoard or track their receipts.

This method is called the Standard Mileage Deduction. It’s really simple to calculate your deduction. All you need to do is track your mileage for taxes. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate.

In 2020, the rate was 57.5 cents. So, if you drove 5000 miles for DoorDash, your tax deduction would be $2,875.

Recommended Reading: How Do I Get Child Tax Credit

Does Doordash Take Taxes Out Of My Paycheck

The answer is no. As an independent contractor, you are responsible for paying your taxes.

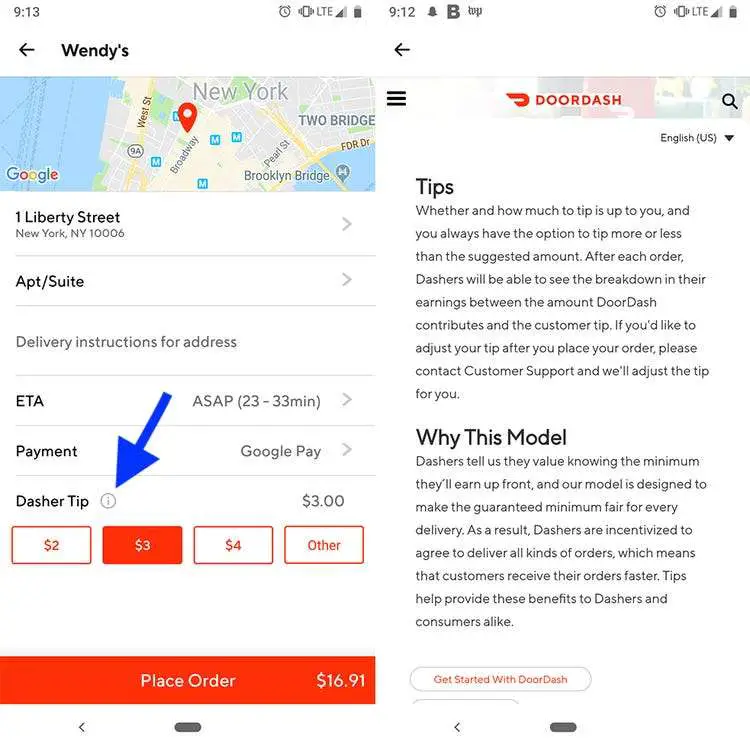

DoorDash is an independent contractor, which means it does not automatically withhold federal or state income taxes. You will have to calculate and pay the taxes yourself. However, there are different ways to go about this.

You will have to do some calculations once you have determined how much you earned. Following that, you will want to determine whether you qualify for any tax deductions. Don’t worry about getting it perfect at this stage. At this point, you have options in which to choose.

How To Take Your Doordash Write

Once you know what you can write off, you’ll need to fill out a Form Schedule C: Profit and Loss from Business.

Remember: You don’t need an LLC to take these write-offs. Even if you don’t have a business legal entity set up, the IRS automatically will classify you as a sole proprietor â someone who’s in business by themself. No matter your business structure, you need to fill out Schedule C to get your write-offs.

Don’t Miss: How Do I Report Tax Evasion

Dashers And Irs Tax Audits

If youre a gig worker, its important to be careful on your tax forms. As an independent contractor, youll need to file Schedule C with the IRS. People who file Schedule C are prime candidates for IRS audits, because many people may over-report their deductions and under-report their income. If your business income isnt reported accurately, or if you dont have the documents to support your claim, you may be at risk of an audit.

While the IRS isnt malicious in their audits, they are invested in looking at the details of what you do, and dont report. Tax Sharks tax audit defense insurance can save you headaches by responding to any audit notices you receive and defending you in an audit.

How You Can Earn Way More Than Average

While most people earn just a little extra cash driving for DoorDash, some drivers earn $40 or more per hour. Heres how they report to do it.

- Only accept large orders- DoorDash ranks you on your acceptance rate, but they wont stop you from driving without a warning first. Feel free to be picky about your orders, and find the largest orders. DoorDash customers tip based on a percentage system, so you want the biggest orders possible.

- Avoid high traffic areas- Traffic slows you down, and it makes parking nearly impossible. Try to avoid orders from the heart of downtown where its tough to figure out where to meet someone. You never want to pay for parking, because that will eat most of your profits.

- Drive during peak activity- Lunchtime and dinnertime offer great opportunities for Dashers. Dont bother working if nobody is ordering.

- Use multiple apps- Successful gig economy workers dont rely on a single app for their income. Become certified as an Uber, UberEats, Lyft, and DoorDash driver, so you can guarantee work any time.

Theres also a great DoorDash Reddit where you can learn from and find tips and tricks from other DoorDash drivers:

You can also learn some things to avoid as well!

Also Check: How Long Will It Take For My Tax Return

Dasher Taxes Are Based On Profits

Gig workers pay taxes based on profits from their gig work. This is different than paying taxes based on income from a salaried job. As a gig worker, you take on more of the risks and have more costs. Dashers can deduct certain costs from their income to calculate their profits, so you dont have to pay extra taxes on your expenses.

Common deductions for DoorDashers include mileage and cell phone data charges. In 2022, the mileage rate is 58.5 cents for businesses, including self-employed gig workers. Alternatively, you can deduct actual expenses, such as insurance, gas, and depreciation of your vehicles value.

Taxes Done Right For Freelancers And Gig Workers

TurboTax Self-Employed searches 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund and seewhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Do I Have To Pay Taxes

What Miles Can You Track For Doordash

The easiest way to determine if a mile driven is for business is whether you are logged into the Dasher app with the intent to accept reasonable offers.

You may claim miles driven to the restaurant or miles driven between deliveries. You are not restricted to times when food or merchandise is in your car.

We go into much more detail about the miles you can claim with Doordash in this part of our Doordash Taxes series.

How Do I Find My Form 1099

In your Payable account, you can choose how you want to receive your 1099.

For the previous tax year, Payable usually sends your 1099 via mail by January 31st. You can review your form online in your Payable account if your information was incorrect or you didn’t receive your form within 3-5 business days.

Also Check: How Do Tax Credits Work

Track Your Expenses And Your Business Mileage

With taxes based on profits, every recorded expense reduces your taxable income.

If you’re in the 12% tax bracket, every $100 in expenses reduces your tax bill by $27.30. That’s $12 in income tax and $15.30 in self-employment tax. $10,000 in tracked expenses reduces taxes by $2,730.

If you drive your car for your deliveries, every mile is a 62.5 cent reduction of taxable income.

Tracking those miles and expenses now will make things much easier for you when filing your tax return.

Sponsored:

What’s The Purpose Of Part V Other Expenses

Several expenses don’t fit well into the expense categories in lines 8 through 26. Part V is where you write a description of the items and the total paid for those items. Not having a description makes it easier for someone to simply make up an other expenses number.Other expenses might omc ide business subscriptions and memberships , Uber Eats service fees, etc.This other expense section is one reason I’m not a fan of Quickbooks Self Employed or Stride Tax. Neither one lets you create different other expense categories for tracking. Thus you get stuck doing a lot of work later.

Recommended Reading: How To File Past Years Taxes With Turbotax

Breakdown Of The Actual Expense Method

The actual expense method requires contractors to keep detailed records of their receipts for business-related expenses.

This method will allow you to deduct expenses like gasoline, car repairs, insurance, tire replacements, licenses and registration fees, etc.

Typically, tracking your receipts will result in a higher tax break. Calculate your tax deduction for both methods for yourself to see which one you give you the bigger write-off.

Understand Three Important Facts About Doordash Taxes

Your first step is to make sure you know these things going forward. We cover these in much more detail in other articles in this series. However, the remaining steps make more sense when you understand these.

1. Your tax impact is based on your profits, not total earnings from delivery fees, service fees, incentives, tips, etc.

This is good news.

Technically, we are small business owners. Dashers are self-employed, meaning you provide delivery services as a business and not as Doordash employees.

A business’s income is its profits, or what’s left over after expenses. That means you don’t pay taxes on the net income you received from Doordash pay and tips. That part is your gross income. You can claim your Dashing miles and Doordash business expenses regardless of whether you itemize deductions.

2. There are actually two different Federal taxes you must pay.

We don’t only have to worry about our Federal income taxes. Dashers must also self-employment taxes.

Calculating the self-employment tax impact is actually pretty simple once you’ve figured out your profits. It’s a straight 15.3% on every dollar you earn. Self-employment tax covers your Social Security and Medicare taxes. There are no tax deductions, tiers, or tax brackets. The only real exception is that the Social Security part of your taxes stops once you earn more than $147,000 .

3. These things impact your tax bill the part BEFORE payments and credits are applied.

Don’t Miss: What Is The Minimum Amount Of Income To File Taxes

Employee Vs Independent Contractor

The way you file your tax return for this innovative and evolving line of work largely depends on whether your delivery company hires you as an employee or as an independent contractor.

On-demand food companies can contract with drivers to make deliveries or hire them as employees. For employees, they typically will withhold from each paycheck federal income taxes on their earnings.

Independent contractors, on the other hand, have to pay their own taxes as they go by estimating the tax they owe and sending the IRS recurring payments throughout the year. You can use TurboTaxs free tax estimator to get an approximation of what you might owe.

Is There A Time When I Would Have A Cost Of Goods Sold As A Doordash Contractor

I can’t think of any. There might be a place where it’s used with some gig platforms. For example, Uber Eats will report they paid $13, but you only received $10 . They then say they charged you a $3 service fee. Some accountants say to use Cost of Goods Sold for that service fee since it’s a cost related directly to the service you are providing. Others will tell you to put it down as an Other Expense in line 27.

Read Also: How Do You File Taxes With Unemployment

Doordash Tax Calculator 202: How Dasher Earnings Impact Taxes

Posted on – Last updated: November 23, 2022

Sponsored:

While Doordash and other delivery gigs are a great way to bring in some extra cash, at some point, reality hits.

Taxes?

It’s not enough that taxes are even more complicated when you’re a self-employed independent contractor. You realize that you’re on your own. No one’s withholding taxes from your Doordash earnings for you.

To top it all off, you can’t just ask, how much will I owe? Well, you could, but since everyone’s situation is different, you’ll never get a good answer

So what do you do?

It’s true. Taxes are tricky, to put it mildly. It’s impossible for anyone to help you know exactly what to expect in only a single article. This is why we have an entire series of articles on how taxes work for Dashers.

This part of the series will discuss how to estimate your taxes. We’ll walk through the things to consider and then provide an actual calculator where you can plug in your numbers. We’ll talk about: