What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, much of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

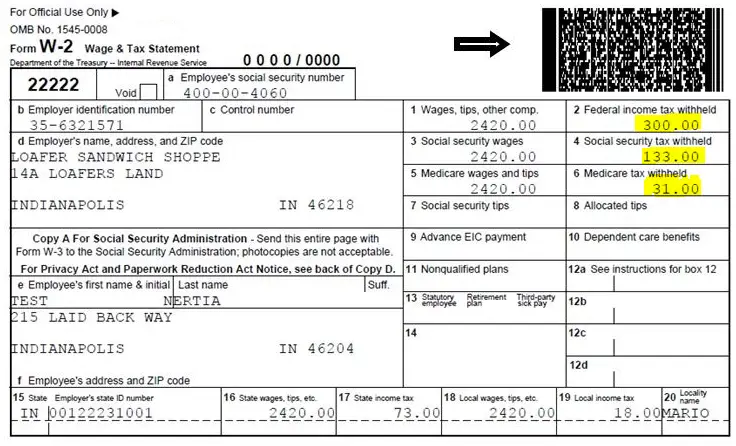

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Also Check: How Do I Get My Pin For My Taxes

State And Local Tax Brackets

States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal governments.

California has the highest state income tax at 13.3% with Hawaii , New Jersey , Oregon , and Minnesota rounding out the top five.

Five states and the District of Columbia have top rates above 7%, with Illinois scheduled to join them if Gov. J.B. Pritzker gets his way.

Seven states Florida, Alaska, Wyoming, Washington, Texas, South Dakota and Nevada have no state income tax.

Tennessee and New Hampshire tax interest and dividend income, but not income from wages.

Not surprisingly, New York City lives up to its reputation for taxing income with rates ranging from 3.078% to 3.876% remarkably, the Big Apple is not the worst. Most Pennsylvania cities tax income, with Philadelphia leading the way at 3.89% Scranton checks in at 3.4%. Ohio has more than 550 cities and towns that tax personal income.

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before Encrypt Cells with password Create Mailing List and send emails…

- Super Formula Bar Reading Layout Paste to Filtered Range…

- Merge Cells/Rows/Columns without losing Data Split Cells Content Combine Duplicate Rows/Columns… Prevent Duplicate Cells Compare Ranges…

- Select Duplicate or Unique Rows Select Blank Rows Super Find and Fuzzy Find in Many Workbooks Random Select…

- Exact Copy Multiple Cells without changing formula reference Auto Create References to Multiple Sheets Insert Bullets, Check Boxes and more…

- Extract Text, Add Text, Remove by Position, Remove Space Create and Print Paging Subtotals Convert Between Cells Content and Comments…

- Super Filter Advanced Sort by month/week/day, frequency and more Special Filter by bold, italic…

- Combine Workbooks and WorkSheets Merge Tables based on key columns Split Data into Multiple Sheets Batch Convert xls, xlsx and PDF…

- More than 300 powerful features. Supports Office/Excel 2007-2019 and 365. Supports all languages. Easy deploying in your enterprise or organization. Full features 30-day free trial. 60-day money back guarantee.

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

Also Check: Michigan.gov/collectionseservice

How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay. Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.

Federal Income Tax Calculator

for a 2021 Federal Tax Refund Estimator.Taxes are unavoidable and without planning, the annual tax liability can be very uncertain. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Read Also: How Much Does H& r Block Charge To Do Taxes

How Tax Brackets Add Up

In 2019, the IRS collected more than $3.5 trillion in Federal taxes paid by individuals and businesses individuals accounted for about 56% of that total.

The agency processed more than 253 million individual and business returns a whopping 73% of returns were filed electronically. Of roughly 154 million individual tax returns, 89% were e-filed.

Individuals and businesses claimed nearly 121.9 million refunds totaling more than $452 billion. The vast majority of these totals 119.8 million refunds amounting to more than $270 billion went to individuals.

Estimating Federal Income Tax

The calculator results provided here are an estimate based on taxable income only. The IRS uses many factors to calculate the actual tax you may owe in any given year. Note that if you are self-employed this calculator does not include estimated self-employment tax. Please consultIRS.gov Form 1040-ES for specific information about estimated tax for the self-employed.

You May Like: How Much Does H& r Block Charge To Do Taxes

Other Ways To Adjust The W

If it’s so early in the year that you haven’t received any paychecks yet, you can just divide your total tax liability for the year that just ended by the number of paychecks you receive in a year. Then, compare that amount to the amount that’s withheld from your first paycheck of the year once you get it and make any necessary adjustments from there.

If you adjust your W-4 to make up for any underpayment or overpayment partway through the year, you’ll want to fill out a new W-4 in January or your withholding will be off for the new year.

Of course, if your income fluctuates unpredictably, this is all a lot harder. But following the steps above should help you get close to a reasonable number.

And remember: You can redo your W-4 several times during the year if necessary.

How Much Tax Do You Pay On $10000

How much tax you pay on any amount of income depends on multiple factors, including your filing status and any deductions or credits you may qualify for. For the sake of simplicity, lets assume youre a single filer whose taxable income is exactly $9,000 and youre not taking any credits. Your 2020 federal income tax liability would be $900, according to IRS tax tables. But before you start worrying about whats next, at that income level you may not be required to file a federal return. The IRS offers an online toolto help you determine if you may or may not need to file.

Also Check: How Much Time To File Taxes

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee choose to claim, the less federal tax their employer deducted from their pay.

Withholding allowances are no longer used on the 2020 W-4 form.

What Are Tax Brackets

Tax brackets were created by the IRS to determine how much money you need to pay the IRS annually.

The amount you pay in taxes depends on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above.

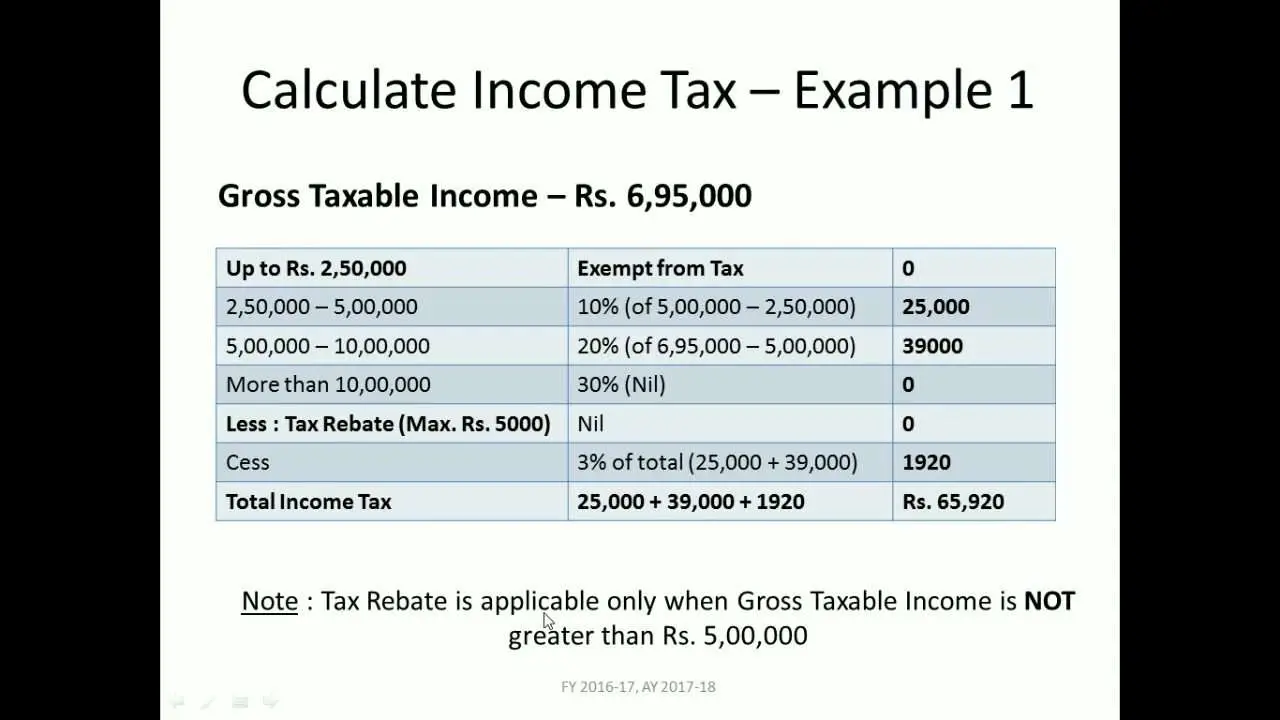

The tax system in the U.S. is progressive, which means your income is taxed at different levels. For example, if your taxable income is $50,000 for 2020, not all of it is taxed at 22% some of it will be taxed in lower brackets.

You can calculate the tax bracket that you fall into by dividing your income that will be taxed into groups the tax brackets. Each group has its own tax rate. The bracket you are in also depends on your filing status: if youre a single filer, married filing jointly, married filing separately or head of household.

The tax bracket your top dollar falls into is your marginal tax bracket. This tax bracket is the highest tax ratewhich applies to the top portion of your income.

For example, if you are single and your taxable income is $75,000 in 2020, your marginal tax bracket is 22%. Since your entire taxable income is not taxed at 22%, some of your income will be taxed at the lower tax brackets, 10% and 12%. As your income moves up the ladder, your taxes will increase. Take a look at this example for someone who has $75,000 in taxable income:

Read Also: Do I Need W2 To File Taxes

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Recommended Reading: How Can I Make Payments For My Taxes

Previous Years Tax Brackets

Taxes were originally due April 15, but as with a lot of things, it changed in 2020. The tax deadline was extended to July 15 in order to let Americans get their finances together without the burden of a due date right around the corner.

Here is a look at what the brackets and tax rates were for 2019:

2019 Tax Brackets| Tax rate |

|---|

Figure The Adjusted Wages

To get the adjusted annual wage amount, lets look at this worksheet. It can be daunting , but well break down each step. Note theres a different process depending on if the employee has a new W-4 or an old W-4 . It may help to have a copy of the new W-4 open in another window so you can refer to the form as we go down the worksheet.

Remember to use the Percentage Method Tables for Automated Payroll Systems if you are trying to verify Patriots FIT calculations.

- The biweekly wages are $3,000

- Multiply $3,000 by 26 pays for biweekly to get the annual wages of $78,000

- If the employee had an amount on Step 4a of the new W-4 with other income , add these two numbers together to increase their annual wages

Recommended Reading: What Does Agi Mean For Taxes

Choose Your Calculation Method

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

- The Wage Bracket Method: The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

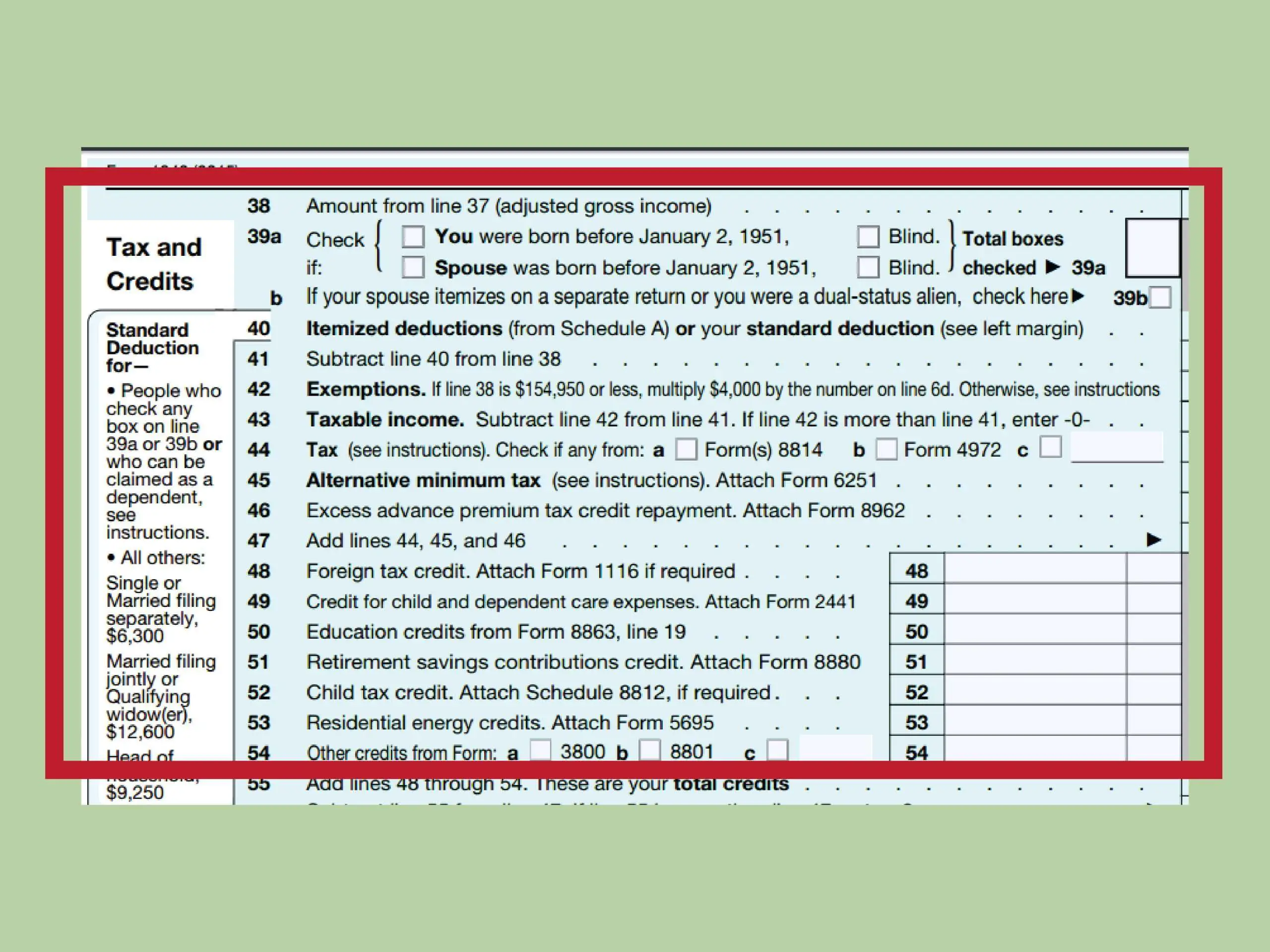

How To Arrive At Your Tax Due

After you’ve figured out your taxable income, there are a few more steps to arriving at your actual tax due.

- Subtract any payments and/or credits from your taxes owed.

- On lines 75 and 76, you will determine whether you owe taxes or will receive a refund.

If you’re getting a big refund, you’re probably having too much withheld from your paycheck. In effect, this means you’re giving the government an interest-free loan. On the other hand, if you have too little withheld, you may be charged an underpayment penalty.

Recommended Reading: Where’s My Tax Refund Ga

In Which Salary Bracket Is Your Taxable Income

Have you found the grade you fall into?

The next step is to identify the range in which your taxable income falls.

For example, mine is precisely 71,000 CHF.

So, I will have to refer to this line only.

One more step and you will have calculated the amount of taxes you will have to pay to the Confederation.

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are called brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2020 tax year, which are the taxes due in early 2021.

Also Check: Buying Tax Liens California

What Is Federal Income Tax

Federal income tax is taxes on income, both earned and unearned , according to the IRS. In the U.S., both individuals and businesses must pay federal income tax.

Federal taxes are the U.S. governments main source of funding. In 2019, individual income taxes accounted for approximately 50% of the federal governments nearly $3.5 trillion in total revenue, according to the Congressional Budget Office.

Taxes help keep the federal government running and providing essential services, such as benefits for senior citizens, veterans, the disabled and low-income families. Tax revenue also supports other important government operations and departments, like defense, transportation, health, justice and international affairs.

How To Calculate Income Tax Payable On The Balance Sheet

In order to come up with an accurate reporting of financial status, it is important for businesses and organizations to know how to compute income tax payable on the balance sheet.

Also Check: 1040paytax.com Official Site