How Taxpayers Can Check The Status Of Their Federal Tax Refund

IRS Tax Tip 2022-60, April 19, 2022

Once a taxpayer files their tax return, they want to know when they’ll receive their refund. The most convenient way to check on a tax refund is by using the Where’s My Refund? tool on IRS.gov. Taxpayers can start checking their refund status within 24 hours after the IRS acknowledges receipt of the taxpayer’s e-filed return. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Taxpayers can access the Where’s My Refund? tool two ways:

- Visiting IRS.gov

To use the tool, taxpayers will need:

- Their Social Security number or Individual Taxpayer Identification number

- Tax filing status

- The exact amount of the refund claimed on their tax return

The tool shows progress in three phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their bank of credit union to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

How Can I Estimate How Much My Tax Refund Will Be

The tax refund calculator takes into account your income, deductions, and credits to give you an estimate of your refund. The process is pretty simple.

If you are getting a refund, its best to file your taxes early in the year. If youre like most Americans, you wait until the last minute to prepare your federal income taxes. Filing your taxes early has its benefits.

The IRS issues refunds on a first-come, first-served basis, so the sooner you file, the sooner youll get your money. And if youre expecting one, why not get it as soon as possible?

How To Pay Federal Income Taxes On Unemployment Benefits

Perhaps the easiest way to pay taxes on unemployment compensation is to have federal income taxes withheld from your weekly payments. To have federal income taxes withheld, file Form W-4V with your states unemployment office to instruct them to withhold taxes.

If you request tax withholding, the state will withhold 10% of each paymentno other amounts or percentages are allowed.

Another option is to make estimated quarterly payments by mailing a check with Form 1040-ES or making a payment online via IRS Direct Pay. However, this option is fairly high maintenance compared to having tax withheld from your unemployment benefits.

First, you need to estimate the amount youll owe using your tax software or the worksheet accompanying Form 1040-ES. Then you need to make four quarterly payments, generally due April 15, June 15, September 15, and January 15 of the following year.

The final option is to wait until you file your tax return to see how much youll owe. However, this option can be risky because it can leave you with a large tax bill and underpayment penalties in April.

Read Also: What Tax Form Do I Give My Nanny

How To File Unemployment On Your Taxes

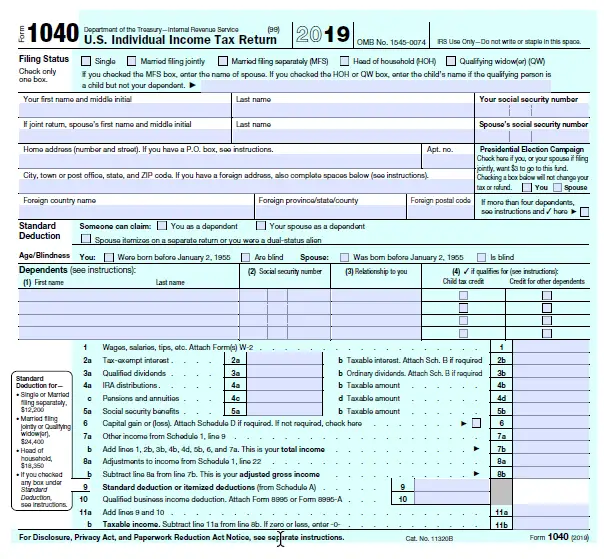

If youre wondering if unemployment is taxed, the answer is yes. These benefits are subject to both federal and state income taxes. The amounts you receive should be reflected on your taxes on Form 1040 .

Important tax planning notes:

- To pay less tax when you file your return, you should request withholding from your unemployment checks on the federal and state level.

- Youll receive a Form 1099-G in the mail that will report the amount of the unemployment benefits paid to you. This form will also show if you had taxes withheld.

You May Like: How To Draw Unemployment In Kentucky

How Do I Calculate Futa Taxes

For each payroll, you must determine FUTA taxes payable based on the total gross pay paid to employees, up to $7,000 per employee each year. Then multiply this total by the FUTA tax rate .

After you calculate the total tax for all employees for the pay period, you must set aside that total in a payables account in your accounting system. Unemployment tax is a trust fund tax, meaning that it is an amount you owe that must be paid to a government agency.

Also Check: Do Dependents Need To File Taxes

Calculating Your Tax Refund

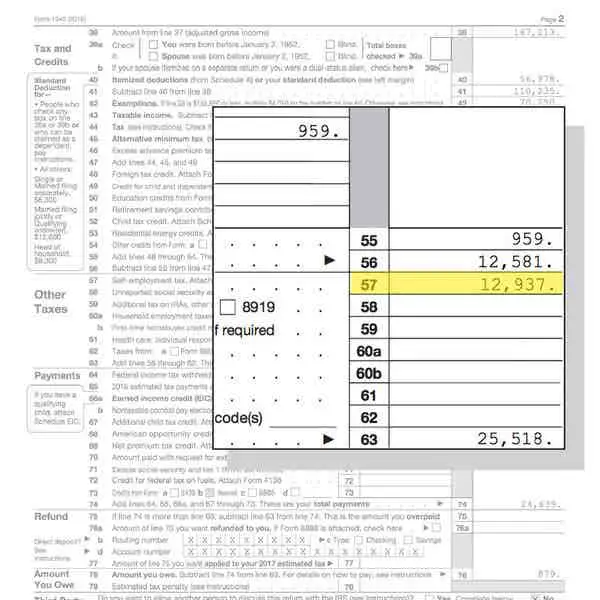

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Recommended Reading: How To Pay My Indiana State Taxes

How Federal Tax Refund Is Calculated

January 29, 2018 By Michael Taggart

With tax season just around the corner, you may be wondering how federal tax refund is calculated. Will you be receiving a refund from the IRS this year? Its always nice to receive one that serves as padding, for spring spending. Read on, to help you figure out exactly how much youll be receiving in federal tax refunds this year. An IRS tax calculator is always useful.

You May Like: How Much Is Tax In The Us

Transcript Of Return From The Irs

Cost: FreeProcessing Time: Instantly online or 5 to 10 business days by mail

You can request an IRS transcript of your tax return from the IRS website. A transcript includes items from your tax return as it was originally filed and will meet lending or immigration requirements.

There are three ways to request a transcript:

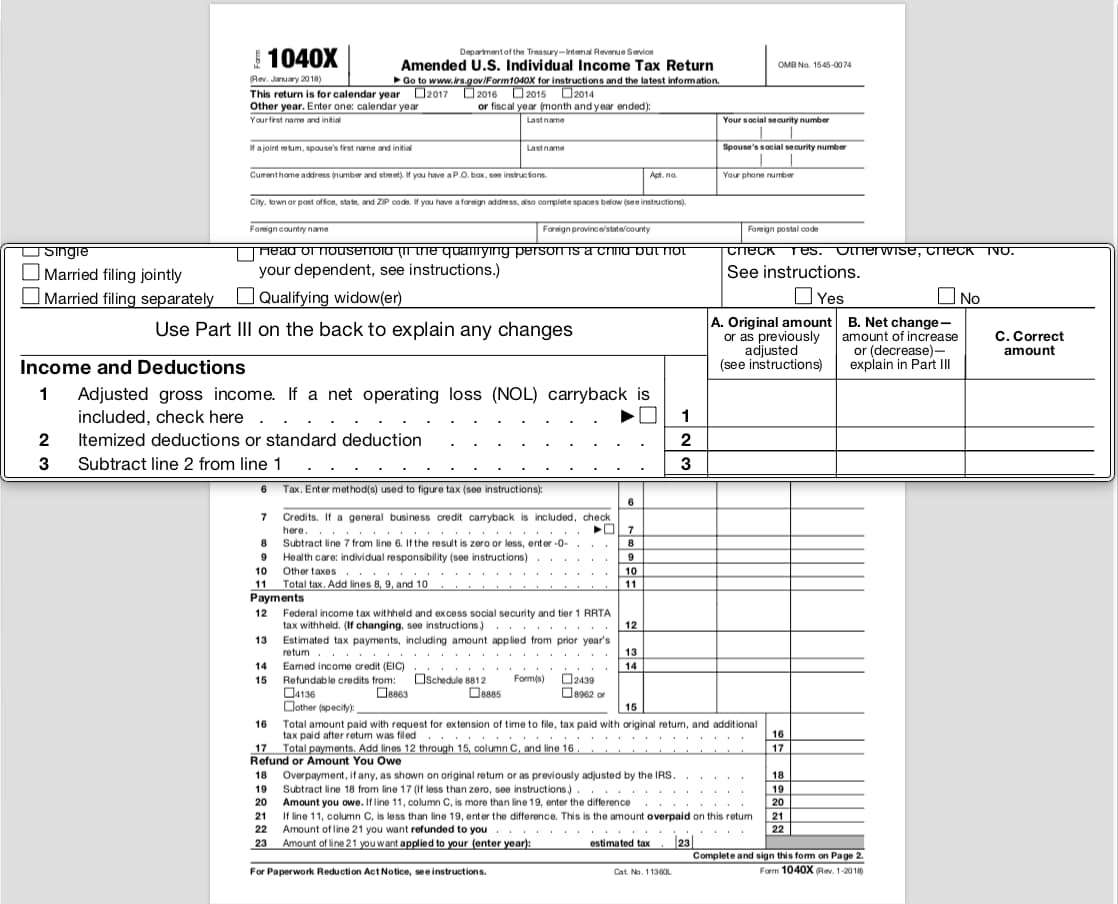

If you’d like to have a record of any changes made to your original tax return by the IRS or through subsequent amendments, you’ll need to request a Tax Account Transcript by calling the IRS at 1-800-908-9946.

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Don’t Miss: How To Track My Tax Refund Turbotax

Why The Irs Issues Refunds

Your employer determines the rate of your withholding tax by calculating your income, personal allowances, and other taxes you want to be withheld, as listed on your W-4 form.

Sometimes, however, your rate of withholding tax is greater than your actual tax liability, or the amount of tax you have to pay. This is why the IRS issues tax refunds to taxpayers, who qualify at the end of each tax season.

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Services Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

Recommended Reading: Can You Pay Taxes Online

How To Find And File Your Federal Tax Forms

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

If bureaucracies are good at anything, its creating paperwork, and the Internal Revenue Service is the king of all bureaucracies, especially when it comes to tax forms. Most paperwork needed for filing your federal tax return can be completed and submitted electronically, but youll need to acquire some forms, on paper or via the web, to get the job done. Well explain how to find and obtain the forms you need, how often the IRS updates its forms, and the options for filing your tax forms online.

For the 2021 tax year, the U.S. tax season began on Monday, January 24, 2022, which is when the IRS begins accepting and processing 2021 returns.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Recommended Reading: When Are Us Taxes Due 2021

New Refundable Tax Credits For The Self

The Families First Coronavirus Response Act was signed into law on March 18, making it the second major coronavirus-related bill. This bills chief provisions include changes to paid sick leave, insurance coverage for COVID-19 testing, waivers for food assistance, and other pandemic-related aid. In addition to changing the work requirements for receiving SNAP benefits, the bill also provided paid sick leave to the self-employed in the form of a tax credit.

Both the Qualified Sick Leave and Qualified Family Leave tax credits have been made effective as of April 1, 2020 and end March 31, 2021 under the COVID-related Tax Relief Act of 2020.

Frequently Asked Questions About 1099

Q â My tax preparer/program requires the state ID for box 10b. What number should I use?

A â All state withholding taxes were paid to the state of Michigan. If required, enter âMIâ in box 10a, and 38-6000134 in box 10b.

Q â Why is my overpayment, which I repaid, not reported on my Form 1099-G?

A â Please refer to the back of your 1099-G RE: Restitution, Penalties and Interest â Monies repaid to the UIA during tax year 2021 are not deducted from the amount shown in Box 1. Refer to your federal 1040 instruction booklet for further information.

Q â If I repaid an overpayment during the tax year, will I have to repay the taxes that were withheld?

A â Yes, UIA paid taxes on your behalf to the federal and state taxing authority at the time your benefit payment was created or issued. Because it was determined that you were not entitled to the payment, the tax withholding paid on your behalf is also considered to have been overpaid. As a result, you must also repay UIA for the federal and state taxes paid on your behalf.

Q â Are PUA amounts included in the 1099-G?

A â Yes. Your 1099-G will include a combined total of benefits paid on any program a claimant was on including UI, PEUC, EB, PUA, TRA or DUA. This will also include additional amounts such as Pandemic Unemployment Compensation and Lost Wages Assistance .

Q â How can I get a duplicate 1099-G?

Q â I paid back part or all of the amount reported on my 1099-G, Box 2. How do I get a corrected form?

Recommended Reading: Will Irs Extend Tax Deadline

I Never Got My Second Stimulus Check Even Though It Says It Was Mail Can I Claim It On My Taxes

If you are eligible for a stimulus check and it was lost, stolen or destroyed, you should request a payment trace so the IRS can determine if your payment was cashed.

If a trace is initiated and the IRS determines that the check wasnt cashed, the IRS says it will credit your account for it but the IRS cannot reissue the payment. Instead, you will need to claim the Recovery Rebate Credit on your 2020 tax return if eligible.

If you are filing your 2020 tax return before your trace is complete, do not include the payment amount on line 16 or 19 of the Recovery Rebate Credit Worksheet, the IRS says. You may receive a notice saying your Recovery Rebate Credit was changed, but an adjustment will be made after the trace is complete.If you do not request a trace on your payment, you may receive an error when claiming the Recovery Rebate Credit on your 2020 tax return.

Josh Rivera

Recommended Reading: When To Apply For Unemployment

Where Is My Refund

Check your State or Federal refund status with our tax refund trackers.

With the IRS tax refund tracker, you can learn about your federal income tax return and check the status of your federal refund instantly. The IRS’ Wheres My Tax Refund tool provides a safe, fast and easy-to-use portal to track your 2021 refund just 24 hours after it has been received. If youre seeking the status of an amended return, call the IRS directly at 1-800-829-1040. Found your federal return, but looking to get your refund even faster? When you file with Liberty Tax®, you may pre-qualify for an advance loan on your IRS tax refund. Learn more today.

You May Like: How To Pay Virginia State Taxes

Copies Of Old Returns

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Help With Unemployment Benefits And How To File Your Taxes

We understand that you may have a lot on your plate right now. Where your taxes are concerned, H& R Block is here to help. Be sure to visit our Unemployment Tax Resource Center for help with unemployment related topics.

Free tax filing with unemployment income: You can include your Form 1099-G for free with H& R Block Online Free.

Worried your taxes are too complex for H& R Block Free Online? Check out Blocks other ways to file.

Related Topics

Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H& R Block.

Also Check: How To Sign Up For Unemployment In Wisconsin

You May Like: How Old Do You Have To Be To File Taxes

Deadlines For Making Tax Forms Available To You

The IRS has established deadlines by which employers and financial institutions must mail you these forms or make them available electronically. Here are the deadlines for when youre supposed to receive some of the most common forms people need to file their 2021 tax returns.

- 1099-S, Proceeds from Real Estate Transactions Feb. 1

- Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc. March 15

What Is A Tax Transcript

A tax transcript is basically a printout summary of the major data on your tax return, including a particularly important one: adjusted gross income, or AGI.

The IRS doesnt charge for tax transcripts, and you can get one online immediately . Youll need to register online with the IRS before you can access the Get Transcript online tool.

In most cases, when you need tax return info you can use a tax transcript. Ask whoever needs your tax information whether a tax transcript will be OK or if a copy of the return is required.

Don’t Miss: How To Get My Tax Return Transcript