Who Can Impose A Tax Lien

While the federal government is most likely to place a tax lien on anyone who has not paid tax in the given time, some other authorities can also use it as a tool to collect other types of taxes, such as unpaid property taxes, counties, state tax boards and municipalities can file tax liens, and the Internal Revenue Service can place it to collect income taxes. Use the above form to perform an IRS tax lien search.

How The Irs Issues Liens

When you owe back taxes, the IRS can issue a federal tax lien that gives the IRS a legal claim to your property. A Notice of Federal Tax Lien may also be filed at your local courthouse and is a public record. A recorded federal tax lien establishes the governments right to your assets over other creditors.

The IRS waits to record most tax liens until after it has sent all five notices in the collection notice stream and hasnt received payment.

Youll want to avoid a Notice of Federal Tax Lien. Liens can affect your ability to attract new business clients, secure and maintain credit, and obtain employment.

Tax Lien Filing Process

If you owe back taxes and dont pay them, the IRS may issue a tax lien. Typically, the agency only issues tax liens when your back tax due is $10,000 or more, but there are some exceptions. Before issuing a tax lien, the IRS must:

- Assess your tax liability. Either by the taxpayer filing a return or the IRS filing a substitute return or assessing tax in an audit.

- Send you a demand letter, and give you 10 days to make arrangements.

Then, the taxpayer must not pay the bill or make any other arrangements to deal with the tax debt. Once these elements are in place, the IRS can file a tax lien with a local county recorder of deeds or the Secretary of State.

Read Also: How Much Are Payroll Taxes In Massachusetts

Know Your Search Options

You can search our database by:

- Debtors Name lists federal lien registrations by debtors name. Results include the debtors name, address, corporate FEIN , the liens status and the type of filing for each record.

- Document Number lists detailed information about the federal tax lien associated with the entered document number.

Assets Of Last Resort That The Irs Can Seize

The IRS can seize anything not listed above however, IRS policies discourage collectors from taking certain items. Retirement plans and homes are generally off limits. Vehicles needed for work are generally not seized if you can demonstrate there is a necessity for the vehicle.

Retirement Accounts

The IRS can take your Keogh, 401, IRA, or SEP. With an employer plan, however, the IRS can only grab it if it is vestedthat is, if you have the immediate right to take the benefits. In that case, you will be taxed when its levied by the IRS but do not have to pay the normal 10% penalty for early withdrawal if you are under age 59H.

In the case of hardship, the IRS can be stopped from taking retirement plans. Contact the Taxpayer Advocate Service immediately and plead that this will create a significant and undue economic hardship on you and your family. You may have to enter into a payment plan with the IRS in order to protect your retirement from levy.

Caution

Social Security and other federal payments are subject to IRS levy powers. The IRS can seize up to 15% of Social Security payments. If the IRS intends to levy on these payments, you will receive a CP-91 or CP-298 notice.

Primary Residences

As a last resort for dealing with an uncooperative taxpayer, the IRS can take a personal residence, mobile home, boat, or any other place you call home if you owe more than $5,000. For married couples, if only one spouse owes the IRS, the other may be able to stop the seizure.

Don’t Miss: Can You Pay Irs Taxes Online

The Fresh Start Program And Liens

The IRS doesnt want to permanently destroy taxpayers credit, but the agency is tasked with collecting the taxes that have been imposed. To give taxpayers more relief, the Fresh Start Program was rolled out in 2011 with the goal of making it as easy as possible for those who owe. One major part of this program was to set the threshold for which liens could be placed at $10,000 or more. So if your tax debt falls below that, you wont have to worry about that part of things.

At the same time, though, the Fresh Start Program also came up with ways that the IRS can help taxpayers get that notice withdrawn. Youll still owe the taxes that prompted the lien, but it will at least remove that stressor. There are two ways you can have the lien withdrawn: if you pay the debt in full or if you are actively paying your IRS debt down through a direct debit installment agreement.

Search For Irs Tax Lien Records

The majority of the emails and calls we receive at FederalTaxLienSearch.com are from Enrolled Agents, CPAs and Attorneys seeking IRS Federal Tax Lien lists for marketing purposes. But aside from tax pros, we also hear from taxpayers inquiring about their own IRS Tax Lien. There are free online resources which can help individual taxpayers get a copy of their IRS Notice of Federal Tax Lien.

Here are a few ways to find these records yourself .

1. Call Insight Tax Services.

My name is Andrew R. Schaefer and Im an Enrolled Agent and owner of Insight Tax Services in Orlando, Florida. I help people nationwide with tax issues at my IRS tax problem resolution practice everyday. I stop levies, remove liens, and save taxpayers millions of dollars in taxes and penalties every year. Id be happy to provide you a free, brief consultation to evaluate your options, including getting rid of your IRS Tax Lien and in some cases erase the filing from public records entirely . Please contact me through my tax firms website InsightTaxServices.com. If youre looking to buy IRS tax lien lists for marketing purposes call or text Andrew at 321-872-7742.

2. Call the IRS

3. Ask your County Clerk

Read Also: How Much Do You Have To Make To Owe Taxes

Federal Tax Lien And The Affordable Care Acts Shared Responsibility

The INDIVIDUAL shared responsibility provision calls for each individual to have minimum essential health coverage , qualify for a coverage exemption, or make a when filing their Federal income tax return.

SRP assessments post on the taxpayers account using a Master File Transaction Code 35 or the mirrored MFT 65.

How To Perform A Tax Lien Search

- Contact the IRS. While local and state government agencies can put a lien against your property, most tax liens that individuals deal with are placed by the federal government for tax payment issues.

- Get in touch with your state board of equalization if youre dealing with a tax lien that has been placed on a business property by your state or local government. Individual states like California all operate their own board of equalization.

- Use a third-party website to begin your property lien search. These can be useful when youre trying to find out if there is a lien against your property or if a lien you dealt with is still showing up. You may also be able to get basic information about tax liens on other properties via third-party websites.

Figuring out if you have a tax lien against your property is often a simple process since youll likely be notified by a government agency. However, there are cases where you may be living at a different address or your notices simply do not make it to you. The preceding list how you can perform a tax lien search

Recommended Reading: How To Find Tax Refund From Last Year

Where To Get Help

Taxpayers who need assistance in dealing with tax liens and tax collections should seek the advice of a federally authorized tax practitioner, such as a tax attorney, a certified public accountant, or an enrolled agent. Taxpayers can also receive free help from publicly funded tax clinics and the Taxpayer Advocate Service.

How To Find Out If You Have A Tax Lien

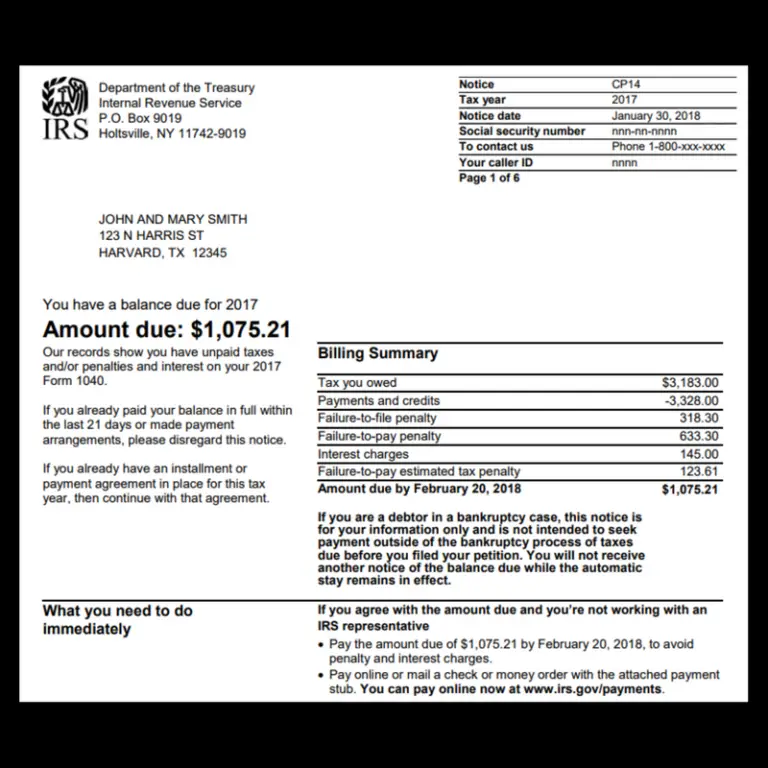

Before issuing a tax lien, the IRS has to send a letter. Usually, when the IRS files a notice of federal tax lien, you will receive IRS letter 3172. You will also receive a copy of 668Y, which is a copy of the actual notice of federal tax lien.

But if you didnt receive a letter, there are other ways to find out if you have a tax lien. You can call the IRS directly. You can also visit your Secretary of States website. Then, look for something that says UCC search or lien filings. If you dont see either of those options on the homepage, look at the site menu, or do a Google search for Secretary of State lien search.

In most cases, that should bring up the link you need. Once you find the right page, you can do a simple search for liens, just by entering your full name. You can also search based on a document number and a few other details.

Alternatively, to check for liens, you can contact the county clerk and recorders office. Keep in mind that the IRS likely filed a lien in the county of your latest address. If youve recently moved, check in the last county you lived. To find contact information for your area, search county recorder .

You can also find liens using legal research databases such as LexisNexis. However, there is a charge for these services, and with so many free options, theres no need to pay for information.

You May Like: Where’s My State Tax Refund 2021

Checking For Tax Liens

Although the IRS can be helpful, they arent the only resource for finding out if you have a federal tax lien. Since liens are placed with local authorities, one of the best places to start is with your secretary of states website. Look for lien filings and your state name or UCC search and your state name. Youll need to input identifying information like your filing number and your name to get the data you need.

There are also legal databases that provide access to information on property liens for a fee. Lexis Nexiss RiskView Liens & Judgments Report is one of those databases. This gives creditors and consumers access to up-to-date information on tax liens, as well as providing a transparent dispute resolution process to make it easy to report incorrect information.

Do I Have A Federal Tax Lien

Its important to know if you have a tax lien against you from the IRS because of unpaid taxes and/or penalties that are unpaid. A quick way to find out if you have a tax lien is by contacting the IRS directly. If you dont have a lien against you yet and owe a bunch of back taxes, you can setup an arrangement with the IRS to pay them back over time, this way you can avoid any potential lien being placed upon your assets.

Recommended Reading: How To Report Nonemployee Compensation On Tax Return

Receiving A Federal Tax Lien

Receiving a tax lien can be unnerving. However, a tax lien is also a misunderstood document. Most citizens who get a lien are often unaware of exactly what a tax lien is and what it represents. This can cause fear and unease with the recipient. Understanding what a lien is and how to deal with it will reduce some of those fears.

Special Tax Liens Applicable To Estates And Gifts

The Internal Revenue Code provides for a special estate tax lien and a gift tax lien, both of which are separate and independent of the general tax lien. IRC § 6324. The estate tax lien and the gift tax lien may exist simultaneously with the general lien provided for by IRC § 6321 or they may exist independently of the general lien under IRC § 6321. The estate and gift tax liens arise automatically, unlike the general tax lien. The following provides a summary of estate and gift tax liens. For more information on the Estate Tax and Gift Tax Liens, see IRM 5.5.8.

5.17.2.9.1

The Estate Tax Lien

When an individual dies, the estate tax lien automatically arises upon death for the estate tax liability. The Government does not have to take any action to create the estate tax lien. This means that the estate tax lien is in existence before the amount of the tax liability it secures is even ascertained. Detroit Bank v. United States, 317 U.S. 329 .

The estate tax lien attaches to the “gross estate” of the decedent. The gross estate, arising under federal law, includes certain types of property not included in the probate estate. For example, property held by trusts established by the decedent many years before death may be includible in the gross estate by reason of the trust instrument reserving to the decedent certain “powers,” such as the power to revoke the trust, change beneficiaries, etc.

5.17.2.9.2

The Gift Tax Lien

5.17.2.10

Read Also: When Do We Get Our Taxes

How Long Can Irs Pursue Back Taxes

As a general rule, there is a ten year statute of limitations on IRS collections. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. Subject to some important exceptions, once the ten years are up, the IRS has to stop its collection efforts.

How Can I Resolve A Tax Lien

You can avoid ever facing a tax lien or levy by simply paying your taxes in full and on time. If you cant pay in full, reach out to the IRS to make other arrangements rather than risk a lien or levy.

If a lien has been filed, you have options for getting rid of it.

- Pay the full amount you owe right away. The IRS will release the lien within 30 days of receiving your full payment.

- Ask to have the lien discharged from certain property. The IRS allows this under very specific circumstances. For example, you cant sell your house if theres a tax lien against it. But if selling it could give you the money you need to pay your taxes, the IRS might agree to discharge the lien.

- Generally, a tax lien takes precedence over other creditors. But under certain circumstances, the IRS could agree to let other creditors move ahead of its claim. For example, you cant refinance a mortgage with a tax lien against your property. But if refinancing would allow you to pay your taxes, or increase an amount youre already paying, the IRS might agree to subordinate its claim on your property.

- Finally, withdrawal of the lien removes it from your property, but still leaves you liable for the amount you owe. The IRS may agree to withdrawal for several reasons. For example, if youre up to date with your payment agreement or if withdrawing the lien will allow the IRS to collect the tax you owe.

Don’t Miss: How To File Pa State Tax Return

Can I Buy An Abandoned House

Buying an abandoned property can be a bargain for homebuyers. But abandoned properties that are unclaimed by their owners are potential low-cost purchases that may actually be attractive to prospective home buyers. An abandoned property is usually a property whose original owner is no longer in possession of the home.

How Can I Buy A House With Just Paying Taxes

A: The short answer to your questions is no. You cant simply pay the real estate taxes on a home and then become the owner of that home. At best, you have to follow the taxing authorities delinquent tax legal process to obtain title to the home, which might eventually lead to you owning the property.

Recommended Reading: Do I File My Personal Taxes With My Business Taxes

Keep Assets Out Of Sight

It is illegal to actively conceal assets from an IRS collector. Rarely, however, is an ordinary citizen pursued for keeping a classic 57 Chevy in a friends garage. Nevertheless, particularly if you are a known tax protestor or crime figure, dont try this without first getting some legal advice.

Keep moveable items away from your home or business premises. The IRS wont know where to look for vehicles, boats, and similar assets if theyre not located where the IRS expects them. Similarly, assets located outside the state or country can be quite difficult for the IRS to discover.

Lexis Nexis Legal Database

Tax liens are public record. If you have access to the legal database Lexis Nexis, the RiskView Liens & Judgements database can provide visibility into how to resolve or dispute the lien.

Depending on the type of lien filing, following up with a tax professional may be in your best interest. They will then be able to advise on the recommended next steps.

Recommended Reading: Can I File Back Taxes Online

What Is An Irs Tax Lien

An IRS tax lien is a right or claim to your property. The IRS tax lien generally arises when you owe a tax debt and fail to timely pay it. The IRS lien arises at the time of assessment, i.e., the time that the IRS records a tax liability as being due.

The IRSs lien is a general tax lien in that it attaches to all of your property. This includes all of your real and personal property, your cash, and even property and cash you acquire after the lien arises.

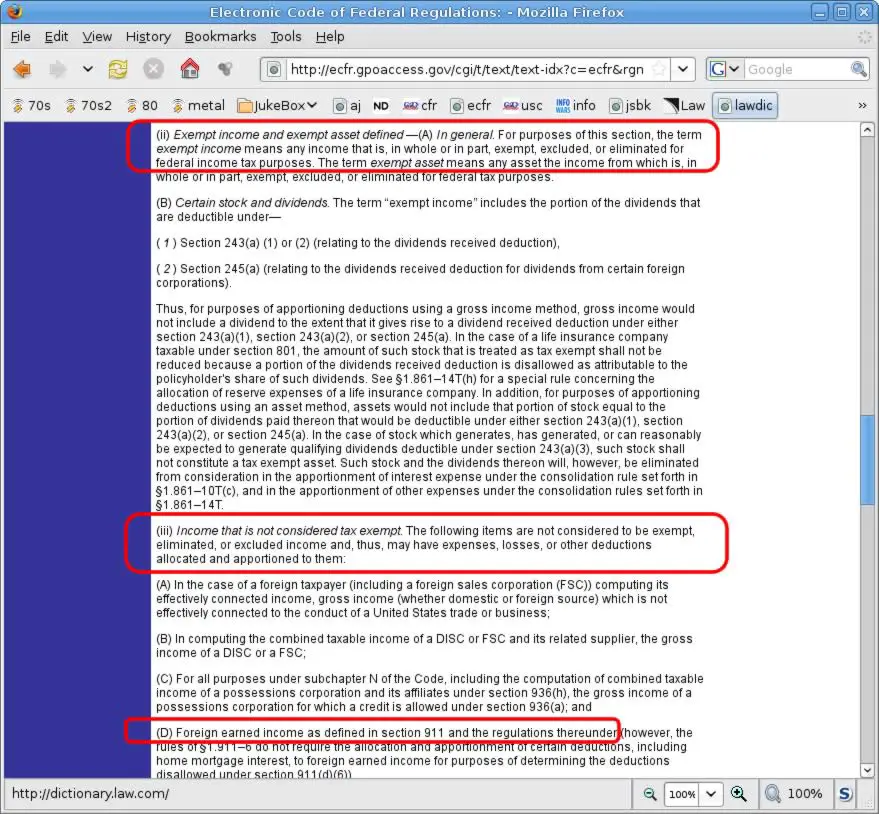

The authority for the IRS lien is found in I.R.C, § 6321. Section 6231 provides that if:

any person liable to pay any tax neglects or refuses to pay the same after demand, the amount shall be a lien in favor of the United States upon all property and rights to property, whether real or personal, belonging to such person.

The key terms are any and all.