Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Property Owner Appeal Process Guide

As the owner of real property in South Dakota, you have the right to ensure your property is being assessed at no more than market value, as well as assessed equitably in relationship to other properties. Understand the process of appealing your assessed value with the Property Owner Appeal Process Guide .

Property Tax Transparency Portal

The South Dakota Property Tax Portal is the one stop shop for property tax information, resources and laws. This system features the Property Tax Explainer Tool that provides a high level breakdown of some of the levies assessed within a specific jurisdiction, numerous DOR property tax facts, publications, forms, and multiple years of property tax data.

While the state does not collect or spend any property tax money, property taxes are the primary source of funding for school systems, counties, municipalities, and other units of local government. Not only is the portal a great resource for finding property tax information, it also makes available data open and transparent for everyone. The previous Property Sales Search is still available for your property tax search needs.

To visit the site click here.

Also Check: Why Raising Taxes On The Rich Is Bad

Property Tax Relief Programs

A number of relief programs offer financial assistance to the elderly and disabled. The Department has put together an overview document on these programs. The Property Tax Reduction Programs Overview document includes information about each program, deadlines and who to contact for more information.

Find descriptions of each program and application forms.

Welcome To Tarrant County Property Tax Division

Tarrant County has the highest number of property tax accounts in the State of Texas. In keeping with our Mission Statement, we strive for excellence in all areas of property tax collections.

Our primary focus is on taking care of citizens. Please complete a comment card and drop in the designated location when you visit our offices, or use our electronic form to let us know how we are doing.

Please be aware that there is no fee to apply for exemptions through Tarrant Appraisal District or apply for refunds for overpayment or adjustments to your taxes. Please contact us if you have questions before paying a third party to assist you. Texas Attorney General Paxton has issued an alert on misleading tax exemption offers.

A newly updated and user-friendly property tax payment portal is now available to all taxpayers in Tarrant County! The new portal is full of features to make online searches and payments easier.

Links to the old tax payment application have been deactivated. Please update your bookmarks as you navigate the new tax portal for the first time.

PLEASE NOTE: You are no longer required to create a profile to make an online payment. Most active profiles have been migrated to the new system. Active profiles will be prompted for a new password. Although not required, users may create a new profile if desired.

Don’t Miss: Where Is My Tax Return Check

Make Sure All Registered Owners Agree To Defer Property Taxes

If theres more than one registered owner or authorized representative of the property, they each must agree to the applications terms and conditions.

For them to agree, you must share the following information with them:

- The confirmation number you received after you submitted the application

- The link for them to Enter into an Agreement:

Each registered owner or authorized representative must enter into an agreement and agree to the terms and conditions within 28 days of the application date.

Your application will not be processed until all owners enter into the agreement.

A reminder letter will be mailed to you 14 days after you apply if the other owners have not yet entered into the agreement.

Your application will be cancelled if each owner does not enter into the agreement within the 28 days.

If a registered owner is deceased, you must contact the Land Title Office to remove their name from the property title. You may have to re-apply once your title is updated.

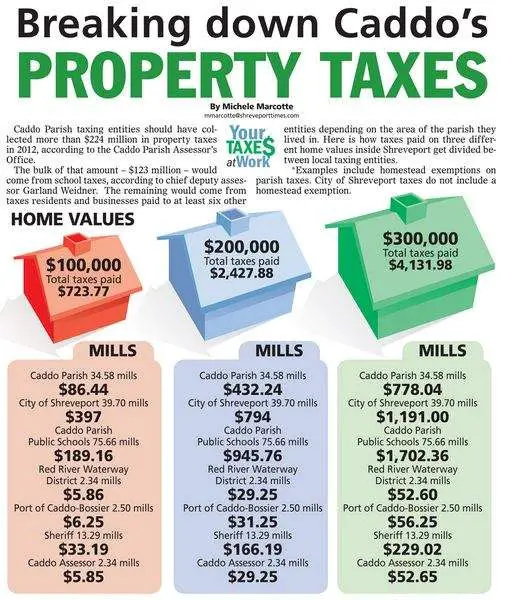

How Do Property Taxes Work

Let’s define a couple of key terms before we get into the details of how property taxes work. First, you must become familiar with the “assessment ratio.” The assessment ratio is the ratio of the home value as determined by an official appraisal and the value as determined by the market. So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% . The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

Wondering how the county assessor appraises your property? Again, this will depend on your countys practices, but its common for appraisals to occur once a year, once every five years or somewhere in between. The process can sometimes get complicated. In a few states, your assessed value is equal to the current market rate of your home. The assessor determines this by comparing recent sales of homes similar to yours. In other states, your assessed value is thousands less than the market value. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website.

To put it all together, take your assessed value and subtract any applicable exemptions for which you’re eligible and you get the taxable value of your property.

You May Like: How Much Will My Mortgage Be With Taxes And Insurance

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

You May Like: How To Find Property Tax Information

How Property Taxes Are Calculated

What Are Property Tax Exemptions

Here’s a breakdown of some of the most common property tax exemptions:

- Senior Citizens

- Veterans/Disabled Veterans

Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. These specialized exemptions are usually a reduction of up to 50% of taxable value. However, rates can vary by location.

Some states offer exemptions structured as an automatic reduction without any participation by the homeowner if your property is your primary residence. Other states and counties require applications and proof for specific exemptions such as a homeowner whos a disabled veteran.

Lets look at an example with regard to the homestead exemption, which safeguards the surviving spouse and protects the value of a home from property taxes and creditors in the event a homeowner dies.

Say your state offers a homestead exemption for a homeowners primary residence that offers a 50% reduction of the home’s taxable value.

This means that if your home was assessed at $150,000, and you qualified for an exemption of 50%, your taxable home value would become $75,000. The millage rates would apply to that reduced number, rather than the full assessed value.

Its worth spending some time researching whether you qualify for any applicable exemptions in your area. If you do, you can save thousands over the years.

You May Like: Where Is My Agi On My Tax Return

When Your Application Is Approved

If you applied for the first time on your property and your application is approved:

If you renewed your application:

- You will not receive an approval letter

You can check your application status online at any time.

Note: Only property classifications for Residential and Residential and Farm are deferrable. All other property classifications must be paid to your tax office.

Fees

If you applied for or renewed the Regular Program, a fee is added to your account:

- $60 for new applications

There are no fees for the Families with Children Program.

Interest

Simple interest is charged on the deferred tax amount starting from the date your property taxes are due or the date you applied to defer, whichever is later. Find out how interest is applied to your tax deferment loan.

How Do I Pay My Property Taxes Online Eluru

The portal offers an online payment option to its users. By visiting the cdma.ap.gov.in/en/welcome-eluru-municipal-corporation-3 citizens can pay property tax, water bill, House Tax, Professional Tax, Water Bill, etc.

Where do I go to file property tax?

The user should click on the click here to file property tax button. Once the user chooses the right option, he should enter his property id to retrieve the previous tax payment information. When the first section is completed, the second section will display the property tax amount which has to be paid.

Is it possible to pay property tax online?

You will be able to pay property tax online only if your municipal corporation has made the facility available. To be able to pay tax online you will need to gather the details of your property in relation to the location of the property.

Read Also: How To Stop Property Tax Auction

South Dakota Buffer Strip Program

South Dakota agricultural property owners with riparian buffer strips have until October 15 to apply for a property tax incentive. Eligible waterways are determined by the Department of Agriculture and Natural Resources with additional waterways as allowed by the county commission. If you have questions about the eligibility of your land, contact your local Director of Equalization. To be eligible applicants must meet the following requirements:

- The land must consist of existing or planted perennial vegetation.

- The buffer strip has to be a minimum of 50 feet wide and can be a maximum of 120 feet wide. The measurement starts at the top of the bank or where the vegetation startswhichever is closest to the water.

- The vegetation cannot be harvested or mowed before July 10, unless the riparian buffer strip is impacted by center pivot irrigation, then the perennial vegetation may not be harvested or mowed before June 25. A minimum of 4 inches of vegetation must be maintained at all times.

- The land may not be grazed from May through September.

Families With Children Program

You may qualify for the Families with Children Program if you’re a parent, stepparent or financially supporting a child.

You must also meet applicant, property and equity qualifications to be eligible for the Families with Children Program:

To qualify for this program you must:

- Be a Canadian citizen or permanent resident of Canada

- Be a registered owner of the property

- Have lived in B.C. for at least one year prior to applying

- Pay property taxes for the residence to a municipality or the province, and

- Have paid all previous years’ property taxes, utility user fees, penalties and interest

You must also be financially supporting either:

You may need to show proof that you’re financially supporting a child under the age of 18 who doesnt live with you.

To qualify for this program, your eligible property must:

- Be your principal residence

- Be taxed as residential or residential and farm

You must have and maintain a minimum equity of 15% of the property’s assessed value. This means that all charges registered against your property plus the amount of taxes you want to defer cant be more than 85% of the BC Assessment value of your property in the year you apply.If you have a secured debt on your property, such as a mortgage or a line of credit, contact your lender before you apply to ensure your approval into the tax deferment program doesn’t conflict with the terms of your loan.Find out how your equity is calculated.

You May Like: How Much Is Sales Tax In Ohio

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

Treasury Services Are Currently Available Online By Phone Email Or Us Mail:

- Phone: Real Property Tax 206-263-2890

- Real Property Email:

- Phone: Mobile Homes and Personal Property Commercial Property Tax 206-263-2844

- Personal Property Email:

- Mail: King County Treasury Operations, 201 S. Jackson Street, Suite 710, Seattle, WA 98104 NOTE NEW MAILING ADDRESS

- Secure drop box: on side of 2nd Ave nearer to S Jackson St.

I know my parcel/account number

Need additional information? Check our Frequently Asked Questions .

Also Check: Where’s My Unemployment Tax Refund

Relationship Between Property Values & Taxes

- Prior to the economic downturn, property values were increasing annually, reaching a high of $58 billion in assessed value in fiscal year 2009.

- In addition, new construction was added to the rolls each year, also increasing the assessed value to be taxed.

- Both these helped keep the tax rate down.

How Do I Find My Ptin Number

For finding your PTIN, visitLocality Search and enter your Property Circle and your name or door number. This will enable you to retrieve your property details and by clicking on PTINs, it gives you the details of your Property tax dues. Choose your card type and make your payment.

How do I get a PTIN number?

Most first-time applicants can obtain a PTIN in about 15 minutes by visiting the online PTIN System and clicking Create an Online PTIN Account. At this time, there is no fee to apply for a PTIN. View this checklist to get started. It only takes about 15 minutes to apply for or renew your PTIN online.

How is House tax calculated in UP?

Calculation of Annual Value. Annual Value-Carpet area x fixed per unit area monthly rate of rent x 12. Or Covered area x fixed per cent unit area monthly rate of rent x 12 x 80% Payable tax. Taxes would be payable in according with the rates fixed under Section 148 of the Act on the basis of annual value.

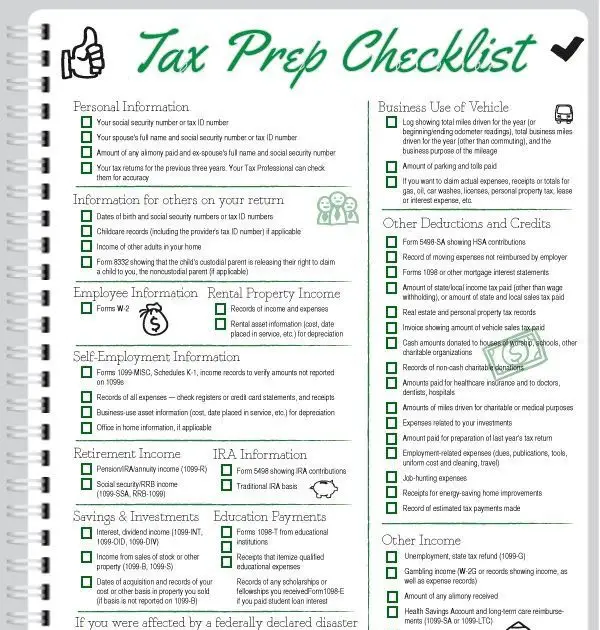

You May Like: How To File Quarterly Taxes