Determine Your Eligibility For An Ein

There are two basic requirements that must be met to apply for an employer identification number:

-

Your principal business must be located in the U.S. or U.S. territories.

-

The person applying must have a valid taxpayer identification number, such as a Social Security number.

Your principal business is determined by identifying the main income-generating activity that you do and your main physical location. Just because you provide services outside of the U.S. doesnt necessarily mean that you dont meet the eligibility requirements. As long as your primary business activities are in the U.S., you are eligible to apply for an EIN.

The person who submits the application doesnt need to be the business owner. The applicant can be a partner or officer of the company. The IRS allows any responsible party to apply, which they define as anyone who manages the companys finances. Another individual, such as a secretary or assistant, can also apply provided that a responsible party signs Form SS-4 and fills out the third-party designee section.

Also Check: How To Pay Tax By Phone

Finding Your Individual Tax Id

How Can I Use My Tax Id Number To File My Taxes

As a business owner, you are responsible for ensuring that your business pays its taxes on time. One of the first steps in filing your taxes is to obtain a Tax ID number for your business. This number is also known as an Employer Identification Number .

You can use your Tax ID number to file your business taxes, open a business bank account, and apply for business licenses and permits. It is important to keep your Tax ID number confidential do not give it out to anyone who does not need it to conduct business with your company.

If you do not have a Tax ID number for your business, you can apply for one online through the IRS website. The application process is simple and takes only a few minutes to complete. Once you have received your Tax ID number, be sure to keep it in a safe place so that you can access it when you need it.

Don’t Miss: Does North Carolina Tax Retirement Income

Check Your Tax Documents

You can find the number on the top right corner of your business tax return. If you open the return and discover that the number has been replaced with asterisks for security purposes, contact your CPA and request the number from them.

The business EIN is listed on the top right of a business tax return. Image source: Author

If you file your own taxes with tax software, the software will save the number from year to year. Visit the softwares business section to retrieve your EIN.

Can You Look Up Anothers Business Ein

If you need to do an EIN number lookup for a different business, you will encounter plenty of roadblocks.

The best way to get it is to ask someone you have a relationship with at the company. If you need the number for a legitimate purpose, you should be able to get it from the other companys accountant.

If the company has applied for a liquor license or building permit, you may be able to find its EIN on the local area chamber of commerce or secretary of state database.

For public companies, you can look up the EIN on the SECs website. Search the companys name, and pull up the most recent 10-Q or 10K.

The EIN is listed with the title I.R.S. Employer Identification Number on Netflixs recent 10-Q.

All non-profit EINs are public information, and you can find them in the IRS database.

If none of these suggestions yield results, you likely wont be able to find the number for free.

You can pay for a business credit report from any of the major providers, do a business search with a legal database like LexisNexis, or use a specific EIN search company that combs through government filings to find the number.

Out of those options, I would recommend purchasing a business credit report as the agencies providing those are generally bigger and more legitimate.

Also Check: Will I Be Taxed On My Stimulus Check

When Should My Business Consider An Ein

Some businesses may be able to operate without an EIN. However, according to the IRS, you may need to apply for one if your business plans to:

- Operate as a corporation or partnership

- File employment, excise, tobacco, firearms or alcohol tax returns

If youre unsure whether your business needs an EIN, you can talk to a certified accountant or tax professional for guidance regarding your individual situation.

How To Apply For An Employer Identification Number In 3 Steps

Ideally, you should apply for an EIN when you first launch your business, but you might also be applying in time for tax season or to submit a business loan application. The application process is free through the IRS, so be wary of companies that charge you to apply for an EIN on your behalf.

Follow these simple instructions to apply for an employer identification number.

Recommended Reading: How To Get Less Taxes Taken Out Of Paycheck

Purpose Of The Tin And Ein

TIN’s and EIN’s establish your business’s identity, much as your Social Security number establishes yours. The IRS needs your TIN or EIN when you file your business’s taxes or, in the case of LLCs, LLPs and partnerships whose tax liabilities are passed on to their owners, when you file the business’s annual reports outlining financial performance.

Finding An Ein For Another Business

Getting someone elses EIN is a more challenging process. Many of the documents with an EIN on them are public documents , but there’s still an overall concern about privacy and business identity theft.

You can look the business up on the EDGAR Search service on the Securities and Exchange Commission website if it’s a public company .

Your search will be more difficult if the company isn’t a public company. You might be able to buy a business credit report for the company, or you might be able to find another public document that includes the companys EIN.

Recommended Reading: When Are Alabama State Taxes Due

Q9 What Is Placement Documentation

A9. Placement documentation is the signed documentation placing the child in your care for legal adoption. In general, one of the following documents will satisfy this requirement:

- A placement agreement entered into between you and a public or private adoption agency.

- A document signed by a hospital official authorizing the release of a newborn child to you for legal adoption.

- A court order or other court document ordering or approving the placement of a child with you for legal adoption.

- An affidavit signed by an attorney, a government official, etc., placing the child with you pursuant to the states legal adoption laws.

The placement documentation is sometimes referred to as Placement AgreementSurrender PapersTemporary Placement PaperworkPlacement Order etc. This documentation termed differently from state to state must clearly establish that the child was placed in your home for purposes of adoption by an authorized adoption agency , and must include the following information:

- Adoptive Parent full name

Do I Need A Tax Id Number

A tax ID number isnt necessarily a requirement for all businesses , but it is impossible to accomplish certain things unless you have one. While not every business needs to get a tax ID number, most will want to. Here are the main reasons why you should consider obtaining a tax ID number for your business:

- To file taxes separately from your personal taxes: Depending on your business entity, you may be required to obtain a tax ID number so that the business can file taxes separately from your personal tax return. All partnerships, corporations and LLCs that elect to be taxed as a corporation must obtain one to file their taxes.

- When you want to hire employees: If you plan on hiring someone to work in your business, then you have to have your business tax ID number in order to do so.

- When you create a Keogh plan: Any tax-deferred pension plan, typically created for a self-employed individual, will need to obtain a tax ID number to open the plan.

- You may need one just for being in a certain industry: If your business is required to pay certain taxes beyond income tax, then you may be required to have a business tax ID number. An example would be a trucking company that is required to pay excise taxes.

Additionally, some financial institutions may not allow you to open a business bank account without one, and there may be some types of business licenses where one is required, but this is not always the case.

Recommended Reading: How To Find Tax Id

How Do I Get A Tax Id Number For A New Business

To review, here are the options if youre wondering how do I get a tax ID number for a new business. You can apply online, over fax, or through the mail. If your business is based in a country outside the United States, you can apply over the phone, and in fact, only businesses based in other countries can use the phone for their application.

You May Like: How Much Taxes To Take Out For 1099

How To Get A Federal Tax Id: Apply Online In 5 Simple Steps

Are you ready to start or grow your business? If your answer is yes, use this guide to learn how to get a federal tax ID, when to use it, and how.

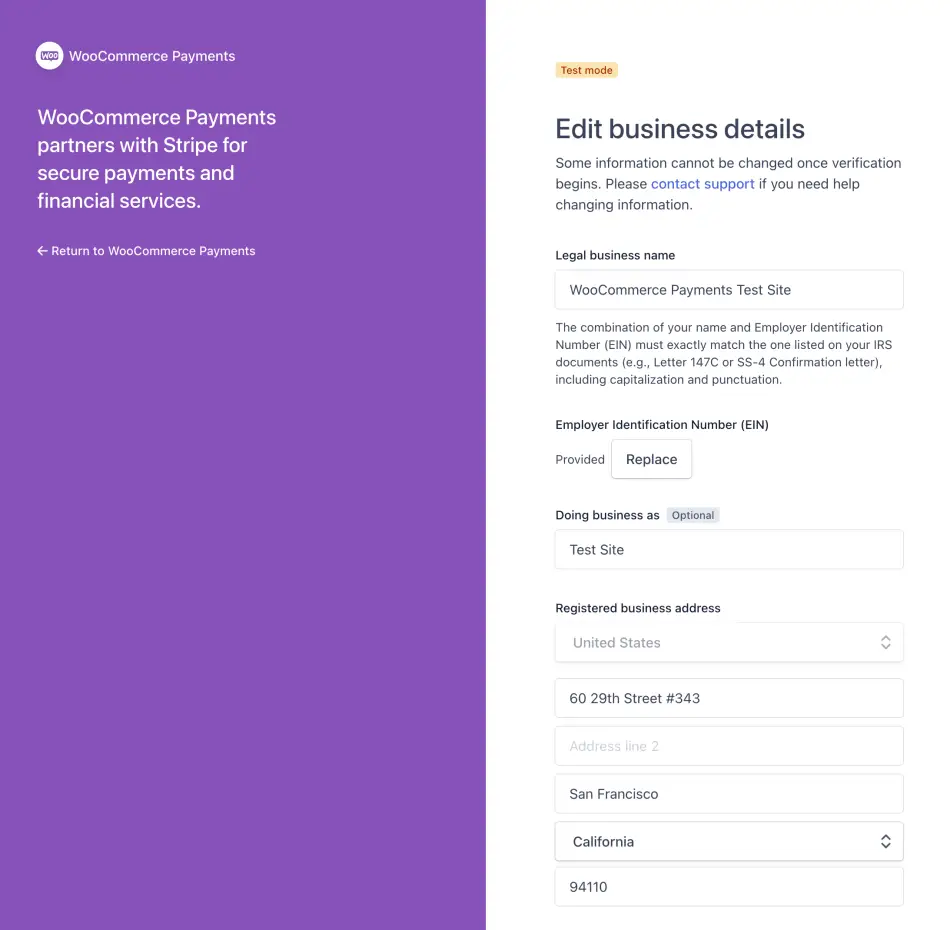

When forming a business entity such as an LLC, youll need to apply for a federal tax ID numberor employer identification number to file taxes and complete other business tasks. This nine-digit number is similar to a Social Security number and is issued by the Internal Revenue Service . Its easy to apply, and all you need to do is fill out a one-page form online and submit it.

Also Check: What Is Medicare Tax Used For

Also Check: Which States Have No Income Tax

Business Tax Id : 4 Ways To Find A Federal Tax Id Number Wikihow

11.09.2021 · the steuernummer is for freelancers and businesses. This number is required by your employer to pay your salary and to calculate the amount of tax you need to pay. Also, financial institutions such as banks, credit unions, and brokerage houses will not open an account for a corporation without an ein. Real estate property tax is collected on the assessed value of real estate owned by a business or an individual. Your companys ein is like a social security number for your business and thus very important.

Recommended Reading: Have My Taxes Been Accepted

How To Apply For A Federal Tax Id Number:

Applying is a simple process, usually done online. If you prefer to apply via fax, mail, or telephone, you can do this too.

Its also worth remembering that applying for a tax ID number is free. If youve been asked to pay to apply, youre on the wrong site!

You can apply for your federal tax ID number here.

During the application process, you will be asked to provide basic information including details regarding your business structure or the type of organization you operate, personal information, addresses, and other details relating to your business.

If you are not applying yourself, you will need to select a person designated as the responsible party for this application. If you are the small business owner, it will most likely be yourself, but it could also be a business partner if you have one. Whoever the responsible party is, they will need to have a valid taxpayer identification number to apply.

You May Like: How Do I File An Extension For California State Taxes

Check Other Places Your Ein May Be Recorded

Aside from confirmation letters from the IRS, you may be able to find a copy of your EIN on other important documents. For example, you might want to take a look at previously filed tax returns. Or you might look over old financing documents, like applications for business loans or lines of credit.

The IRS also suggests that you might be able to get a copy of your EIN by contacting institutions with which you shared that information in the past such as your business bank or local and state business license agencies.

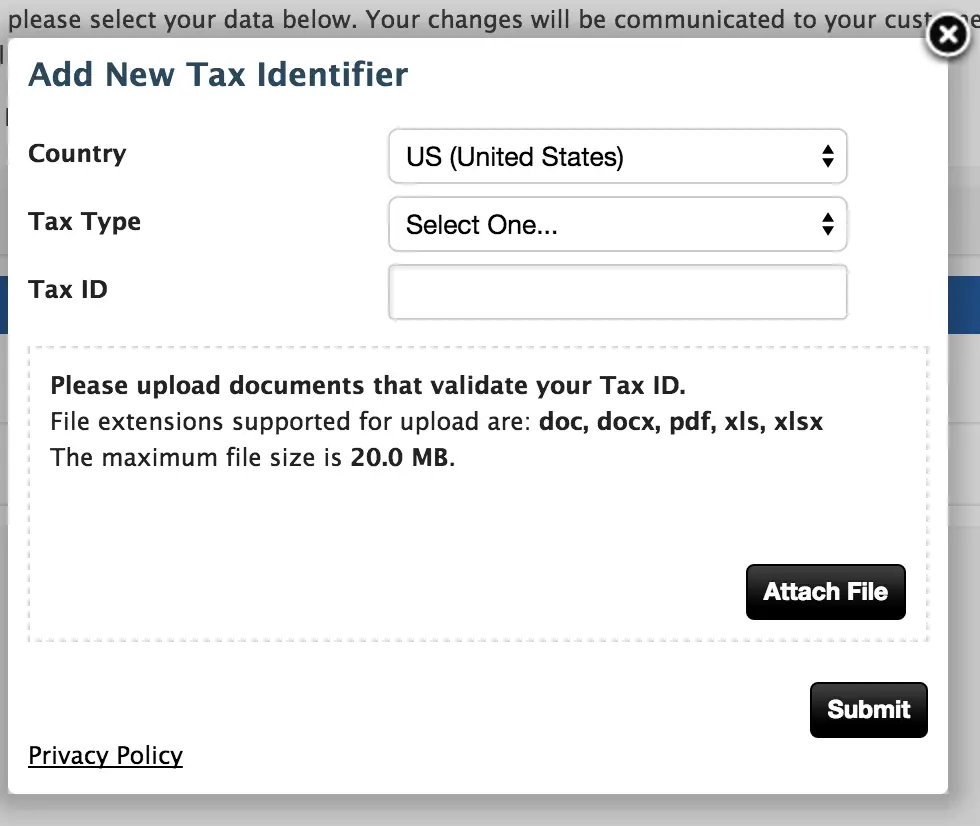

Option : Check Your Ein Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

-

If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by traditional mail.

-

If you applied by fax, you would have received your confirmation letter by return fax.

-

If you applied by mail, you would have received your confirmation letter by return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

In this sample EIN confirmation letter, you can find your EIN at the top of the page, as well as in the first paragraph.

Also Check: How To Get Out Of Capital Gains Tax

How To Find Another Companys Ein

Small business owners typically need to find their own companys tax ID number, but they may need to look up the EIN of another company for which they dont know who is the owner. It is possible, for example, to verify the information of a new supplier or client using an EIN. Additionally, in certain industries, such as business insurance, you might need the EINs of other companies on a daily basis.

The following options can be used to find another businesss federal tax ID number:

- Ask the company

- Inquire with a credit bureau

- Use a paid EIN database

Use Melissa Database For Nonprofits

The Melissa Database provides free federal tax ID lookup for nonprofit organizations.

If you have a legitimate need to find the EIN for another business, then you can use one of these options to look up the number. Just be sure to keep your own EIN secure. Only share the number with a limited subset of peoplelenders, prospective suppliers, bankers, etc. You should guard your business’s EIN just like you would guard your social security number.

Don’t Miss: How To Pay Back Taxes Online

Electronic Data Gathering Analysis And Retrieval System

Using the Electronic Data Gathering, Analysis, and Retrieval System is the easiest way to search for a federal tax ID number.

Maintained by the SEC, the EDGAR system is a database that includes information about for-profit companies. This online service is completely free.

The EDGAR database includes several forms that may contain a businesss EIN, including the 8-K, 10-K, and 10-Q forms.

Before you start your EDGAR search, you should keep in mind that searching just the first few letters of a businesss name will provide you better results, as many businesses are not listed under their full names.

Dont Miss: How Much Do I Get Back In Taxes

Check Your Ein Confirmation Letter

The IRS will notify you when it approves your EIN application. Depending on how you apply, you may receive a confirmation letter with your EIN online at the time it was issued or via mail or email.

Look back through your paper and digital business files. You or whoever helped you apply may have saved a copy of it for future reference.

You May Like: How Do I Apply For Farm Tax Exemption

How Do I Find My Missouri Tax Id Number

Find Your Missouri Tax ID Numbers and Rates

- Find Your Missouri Tax ID Numbers and Rates Missouri Withholding Account Number. You can find your Withholding Account Number on any previous quarterly return, or on any notices you have received from the Department of Revenue. If youre unable to locate this, contact the agency at 751-8750. Missouri Employer Account Number