Utah Innocent Spouse Relief

Normally, when you file a tax return jointly with your spouse, you are both liable for all of the tax due on the return. However, if your spouse understates the tax due without your knowledge, you may qualify for Innocent Spouse Relief. This generally applies if your spouse underreported income or overclaimed deductions without your knowledge.

To apply, you can submit Form TC-8857 . Or you can send a copy of IRS Form 8857 . The Utah TC will also approve your request if you get Innocent Spouse Relief on your IRS taxes.

If your state tax refund was seized due to a state tax debt incurred by your spouse before you were married, you can get your portion of the refund back through Utah’s Injured Spouse Relief program. To apply, you need to submit a copy of IRS Form 8379 along with proof of your income and state taxes withheld. If your state tax refund was seized due to a debt to any other agency, you must apply for a refund from that agency.

You can apply for Injured Spouse Relief proactively if you believe that your state tax refund will be seized due to your spouse’s tax debt. Simply attach a copy of IRS Form 8379 to your joint Utah return when you file it.

How You’ll Receive Your Payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return

- Received your Golden State Stimulus payment by check

- Received your tax refund by check regardless of filing method

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund

What You Need For Check The Status Of Your Ma Income Tax Refund

To check the status of your personal income tax refund, youll need the following information:

- Tax year of the refund

- Your Social Security number or Individual Taxpayer Identification Number

|

|

Read Also: What Is Federal Tax Due

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

Tax Penalties In Utah

If you file or pay your state taxes late, you will incur penalties on your account as follows:

- Filing one to five days late: 2% of the unpaid tax, with a minimum penalty of $20.

- Six to 15 days late: 5% of the unpaid tax, with a minimum penalty of $20.

- 16 or more days late: 10% of the unpaid tax, with a minimum fee of $20.

If you file but don’t pay the tax, you will face late payment penalties at the same rates quoted above. If you pay more than 90 days after the due date, your late payment penalties will be as follows:

- 91 to 95 days late: 2% of the unpaid tax, with a minimum of $20.

- 96 to 105 days late: 5% of the unpaid tax, with a minimum of $20.

- 106 days or more: 10% of the unpaid tax, with a minimum fee of $20.

If you don’t file and don’t pay, the penalties don’t stack. Instead, you incur a penalty of 10% of the unpaid tax, with a minimum penalty of $20.

Utah also assesses interest on unpaid state taxes. The interest rate adjusts annually, and as of 2023, it’s 5%. To calculate the interest on your Utah tax bill, multiply the unpaid tax by the interest rate times the number of days you’re late divided by 365.

If your account is audited and you incur a tax liability, you must pay in full within 30 days, or you will incur the following penalties:

- 31 to 35 days late: 2% of the unpaid tax, with a minimum of $20.

- 36 to 45 days late: 5% of the unpaid tax, with a minimum of $20.

- 46 or more days late: 10% of the unpaid tax with a minimum of $20.

Read Also: What Does Tax Liability Zero Mean

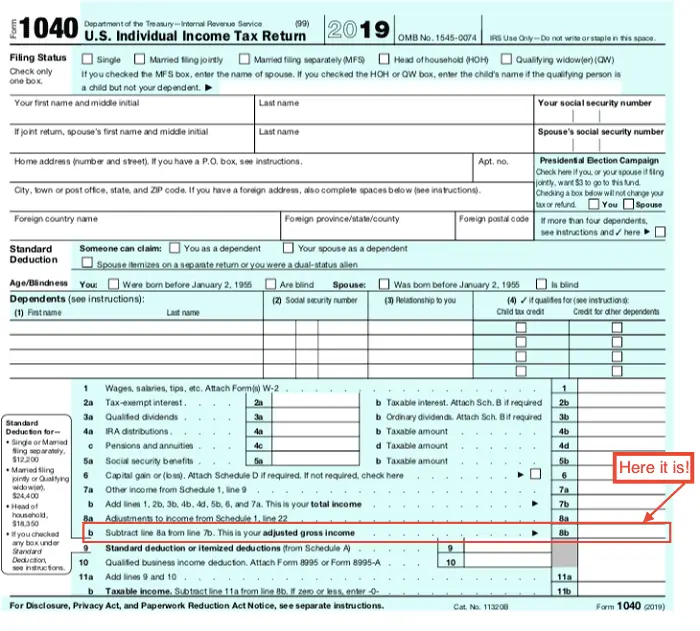

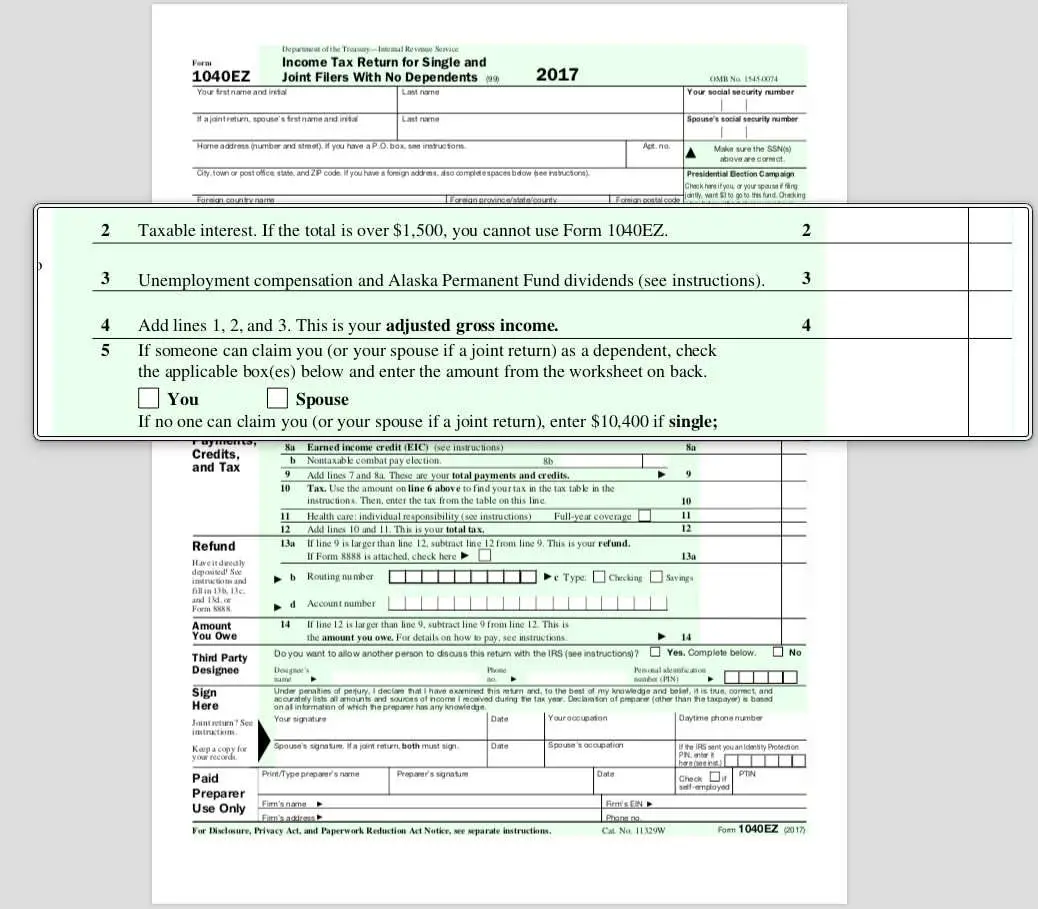

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Other Ways To Check Your Tax Refund Status

If you dont have access to the Internet or a computer, you can call the IRS at 800-829-1954 to obtain the status of your refund. You will need the same three pieces of information as those who use the online tool, so be sure you have a copy of your tax return available.

TurboTax also has a Where’s My Refund Tracking step-by-step guide that will show you how to find the status of your IRS or state tax refund. Use TurboTax, IRS, and state resources to track your tax refund, check return status, and learn about common delays.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Read Also: When Are Llc Tax Returns Due

Enforcement Actions For Unpaid Utah Taxes

If you don’t file your taxes, the Tax Commission can file a return on your behalf to assess taxes against you. If you have unpaid taxes from a tax assessment, an audit, or a return that you filed, the state can use a range of tactics to collect the unpaid taxes. Here’s what can happen if you don’t pay taxes in Utah.

How Do I Access Mytax Illinois To Activate A Mytax Illinois Account

Setting up access to your MyTax Illinois account is easy!

If you need more information, see the MyTax Illinois Help Guide. If you need additional assistance, email us at

When you login to your MyTax Illinois account, you will be required to use a two-step verification. We will send you a security code, a security enhancement to help protect your account. When you first set up two-step verification, you can choose to receive this code by email to an address you provide or by using an authenticator app. A new security code will be provided to you by the method you select each time you log in to MyTax Illinois.

If you would like to set up a secondary method, such as a second email address, to verify your MyTax account, you can do so under “Manage My Profile” once you have logged in to your account.

Read Also: Do I Have To Pay Taxes On My Unemployment

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their returns after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get a refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Recommended Reading: What Is Tax Liability Zero

Wheres My State Tax Refund Idaho

Learn more about your tax return by visiting the Idaho State Tax Commissions Refund Info page. From there you can click on Wheres My Refund? to enter your information and see the status of your refund.

Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive a confirmation for filing their states return. Those who file a paper return can expect refunds to take 10 to 11 weeks.

If you receive a notice saying that more information is necessary to process your return, you will need to send the information before you can get a refund. Once the state receives that additional information, you can expect it to take six weeks to finish processing your refund.

How To Claim A Tax Refund

You may be able to get a tax refund if youve paid too much tax. Use this service to see how to claim if you paid too much on:

- job expenses such as working from home, fuel, work clothing or tools

- a Self Assessment tax return

- a redundancy payment

- UK income if you live abroad

- interest from savings or payment protection insurance

- income from a life or pension annuity

- Yes this page is useful

- No this page is not useful

Don’t Miss: How To Get Out Of Paying Back Taxes

I Received A Form 1099

If you claimed itemized deductions on your federal return and received a state refund last year, you will receive a postcard size Form 1099-G statement. This form shows the amount of the state refund that you received last year but does not mean that you will receive an additional refund. Generally, your State income tax refund must be included in your federal income for the year in which your check was received if you deducted the State income tax paid as an itemized deduction on your federal income tax return. Please view the Frequently Asked Questions About Form 1099-G and Form 1099-INT page for additional information about Form 1099-G and Form 1099-INT.

Watch Out For Scammers

And, as always, keep alert for scams! Scammers are already trying to steal people’s payments. Do not reply to unsolicited texts, emails, or other requests for personal information. You will never have to pay money in order to receive your refund . Double check the sender of any correspondence to see if it matches the official entities mentioned above.

Take a look at more stories and videos by Michael Finney and 7 On Your Side.

7OYS’s consumer hotline is a free consumer mediation service for those in the San Francisco Bay Area. We assist individuals with consumer-related issues we cannot assist on cases between businesses, or cases involving family law, criminal matters, landlord/tenant disputes, labor issues, or medical issues. Please review our FAQ here. As a part of our process in assisting you, it is necessary that we contact the company / agency you are writing about. If you do not wish us to contact them, please let us know right away, as it will affect our ability to work on your case. Due to the high volume of emails we receive, please allow 3-5 business days for a response.

You May Like: What Does Sales Tax Mean

Respond Rapidly For Faster Refund

All income tax returns go through fraud detection reviews and accuracy checks before we issue any refunds. We might send you letters asking for more information.

- Fraud Detection: The Tax Commission uses a variety of methods to validate your identity and tax return to detect and combat tax identity theft. To help protect taxpayer information and keep taxpayer dollars from going to criminals, we might send you:

- An Identity Verification letter that asks you to take a short online quiz, provide copies of documents to verify your identity, or state that you didnt file a return.

- A PIN letter that asks you to verify online whether you or someone you authorized filed the tax return we received.

How Can I Check The Status Of My Refund

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

Read Also: When Us The Last Day To File Taxes

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

How Many Years Back Can I Get A Tax Refund

Taxpayers have three years to complete their taxes and receive a refund. While those who owe taxes must pay them by the April due date, those owed a refund have three years to file, although they wont be entitled to this money after this time. The money from tax returns that are not filed within that time frame is then transferred to the U.S. Treasury.

Recommended Reading: How Much Charitable Giving Is Tax Deductible

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.