Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times.

And Before You Go Some Good News

Happy Days are here again.

The actor Henry Winkler is auctioning off costumes, props and other memorabilia from his career, including his beloved character Fonzies leather jacket and motorcycle.

The Fonzs complete outfit the jacket, Levis jeans, white T-shirt and black boots is expected to sell for $50,000 to $80,000 at Bonhams auction house in Los Angeles on Wednesday, KABC reports.

Winkler told KABC that he planned to donate the proceeds to a nonprofit his daughter started to help families separated at the border.

Thanks for reading. Ill be back tomorrow. Soumya

P.S. Heres todays Mini Crossword, and a clue: Commenter you should just ignore .

Jaevon Williams and Mariel Wamsley contributed to California Today. You can reach the team at .

Also Check: Are Stimulus Checks Part Of The Cares Act

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

Read Also: Are Adult Diapers Tax Deductible

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to a form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page, you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

Don’t Miss: How To Tax Return Online

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit or Child Tax Credit amounts. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset or different refund amount when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Also Check: How Far Back Do I Have To File Taxes

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

Read Also: Can You Gift Money From An Ira Without Paying Taxes

Wheres My State Tax Refund Wisconsin

Wisconsins Department of Revenue has an online tool, called Refund 123, that allows you to see the status of your tax refund. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars.

Refunds for taxpayers who filed electronically are typically issued within three weeks. Paper returns will take longer to process. The states fraud and error safeguards may also delay the processing of your return for up to 12 weeks.

How New Jersey Processes Income Tax Refunds

Beginning in January, we process Individual Income Tax returns daily. Processing includes:

Generally, we process returns filed using computer software faster than returns filed by paper. Electronic returns typically take a minimum of 4 weeks to process.

Processing of paper tax returns typically takes a minimum of 12 weeks.

We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

In some cases, they will send a filer a letter asking for more information. In such cases, we cannot send a refund until the filer responds with the requested information.

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper.

To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests.

Please allow additional time for processing and review of refunds.

| Sorry your browser does not support inline frames. |

You May Like: How To Pay My Property Tax

How To Check On Your State Tax Refund

Any state tax refund you have coming can come at a variety of times, depending on what state you filed in. Most of the time, state returns are processed faster than federal returns. Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income. Tennessee has phased out tax on income from dividends and investments and New Hampshire has proposed legislation to do the same.

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Also Check: How Do I Pay Sales Tax In Texas

I Have Checked The Status Of My Return And I Was Told There Is No Record Of My Return Being Received What Should I Do

Due to the late approval of the state budget, which included multiple tax law changes, the Department has experienced delays processing returns. If you filed your return electronically and received an acknowledgment, your return has been received but may not have started processing. Follow the guidance below based on your filing method:

Filed Electronically:

If its been more than six weeks since you received an acknowledgment email, please call 1-877-252-3052.

Filed Paper:

If its been more than 12 weeks since you mailed your original return, you can mail a duplicate return to NC Department of Revenue, P O Box 2628, Raleigh, NC 27602, Attn: Duplicate Returns. The word “Duplicate” should be written at the top of the return that you are mailing. The duplicate return must be an original printed form and not a photocopy and include another copy of all wages statements as provided with the original return.

Irs Announces Tax Filing Start Date New Tax Day This Yearyour Browser Indicates If Youve Visited This Link

The Internal Revenue Service has announced a start date for this years tax season. The nations tax agency will start accepting and processing 2021 returns on Monday, Jan. 24. You generally do not have to wait to file 2021 returns and can do so when ready but the IRS wont start processing returns until Jan.

Cleveland.com

Recommended Reading: When To File Quarterly Taxes

When You’ll Receive Your Payment

MCTR direct deposit payments for Californians who received GSS I or II are expected to be issued to bank accounts between October 7, 2022 and October 25, 2022. The remaining direct deposits will occur between October 28, 2022 and November 14, 2022.

MCTR direct deposit recipients who have changed their banking information since filing their 2020 tax return will receive a debit card. Debit cards for this group will be mailed between December 17, 2022 and January 14, 2023.

MCTR debit card payments for Californians who received GSS I and II are expected to be mailed between October 24, 2022 and December 10, 2022. The remaining debit cards will be mailed by January 14, 2023.

Refer to the tables below for the latest updates to the payment schedules.

Direct deposit payments| Direct deposit recipients who have changed their banking information since filing their 2020 tax return | 12/17/2022 through 01/14/2023 |

Direct deposits typically occur within 3-5 business days from the issue date, but may vary by financial institution.

Allow up to 2 weeks from the issued date to receive your debit card by mail.

We expect about 90% of direct deposits to be issued in October 2022.

We expect about 95% of all MCTR payments direct deposit and debit cards combined to be issued by the end of this year.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

Don’t Miss: How To File Income Tax Online For Free

If Your Refund Isnt What You Expected

If your refund amount isnt what you expected, it may be due to changes we made to your tax return. These may include:

- Corrections to any Recovery Rebate Credit or Child Tax Credit amounts

- Payments on past-due tax or debts, offset from all or part of the refund amount

For more details, see Tax Season Refunds Frequently Asked Questions.

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.

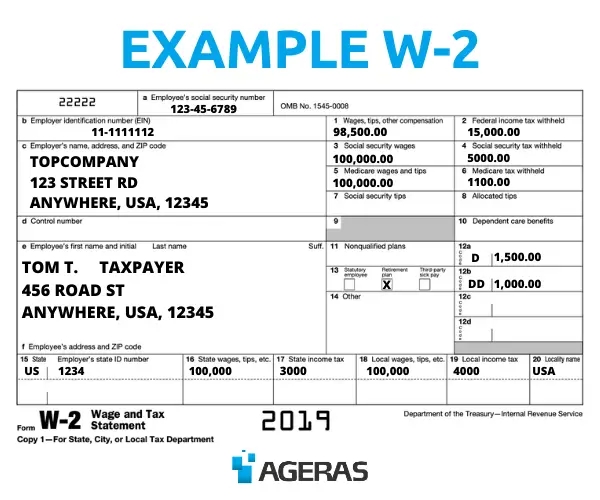

You May Like: How To Calculate Tax Return From W2

Wheres My State Tax Refund Montana

Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. From there you will need to enter your SSN and the amount of your refund.

The processing time for your tax return and refund will depend on when you file. The Montana Department of Revenue says that if you file your return in January, it may process your refund within a week. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns.

Will I Still Receive A Direct Deposit If I Havent Gotten It Already

The short answer yes. But it depends on a few factors.

Californians who received a Golden State Stimulus check should receive a direct deposit by Tuesday, Oct. 25.

If you did not receive the Golden State Stimulus, but are still eligible for the inflation relief payment, you should see the direct deposit between Oct. 28 and Nov. 14, according to the state,

Recommended Reading: How To Pay Estimated Taxes

Millions In State Tax Refunds Heading To Unclaimed Property If Taxpayers Dont Claim Themcontinue Reading

BATON ROUGE Louisiana taxpayers have until Oct. 6, 2022, to claim millions of dollars in state income tax refunds before they become unclaimed property.

The Louisiana Department of Revenue sent letters to 20,400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state treasurers office. More than $36 million in unclaimed refunds is due for transfer if not claimed from LDR.

To claim a refund, complete and return to LDR the voucher in the Notice of Unclaimed Property letter dated Aug. 18, 2022. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real-time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

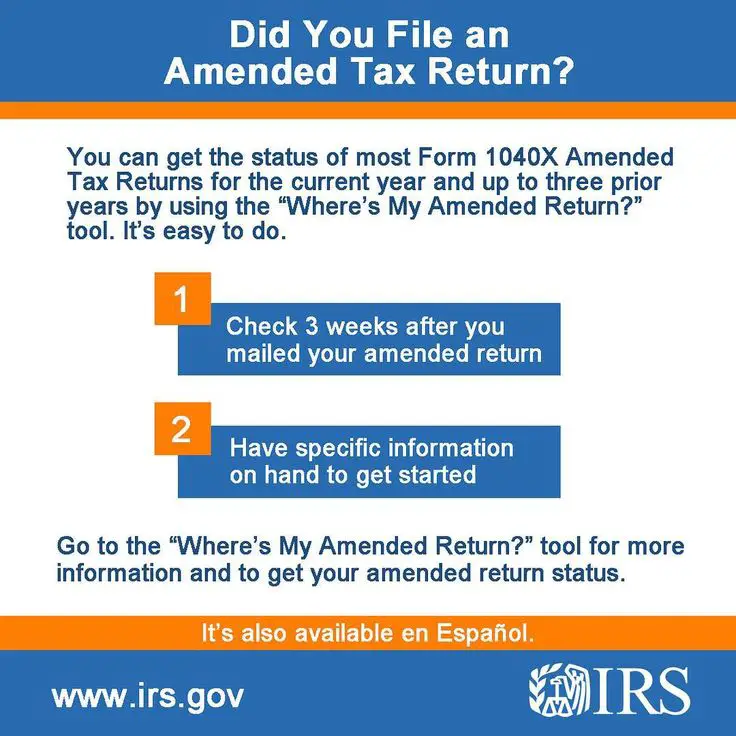

You May Like: What Does It Mean To Amend Your Taxes