Contact Irs Through Phone

If you are not a tech expert or dont have proper information to get registered on the online portal, then worry not. You can still know about your back taxes. All you need to do is to make a contact with the IRS officials through a phone call.

You can call the IRS at 1-800-829-1040 between 7:00 a.m. and 7 p.m. local time. During the call, you may have to wait an average of 27 minutes until you get connected to the IRS representative. The representative will ask you a few details and then tell you about your back taxes.

Moreover, to avoid the longer wait time, it is suggested to call as early as possible.

How Do Tax Credits Work

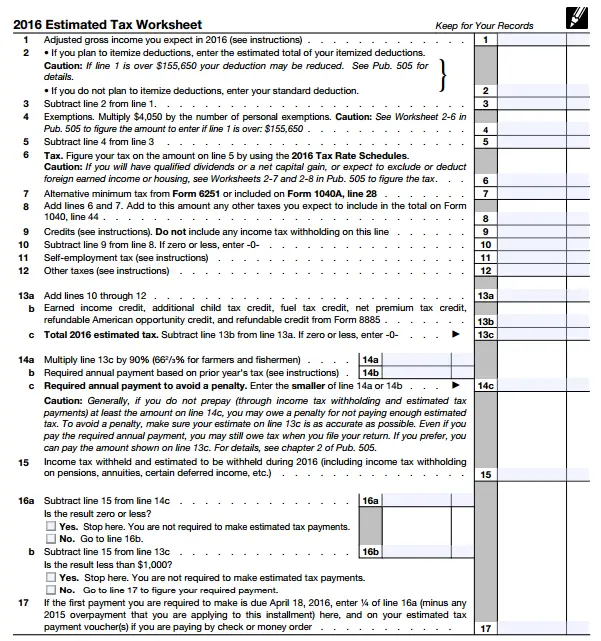

While there are different types of tax credits, they all work basically the same way when it comes to reducing your tax bill. Its important to read the fine print on any tax credit opportunity or talk to a tax preparation professional to help maximize your credits when possible. However, in general, tax credits work as follows:

Reporting Your Social Security Income

To report your Social Security income, you can use Form 1040 or 1040-SR. If you receive Social Security income, you will likely get a form from the Social Security Administration called SSA-1099, which has your total benefit amount received for the year in box 5. Enter the total on line 6a and the taxable portion on line 6b. If no amount is taxable, enter -0- on line 6b.

You May Like: When Does Taxes Start 2021

Pay The Tax Debt In Full

Got funds to pay it off? Often that is the best way to go. When you have too much money, have too many assets, or make too much on a monthly basis, you likely will not qualify for an Offer In Compromise. The IRS will give you a 60-120 extension to full pay by just calling and asking. You only get one of these so uses it wisely. They generally give 60 days to cases in collections and 120 days to cases not yet in collections.

Make sure to request a first-time penalty abatement if you qualify.

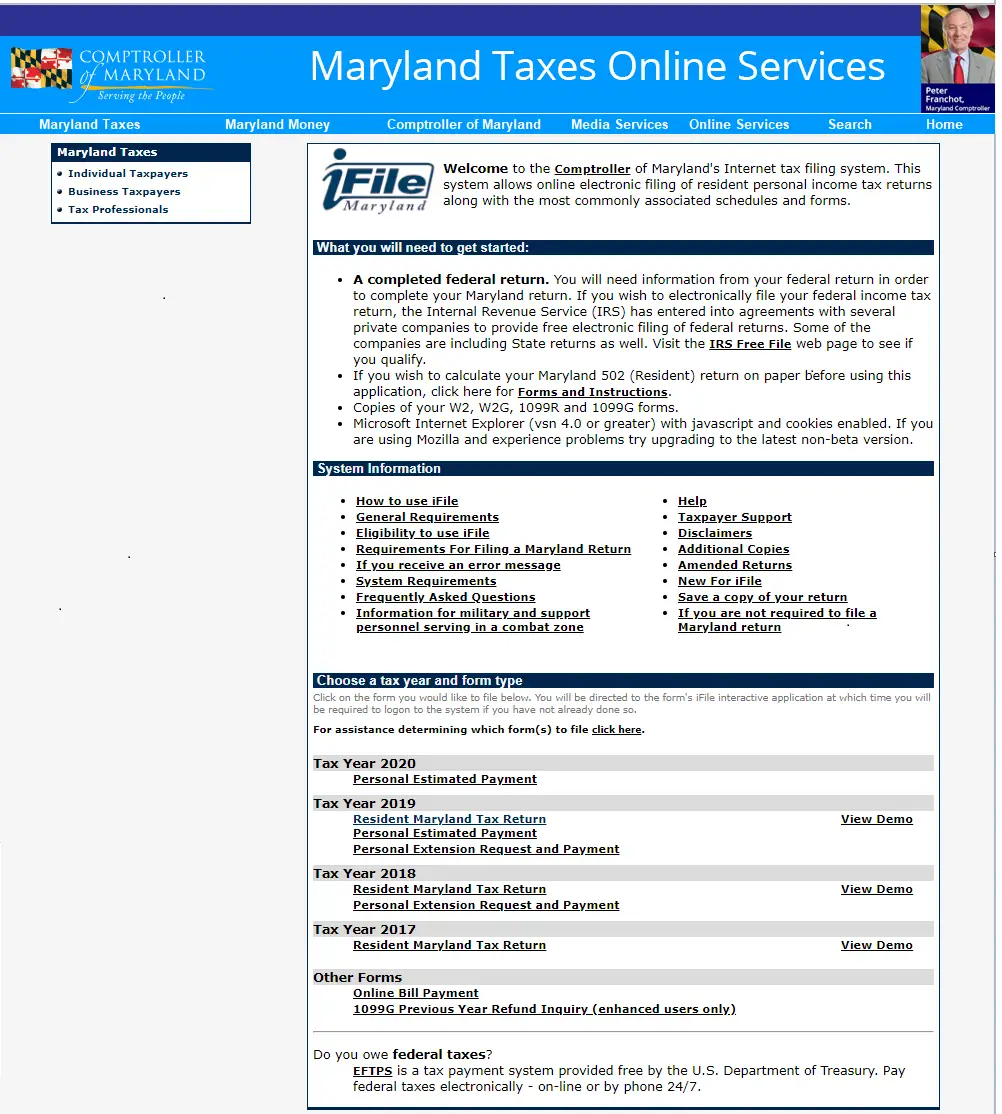

Notice Of Income Tax Assessment

A Notice of Income Tax Assessment is issued when there is no response to an initial notice or when a tax liability is not resolved or paid within the time indicated on the initial notice. The NITA includes updated interest and a penalty of up to 25% based on the unpaid tax. Appeal rights are provided on this notice.

The Compliance Program Section conducts numerous audits to ensure that tax returns filed with the State of Maryland are in compliance with federal and Maryland income tax laws. Listed below are some of our most common audit programs. You may have received a notice if one of our programs indicated that we need more information, made an adjustment, or an assessment. Look up your notice under “I Received a Notice” to learn more about a notice you may have received.

Statute of Limitations

Generally the Comptroller’s Office has three years to audit a tax return from the due date of the return or the date the return was filed, whichever is later. However, there is no statue of limitations when there has been a change made to the federal return by the IRS and the taxpayer fails to notify the Comptroller’s Office within ninety days of the final determination by the IRS. If the Comptroller’s Office is notified within the ninety days, the Comptroller’s Office has one year to assess the deficiency.

If you have question regarding any of our audit programs, you may call 767-1966 or toll free at 1 648-9638.

If you need additional help, please contact us to Get Help!

You May Like: When Will Tax Returns Be Accepted 2021

Obtain Copies Of All Tax Returns That You Still Owe Taxes On

The first thing you’ll need to do is gather all of your relevant returns and documents that relate to each year you still owe back taxes for. Each of your tax returns will report the amount of tax you owe, but never paid. If you did file a return but no longer have a copy, you can obtain one from your accountant who prepared it for you or if necessary, you can order a duplicate copy from the IRS.

How Much Of Your Social Security Income Is Taxable

Social Security payments have been subject to taxation above certain income limits since 1983. No inflation adjustments have been made to those limits since then, so most people who receive Social Security benefits and have other sources of income pay some taxes on the benefits.

However, regardless of income, no taxpayer has all their Social Security benefits taxed. The top level is 85% of the total benefit. Heres how the Internal Revenue Service calculates how much is taxable:

- The calculation begins with your adjusted gross income from Social Security and all other sources. That may include wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts, and other taxable income.

- Tax-exempt interest is then added.

- If that total exceeds the minimum taxable levels, then at least half of your Social Security benefits will be considered taxable income. You must then take the standard or itemize deductions to arrive at your net income. The amount you owe depends on precisely where that number lands in the federal income tax tables.

Combined Income = Adjusted Gross Income + Nontaxable Interest + Half of Your Social Security Benefits

The key to reducing taxes on your Social Security benefit is to reduce the amount of taxable income you have when you retire, but not to reduce your total income.

You May Like: What To Do If State Taxes Rejected

Fill Out A Form And Drop It In The Mail

Another option outside of the online portal is to contact the IRS by sending a form through snail mail.

While this is a viable option for any taxpayer, keep in mind that it will take much longer due to the nature of mail. And if you do owe, penalties and interest will continue to accrue while you wait for a response.

Youll also want to make sure the IRS has your current address. If they dont, theyll send their response to the most recent address they have on file, which may not be your current one.

Individual taxpayers who filed a Form 1040, 1040A, or 1040EZ can request an Account Transcript. This transcript will only cover a single tax year and might not include any tax penalties, interest, or additional charges.

If you filed another type of form or are representing a business, youll need to submit Form 4506-T, Request for Transcript of Tax Return. Once the IRS receives and processes your 4506-T form, they will send you a free transcript.

Five Steps To Take If You Owe Taxes And Cant Pay

Its a terrible feeling. Youve entered all of your information on your annual income tax return and find that you owe the Internal Revenue Serviceand not just a little, but more than you can afford to pay. Its tempting to avoid the problem by not filing your return or not paying the tax bill, but that has consequences. If you arent sure what to do about your tax bill or letters or notices from the IRS, start here.

You May Like: How To Claim Tax Relief On Charitable Donations

Using The Irs Online System

The IRS provides you with a tool to view your tax status and payment history. While the system can help you determine the amount you owe, it is not available all the time. The periods you can log in are Monday-Saturday, 6 am-9 pm, and 10 am-12 am on Sundays.

When using the portal to check your tax balance, you need to confirm your identity. The system will require you to provide various details like:

- Social security number

- A bank account number

Once you log in to your account, you can confirm the balance you owe. Still, it is crucial to note that the system takes about 24 hours to update. Hence, you may not view the most recent penalties and fines.

How Much Is Taxable

Generally, up to 50% of benefits will be taxable. However, up to 85% of benefits can be taxable if either of the following situations applies.

- The total of one-half of the benefits and all other income is more than $34,000 .

- You are filing Married Filing Separately and lived with your spouse at any time during the year.

Who is taxed. Benefits are included in the taxable income for the person who has the legal right to receive the benefits.

Example: Lisa receives Social Security benefits as a surviving spouse who is caring for two dependent children, Christopher, age 9, and Michelle, age 7. As dependents of their deceased father, Christopher and Michelle also receive Social Security benefits. The benefits for Christopher and Michelle are made payable to Lisa. When calculating the taxable portion of the benefits received, Lisa uses only the amount paid for her benefit.

The amounts paid for Christopher and Michelle must be added to each childâs other income to see whether any of those benefits are taxable to either of the children.

Withholding. You can choose to have federal income tax withheld from Social Security or Railroad Retirement benefits by completing Form W-4V, Voluntary Withholding Request.

Recommended Reading: What Items Do You Need To File Taxes

Can Someone Take Your Property By Paying The Taxes In Oklahoma

Accordingly, in Oklahoma, if your property tax payment is three or more years delinquent, you could potentially lose your home to a tax sale. Fortunately, a tax sale usually only happens if you dont respond to notice from the county treasurer about getting caught up.

Oklahoma Taxpayer Access Point FAQ.

At What Age Do You Stop Paying Property Taxes In Oklahoma

65Property owners just have to know that after they turn 65, the taxable values of their homes can be locked in, if their annual gross household incomes are under certain amounts. Eligible seniors must file a one-time application with their respective county assessor offices between Jan.

Also Check: How Do I File My California State Taxes For Free

Withdraw Taxable Income Before Retirement

Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits.

You could be in your peak earning years between ages 59½ and retirement age. Take a chunk of money out of your retirement account and pay the taxes on it. Then, you can use it later without pushing up your taxable income.

This means you could withdraw funds a little earlyor take distributions, in tax jargonfrom your tax-sheltered retirement accounts, such as IRAs and 401s. You can make penalty-free distributions after age 59½. This means you avoid being dinged for making these withdrawals too early, but you must still pay income tax on the amount you withdraw.

Since the withdrawals are taxable , they must be planned carefully with an eye on the other taxes you will pay that year. The goal is to pay less tax by making more withdrawals during this preSocial Security period than you would after you begin to draw benefits. That requires considering the total tax bite from withdrawals, Social Security benefits, and other sources. Be mindful, too, that at age 72, youre required to take RMDs from these accounts, so you need to plan for those mandatory withdrawals.

Visit Local Irs Office To Get Your Tax Balance

Youll need to visit the IRS website to find the IRS office closest to you. These offices are referred to as Taxpayer Assistance Centers .

Youll need to call ahead to schedule an appointment at your local TAC. Each TAC has its own hours and a specific list of services provided at that location. If you need additional services, such as submitting payment or requesting an installment agreement, check to see if your local TAC offers these services.

Some TACs provide Facilitated Self Assistance computer kiosks which can be used to access the IRS website. An IRS employee will be available if you need help with this process.

Recommended Reading: How Are Property Taxes Calculated In Texas

Are Taxes High In West Virginia

West Virginia Tax Rates, Collections, and Burdens

West Virginia has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.52 percent. West Virginias tax system ranks 21st overall on our 2022 State Business Tax Climate Index.

Are property taxes high in West Virginia?

West Virginia has one of the lowest property taxes in the country. The state ranks 45th in per capita property taxes. Residents also pay a smaller percentage of their personal income toward property taxes.

How much is personal property tax on vehicles in WV?

West Virginia Sales Tax on Car Purchases:West Virginia collects a 5% state sales tax rate on the purchase of all vehicles.

Frequently Asked Questions About Your Online Account

Are there plans to make online account available to international taxpayers?

Currently taxpayers have to get through Secure Access to get to online account, and Secure Access is not available for taxpayers who have international addresses. The Taxpayer First Act Report to Congress includes a commitment to better serve international taxpayers and will be built out in the future.

Im unable to access my account with the information I provided what can I do?

Other ways to find your account information

- You can request an Account Transcript. Please note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Can I authorize someone else to access my online account?

No. Only the taxpayer should log into their account. Credentials should never be shared with others.

Why am I getting a message saying that the service is not available after I log into my online account?

What if I filed my tax return or paid my taxes late?

If you filed your tax return or paid your taxes late, the IRS may have assessed one or more penalties on your account. In some cases, the IRS will waive the penalties for filing and paying late. However, youll need to ask the IRS to do this.

Where can I see the details of my payment plan?

You may be able to:

Read Also: How Do Tax Debt Relief Companies Work

Ways To Find Out How Much You Will Owe The Irs

You may know that you owe the IRS money, but do you know exactly how much you owe?

Maybe youve received correspondence from the IRS in the mail stating that you owe a debt, but its not clear how much it is. The trouble with the paperwork that the IRS sends out is that it can be confusing, often referencing prior tax years which have faded from your memory, requesting forms you have never heard of, and threatening a hefty penalty if you dont get everything to them by a certain date.

This is where a tax professional is helpful you can forward them the intimidating IRS letter, and they will act on your behalf to resolve any disputes. But not everyone uses a certified professional accountant, which is why its always helpful to know about tax procedures.

IRS correspondence is complicated, and sometimes in between all the tax jargon you dont fully understand, you arent even told exactly how much you owe, or why. To find out the best and most reliable ways would be to call the IRS directly or to check online using a specific tool they have provided for taxpayers. Mail is often lost in transit, and usually, the correspondence does not contain your total balance for all years owed anyhow.

Heres a guide to finding out exactly how much you owe the IRS.

Vermonts Social Security Exemption

Vermonts personal income tax exemption of Social Security benefits reduces tax liabilities mainly for lower- and middle-income Vermonters who are retired or disabled. It does this by excluding from taxable income all or part of taxable Social Security benefits reported on the federal Form 1040, U.S. Individual Income Tax Return, which are included in federal AGI. The exemption does not exclude other types of income.

For those who are married filing jointly and civil union partner filing jointly, the exemption applies in full up to an AGI of $60,000, phases out between $60,000-$70,000, and does not apply to filers with AGI greater than or equal to $70,000. For all other filing statuses, the Vermont exemption applies in full to an AGI up to $45,000. It then phases out smoothly for filers earning between $45,000-$55,000. It does not apply to filers with AGI greater than or equal to $55,000. The exemption reduces a taxpayers Vermont taxable income before state tax rates are applied.

Table 2 illustrates how the Vermont exemption is applied by filing status and income level. Graph 1 shows the percentage of taxable Social Security benefits that are exempt from Vermont taxable income based on filing status and AGI.

Don’t Miss: How To Calculate 1099 Taxes

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.