Contact Tax Industry To Find Out How Much You Owe

Working with a tax liability professional is the simplest way to determine your total debt. At Tax Industry, we have a team of experts specialized in tax resolution.

With their services, you can avoid lengthy processes of contacting the IRS. Further, they can help you negotiate favorable installment repayment terms and forgiveness programs. Contact us now to consult with a tax liability expert.

- FinishLine Tax Solutions

- FinishLine Tax Solutions is a full-service, fully accredited tax resolution firm in Houston, TX, assisting companies and individuals nationwide in resolving tax problems with the IRS. We specialize in areas of back taxes such as IRS wage garnishments, IRS bank levies, and unfiled tax returns. Our team of experts comprised of licensed Enrolled Agents, CPAs, & IRS Tax Attorneys can assist you with IRS Audit Representation and Tax Planning. We are one of the leading tax resolution firms in the nation and your go-to tax relief firm that can take you to the Finish Line. Call us today to learn more about our tax relief process and tax resolution services.

Latest entries

Find Out How Much You Owe The Irs By Calling Them Directly

You can also call the IRS directly to inquire how much you owe. Individual taxpayers may call 1-800-829-1040. Lines are open from Monday through Friday, 7 a.m. to 7 p.m. For taxpayers representing business make call 1-800-829-1240, at also the same given days and time. Remember that it might take some time in the queue before you can speak with someone.

Should I Take Out A Personal Loan To Pay My Back Taxes

A personal loan is one way to approach tax debt. You can borrow money from a private lender to pay the IRSits likely that the interest on the loan will be much lower than the interest and penalties the IRS charges. Then, all you have to do is make the monthly loan payments, without progressing to IRS collection enforcement actions like wage garnishment, bank account levies, or tax liens.

Also Check: What Is Federal Withholding Tax

Mailing The Irs: How To Check Your Balance Owed By Mail

Keep every IRS notice you receive related to your taxes owed. If you owe taxes for multiple years, you may receive different notices with amounts for each year. You also may not have received notices for the most recent tax periods yet.

You can request your tax transcripts by mail to determine how much you owe. However, each account transcript will only show how much you owe for one specific tax year, and the penalty and interest amounts may not be up-to-date.

Ways To Find Out How Much You Will Owe The Irs

You may know that you owe the IRS money, but do you know exactly how much you owe?

Maybe youve received correspondence from the IRS in the mail stating that you owe a debt, but its not clear how much it is. The trouble with the paperwork that the IRS sends out is that it can be confusing, often referencing prior tax years which have faded from your memory, requesting forms you have never heard of, and threatening a hefty penalty if you dont get everything to them by a certain date.

This is where a tax professional is helpful you can forward them the intimidating IRS letter, and they will act on your behalf to resolve any disputes. But not everyone uses a certified professional accountant, which is why its always helpful to know about tax procedures.

IRS correspondence is complicated, and sometimes in between all the tax jargon you dont fully understand, you arent even told exactly how much you owe, or why. To find out the best and most reliable ways would be to call the IRS directly or to check online using a specific tool they have provided for taxpayers. Mail is often lost in transit, and usually, the correspondence does not contain your total balance for all years owed anyhow.

Heres a guide to finding out exactly how much you owe the IRS.

Recommended Reading: How Does Property Tax Work

Balance Owing On Your Tax Return

If you have an amount on line 48500, you have a balance owing.

Your 2020 balance owing is due on or before .

You should file your tax return, pay any amounts you owe, or make a post-dated payment to cover your balance owing by the due date to avoid paying interest and late-filing penalties. If your balance owing is $2 or less, you do not have to make a payment.

Recommended Reading: Efstatus.taxact.com.

What To Do If You Owe The Irs But Cant Pay

Once you figure out how much you owe the IRS, your next step is to figure out what to do about it.

If you have money in your bank account to cover your balance, its as easy as just paying that payoff amount to the IRS.

But what do you do if you dont have the money to pay your taxes owed?

The IRS isnt blind to this problem. They offer solutions for cases like this, which include an installment agreement and Offer in Compromise. Not everyone qualifies for each solution though, so its important to find an available option that can offer you some relief.

If you went with the tax debt relief expert route, theyll be able to walk you through the options available to you and what they would suggest for your unique situation. Our tax pros will even do the heavy lifting to set up a tax resolution that works for you, whether it be a payment plan or an appeal.

If you need back taxes help, reach out for assistance before the tax debt storm comes your way. Liens and garnishment loom on the horizon until you take action to deal with your tax liability. Remember, our tax professionals are only a phone call away.

Don’t Miss: What Is Ohio Sales Tax

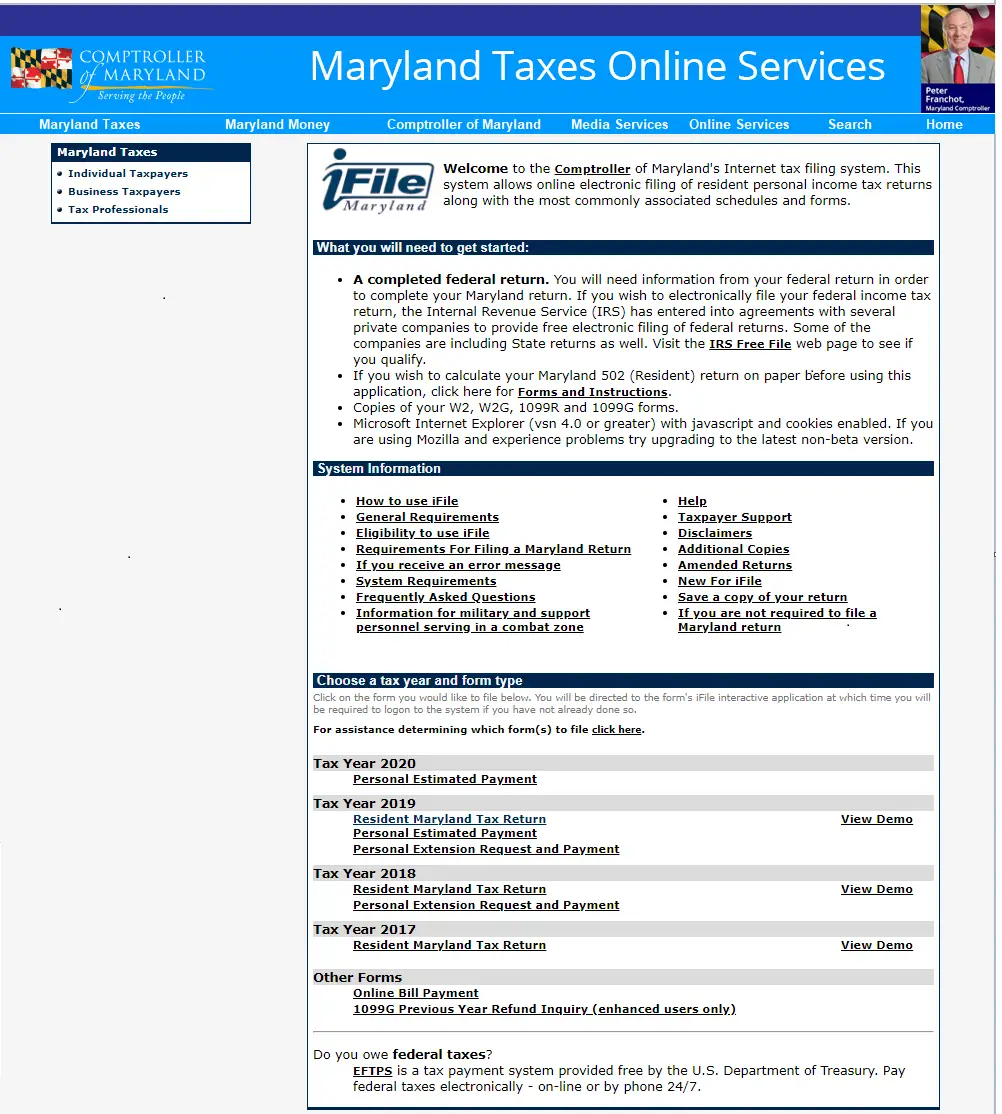

Find Out How Much You Owe The Irs Using The Online Tool

The IRS offers an online tool to help you figure out how much tax you owe. The tool shows the balance for each tax year including the principal amount and any penalties or interest. It also shows payments youve made in the last 18 months and your payoff amount.

One of the reasons why the IRS online tool is handy because the updated information it provides. This is probably the most convenient way to get access to information on your tax dues. To use this service, you need to have an account in the IRS website. Make sure that you have the following information ready when signing up:

- Social security number

- Mailing address from your last tax return.

- Mobile phone with your name on the account.

- Account number from a mortgage or home equity loan, a car loan, or a credit cardthat also needs to be in your name

The great thing about the online tool is that it updates interest and penalties every 24 hours which makes the data reliable. You can also view or print transcripts here. If you would like to request the transcript to be mailed to you, it would take five to ten days. Payments made usually takes one to three weeks to post.

The tool is available during the following days and times:

- Monday to Friday: 6 a.m. to 12:30 a.m. ET

- Saturday: 6 a.m. to 10 p.m. ET

- Sunday: 6 p.m. to 12:00 a.m. ET

What Is My Tax Illinois

MyTax Illinois is a free online account management program that offers a centralized location, provided by the Illinois Department of Revenue, for businesses to register for taxes, file returns, make payments, and manage their tax accounts. Most of these features require the taxpayer to create a MyTax Illinois account.

Read Also: How To Do Taxes With Doordash

Read Also: How To Lower Property Taxes In Florida

How Does The Irs Notify Taxpayers Of Tax Debt

send you a notice

- IRS Statutory Notice of Deficiency: If you receive a CP3219 or LT3219 notice, the IRS is notifying you that you owe additional taxes on a tax return. This may mean theyve performed an audit, your tax return doesnt match taxable income information the IRS has received from other parties, or theyre performing an unfiled return investigation.

- Final Notice of Intent to Levy: If youve ignored previous notices and refused to get in contact with the IRS about settling your debt, youll receive a Final Notice of Intent to Levy. This means your case has been transferred to the IRS Collection Unit, who now have the authority to enforce collection through a lie or levy.

Find Out How Much You Owe The Irs By Checking Previously Mailed Notices

If you have already received a notice from the IRS, you can check your balance from the notice that they mailed to you. This is our least recommended method if you owe several years because you might miss a notice since they send a lot. The notice should state the amount due plus interest and penalties that apply. You should also take note that the notice the IRS mails out only covers one year of taxes owed. So if you owe a couple of years, then you should add the amounts indicated per notice they mailed out to you. If you think that the IRS missed mailing you a notice for a tax year or two, then its best if you make sure how much you owe the IRS by calling them. You can call the number that they included in the notice.

You May Like: Where To Get Help Filing Taxes

Using The Irs Online Tool

The IRS has an online tool that can help you figure out how much you owe in taxes. The tool shows a balance for each year, making it easy to see the total amount you owe. It also shows the principal amount and any penalties or interest you may have accrued. Another great feature is that it keeps track of any payments you have made in the last 18 months.

After you have made a payment, it usually takes the system one to three weeks to post your payment. Do not be alarmed if you make a payment and it does not post immediately. Interest and penalties are updated every 24 hours. After viewing the amount you owe, this online tool also provides you with direct links to set up an electronic payment or get your tax transcripts.

If you need an official hard copy of your tax transcripts, you can also use this tool to request that the IRS mail your transcript to you. This will usually take five to ten business days. If you filed a tax return for both yourself and your business, make sure you are using the tax ID number for the correct return. Another nice feature is that these transcripts are free of cost.

RELATED: 5 Things to Avoid If You Owe Money to the IRS

Through this online tool is very convenient, it is not operable during the middle of the night and is limited on Sundays.

Its hours of operation are:

Monday to Friday 6 a.m. to 12:30 a.m ET

Saturday 6 a.m to 10 p.m ET

Sunday 6 p.m. to 12:00 a.m ET

What Is My Tax Account Balance

Your tax account balance is the total amount you paid throughout the year toward the tax on the income you made. Your balance includes:

- any estimated tax payments made using software, from your online services account, or with Form IT-2105, Estimated Tax Payment Voucher for Individuals,

- any overpayment from last years return that you asked us to apply to the following year, and

- if you filed an extension, any payment made using software, from your online services account, or with Form IT-370, Application for Automatic Six-Month Extension of Time to File for Individuals.

Note: If your employer withheld taxes from your paycheck, that amount is shown on your pay stub and the W-2 you receive at the end of the year. The amount is not included in your tax account balance as shown on your Account Summary homepage.

Recommended Reading: Where Do I Send My Federal Tax Return To

Fill Out A Form And Send It Through The Mail

Here is what you should do to find out if you owe taxes through the U.S. Postal Service. Obviously, this method takes more time, but its still a viable option for any taxpayer. Just keep in mind that interest will continue to accrue daily on any amount not paid, including on both penalties and interest.

You can request an Account Transcript if you filed a Form 1040, 1040A, or 1040EZ. As a business, you can request a Transcript of Tax Return if you submitted a Form 4506-T. Post office hours will depend on your location. So, you should check when it opens, the time it closes, and the services offered based on where you are.

You will receive a transcript covering a single tax year, so some additional charges may be left out. This means if youre wondering how to find out if I owe back taxes for previous years, you should seek another way.

Here are a few simple mailing tips:

- Check the IRS website and send to the correct address

- Make sure the IRS has your current address because that is where theyll send a response

- Apply the right amount of postage.

See If Our Program Is Right For You

You May Like: What Address Do I Send My Tax Return To

Search For Unclaimed Money In Your State

Businesses send money to state-run unclaimed property offices when they cant locate the owner. The unclaimed funds held by the state are often from bank accounts, insurance policies, or your state government.

-

Search for unclaimed money using a multi-state database. Perform your search using your name, especially if youve moved to another state.

-

Verify how to claim your money. Each state has its own rules about how you prove that youre the owner and claim the money.

You May Like: What Is Tax In Texas

Get A Loan Out Of Default

| Loan | ||

|---|---|---|

| The collection agency listed on your collection notice |

You can confirm which collection agency holds your account by calling: |

|

| Ontario Student Loans | The collection agency listed on your collection notice | You can confirm which collection agency holds your account by calling the Account Management and Collections Branch, Ministry of Finance: |

Learn how you could be eligible for financial relief and how the deferral may apply to your debt.

Using The Mail To Find Out How Much You Owe The Irs

If you have a copy of the latest notice mailed to you by the IRS, you can check that for your tax liability balance. Note that the amount shown does not include any interest or penalties assessed since the notice was sent. Also, many times the IRS will send notices that only contain one year of taxes owed, so if you owe taxes for multiple years it is likely that you will need to add up the balances on all of the notices . To get up-to-date information, you need to check online or by calling the IRS.

Don’t Miss: Do You Need 1099 To File Taxes

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you arenât required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Apply Your Marginal Tax Rate To Your Cpp

The final and easiest step in calculating your CPP taxes is to apply your marginal tax rate to your CPP. If youre going to get $10,000 in CPP in a year, and your marginal tax rate is 30%, then youll pay $3,000 in taxes.

As you can see, its not that complicated once you have everything figured out. If you want to avoid having to calculate all this yourself, you can request that the CRA do it for you. However, their estimates may be off if you have unexpected windfalls they dont know about.

This article represents the opinion of the writer, who may disagree with the official recommendation position of a Motley Fool premium service or advisor. Were Motley! Questioning an investing thesis even one of our own helps us all think critically about investing and make decisions that help us become smarter, happier, and richer, so we sometimes publish articles that may not be in line with recommendations, rankings or other content.

Fool contributor Andrew Button has no position in any of the stocks mentioned. The Motley Fool recommends FORTIS INC.

You May Like: How Much Is Washington State Sales Tax

Why Do I Need Freeirsreportcom

FreeIRSReport.com makes it easy to see exactly how much you owe the IRS, in total. Even if youve received an IRS collection notice, you may not know exactly how much you owe. Collection notices generally only apply to a single filing year. You may owe multiple years of taxes and could be facing penalty interest up to 25% of what you owe.

In addition, the free tax analysis that you receive will come with built-in solutions based on your financial situation. If you contact the IRS directly, theyll be happy to tell you what you owe, but not what to do about it.