What Is The Individual Taxpayer Identification Number

Individual Taxpayer Identification Number, or ITIN for short, is a tax processing number used by the IRS to aliens who may or may not have the right to work in the U.S., such as aliens on temporary visas and non-resident aliens. The ITIN is issued to persons who are required to have a U.S. taxpayer identification number but dont have one or arent eligible to obtain an SSN. Often people who arenât U.S. citizens need this identification number to open a bank account.

When To Apply For A New Ein

Your EIN or Tax ID number will stay with your business for the life of the company.

However, if certain changes are undergone a new EIN needs to be issued. So, if youre moving forward with any of the below changes to your business, keep in mind that your old EIN is not going to work and youll need to apply for a new one:

- Ownership has changed

- You were a sole proprietor when you received your EIN and have since incorporated

- Youre a sole proprietor and youve recently established a retirement or profit-sharing plan

- You purchase a pre-existing business

- Your business becomes a subsidiary

For more information and a complete list of cases where your business will need to obtain a new EIN, see irs.gov/pub/irs-pdf/p1635.

One common case where you would not need to apply for a new EIN is in the case of a business ceasing operation and then picking up shop again later. If youre picking up operations again after a hiatus, your EIN is still relevant.

How To Obtain A Tax Id Number For An Llc

Be sure to meet your tax obligations as you move forward with your new LLC company.

Once an LLC is registered with the appropriate state government agency, usually the secretary of state, the entity’s owner must decide whether they wish or need to secure an Employer Identification Number from the Internal Revenue Service.

LLCs without employees don’t need to obtain an EIN to do business as they may file the business’ taxes using the owner’s Social Security Number . However, once an LLC hires its first employee, an EIN is required for the entity to file taxes.

Read Also: How Do I File My Unemployment On My Taxes

Option : Check Your Ein Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

-

If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by traditional mail.

-

If you applied by fax, you would have received your confirmation letter by return fax.

-

If you applied by mail, you would have received your confirmation letter by return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

In this sample EIN confirmation letter, you can find your EIN at the top of the page, as well as in the first paragraph.

What Is My Tin Finding Out Your Own Tax Number

The IRS have to process huge amounts of data from millions of different US citizens. Organizing this is a real challenge, not only because of the sheer volume of data to be processed, but also because identifying people can be quite tricky without the right system. For example, according to the Whitepages name William Smith has over 1,000 entries in the State of Alabama alone. Across the USA this number increases, and the likelihood is that some of these individuals will have the same date of birth, for example, which is often used to identify people. This means that there needs to be another system for keeping track of individuals for tax purposes in the US other than just their names: A taxpayer identification number serves this purpose.

A Taxpayer Identification Number is often abbreviated to TIN and is used by the Internal Revenue Service to identify individuals efficiently. Where you get your TIN, how it is structured, and whether a TIN is the right form of identification for your purposes sometimes seems like it isnt as straightforward as it should be. However, this guide will look at exactly these issues which should show that finding out this information can be as easy as 1,2,3. In this article, we want to concentrate on the tax number that you as an employee will need for your income tax return or the number that you as an employer require for invoicing, and well explain exactly where you can get these numbers.

Contents

Don’t Miss: Where Is Home Office Deduction On Tax Return

How To Find State Tax Id Number For A Company

Most businesses must have an employer identification number in order to open a bank account, receive a business license, file taxes, or apply for a loan.3 min read

Need to know how to find a state tax ID number for a company? Most types of business entities must have an employer identification number in order to open a bank account, receive a business license, file taxes, or apply for a loan. This EIN, also known as a business tax ID number or federal tax ID number, is a nine-digit number that the IRS uses to identify a business.

Whether or not your company employs workers, youll probably need this number for federal tax filing purposes. However, not every company needs an EIN. In some instances, a sole proprietor without any employees can simply use their own social security number.

Some states may require your business to have an EIN prior to completing state tax forms or registering your company within the state. In addition to tax filing, the EIN is used to identify a business in order to process a business license or satisfy other state requirements. For example, California State requires most businesses to have an EIN prior to registering state payroll taxes.

Option : Call The Irs To Locate Your Ein

You should be able to track down your EIN by accessing one or more of the documents listed above but if you’re still not having any luck, the IRS can help you with federal tax ID lookup. You can call the IRSs Business and Specialty Tax Line, and a representative will provide your EIN to you right over the phone. The Business and Specialty Tax Line is open Monday through Friday from 7 a.m. to 7 p.m. ET. This should be your last resort, however, because call wait times can sometimes be very long.

Before you call, keep in mind that the IRS needs to prove youre actually authorized to retrieve your business tax ID number. For example, youll need to prove you are a corporate officer, a sole proprietor, or a partner in a partnership. The IRS representative will ask you questions to confirm your identity.

Don’t get frustrated: This is simply a precaution to help protect your businesss sensitive data. After all you wouldn’t want the IRS to give out your social security number to anyone who called, would you? Once you’ve found your business tax ID number, we suggest putting the number in a safe placelike a locked file cabinet or secure cloud storage so you won’t have to go through these steps again.

Read Also: What Form To File Extension Taxes

Where Do I Find My Small

Related

Everyone with a business needs a tax identification number, or TIN. Individuals usually use their Social Security numbers. Proprietors and partners often choose to get a TIN for their business operations, even if taxes from the businesses pass on to the owners. Corporations, limited liability companies, or LLCs, and limited liability partnerships, or LLPs, usually get Employer Identification Numbers, or EINs for tax identification purposes.

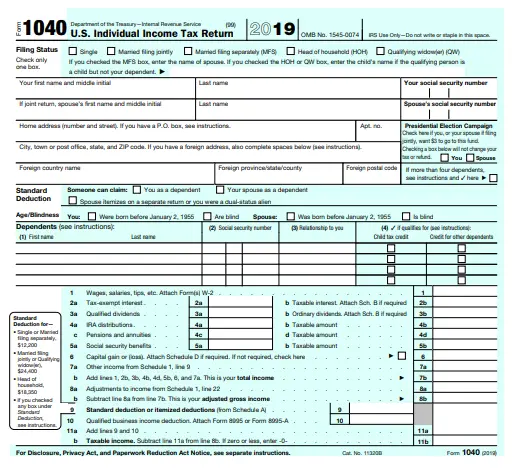

Check Your Tax Documents

You can find the number on the top right corner of your business tax return. If you open the return and discover that the number has been replaced with asterisks for security purposes, contact your CPA and request the number from them.

The business EIN is listed on the top right of a business tax return.

If you file your own taxes with tax software, the software will save the number from year to year. Visit the softwares business section to retrieve your EIN.

Also Check: What Tax Return Does An Llc File

Read Also: What Is Federal Withholding Tax

Apply For Your Tax Id Number Online

Do you need your Tax ID Number fast? Applying for your Tax ID Number online is the best option. When you apply online through a third-party tax ID service, you can get your Tax ID Number in an hour. The tax ID service will collect and verify your information and give you a Tax ID Number that can then be used immediately on official forms and documents.

Finding The Federal Tax Id Number Of A Third Party

Don’t Miss: When’s The Deadline To Do Your Taxes

Federal Employer Identification Number

Sole proprietors who do not have employees, who are not required to file information returns, who do not have a retirement plan for themselves, and who are not required to pay federal excise taxes in connection with their business generally may use their social security number as their federal employer identification number ). Single-member limited liability companies that have elected to be taxed as a sole proprietorship may follow that rule, too.

All other business entities are required to obtain a federal employer identification number by filing Form SS-4 with the Internal Revenue Service. Note also that an independent contractor doing commercial or residential building construction or improvements in the public or private sector is considered to be, for workers compensation purposes, an employee of any person or entity for whom or which that independent contractor performs services unless, among other things, that independent contractor has a federal employer identification number.

Form SS-4 may be obtained from the Internal Revenue Service by calling the IRS at the telephone number listed in the Resource Directory section of this Guide. The form and instructions can also be printed directly from the IRS website at Forms and Publications, go to Forms, Instructions & Publications.

To obtain a federal employer identification number from the Internal Revenue Service :

You May Like: How To Pay Taxes For Free

How To Get An Ein

You can apply to the IRS for an EIN in several ways: by phone, fax, or mail, or online. Filing online using the IRS EIN Assistant online application is the easiest way. You can get your number immediately using the online or phone option.

Its a good idea to print out a copy of the application form before you begin the application process. Work through the application questions so you have all the answers youll need.

Don’t Miss: Can You File For Previous Years Taxes

Individual Taxpayer Identification Number

The IRS issues the Individual Taxpayer Identification Number to certain nonresident and resident aliens, their spouses, and their dependents when ineligible for SSNs. Arranged in the same format as an SSN , the ITIN begins with a 9. To get an individual tax id number, the applicant must complete Form W-7 and submit documents supporting his or her resident status. Certain agenciesincluding colleges, banks, and accounting firmsoften help applicants obtain their ITIN.

Understanding The Tax Identification Number

A tax identification number is a unique set of numbers that identifies individuals, corporations, and other entities such as nonprofit organizations . Each person or entity must apply for a TIN. Once approved, the assigning agency assigns the applicant a special number.

The TIN, which is also called a taxpayer identification number, is mandatory for anyone filing annual tax returns with the IRS, which the agency uses to track taxpayers. Filers must include the number of tax-related documents and when claiming benefits or services from the government.

TINs are also required for other purposes:

- For credit: Banks and other lenders require Social Security numbers on applications for credit. This information is then relayed to the to ensure the right person is filling out the application. The also use TINsnotably SSNsto report and track an individuals .

- For employment: Employers require an SSN from anyone applying for employment. This is to ensure that the individual is authorized to work in the United States. Employers verify the numbers with the issuing agency.

- For state agencies: Businesses also require state identification numbers for tax purposes in order to file with their state tax agencies. State taxing authorities issue the I.D. number directly to the filer.

Read Also: Will I Get Any Money Back From My Taxes

You May Like: What Is My Sales Tax Number

How To Find Your Employer Identification Number

An Employer ID Number is an important tax identifier for your business. It works in the same way a Social Security number does for individuals, and almost every business needs one. The most important reason for an EIN is to identify your business for federal income tax purposes, but its also used to apply for business bank accounts, loans, or credit cards, and for state and local taxes, licenses, and other registrations .

Federal Tax Id Number Versus Ein

In short, a federal tax ID is the same as an EIN. As is often the case in business, though, youll hear several acronyms that all reflect the same concept. These acronyms can be confusing, but here is a clear breakdown of what each refers to and how they differ.

- The federal tax ID number is also known as the TIN.

- Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a federal tax ID number, and it is used to identify a business entity.

- An EIN may also be called a FEIN .

Read Also: How Can I Get My Tax Information From 2015

Obtain A Federal Employer Identification Number From The Irs

Most businesses are required to register with the IRS to receive a Federal Employer Identification Number . This is also sometimes referred to as an Employer Identification Number , or a Federal Tax ID Number. Some reasons for obtaining a FEIN include, but are not limited to:

- Paying federal and state taxes

- Obtaining a Maryland Tax ID Number from the Maryland Comptrollers Office

- Opening a business bank account

- Hiring employees

You can apply for a FEIN online or download the form through the IRS website, or can call them at 1-800-829-4933. Remember, you must have a Maryland SDAT Identification Number in order to apply for a Federal Employer Identification Number. Once approved, your FEIN will be a nine-digit number.

Stay Consistent

When filing with different agencies for the same business, it is important you keep your business information consistent. For example: make sure the business name submitted to the IRS is identical to the business name registered with SDAT, including punctuation.

Who Is Eligible For A Refund

The owner of the salvage vehicle may request a refund of the prorated VLF. The owner of the salvage vehicle can usually be determined as follows:

- The insurance company is the owner if you received a settlement for your loss and possession of the salvaged vehicle is retained by an insurance provider or their agent.

- You are the owner if you retained the salvaged vehicle following a determination by your insurance provider that your vehicle is uneconomical to repair and:

- No repairs are initiated by you or in your behalf, and

- You applied for a Salvage Certificate or Non-repairable Certificate.

If you are not sure that the VLF refund was included as part of your settlement you should contact your insurance provider for verification. DMV does not have this information. Persons who were cited for violations of CVC §§23152, 23153, or 23103 as specified in §23103.5 , incidental to the loss, are not eligible for this refund.

You May Like: Is There State Income Tax In Tennessee