How To Find Free Property Tax Records

Finding free property tax records is fairly simple, and thanks to online access to many of these records, you can probably do so from the comfort of your own home. Deeds, mortgages and other property-related records are a matter of public record and available to anyone seeking them. The information kept on a given property ranges from the name of the owner to how much taxes paid each and currently owed.

You can locate property tax records for your property and others without having to pay expensive fees. All deeds, mortgages and related paperwork are considered public record, and can be viewed at your local county assessor or auditor’s office.

The Problem With Waiting For Tax Lien Sales

The city, county, or township will hold a public auction or tax lien sale to try and recoup some of the unpaid property taxes at least once a year.

This isnt a secret its the avenue many real estate investors use to find and buy great properties at much less than theyre worth.

Thats the issue. So many longtime and beginner investors show up and show out at these auctions that a few negative things can happen:

- Too many bidders at the auction, less opportunity for each one

- Limited choice means only the properties already seized are available

- Bidding wars drive costs up, sometimes beyond market value

None of these are good things in the world of real estate investing. In order to access the best deals and the widest range of properties, you have to get out of the highest bidder mentality and get your hands on the delinquent property tax list and contact pre-foreclosure property owners.

Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

Recommended Reading: How Much Tax Is Taken Out Of Paycheck In Texas

How Much Is The Property Tax In Ontario

Commercial General 1.2137%

Vancouvers Low Property Taxes May Not Be Feasible For Everyone

Despite the fact that Toronto has lower property taxes than the majority of other GTHA municipalities, the city has managed to balance its books thanks to the Municipal Land Transfer Tax, which has brought in billions of dollars from the booming real estate market. However, according to property records, Vancouver has some of the most expensive homes in Canada and the lowest property taxes. The low property taxes in Vancouver may appeal to some, but it may not be feasible for everyone.

The Property Tax Rate In Niagara Falls

A property tax in Niagara Falls is typically $4.20. Rates vary depending on the type of property. A commercial property, for example, will have a higher tax rate than a residential property. County taxes are divided into one-third and one-half tiers based on the size of a business. At the moment, the property tax rate is $9.54 per $1000 of assessed value. The Niagara Falls City Council, after determining the city tax rate, establishes the tax rate.

Recommended Reading: When Do I Have To Pay My Taxes By

What Is The Education Property Tax Credit Advance How Do I Apply For It

The Education Property Tax Credit is a credit for homeowners and tenants offsetting occupancy costs – property tax for homeowners and 20% of rent for tenants â payable in Manitoba. The Advance is the Education Property Tax Credit applied directly to the municipal property tax statement for homeowners.

The Education Property Tax Credit Advance can only be claimed on a homeownerâs principal residence. The maximum Education Property Tax credit is $700.00. If the EPTCA is not included in you tax bill, you can apply for the credit in the following ways:

- If you notify our office before the printing of the property tax bill for the year, we could directly apply the credit to your tax bill starting in that year.

- If you notify our office after the printing of the property tax bill for the year, you may claim the credit on your personal income tax return for that year and will receive the credit on your property tax bill in subsequent years.

What Is Lake County Doing To Lower My Bill

Lake County has more than 200 individual entities that levy property taxes, which is why the Lake County Board is pursuing partnerships and looking for consolidation opportunities to reduce this number. Consolidation efforts are centered around partnerships that will enhance efficiency, accountability, and cost savings.

- Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

- Learn more about consolidation efforts and how your property tax dollars are used to help make Lake County a great place to live, work and visit.

Don’t Miss: How To File Taxes Without Social Security Number

Last Year’s Property Tax Amount

This amount indicates the previous years municipal and provincial education property taxes for your property.

It may be different from the amount stated on your last annual tax notice if your property was subject to an assessment correction, Assessment Review Board decision, a supplementary or amended assessment, a change in exemption status or a change in property use.

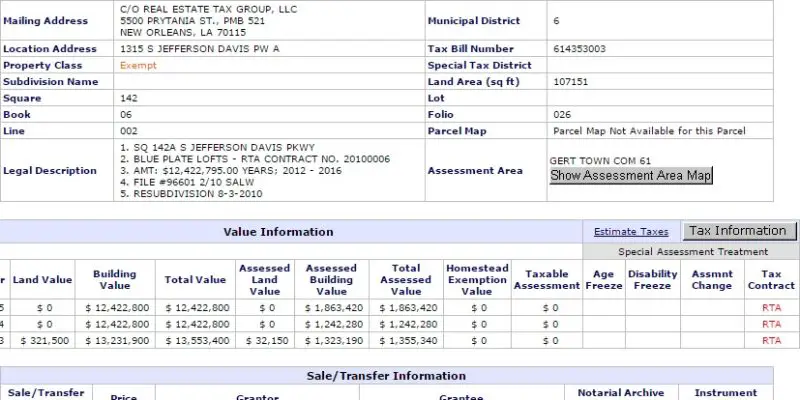

Real Property Tax Database Search

The Office of Tax and Revenue’s real property tax database provides online access to real property information that was formerly available only through manual searches and at various DC public libraries. You can obtain property value, assessment roll, and other information for more than 200,000 parcels using the links below. The DC Public Library also has this database, and you may still conduct a manual search at the OTR Customer Service Center.

If you need assistance, call the Customer Service Center at 727-4TAX or contact OTR via email.

Recommended Reading: How File Old Tax Returns

Understanding Your Property Tax Notice

The amount of property tax you pay is based on your annual property assessment. We send you your property tax notice in early May, for payment at the beginning of July.

Your property tax notice is made up of taxes set by Burnaby City Council, including general city taxes, Local Area Service Levy, sewer parcel and Business Improvement Area Bylaw.

Provincial legislation requires Burnaby to collect taxes for services provided by other taxing authorities, such as the Province of BC, TransLink, Metro Vancouver, BC Assessment Authority and Municipal Finance Authority.

Important Information For 2022

Due to processing delays at the Province of Alberta Land Titles Office, recent ownership and mailing address changes were not reflected on the property tax bills mailed in late May.

The City of Calgary is not responsible for delays. Non-receipt of your property tax bill does not exempt you from late payment penalties.

The Alberta Government introduced a Property Tax Late Penalty Reimbursement. If you recently purchased property, did not receive a tax notice, and paid a late payment penalty, you may be eligible for reimbursement. You are still responsible for ensuring your outstanding property tax is paid in full. The Government of Alberta will not reimburse additional late penalties incurred for non-payment. Visit www.alberta.ca/property-tax-late-penalty-reimbursement for more information.

You May Like: How To File Sales Tax In California

When Are My Taxes Due

The due date for property taxes is September 30th. Late payments are charged with a monthly interest of 0.6%. For more details about outstanding payments, please contact our office by toll free number at 1-888-677-6621 or email .

To provide relief during the pandemic, the Manitoba government waived interest between March 2020 and May 2020.

What Happens If Property Taxes Are Not Paid

Payment of property taxes is a legal obligation of property owners, as taxes are the means by which local residents contribute to the cost of education and local services in their community. Failure to pay taxes result in a loss of revenue, impacting the communitiesâ ability to provide municipal services such as water, sewer, and waste disposal.

In addition, failure to pay outstanding taxes may result in:

- Your property being placed in tax sale

- Further legal action taken by the provincial government

Also Check: Do I Need W2 To File Taxes

Who Pays The Most In Property Tax

There is no easy answer when it comes to who pays the most in property taxes. However, some research suggests that it is the wealthy who shoulder a disproportionate burden when it comes to this type of taxation. This is because they tend to own more expensive property, which is taxed at a higher rate. Additionally, the wealthy are often subject to higher taxes on their income and estate, which can also lead to them paying more in property taxes. While there is no definitive answer, it seems clear that the wealthy pay more in property taxes than other groups.

Real property is subject to ad valorem taxation, which means it is subject to the same tax as other types of property. In 2009, local governments and school districts outside of New York City collected a total of $28.87 billion in property taxes. Schools levied 62 percent of the tax, while counties levied 17 percent.

Paid Property Tax Searches

An online search for websites pulls up numerous websites that offer “free” property tax searches. Unfortunately, many of these ultimately require you to pay for the search. This information is a matter of free public record, and with a little due diligence, you can easily obtain this information yourself directly from the auditors or assessors office in the county in which the property is located.

Property taxes are maintained by a number of offices including city hall, the county courthouse and the county recorder. You may have to put in a little footwork, but its free and more than likely you can access these records online yourself. If you still find yourself at a dead end, try searching Trulia®, Zillow® or Realtor.com® for comprehensive and free property searches.

Don’t Miss: Where To Send My 1040 Tax Return

Highest Property Taxes In Canada

The highest property taxes in Canada can be found in the province of Ontario. In the city of Toronto, the average property tax rate is 2.47%. This is higher than the rate in any other major Canadian city.

In Canada, there are three major taxes that residents must pay. Property tax is unique in that it is levied on an asset rather than a financial flow. Rents in Canada are subject to house taxes, which are paid by the local government. Non-residential properties are taxed more than residential properties. Your municipalitys property tax rate will then be taken into account in addition to the market value of your home. The province with the lowest property taxes in Canada is British Columbia, while the province with the highest is New Brunswick. Property taxes are levied in all of the provinces cities, regardless of where it is located.

The tax rate in Toronto is about $12,437 when compared to the property tax rate of 0.599704%. Property taxes in Ontario are relatively low, but when calculated, they are quite high. In comparison to other provinces, the average property tax in Ontario is higher. To find out how much property taxes are in Winnipeg, for example, you could use a city property tax calculator.

How Is My Property Tax Calculated

Property tax is based on the assessed value of your property. Manitoba Municipal Relations, Assessment Services branch assesses each property for both the land and the buildings of that property by comparing lot sizes, location, local improvements, building age, size, condition and the quality of the construction.

Property taxes that are collected are provided to school divisions for school taxes and the northern affairs communities to cover the cost of municipal service provided to property owners.

Don’t Miss: How To Track My State Taxes

Planned Update To Transition To New Appraisal System

As the Assessors Office transitions to a new mass appraisal system, the office is implementing a planned system update that will have some impact on our website and web maps.While there will be little public impact, it will cause a delay in updating some information on our website from August 25 until at least October 3, 2022.We understand this may cause some confusion and are working diligently to make this transition to the new Assessment Analyst Geographic Assisted Mass Appraisal system as smooth as possible. We appreciate your patience during these next few weeks.During this transitionary period, we will continue to receive and process ownership documents, but our website will not reflect property ownership changes, mailing address updates, or transfers of titles until the changeover is complete.For any immediate property ownership record requests, please contact the For any splits that occur during the blackout period, parcel numbers will still be created and mapped by our GIS Mapping Unit but will be displayed as Ownership Pending on our website until the information can be posted in the AA-GAMA system.Regarding subdivisions, our GIS Unit will continue to map all subdivision splits but realize developers need parcel numbers in advance.

Assessor’s Office Rolls Out Long-term Strategic Plan

May 13, 2022

How Much Is My Tax Bill

Your annual tax statement includes the amount of taxes owing as of the date of the statement. If you are making a late payment, you may have been charged with monthly interest. Please contact our office for the up-to-date outstanding amount by toll free number at 1-888-677-6621 or email and remember to include the roll number of the property.

Also Check: Where’s My Unemployment Tax Refund

My Take On Tax Delinquent Properties

VectorMine/Shutterstock

Let me start by saying that this is only my opinion. I dont fault anyone for trying to find tax delinquent properties. They can be a great way to find property for little money down.

That said, my investment strategy revolves around helping people, and buying past-due tax notes just doesnt fit my model. I couldnt sleep well at night knowing Id be taking someones house from them for a small past due balance.

Yes, business is business, but I just dont believe in the model when it comes to buying with the goal of eventually taking the home. However, it can be highly profitable when done right.

And again, not everyone shares my investment philosophy, which is fine. Alternatively, some investors are just seeking interest, and tax delinquent properties offer a great return.

If you dont actually intend to foreclose on the home, it can be a great way to help someone get back on track while also getting a little interest in the meantime. Its a win-win.

I have looked into this, but the time and effort required were not worth the return for me. Its a labor-intensive process, and most balances fall under $5,000, so even at a 14% interest rate, here in Nebraska youd only get 7% annually. This is simply is not enough return for me to invest my energy into a deal

The best real estate investing software. Period.

Pros:

- Extensive property database

- Very accurate comp tool & filters

- Very low $97 monthly price

Cons:

Using The Information Youve Found

There are many reasons why youd want to know the information on a property. New homeowners can check public records so they have an idea of what their property taxes may be. Existing homeowners often perform searches on their own properties to ensure they are current on their property taxes.

More than likely, you will also find the parcel boundaries. This information is useful in the event you want to make any improvements to the parcel. Knowing your exact property lines and boundaries prevents you from accidentally encroaching on your neighbors land.

Also Check: When Do I Have To Do My Taxes By

How To Find Tax Delinquent Properties In Your Area

Imagine scoring a well-maintained $300,000 home for just a few thousand dollars. Does that sound too good to be true? Its not. Read on to learn how to find tax delinquent properties in your area to accomplish just that.

The best real estate investing software. Period.

Pros:

- Extensive property database

- Very accurate comp tool & filters

- Very low $97 monthly price

Cons:

Average Property Tax Ontario

According to the most recent data from the Canadian Revenue Agency, the average property tax rate in Ontario is 1.38%. This means that for every $100 of assessed property value, the average Ontarian pays $1.38 in property taxes. The average property tax bill in Ontario is $2,788.

Property tax rates vary across the province based on the size of municipal governments, the budget of councils, and the value of local real estate. City centers with a larger population, such as the City of Toronto, may be able to offer lower property tax rates due to a larger pool of taxpayers and higher property values. Rural communities may be subject to a higher tax rate because their population is smaller and their resources are limited. Between September 2020 and September 2021, the benchmark home value for Ontario increased by 19.7%. Zoocasas 2021 property tax rates for 35 Ontario municipalities have been published. A $500,000 property in Toronto is taxed at $3,055.07 per year, according to the Tax Foundation. As Toronto continues to boast the lowest property tax rate in Ontario, its counterparts in Markham and Richmond Hill have also seen significant drops in their tax rates. In many cases, the lowest-priced real estate is found in tax-burdened cities with high property taxes. The latter may be raised if a local council believes that businesses require more competitive advantages.

Don’t Miss: How Do I File My California State Taxes For Free