Example : Increase In Municipal Costs

If your municipality needs more money, your property taxes may increase.

Using the original property values of $125,000, $175,000 and $200,000, an increase in municipal costs to $2,500 increases the overall tax rate to 0.5%.

The total value of the three properties is $500,000 and the cost of services is now $2,500, so the tax rate is 2,500/500,000 = 0.005, or 0.5%. Therefore:

- The owner of the $125,000 property pays 0.5%, or $625.

- The owner of the $175,000 property pays 0.5%, or $875.

- The owner of the $200,000 property pays 0.5%, or $1,000.

- The total of the tax paid by the three property owners is $2,500.

What Are Property Tax Exemptions

Here’s a breakdown of some of the most common property tax exemptions:

- Homestead

- Senior Citizens

- Veterans/Disabled Veterans

Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. These specialized exemptions are usually a reduction of up to 50% of taxable value. However, rates can vary by location.

Some states offer exemptions structured as an automatic reduction without any participation by the homeowner if your property is your primary residence. Other states and counties require applications and proof for specific exemptions such as a homeowner whos a disabled veteran.

Lets look at an example with regard to the homestead exemption, which safeguards the surviving spouse and protects the value of a home from property taxes and creditors in the event a homeowner dies.

Say your state offers a homestead exemption for a homeowners primary residence that offers a 50% reduction of the home’s taxable value.

This means that if your home was assessed at $150,000, and you qualified for an exemption of 50%, your taxable home value would become $75,000. The millage rates would apply to that reduced number, rather than the full assessed value.

Its worth spending some time researching whether you qualify for any applicable exemptions in your area. If you do, you can save thousands over the years.

What Is A Property Tax Assessment

A property tax assessment determines the cost of your property taxes. This professional estimation of your propertys worth is determined by a number of factors, including how it compares to other, similar homes in your area.

If youre scoping out places to live, you can get an idea of the property tax situation in the area by looking at how much homeowners pay per thousand dollars of home value.

This measurement is referred to as a mill. If there are special assessments for property taxes to pay for education or infrastructure funding like roads, cities will hold a millage to vote on whether taxpayers should spend a certain amount of money per thousand dollars in home value in order to fund it.

You can find your local millage rate by contacting your county assessors office.

Recommended Reading: What Does Agi Mean In Taxes

Bills Paid By Mortgage Companies Agents Or Tenants

If your bills are to be paid by a mortgage company, agent or tenant:

- Forward your interim tax bill to the mortgage company, agent or tenant.

- Email the City at to have future bills redirected.

If paid by a mortgage company, you will receive a receipt after payment of your final bill in July. If your tax bills are not paid by the due dates, you will receive reminder notices. It is your responsibility to inform the City in writing when a mortgage company, agent or tenant will no longer be paying your tax bill.

If you have registered for payment through your mortgage, and you receive a bill, we have no record of your mortgage company on your account. Contact your bank for instructions. You should request that your bank contact us to ensure we record their interest on your account. This will ensure all future bills will be sent to them. To avoid a penalty on your account you should contact your bank immediately.

Determine Your Home’s Assessed Value

Your home’s assessed value is actually more complicated than just determining what someone might pay for your home if they were to buy it right now, or even what you just paid for it if you purchased it recently. You can most easily find this number if you:

- Try searching by state, county, and zip code on NETROnline to find your assessor’s contact information.

- Depending on where you live, you may be able to click the “Go to Data Online” link once you’ve located your county to start a property records search to find this information without making a call.

- If the records aren’t readily available online, you can call the number from the public records file on the first page.

According to Realtor.com, tax assessors establish a home’s assessed value every time the property changes hands or is upgraded. They factor in things like the size of your lot and your home, as well as the number of beds and baths in the house, and compare it to other similar properties in your neighborhood.

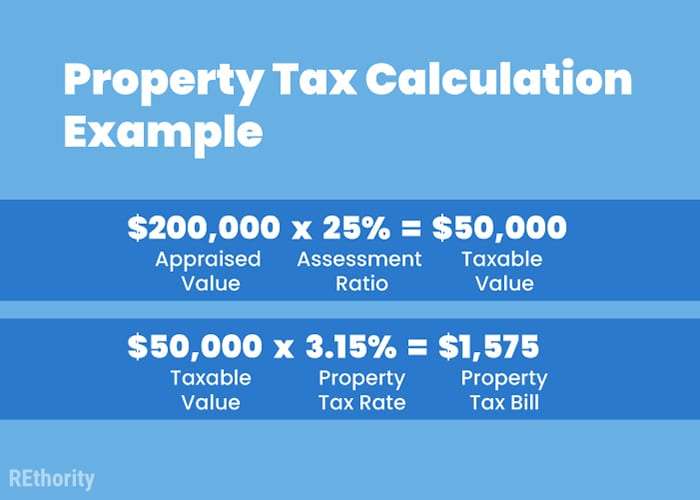

To determine your home’s assessed value, assessors multiple the actual value of your home by your local assessment percentage. A home with a value of $250,000, for example, might have an assessed value of $20,000 if the local assessment percentage is 8%.

Popular Articles

Don’t Miss: Do You Have To Report Roth Ira On Taxes

Your Property Tax Is Proportional To The Value Of Your Property

In this example, a small municipality with three properties worth $125,000, $175,000 and $200,000 has services costs of $2,000 that are paid by property owners through property taxes.

Each property owner in the municipality pays a proportion of that $2,000 based on their property’s assessed value. This is calculated by first adding up the value of all three properties, for a total of $500,000. Since the cost of services is $2,000, the tax rate is 2,000/500,000 = 0.004, or 0.4%. Therefore:

- The owner of the $125,000 property pays $500.

- The owner of the $175,000 property pays $700.

- The owner of the $200,000 property pays $800.

- The total of the property tax paid by the three property owners is $2,000.

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

Don’t Miss: How Can I Make Payments For My Taxes

All Deferment Applications Must Be Submitted Online Through The Service Bc Provincial Website

Renewal and New Deferment applications will not be accepted or given out at Maple Ridge City Hall. All deferment applications must be submitted on-line through the Service BC Website.

Remember you will still need to:

- Claim your Home Owner Grant and

- Pay the Total Utility Services amount to the City of Maple Ridge

How Your Property Tax Is Calculated

Property taxes are calculated using the assessed value of your property and multiplying it by the combined municipal and education tax rates for your class of property.

Your municipality or local taxing authority will use these taxes to help pay for the services they are responsible for such as:

- police

- waste disposal

- parks and leisure facilities

Education tax rates, set by the Ontario Government, may also be applied using these assessed values.

To learn more about how taxes are calculated, watch the video below.

Read Also: How Can I Make Payments For My Taxes

All About Property Taxes

When you purchase a home, you’ll need to factor in property taxes as an ongoing cost. After all, you can rely on receiving a tax bill for as long as you own property. Its an expense that doesnt go away over time and generally increases over the years as your home appreciates in value.

What you pay isnt regulated by the federal government. Instead, its based on state and county tax levies. Therefore, your property tax liability depends on where you live and the value of your property.

In some areas of the country, your annual property tax bill may be less than one months mortgage payment. In other places, it can be as high as three to four times your monthly mortgage costs. With property taxes being so variable and location-dependent, youll want to take them into account when youre deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but youll need to have room in your budget for the taxes if you want to live there.

A financial advisor in your area can help you understand how homeownership fits into your overall financial goals. Financial advisors can also help with investing and financial plans, including taxes, retirement, estate planning and more, to make sure you are preparing for the future.

What Is A Homes Fair Market Value

The market value of a home is basically the amount a knowledgeable buyer would pay a knowledgeable seller for a property, assuming an arms-length transaction and no pressure on either party to buy or sell. When a property sells to an unrelated party, the sales price is generally assumed to be the fair value of the property.

Don’t Miss: Can You File Missouri State Taxes Online

How Do I Make A Property Tax Payment

You can choose one of the following methods of payment:

- Internet/Online Banking and Telpay through your local bank or credit union.

Payee name:Manitoba IMR Property Tax. The account number would be your municipality number plus your roll number which you can find on your tax bill. It should be a total of 12 digits. Example:Municipality number: 702, Roll number: 0123456.000, In this case, delete the first zero in the roll number. Account number is 702123456000.

The most efficient way to pay your property tax bill is to make an online payment. Some payments may take 2-3 days. If you have questions about the on-line banking process, please contact your bank for further assistance.

- Chequesand Money Orders by Mail, including postdated cheques. Please make cheques payable to Minister of Finance as well as indicating your roll number to where the payment is being applied. Please send your cheques to:

Property TaxationManitoba Indigenous Reconciliation and Northern Relations400-352 Donald Street

- In office payments such as:

- Cash:Please do not mail

- Debit:No credit cards are accepted

- Cheques and Post dated Cheques:Payable to the Minister of Finance

- Address: Manitoba Indigenous Reconciliation and Northern Relations, 59 Elizabeth Drive, Thompson MB

Please note that, as a result of social distancing due to the pandemic, the office may not be open to in-person payments without an appointment. Please call our office by toll free number at 1-888-677-6621.

Last Year’s Property Tax Amount

This amount indicates the previous years municipal and provincial education property taxes for your property.

It may be different from the amount stated on your last annual tax notice if your property was subject to an assessment correction, Assessment Review Board decision, a supplementary or amended assessment, a change in exemption status or a change in property use.

You May Like: How Can I Make Payments For My Taxes

Secured Property Taxes Terms

Annual Secured Property Tax BillThe annual bill, which includes the General Tax Levy, Voted Indebtedness, and Direct Assessments, that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1, due in two installments.

Adjusted Annual Secured Property Tax BillA bill that replaces the Annual Secured Property Tax Bill due to the following reasons: a change or correction to the assessed value of the property the allowance of an exemption that was previously omitted the correction of a Direct Assessment placed on the property from a municipality or special district or the inclusion of a penalty for failure to comply with certain requirements of the Office of the Assessor prescribed by law .

Ad ValoremAccording to the value Based on value. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property.

Non-Ad Valorem Not according to the value.

AssessmentThe rate or value of a property for taxation purposes.

Assessors Identification Number A 10-digit number that identifies each piece of real property for property tax purposes, e.g., 1234-567-890.

California Relay ServiceA telecommunications relay service that provides full telephone accessibility to people who are deaf, hard of hearing, or speech impaired.

Current YearThe current fiscal tax year in which the Department of Treasurer and Tax Collector issues an Annual Secured Property Tax Bill.

Testate

Local Property Appraisal And Tax Information

The Comptroller’s office does not have access to your local property appraisal or tax information. Most questions about property appraisal or property tax should be addressed to your county’s appraisal district or tax assessor-collector.

Appraisal districts can answer questions about:

- agricultural and special appraisal

County tax assessor-collector offices can answer questions for the taxing units they serve about:

- payment options

- tax receipts

- other information related to paying property taxes

Questions about a taxing unit that is not listed as consolidated in a county should be directed to the individual taxing unit.

This directory contains contact information for appraisal districts and county tax offices and includes a listing of the taxing units each serves. Taxing units are identified by a numerical coding system that includes taxing unit classification codes.

This directory is periodically updated with information as reported by appraisal districts and tax offices.

You May Like: What Does H& r Block Charge

Bc Speculation And Vacancy Tax Due March 31 2021

The Provincial Speculation and Vacancy Tax is part of the BC Governments affordable housing plan. All owners of residential property in Maple Ridge must complete an annual declaration, either by phone or on-line. The information you need will be mailed by mid-February if you have not received one by late February, please contact the Province.

For information about the tax and the process, please contact:

I Paid My Property Tax Bill But I Have Not Received My Receipt

Effective August 2020, tax receipts will be provided only for in-person payments . We will no longer be providing tax receipts for other types of payments . For these payments, please keep your banking confirmation number for records, as that will be your proof of payment. If you require a receipt for a specific purpose , please contact our office by toll free number at 1-888-677-6621 or email .

You May Like: Where Is My State Refund Ga

How Much Is My Tax Bill

Your annual tax statement includes the amount of taxes owing as of the date of the statement. If you are making a late payment, you may have been charged with monthly interest. Please contact our office for the up-to-date outstanding amount by toll free number at 1-888-677-6621 or email and remember to include the roll number of the property.

What Is The Education Property Tax Credit Advance How Do I Apply For It

The Education Property Tax Credit is a credit for homeowners and tenants offsetting occupancy costs – property tax for homeowners and 20% of rent for tenants â payable in Manitoba. The Advance is the Education Property Tax Credit applied directly to the municipal property tax statement for homeowners.

The Education Property Tax Credit Advance can only be claimed on a homeownerâs principal residence. The maximum Education Property Tax credit is $700.00. If the EPTCA is not included in you tax bill, you can apply for the credit in the following ways:

- If you notify our office before the printing of the property tax bill for the year, we could directly apply the credit to your tax bill starting in that year.

- If you notify our office after the printing of the property tax bill for the year, you may claim the credit on your personal income tax return for that year and will receive the credit on your property tax bill in subsequent years.

Recommended Reading: Have My Taxes Been Accepted

Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

Exemptions For People With Disabilities And/or Veterans With Disabilities

If you qualify for this exemption, you may pay reduced rates or nothing at all depending on the law in your area. In some cases, this particular exemption may be tied to specific qualifications. For example, your level of tax exemption as a disabled veteran may be tied to your disability rating from the VA.

Recommended Reading: Mcl 206.707

When Are My Taxes Due

The due date for property taxes is September 30th. Late payments are charged with a monthly interest of 0.6%. For more details about outstanding payments, please contact our office by toll free number at 1-888-677-6621 or email .

To provide relief during the pandemic, the Manitoba government waived interest between March 2020 and May 2020.