Our Services Are Available Online By Phone Email Or Us Mail:

- Phone: Real Property Tax 206-263-2890

- Phone: Mobile Homes and Personal Property Commercial Property Tax 206-263-2844

- Email:

- Mail: King County Treasury Operations, 201 S. Jackson Street, Suite 710, Seattle, WA 98104 NOTE NEW MAILING ADDRESS

- Secure drop box: on side of 2nd Ave nearer to S Jackson ST

COVID-19 Update: The health and safety of our community and employees is our top priority. To help slow the spread of coronavirus , King County Treasury customer service operations are being provided remotely until further notice.

First-half property taxes are due May 2nd 2022

To review current amounts due please use the safe and secure online eCommerce System

What are Real Property and Personal Property Taxes?

- Real Property is residential or commercial land and structures

- Personal property is assets used in conducting a business

- Mobile homes and floating homes are taxed as personal property if not associated with a real property account

I know my parcel/account number

Need help? Check our Frequently Asked Questions , call 206-263-2890, or email .

Many changes have been made to the property tax exemption and deferral programs for seniors, people with disabilities, and military veterans with a service-connected disability.

Where Are Property Taxes Lowest And Highest

Note that the five states with the highest property taxes are:

STATE

|

$1,221 |

Please note: This data is based on WalletHubs 2021 findings however, the numbers pull from the 2019 census. So, you may see some fluctuation between the numbers mentioned above and other reports, particularly the median home value. Prices may also change depending on market influences.

Whats The Difference Between Property Taxes And Real Estate Taxes

Property taxes and real estate taxes are interchangeable terms. The IRS calls property taxes real estate taxes, but they are the same in all aspects. The money collected helps the government fund services for the community.

Sometimes youll also see a special assessment tax. This occurs when your locality needs to raise money to fund a specific project.

Recommended Reading: Sales Tax In Philadelphia

How Do Property Taxes Work

Let’s define a couple of key terms before we get into the details of how property taxes work. First, you must become familiar with the “assessment ratio.” The assessment ratio is the ratio of the home value as determined by an official appraisal and the value as determined by the market. So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% . The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

Wondering how the county assessor appraises your property? Again, this will depend on your countys practices, but its common for appraisals to occur once a year, once every five years or somewhere in between. The process can sometimes get complicated. In a few states, your assessed value is equal to the current market rate of your home. The assessor determines this by comparing recent sales of homes similar to yours. In other states, your assessed value is thousands less than the market value. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website.

To put it all together, take your assessed value and subtract any applicable exemptions for which you’re eligible and you get the taxable value of your property.

Deduct Any Exemptions You Qualify For

Most areas offer property tax exemptions to certain demographics. The exemptions are an attempt to make it easier for homeowners to afford their property taxes. In some cases, it may even eliminate property taxes altogether.

Here are the most common property tax exemptions, but check with your local government to see what options you have.

Homestead Exemption

Most areas offer a homestead exemption or a discount for living in the property full-time. You wont qualify for this exemption if you use the home as a vacation or investment home.

Senior Citizen Exemption

Many areas offer a senior citizen exemption which either discounts real estate taxes or freezes them at a specific rate. To qualify, you usually have to be of a particular age and live in the property full-time. This can be especially helpful if youre on a fixed income.

Religious Exemptions

If your property is a church, religious or charitable institution, it may be exempt from real estate taxes.

Exemptions for Homeowners with Disabilities

If youre a disabled homeowner , you may be eligible for an exemption that either reduces your tax liability or eliminates it. Every government has different rules and different exemptions based on the severity of your disability.

Recommended Reading: How To Write Off Miles For Doordash

Every Homeowner Pays Property Taxes Heres How

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

A property tax bill is part of the homeownership experience. Local governments collect these taxes to help fund projects and services that benefit the entire communitythings such as roads, schools, police, and other emergency services. There are two primary ways to pay your property tax bill: as part of your monthly mortgage payment or directly to your local tax office.

What Is Basic And Sef In Real Property Tax

Although the SEF tax is collected simultaneously with the basic RPT, the SEF tax is imposed at a fixed rate of one percent on the assessed value of real property while the basic RPT is imposed at not exceeding two percent of the assessed value of real property for cities and municipalities within Metro Manila and not

Recommended Reading: Efstatus.taxact.com.

What Is The Difference Between Real Property Tax And Estate Tax

Real property tax or commonly known as amilyar is a tax on the value of the real property a person owns. This is a form of ad valorem tax based on a fixed proportion of the propertys value. While the BIR administers estate tax, the local government units have the responsibility to administer RPT.

How Often Is Property Tax Paid In California

Property taxes are paid in two installments. The fiscal years first property tax bills are mailed out on October 1st the first installment is due by November 1st, and is considered delinquent on December 10th. The second installment is due February 1st, and this payment is considered delinquent after April 10th.

Read Also: How Does Doordash Do Taxes

How Is Property Tax Calculated

To determine your tax bill, the tax office multiples your propertys assessed value . For example, if your home is assessed at $200,000, and the local tax rate is 1%, your tax bill would be $2,000. Of course, the higher the assessed value, the higher the tax bill.

Some local governments apply the tax rate to just a portion of the assessed value. This is known as the assessment ratio. If your home is assessed at $200,000, and your county has an assessment ratio of 80% and a tax rate of 1%, your tax bill would be $1,600 .

If Youre Overpaying Taxes

When you get the total amount the county thinks your property is worth, you dont have to accept the finding. If you find that the amount is high, you can appeal the assessment and have the county look into it. Youll need to gather documentation to state your case and go through the appeals process outlined by your local authorities. If property values in your neighborhood have dropped quickly in recent years due to an outbreak of crime, for instance, bring evidence of local home sales and current real estate listings to back up your claims.

The county assessor is the one who makes the final decision and, unfortunately, that decision is one youll probably have to accept. Chances are, the overage will need to be significant before the assessor will agree to make an adjustment. If your case is approved, though, youll see a change in your property tax bill, which will help lower your monthly mortgage payment until the next assessment.

Read Also: Amend Tax Return Online For Free

What Are Property Tax Exemptions

Here’s a breakdown of some of the most common property tax exemptions:

- Homestead

- Senior Citizens

- Veterans/Disabled Veterans

Most states and counties include certain property tax exemptions beyond the full exemptions granted to religious or nonprofit groups. These specialized exemptions are usually a reduction of up to 50% of taxable value. However, rates can vary by location.

Some states offer exemptions structured as an automatic reduction without any participation by the homeowner if your property is your primary residence. Other states and counties require applications and proof for specific exemptions such as a homeowner whos a disabled veteran.

Lets look at an example with regard to the homestead exemption, which safeguards the surviving spouse and protects the value of a home from property taxes and creditors in the event a homeowner dies.

Say your state offers a homestead exemption for a homeowners primary residence that offers a 50% reduction of the home’s taxable value.

This means that if your home was assessed at $150,000, and you qualified for an exemption of 50%, your taxable home value would become $75,000. The millage rates would apply to that reduced number, rather than the full assessed value.

Its worth spending some time researching whether you qualify for any applicable exemptions in your area. If you do, you can save thousands over the years.

Your Check Register Records

If you pay your property taxes yourself, the quickest way to find out how much you paid is simply to go back through your check registers, bank account statements or credit card statements. Look for a payment to the treasurer or revenue department in whatever jurisdiction levies property taxes. If you don’t have such records, or you don’t pay property taxes directly, you have a couple of options.

Read Also: Reverse Ein Lookup Irs

Pay Your Local Tax Office

If you dont pay your property tax as part of a monthly mortgage payment, youll pay the tax office directly. You should receive a bill in the mail that includes payment directions. Depending on where you live, you may have several payment options:

- Online using a credit or debit card

- Online using an electronic check payment

In addition to the different payment options, you may get to choose if you want to pay the bill all at once or split it into monthly, quarterly, or biannual payments. Pay attention to any prepayment discounts offeredsome municipalities provide a discount if you pay early.

If you use a , you may be charged a convenience feea flat dollar amount or a percentage of the bill, typically 2% to 3%.

The Problem With Waiting For Tax Lien Sales

The city, county, or township will hold a public auction or tax lien sale to try and recoup some of the unpaid property taxes at least once a year.

This isnt a secret its the avenue many real estate investors use to find and buy great properties at much less than theyre worth.

Thats the issue. So many longtime and beginner investors show up and show out at these auctions that a few negative things can happen:

- Too many bidders at the auction, less opportunity for each one

- Limited choice means only the properties already seized are available

- Bidding wars drive costs up, sometimes beyond market value

None of these are good things in the world of real estate investing. In order to access the best deals and the widest range of properties, you have to get out of the highest bidder mentality and get your hands on the delinquent property tax list and contact pre-foreclosure property owners.

Don’t Miss: Plasma Donation Taxable Income

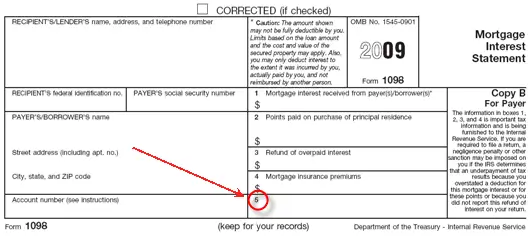

Form 1098 Tax Document

Obtain Form 1098 from your mortgage lender. This tax document lists the mortgage interest you pay during the year and also lists any real estate taxes your lender paid on your behalf through an escrow account. Your lender is authorized to pay only the actual amount of your property tax assessment through an escrow account, so in general, tax amounts shown are correct.

Examine Box 4 on Form 1098. Your lender uses this general information box to report information other than your mortgage interest to you. Any amounts shown should include a description, such as “Taxes” or “Property Tax.”

Compare Box 4 amounts with other sources. Your end-of-the-year mortgage statement may itemize taxes and other items paid through your escrow account. Compare any tax payments shown on this statement with the amount in Box 4. You may also contact your county assessor for confirmation of Box 4 amounts.

References

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S& P 500 with an average gain of +26% per year. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm.

Visit performance for information about the performance numbers displayed above.

Make A Direct Payment

If youre allowed and choose to pay your taxes yourself, you will pay them in full when they become due. Like we said earlier, some areas allow you to make quarterly or semi-annual payments to decrease the amount youll pay at once.

Either way, youll make the total required payment by the due date or risk paying penalties and facing a tax lien.

Don’t Miss: Protest Taxes Harris County

Who Pays The Property Taxes

Property taxes are paid by homeowners of their own real property. However, the homeowner is not always the entity sending in the payment. A homeowner who has a mortgage escrow account might be paying a monthly amount toward the property tax bill. When the bill is due, the escrow company is responsible for paying it.

Whether you send the check in yourself or have an escrow company managing the property taxes, you should check a week after the check clears. Confirm the bill payment was properly recorded.

Additionally, if you are new homeowners or if your home has been reassessed for any reason due to improvements, you will receive a supplemental property tax bill. This is in addition to anything you pay to the county directly or through escrow. If you receive a supplemental tax bill, review it and confirm that it is indeed a new bill and pay it to avoid being delinquent.

Where Do I Enter My Real Estate Taxes In Turbotax Online

If these are taxes for rental property you own, enter your property taxes in the same place you enter your other rental expenses.

If you’re a homeowner, your property taxes are entered in the Deductions & Credits section:

You May Like: Doordash Driver Tax Deductions

Required Information For A Search

All you need to perform a property tax search is the physical address of the property. Homeowners should obviously have this information, and investors can get it by driving past a property or looking at any number of online websites such as Zillow, Realtor.com or Redfin. In addition to recent sales and estimated values of homes, these sites also show property tax histories. This information is usually toward the end of any specific home’s information page. This is a fairly good start to determine the property tax for any property, but it isn’t the official record and should not be treated as 100 percent accurate.

Are My Property Taxes Deductible From My Federal Income Taxes

While property taxes may seem expensive, the good news is you can deduct them from your federal income taxes. The Tax Cuts and Jobs Act enforced a $10,000 cap for married couples filing jointly . This means you can deduct up to the first $10,000 paid in property taxes per year on your federal income taxes.

There’s one catch here. The $10,000 cap is taken together with any state income or sales tax deductions you might take. So if you’re deducting state income or sales tax is well as your property taxes, you can only deduct a total of up to $10,000 between the categories.

Read Also: Doordash Deductions

Real Estate Tax Payments

Online payment function Online payment function will be available through May 31, 2022, until 11:59 p.m. EDT . Amounts reflected are amounts due until May 31, 2022, before the tax certificate sale. Accounts that have a certificate issued, are in bankruptcy or litigation cannot be paid online. Please note that, if paying with a credit or debit card, a non-refundable convenience fee of 2.21 percent will be charged by the financial institution to each transaction. If paying with an electronic check, there is no convenience fees .

As the result of COVID-19, and to safeguard our employees and customers, we strongly recommend that you submit your 2021 tax payment online or mail in your payment instead of visiting the Public Service Office to conduct any Tax Collector business transactions, including paying Real Estate taxes, Tangible Personal Property taxes and Local Business taxes. Please call 305-270-4916 for information.

Postdated checks cannot be held for future date processing and will be processed as of date of receipt. Bank account payments returned by your bank for any reason will void your payment. Additional fees up to a maximum of 5 percent and not less than $25 may be charged as a result of returned payments.

The information contained herein does not constitute a title search or property ownership. Amount due may be subject to change without notice.

Under Florida law:

Value Adjustment Board Petitions Payment Requirement due by March 31

2021 Reminder Tax Bills