How To Calculate Fixed Amount Off Of Price

A fixed amount off of a price refers to subtracting whatever the fixed amount is from the original price. For example, given that a service normally costs $95, and you have a discount coupon for $20 off, this would mean subtracting $20 from $95 to get the final price: $95 $20 = $75 In this example, you are saving the fixed amount of $20.

Additional Example Of The Sales Tax Calculation

Now let’s assume that total amount of a company’s receipts including a 7% sales tax is $32,100. The true sales will be S, and the sales tax will be 0.07S. Therefore, S + 0.07S = 1.07S = $32,100. The true sales, S, will be $30,000 . The sales tax on the true sales will be 0.07 X $30,000 = $2,100. Our proof is $30,000 of sales + $2,100 of sales tax = $32,100. In general journal form the accounting entry to record this information is: debit Cash $32,100 Sales $30,000 Sales Tax Payable $2,100.

How Do You Add 6% Sales Tax

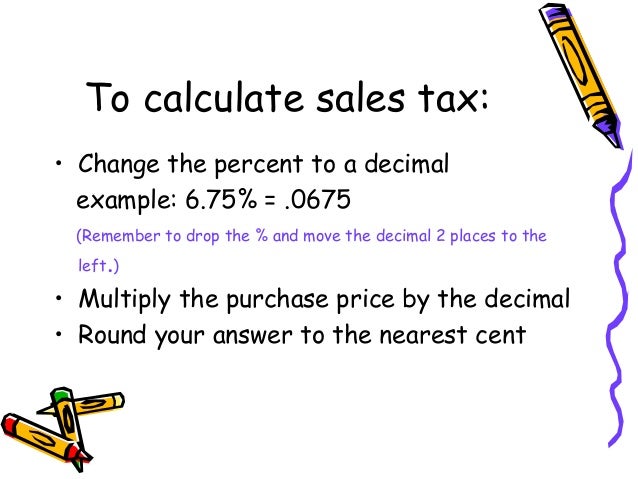

Calculating sales tax on a product or service is straightforward: Simply multiply the cost of the product or service by the tax rate. For example, if you operate your business in a state with a 6% sales tax and you sell chairs for $100 each, you would multiply $100 by 6%, which equals $6, the total amount of sales tax.

Dont forget to share this post with your friends !

Don’t Miss: Does Door Dash Take Out Taxes

How Businesses Calculate Sales Tax

The cost a customer pays when purchasing goods or services from a business includes both the company’s sales price and the cost of applicable sales taxes. Businesses and their employees need to know what sales tax is, why they must collect it and how to calculate the correct sales tax amount on each purchase.

Thoroughly understanding this information helps ensure they comply with their state and local sales tax rules and regulations. In this article, we discuss how sales tax is calculated, what it is and answer other frequently asked questions employees have about sales tax.

How To Calculate Sales Tax: A Simple Guide

Sales tax is a tax consumers pay when buying anything . In the U.S., sales tax is a small percentage of a sales transaction. Sales tax rates are set by states and local areas like counties and cities. Governments use sales tax to pay for budget items like fire stations or street sweeping.

If the products and services you sell are subject to sales tax, then youâre required to:

- Calculate how much sales tax to charge on each transaction

- Collect the sales tax from buyers

- Pass it on to your stateâs taxing authority by filing a sales tax return

Your stateâs taxing authority is generally called the â Department of Revenue,â but it may go by another name.

Also Check: Is Doordash Pay Taxed

Calculating Sales Tax For The Combined Purchase Of Taxable And Non

This example shows how to calculate the sales tax amount and the total amount a customer owes for the purchase of various items from a supermarket. Some of the items the customer is purchasing are taxable, while other items are non-taxable. The customer is purchasing food, toiletries, school supplies, clothing and electronics. The following list shows the supermarket’s total sales price for each of these categories:

-

Food: $205.00

-

Clothing: $46.01

-

Electronics: $70.07

The supermarket is in Tampa, Florida. The cashier knows the state sales tax rate is 6% and the sales tax rate in Hillsborough County is 2.5%. They also know the food items the customer is purchasing are all tax-exempt. The cashier uses this information to make the following calculations:

-

*Sales price for non-taxable goods: $205.00*

-

*Sales price for taxable goods: $167.93 *

-

*Sales tax amount: $14.27 *

-

*Total amount the customer owes: $387.20 *

Central Sales Tax Act 1956

The Central Sales Tax Act governs the taxation laws in the country, extending to the entire country and contains the rules and regulations related to sales tax. This Act allows the Central Government to collect sales tax on various products. The Central Sales Tax is payable in the state where the particular goods are sold.

Also Check: 1040paytax.com

Add Up All The Sales Taxes

To use this formula, you first need to add up all applicable sales taxes. Start by determining what the sales tax rate is in your state. Then look to see if your county or city applies any additional sales taxes. If so, you want to add all of these numbers together. For example, New York State has a sales tax rate of 4% and New York City has a sales tax rate of 4.5%. If you are buying or selling a product within New York City, the sales tax rate is 8.5% combined.

How Do You Calculate Original Price After Discount

Finding the original price given the sale price and percent

Recommended Reading: Who Has The Power To Levy And Collect Taxes

Do You Pay The Sticker Price Or The Out The Door Price

Even great negotiators often pay more than a cars sticker price. Thats because the dealership and government add taxes and fees to the final out-the-door price. You cant avoid taxes, but you can contest some fees when buying a car. Knowing which to fight can help you avoid spending more than you plan on a car.

Federal Revenues From Sales Taxes

Sales taxes also contribute to the Canadian governments budget. The 5% Goods and Services Tax is expected to bring $40.8 billion in tax revenue during the 2019 fiscal year. This amounts to 14.2% of total tax revenue on the federal level. This is almost double the amount Canada spends on national defence every year.

Also Check: Www.1040paytax

How To Calculate Sales Tax In Colorado

Colorado base sales tax rate: 2.9%Return and payment deadlines: Depending on tax liability, businesses can file monthly, quarterly, seasonal or annually

Colorado has a low base sales tax rate of 2.9%.

The combined tax rates in the state can be as high as 11.2%. A business operating in Denver, for example, must charge a combined sales tax rate of 8.81%.

Several services and products are given an exemption from Colorados sales tax, including food, farm equipment, energy and machinery.

An example of how to calculate sales tax in Denver, Colorado:

Headphones x Denver sales tax rate = $108.81

Determine Which Goods Or Services Are Taxable

Categorize your business’s goods or services based on which are taxable and which ones are tax-exempt. To do this accurately, you need to know the sales tax rules for each city, county and state your business has a location in and when each rule applies.

Remember to check whether the areas your business is in have specific items that are tax-exempt such as food, clothing or prescription medications. Make sure you also know when sales tax holidays occur, what items are tax-exempt during these holidays and what rules apply for qualifying an item as tax-exempt at these times.

Read Also: How To Pay Taxes For Doordash

The Definition Of Sales Tax

Sales tax is an additional cost that a consumer has to bear when they buy goods and services. It goes by another name of consumption-based tax. The consumer has to pay the fee, but its collected by a retailer as opposed to the government in many situations.How it works on a basic level is that when you buy something at the counter, you pay the price of the item. Then, something extra gets added on as a tax. You give the full amount to the shopkeeper, but they have to pass on the sales tax and value-added tax to the government.

To Verify The Tax Rate For A Location:

- Find a list of the latest sales and use tax rates at the following link: California City & County Sales & Use Tax Rates.

- You can look up a tax rate by address

- Visit or call our Offices

- Call our Customer Service Center at 1-800-400-7115 . We are available to help you 8:00 a.m. to 5:00 p.m., Monday through Friday, except State holidays.

Don’t Miss: How Does Doordash Work For Taxes

How To Determine Retail Sales Price From The State Tax Rate

As a business owner, you are responsible for collecting state sales taxes on each sale. If you want to run a promotional price that includes sales tax, you need to be able to calculate the retail price from the total. For example, you might want to set a promotional price at $48, including tax. If you know the state sales tax rate, you can calculate the retail price from the total price.

1

Divide the state sales tax rate by 100 to convert it to a decimal. For example, if the state sales tax rate equals 4.95 percent, divide 4.95 by 100 to get 0.0495.

2

Add 1 to the state sales tax rate as a decimal. In this example, add 1 to 0.0495 to get 1.0495.

3

Divide the result by the total price to find the retail price. For this example, if the total price equals $48, divide $48 by 1.0495 to get $46.69 as the retail price.

References

How To Calculate Sales Tax Backwards From Total

How to Calculate Sales Tax Backwards From Total

More itemsApr 28, 2020

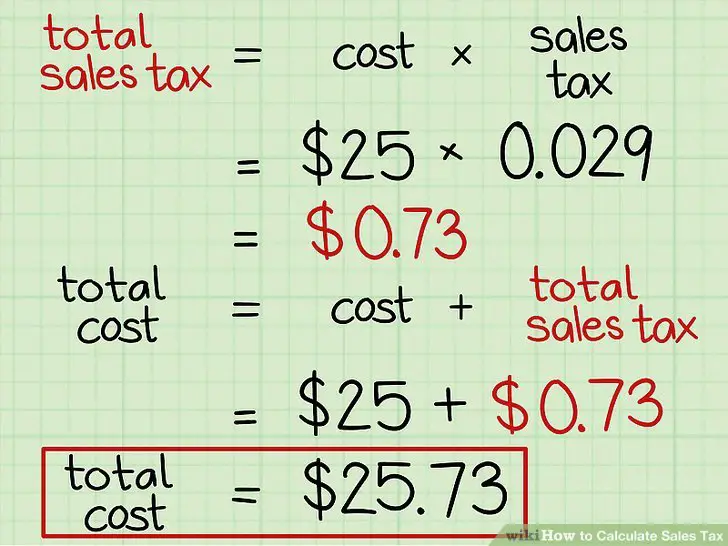

How do you calculate the total with sales tax?

- Calculating Total Cost Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax = total sales tax . Once youve calculated sales tax , make sure to add it to the original cost to get the total cost.

Don’t Miss: Pin Number To File Taxes

Sales Tax Generally Depends On The Ship

When selling online, you first need to determine if you are required to collect sales tax from buyers in your buyerâs state. Next, you need to determine the sales tax rate at the buyerâs location.

There are over 10,000 sales tax jurisdictions in the United States. And the sales tax rate you charge depends on your buyerâs shipping address. For example, the sales tax rate in Atlanta, GA is 8.9%, but the sales tax rate just outside the city limit is 7%. To collect sales tax when selling online, you must determine if your customer lives within the Atlanta city limits or outside them.

If your customer lives in Atlanta proper, youâd charge them 8.9% sales tax. But if they live outside the city limits, youâd only charge 7%.

How To Calculate Sales Tax In Massachusetts

Massachusetts base sales tax rate: 6.25%Return and payment deadlines: Monthly, semi-monthly, quarterly or annually

The sales tax in Massachusetts is 6.25% and is the same rate across the state.

Consumers wont pay any sales tax on products like furniture, home appliances, groceries, gasoline and clothing. However, businesses are required to charge sales taxes on tangible personal property, even if a customer orders online or over the phone.

An example of how to calculate sales tax in Springfield, Massachusetts:

Pair of jeans purchased online x Springfield sales tax rate = $74.38

Don’t Miss: Is Freetaxusa Legit

How Do You Calculate New Price After Increase

Divide the larger number by the original number.

How To Calculate Sales Tax In California

California base sales tax rate: 6%Mandatory local sales tax rate: 1.25%Minimum combined sales tax rate: 7.25% Return and payment due dates: Monthly or quarterly

The state of California has several sales tax rates to be aware of.

The base sales tax rate in the state is 6%, and there is also a mandatory 1.25% local rate in place, taking the total minimum combined sales tax rate to 7.25%.

The local tax rate to add to the base rate will depend on the county and city youre in and some have a higher rate than 1.25%. For example, Los Angeles County has a minimum combined sales tax rate of 9.5%, but some municipalities within L.A. county, such as Santa Monica, charge 10.25%.

You may be exempt from Californias sales tax altogether, depending on what you sell. The state doesnt require you to pay it on certain food products, groceries, prescription medicine or medical devices.

An example of how to calculate sales tax in Los Angeles, California:

Consultancy services x L.A. sales tax rate = $1095.00

Don’t Miss: Do You Get Taxed For Donating Plasma

How To Calculate Sales Tax In New York State

New York base sales tax rate: 4%Return and payment deadlines: Monthly, quarterly or annually

New York has one of the lowest base sales tax rates for a large state at just 4%.

The caveat is the local tax rates charged by New Yorks cities and counties. For example, sales tax in New York City can be as high as 8.875%, the highest in the state. Theres also an additional sales tax rate of 0.375% for taxable sales made within the Metropolitan Commuter Transportation District , taking in Manhattan, Brooklyn, Queens, Staten Island, Rockland, Nassau, Suffolk, Putnam, Orange, Dutchess and Westchester.

Most food and medicines are exempt from the tax, along with charitable organizations and government agencies.

An example of how to calculate sales tax in New York City, New York:

Broadway tickets x NYC sales tax rate = $108.88

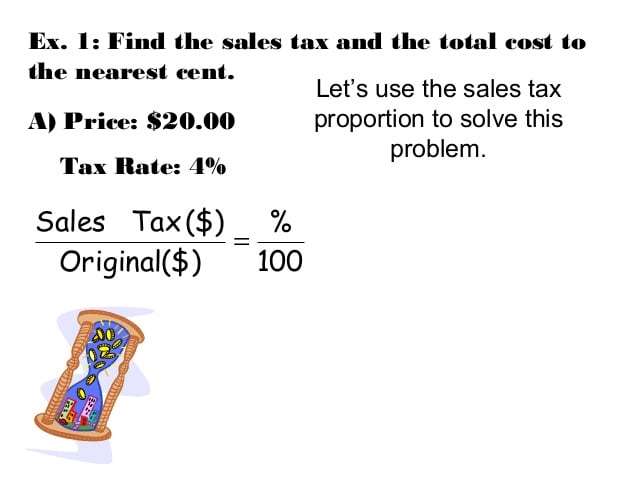

Solving Sales Tax Applications

- Calculate total purchase price given sales tax and price

- Calculate sales tax given tax rate and purchase price

- Calculate tax rate given sale price and amount of sales tax

Sales tax and commissions are applications of percent in our everyday lives. To solve these applications, we will follow the same strategy we used in the section on decimal operations. We show it again here for easy reference.

Also Check: How To Find Your Employer’s Ein

How To Find Sales Tax In Your Area

To find the sales tax in your city, you can go to your states official government website, locate the page for its department of revenue or revenue services, and search for tax rate information. Sales tax can vary by country, county, state, and city, plus they can change often.

Make sure to keep up to date on important things like taxes! Being aware of your past, present and future finances is important in managing a functional budget. To learn more, check out this course on personal finance.

History Of The Sales Tax

The very first taxes in human history were direct taxes, which are a type of tax imposed on individual persons. The most general ones were the corvée, compulsory labor provided to the state in Egypt , and the tithe, where crops and grains were given to the state from landowners, which was invented in ancient Mesopotamia. Sales tax, which belongs to another basic form of taxation, the indirect taxes, were also present in ancient time. Tomb paintings in Egypt, dating back around 2000 BC, portray tax collectors and sales taxes on commodities, such as cooking oil, can be traced to that time . In Europe, sales tax appeared firstly during the reign of Julius Caesar around 49 BC-44 BC, when the government of Rome enforced a payment of 1 percent sales tax. Sales tax gradually became widespread over Europe. Spain had a national sales tax from 1342 until the 18th century, with rates varying between 10 and 15 percent. Also, it was introduced in France where it didn’t enjoy much popularity: during the 17th century alone, there were 58 rebellions against it . However, in modern times the sales tax in Europe took a declining path, and from the 1960s the dominating consumer-based tax steadily became the value-added tax.

Recommended Reading: Doordash Pay Calculator

Calculate The Combined Sales Tax Rate

The combined sales tax rate is a single figure that represents an area’s total sales taxes, which includes city, county and state sales taxes. Businesses calculate the combined sales tax rate by adding these individual sales tax rates together. Businesses with two or more locations need to calculate the combined sales tax rate for each area they do business in to ensure they collect the correct amount of sales tax from consumers at each location.

For example:The city of Tampa is in Hillsborough County in the state of Florida. Florida’s base sales tax rate is 6%, and Hillsborough County has a sales tax rate of 2.5%. When you add these sales tax rates together, the combined sales tax rate in Tampa, Florida is 8.5%. But counties surrounding HillsboroughâPinellas County, Pasco County and Polk Countyâeach have a sales tax rate of 1%, making the combined sales tax rate in these areas 7%.

Sales Taxes In Ontario

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax of 13%. The HST is applied to most goods and services, although there are some categories that are exempt or rebated from the HST.

The HST was adopted in Ontario on July 1st, 2010. The HST is made up of two components: an 8% provincial sales tax and a 5% federal sales tax. These replaced the 8% Retail Sales Tax and 5% federal Goods and Services Tax respectively.

Recommended Reading: How To Appeal Property Taxes Cook County