Other Ways To Check Your Tax Refund Status

If you dont have access to the Internet or a computer, you can call the IRS at 800-829-1954 to obtain the status of your refund. You will need the same three pieces of information as those who use the online tool, so be sure you have a copy of your tax return available.

TurboTax also has a Where’s My Refund Tracking step-by-step guide that will show you how to find the status of your IRS or state tax refund. Use TurboTax, IRS, and state resources to track your tax refund, check return status, and learn about common delays.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Access The Irs Child Tax Credit Update Portal

The IRS Child Tax Credit Update Portal is an information portal where you can view information about your family’s child tax credit status, including:

- Your eligibility

- Your mailing address

And so forth.

You can also use it to update the IRS about changes that may affect your family’s eligibility and / or filing status.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit or Child Tax Credit amounts. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset or different refund amount when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Also Check: Is My Ira Contribution Tax Deductible

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Read Also: Where’s My Income Tax Return

How Can I Claim Tax Credits

Tax credits directly reduce how much you owe the IRS. They’re either refundable or non-refundable. If the amount of a refundable credit is more than the tax you owe, the IRS will send you the difference. If your claimed credits are non-refundable, the government doesn’t send you the extra if your credits are more than what you owe.

You can claim most tax credits on Schedule 3 of the 2021 Form 1040. These include:

- The foreign tax credit

- The credit for child and dependent care expenses

- Education credits

- The retirement savings contribution credit

- Residential energy credits

- The net premium tax credit

Claiming some of these credits requires filing additional forms. Each line clearly states which form you need to use.

Some credits are claimed directly on Form 1040 rather than on a separate schedule or worksheet. These include:

When You Should Call The Irs

The IRS online tools are all that most people need to track the status of a tax refund. But there are some exceptions. You might need to give the IRS a call in the following situations:

- Wheres My Refund?, Wheres My Amended Return?, or IRS2Go directs you to call.

- Its been more than 21 days since you filed electronically and youre eager to know the status of your refund or worried about theft or fraud.

- Its been more than 20 weeks since you mailed an amended tax return.

Keep in mind that calling the IRS wont speed up the processing of your refund. According to the IRS, if youre eager to know when your refund will arrive, youre better off using one of its online tracking tools. The IRS updates the status of refunds daily, generally overnight, so checking an online tool multiple times throughout the day probably wont be helpful.

Remember, phone representatives at the IRS can only research the status of your refund 21 days after you file electronically, six weeks after you mail a paper return, or 16 weeks after you mail an amended return.

Recommended Reading: Where Do You Pay Your Property Taxes

What Is A Payroll Tax Refund

Typically, if you overpaid your taxes during the year, you may be entitled to a payroll tax refund.

This refund is issued by the Internal Revenue Service and is based on the amount of taxes that were withheld from your paychecks. The refund will be equal to the amount of taxes that were overpaid, minus any penalties or interest that may be owed.

In order to receive a payroll tax credit, you must file a tax return and include a copy of your W-2 form. The IRS will then issue a refund check, which will be sent to the address listed on your tax return.

How Do I Know If I’ve Been Overpaid

Remember Letter 6419?

For families receiving advance child tax credit payments, Letter 6419 explains how much credit the family is entitled to, and how that calculation was made.

You can also go to the Child Tax Credit Update Portal to see the details of your family’s eligibility, the total amount of payments to your family, and more.

If Your Status or Information Changes

If you need to update your filing status, direct deposit or bank account information, or you want to unenroll from the program, you can do all of these things at the IRS Child Tax Credit Update Portal.

Also Check: What Is Bidens Tax Plan

Will I Get A 2020 Tax Refund

Typically, you receive a tax refund after filing your federal tax return if you pay more tax during the year than you actually owe. This most commonly occurs if too much is withheld from your paychecks. Another scenario that could create a refund is if you receive a refundable tax credit that is larger than the amount you owe. Life events, tax law changes, and many other factors change your taxes from year to year. Use the refund calculator to find out if you can expect a refund for 2020 .

Dont Miss: Can You File Missouri State Taxes Online

The Most Accurate Tax Calculator

At Etax, after you register and log in, then start a tax return, the tax refund calculator shows your tax refund estimate at the top of the screen.

The tax refund calculator shows your ATO tax refund estimate. The more details you add to your tax return, the more accurate the tax calculator becomes

It is accurate to the cent, based on the information you add to your return and it updates as you go.

Etax includes the all tax cuts and tax rebates in your refund estimate, for 2021.

Each time you add a new detail to your return, the tax refund calculator re-calculates your tax estimate. You can see how each number and each tax deduction affects your overall tax refund.

This happens automatically, helping you see how different items in your return can affect your refund. Thats not possible with most tax calculators!

Recommended Reading: Do Seniors On Social Security Have To File Taxes

Check The Status Of Your Income Tax Refund

ONLINE:

- Click on TSC-IND to reach the Welcome Page

- Select Check the Status of Your Refund found on the left side of the Welcome Page.

-

You must have your social security number and the exact amount of the refund request as reported on your Connecticut income tax return. Enter the whole dollar amount of the refund you requested. For example, if you requested a refund of $375, enter 375.

NOTE: Please be aware that for all direct deposit refunds you must allow at least two business days after the date the refund is processed for the credit to be in the account.

TELEPHONE:

- Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962 . You will need your social security number and the exact amount of the refund request as reported on your income tax return. Enter the whole dollar amount of the refund you requested followed by the # sign. For example, if you requested a refund of $375, enter 375#. You can only check the status of the refund for the current filing season by telephone.

Paper Returns: Due to the volume during the filing season, it takes 10 – 12 weeks to process paper returns. Until the return is processed, your return will not appear on our computer system and we will not be able to check its status or to give you information about your refund. NOTE: Please consider using one of the electronic filing options. Visit our Online Filing Page for more information.

Easily Find Out Out Whether You Owe Tax Or Will Get A Refund

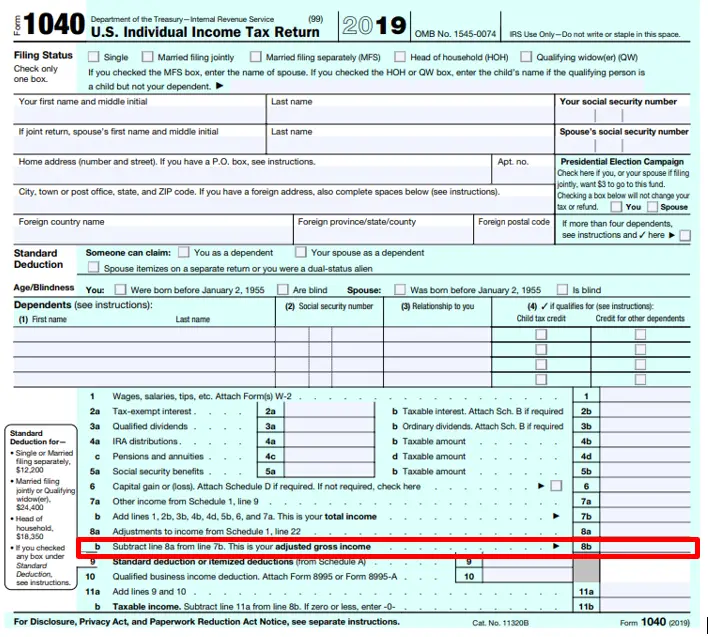

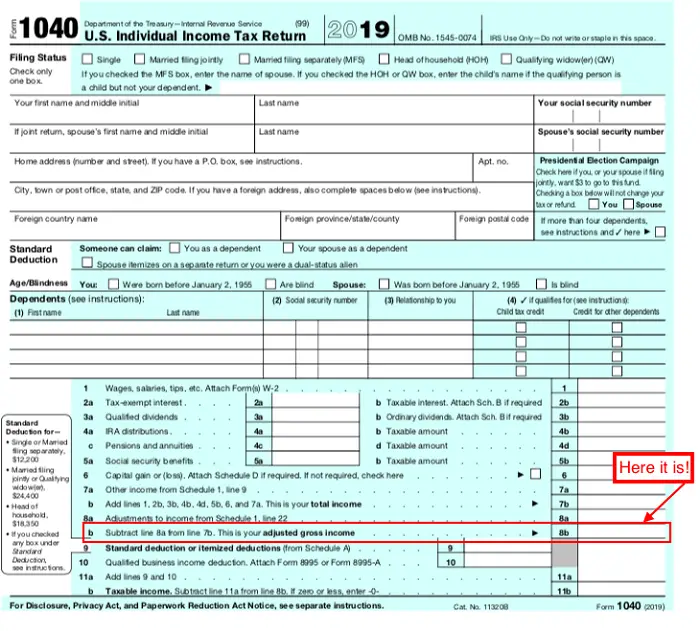

Filling out your Form 1040 tax return will tell you whether you’ll receive a refund or you owe taxes to the Internal Revenue Service . For many taxpayers, this process isn’t complicated. Most of the lines on the form provide simple, straightforward directions.

The IRS radically changed the Form 1040 tax return back in 2018. The revised form wasn’t well-received. As a result, the IRS made changes to the tax return again for 2019, then tweaked it a little more for tax year 2020.

The steps, schedules, and line numbers explained here apply to the 2021 Form 1040, the return you’ll file in April 2022. They’ll help you find out just how much you owe the IRSor better yet, how much of a refund you’ll be receiving.

Read Also: How Does Contributing To Ira Reduce Taxes

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Review Mailed Irs Notices

In some cases, checking your tax balance is as easy as reviewing the most recent notice you received via mail from the IRS. Keep in mind, however, that mailed notices may not be complete or up to date. A notice thats over a few months old may not include accrued interest or accumulated penalties. Since many notices only cover a single tax year, reviewing your most recent IRS letter may not give you a complete picture of your back taxes. Consider calling or checking online for updated information.

Read Also: Do Federal Tax Liens Expire

Lines 800 And 801 Tax Withheld At Source

This is the amount shown as income tax deducted on any information slips, such as NR4, T4A, or T4A-NR, you may have received. You do not have to file these information slips with your return, unless you are a non-resident corporation. However, keep them in case we ask for them later.

On line 800, enter the total amount of income tax deducted from all your information slips. On line 801, enter the total payments on which tax has been withheld.

ReferencesIC75-6, Required Withholding From Amounts Paid to Non-Residents Providing Services in Canada

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Read Also: Where Do I Put Business Expenses On Tax Return

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Line 712 Part Iv Tax Payable

Dividends subject to Part IV tax

The following types of dividends are subject to Part IV tax:

- taxable dividends from corporations that are deductible under section 112 when you calculate taxable income

- taxable dividends from foreign affiliates that are deductible under paragraphs 113, , , or , or subsection 113 when you calculate taxable income

Taxable dividends received are only subject to Part IV tax if the corporation receives them while it is a private or subject corporation. Taxable dividends received from a non-connected corporation are subject to Part IV tax.

Taxable dividends received from a connected corporation are subject to Part IV tax only when paying the dividends generates a dividend refund for the payer corporation.

The Part IV tax rate is 38 1/3%.

Definitions

A private corporation is a corporation that is:

- resident in Canada

- not controlled by one or more public corporations

- not controlled by one or more prescribed federal Crown corporations

- not controlled by any combination of prescribed federal Crown corporations and public corporations

ReferenceSubsection 89

Subject corporation

A subject corporation is a corporation, other than a private corporation, that is resident in Canada and is controlled by or for the benefit of either an individual other than a trust, or a related group of individuals other than trusts.

ReferenceSubsection 186

The following types of corporations are exempt from Part IV tax:

ReferenceSection 186.1

Recommended Reading: What Refinance Costs Are Tax Deductible

If You Do Not Have A Personal Tax Account

You need a Government Gateway user ID and password to set up a personal tax account. If you do not already have a user ID you can create one when you sign in for the first time.

Youll need your National Insurance number and 2 of the following:

- a valid UK passport

- a UK driving licence issued by the DVLA

- a payslip from the last 3 months or a P60 from your employer for the last tax year

- details of your tax credit claim

- details from your Self Assessment tax return

- information held on your credit record if you have one