What Does It Mean If A Property Has Delinquent Taxes

Every year, property owners must pay their property taxes imposed by the county they live in. According to the U.S. Census Bureau, American households pay an average of $2,471 on property taxes annually. With all of the other expenses that homeowners are responsible for, it makes sense that some may find themselves in a financial bind if they cant make this payment.

Homeowners that are unable to pay their property tax bill risk losing their property. Essentially, if the property tax bill goes unpaid, the county can sell a tax lien certificate to reimburse the government for the lost payment.

Counties auction off their tax lien certificates annually to the investors who are willing to pay the most. The county may also factor in the interest rate investors can charge the homeowner to recuperate the property tax debt.

If an investor decides to purchase a tax lien, the investor must pay off the outstanding property tax bill plus any fees or penalties. Then, you will reclaim the debt from the current homeowner with interest. Local guidelines determine rate restrictions and payment schedules.

If the homeowner fails to repay their debt, the investor is given the legal right to obtain the propertys title in the form of a tax sale.

When Are Nyc Property Taxes Due

In New York City, the first of the month following the tax year in which the property is assessed is the time when taxes on residential property are due. Property taxes are due on the first of the month following the propertys registration with the city. Property taxes are due for the following dates: July 1, October 1, January 1, and April 1. The tax rate for real estate in New York City varies from year to year, as does the amount of exemptions and abatements. In July, you may be subject to different taxes. If you live in New York City, you should be aware of any changes to the citys property tax rates or due dates. The Department of Finance website includes a searchable database of current and upcoming tax rates and due dates.

Find Out Back Property Taxes And Tax Lien Information For Free

That is the second step on your Due Diligence checklist, the second question you should ask when buying land checking what taxes and tax liens are owed. And now you know how to do that for FREE.

The next Due Diligence item on your checklist should be: What is the property zoning? Im going to go over how to check that in part 3 of this video and blog series.

If you enjoyed this post make sure you like it, share it, tell your friends about it, and dont forget to subscribe to our YouTube channel so youre the first to know when the next video in this Due Diligence series is published. By the end of this series, you will have a comprehensive checklist of items you need to check before you buy any piece of land.

If you have any questions leave a comment below Ill make sure I answer them and help you out. Thank you for reading!

Dont Miss: Doordash 1099 Form

Don’t Miss: How To Pay Payroll Taxes

Where Can I Obtain A List Of Tax Deed Excess Proceeds That Have Not Been Disbursed By The Clerk’s Accounting Department

You can download Weekly Tax Deed Spreadsheet here. Please note that the information is being provided in the format that it is maintained, with only the file number and unclaimed amount listed.

As for any information you need , please note that as a convenience to the public, our office has made the Tax Collectors Certification and O & E Report for tax deed properties online free of charge this would list most of the information you are requesting for each individual tax deed file. These documents can be located using the Clerks Public Access View Application.

When attempting to locate the tax deed file number, use the following format YYYY-CaseNumber instead of the case numbers listed on the downloaded weekly tax deed spreadsheet .

Information On Delinquent Accounts

The Cook County Clerk’s office has a variety of property tax responsibilities.

When delinquent or unpaid taxes are sold by the Cook County Treasurer’s office, the Clerk’s office handles the redemption process, which allows taxpayers to redeem, or pay, their taxes to remove the risk of losing their property. Records for delinquent taxes for prior years are the responsibility of the Clerk’s office.

The Clerk’s office also maintains the county’s property tax maps and calculates tax rates based on the tax levies submitted by the county’s taxing districts and the valuation of properties within those districts.

For more information visit the Cook County Clerk’s page onReal Estate and Tax Services.

You can search Delinquent Property Taxes online.

Also Check: Where Can I Find Tax Forms

How Can I Invest In Tax Liens

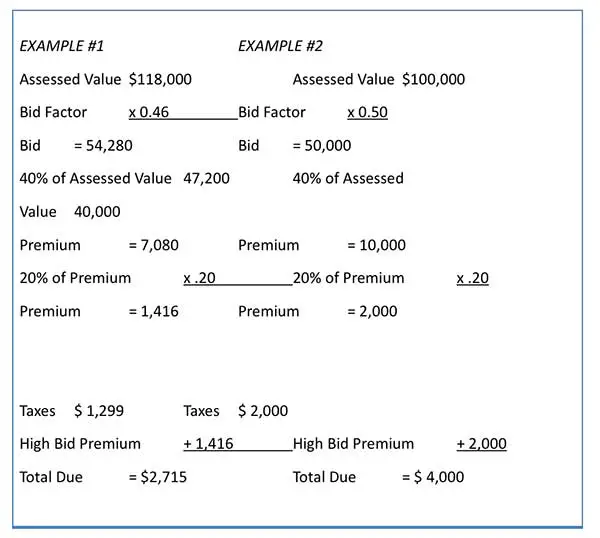

Investors can purchase property tax liens the same way actual properties can be bought and sold at auctions. The auctions are held in a physical setting or online, and investors can either bid down on the interest rate on the lien or bid up a premium they will pay for it. The investor who accepts the lowest interest rate or pays the highest premium is awarded the lien. Buyers often get into bidding wars over a given property, which drives down the rate of return that is reaped by the winning buyer.

Buyers of properties with tax liens need to be aware of the cost of repairs, along with any other hidden costs that they may need to pay if they assume ownership of the property. Those who then own these properties may have to deal with unpleasant tasks, such as evicting the current occupants, which may require expensive assistance from a property manager or an attorney.

Anyone interested in purchasing a tax lien should start by deciding on the type of property they’d like to hold a lien onresidential, commercial, undeveloped land, or property with improvements. They can then contact their city or county treasurer’s office to find out when, where, and how the next auction will be held. The treasurers office can tell the investor where to get a list of property liens that are scheduled to be auctioned, as well as the rules for how the sale will be conducted. These rules will outline any preregistration requirements, accepted methods of payment, and other pertinent details.

Pt Aid Payment Agreement

The NYC Department of Finance recognizes that an unexpected event or hardship may make it difficult for you to pay your property taxes. If you qualify for the Property Tax and Interest Deferral program, you can defer your property tax payments so that you can remain in your home. The Property Tax and Interest Deferral program removes properties from the tax lien sale once an application is complete.

To apply for a PT AID payment agreement, download and complete the PT AID initial application below, or call 311 for assistance.

Don’t Miss: Where Do I Get Irs Tax Forms

Investing Passively Through An Institutional Investor

Tax lien investing requires a significant amount of research and due diligence, so it may be worth it to consider investing passively through an institutional investor who is a member of the NTLA. Approximately 80% of tax lien certificates are sold to NTLA members.

To secure membership through NTLA, applicants must pass a background screening process to ensure compliance with NTLA Code of Ethics. Members must also pay member dues of varying amounts based on membership type. Members can participate in member-only webinars, earn a Certified Tax Lien Professional certification, and use the association’s online directory to connect with other industry experts.

Search For Unclaimed Money In Your State

Businesses send money to state-run unclaimed property offices when they cant locate the owner. The unclaimed funds held by the state are often from bank accounts, insurance policies, or your state government.

- Search for unclaimed money using a multi-state database. Perform your search using your name, especially if youve moved to another state.

- Verify how to claim your money. Each state has its own rules about how you prove that youre the owner and claim the money.

Recommended Reading: How To Lie And Get More Money On Taxes

What Is The Tax Sale Process

Tax sale steps include:

Search of Registry Documents:

The deed or certificate of ownership for the property is forwarded to a designated law firm, who will ensure the property is free of all claims and encumbrances.

Advertising:

Properties for sale are advertised in the local newspaper once a week for two consecutive weeks, and in two consecutive issues of the Royal Gazette.

Public Auction:

A public auction is scheduled and the date, time and place is advertised.

Any properties that are not free of overdue taxes prior to the date and time of the sale or where acceptable payment arrangements have not been made are sold.

Disbursement of Sale Proceeds:

Once the sale of the property is complete, the proceeds from the sale are disbursed in the following manner:

Once these are paid, the remaining proceeds will go to the assessed owner.

How Do I Calculate My Property Taxes In Nyc

The property tax bill for each Manhattan condo or house can be found on the City of New York Department of Finances website.

The Pros And Cons Of Buying A Condo In Nyc

Residential property in New York City is typically classified as Class 1 because it includes family homes, small stores, and offices with one or two apartments attached. The majority of condominiums are no more than three stories tall. Individual condominium owners are not required to pay corporation taxes. Condo prices are higher than co-ops in part because of their higher costs.

Also Check: What Is Hawaii State Tax

The Servicer Might Pay Any Delinquent Taxes If You Don’t

If your loan isn’t escrowed and you don’t pay the property taxes, the loan servicer might pay any delinquent taxes and then bill you for them. Here’s why: Property tax liens almost always havepriority over other liens, includingmortgage liens and deed of trust liens.

Because a property tax lien has priority, a tax sale wipes out any mortgages. So, the loan servicer will usually advance money to pay delinquent property taxes to prevent this kind of sale from happening. The servicer will then demand reimbursement from you, the borrower.

Two Ways To Benefit From Investing In Tax Liens:

Scenario 1: Passive Returns

The investor buys the tax liens and waits until the owner pays them back. The good news for the investor is that they also earn interest on their money. It could be anywhere from 5% to 36% per year, but rates are generally in the 10-12% range.

But wait, there is more! The investor is also paid any penalties that the homeowner has accrued.

All the county cares about is getting its taxes paid, which the investor does when they buy the lien. So, you buy the tax lien, and Jack still owns his condo. You wait, and hopefully, he will pay. Although you never know when that might happen, it may be a couple of days, or it could be years.

But if your patient, it is a guarantee on your money and then some.

Scenario 2: The Road to a Larger Real Estate Portfolio

Lets get back to Jack.

You buy the tax lien, and he never pays off his back taxes. You have the authority to start tax foreclosure proceedings. During the foreclosure, you can buy the property like anyone else who is interested. At the very least, youll be paid back your initial investment. Plus, you have the choice to buy the property at a discounted rate.

However, there is never a guarantee there will be equity in the property.

To learn more about tax liens, head over to the National Tax Lien Association site. There is a wealth of information to be found there.

You May Like: How To File Taxes If Self Employed And Employed

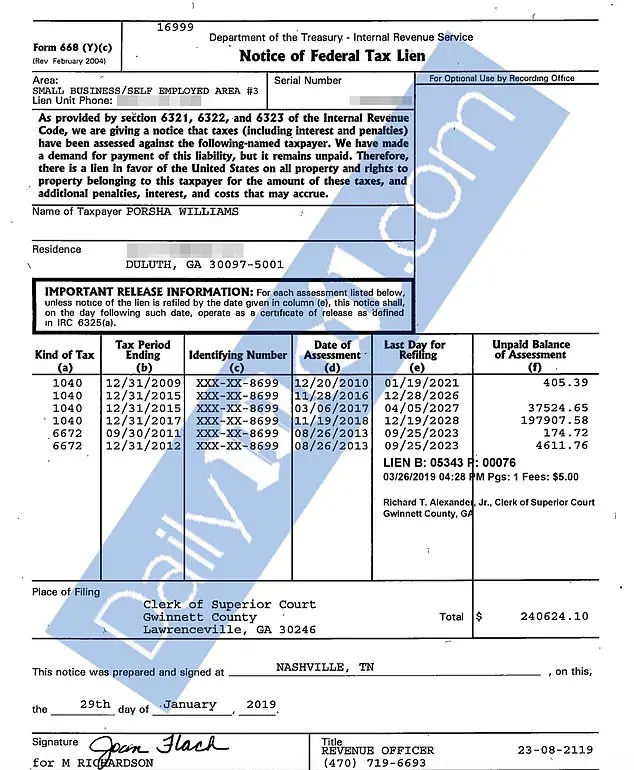

What Does It Mean If You Have A Tax Lien

If you have a tax lien, it means that the government has made a legal claim against your property because you have neglected or failed to pay a tax debt. In the case of a property tax lien, you have either neglected or failed to pay the property taxes that you owe to the city or county where your property is located. When this happens, your city or county has the authority to place a lien on the property.

So How Do You Go About Reaching Out To Jack

You got the property list, which has the addresses and the names of the owners. However, the owner may not live there. So, the first thing you must do is follow the tax record of the property to find the owners correct mailing address.

You can do that here on www.propertytaxrecords.org.

Once you know the mailing address, its time to start writing a simple and straightforward letter. The owner is under pressure to sell and has been getting copious amounts of notices from the city and county. They are generally super stressed and may have even stopped opening any bills or notices at all.

Its possible that if you come in with an offer that will make the homeowner a little bit of money, they will reach out to you. At this point, they have nothing to lose. They are at the end of their rope financially.

There are a couple of ways to go about this letter:

# 1 is a postcard.

Hi Jack, Im Nancy. I see that you own the property on 456 N. State Street in Baltimore. Im looking to buy properties in that zip code. Im prepared to pay cash within the next 30 days, and my funds are limited. Please call me as soon as you can before I decide to purchase another property. I look forward to hearing from you soon: -132-4356.

#2 is a more basic letter.

Hi Jack, My name is Nancy, and I am looking to buy property in your area. Please call me -132-4356.

Also Check: What All Do I Need To File Taxes

How The Bexar County Property Tax Rate Is Determined

The Bexar Appraisal District appraises all the real estate and business properties in the area. Then, individual jurisdictions set a rate that aligns with their yearly budgets . The Tax Assessor-Collectors Office then handles the collecting for each jurisdiction. Additionally, the Tax Assessors own assessment must line up with what was determined by the appraisal district and the jurisdiction.

How Much Is Property Tax In Nyc

The effective property tax rate in New York City is a little more than 1%, which is slightly lower than the state average of6%. In fact, many counties in New York have a rate of more than 2.5%, which is more than twice the national average.

Soaring Real Estate Taxes In New York City

Nonetheless, New York City has some of the most expensive real estate in the country. As a result, if you want to own a property in one of the citys most desirable neighborhoods, taxes will be higher.

Read Also: How Much Do You Have To Earn To Pay Tax

What Happens If A Property Receives No Bids At The Auction

Properties for which no bids are received are placed on the Lands Available List, if it is a County-held certificate. Florida Statute 197 states the County may, at any time within the first 90 days from the day the property is placed on the list, purchase the property for the opening base bid. After the ninety-day period, the property is available for purchase by the public for the base bid plus accrued interest, any taxes due, documentary stamps, and recording and indexing fees.

If a non-homestead property brought to sale by an individual certificate holder has no bids, the property shall be sold to the certificate holder, who shall pay to the Clerk any amounts included in the minimum bid not already paid within 30 days after the sale. If the certificate holder fails to make full payment, within 30 days after the sale, the Clerk shall enter the property on a list entitled “Lands Available for Taxes.”

If a homestead property brought to sale by an individual certificate holder has no bids, the certificate holder shall pay to the Clerk one-half of the assessed value of the homestead, the documentary stamp tax and the recording fees within 30 days after the sale. Upon payment, a tax deed shall be issued and recorded by the Clerk. If the certificate holder fails to make full payment, 30 days after the sale, the clerk shall enter the property on a list entitled Lands Available for Taxes.

Sale Of A Property Due To Unpaid Taxes

The City may advertise the sale of the property because of unpaid taxes. Generally, advertisements are published in Mississauga News for four weeks and Ontario Gazette for one week. Tender packages are also made available online or at the City, for a fee.

These sales are not typical real estate transactions. If youre considering taking part in a sale, you should seek independent legal advice from a lawyer licensed to practice in Ontario, and in good standing with the Law Society of Upper Canada.

There are currently no properties for sale.

Also Check: What Happens If I Send My Taxes Late

Finding Delinquent Taxes In Newspaper

Unfortunately for those who are late on payments, state law requires the county to publish the names and legal descriptions of everyone whos delinquent in the local newspaper. This law is designed to make sure property owners are well aware of the delinquency before next steps are taken. Before you begin your Oklahoma tax lien search, it may be easier to check local papers that cover the property in question.

The Oklahoma tax delinquent list is published each September for all taxes that are late prior to Jan. 1 of that year. Taxpayers have until Aug. 15 to pay the taxes in full to avoid the information being published. Youll also have to pay all penalties and interest on that amount, as treasurers are prohibited from waiving those fees by law. However, if a landowner feels these fees are in error, he can file a dispute through the local assessors office.