Option : Check Your Ein Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

-

If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by traditional mail.

-

If you applied by fax, you would have received your confirmation letter by return fax.

-

If you applied by mail, you would have received your confirmation letter by return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

In this sample EIN confirmation letter, you can find your EIN at the top of the page, as well as in the first paragraph.

How Do I Find An Ein

For a company, an EIN is similar to a social security number for an individual. As such, most companies keep their tax ID numbers private, so you probably won’t find it published on the company’s website. However, many documents require the number. If you’re an employee of a company, look in box B on your W-2 statement. If you’re an independent contractor, you can find this number in the Payer’s Federal Identification Number box on Form 1099.

If you’re an employee of a company and have been unable to find your company’s EIN, you may call or e-mail the Department of Revenue for your state. You’ll need to provide your employer’s legal company name and any additional required information.

If you have a valid reason to know a business’s EIN, you can simply call the business and ask for it. If you are dealing with a small company, you can speak with the company owner or your usual contact person. If you are dealing with a large company, get in touch with the accounts payable department if you need to send an invoice. If you’ve received an invoice from a company, contact that company’s accounts receivable department. This is usually the contact person whose name is printed on the invoice.

If you are providing a product or service to another company and would like to know whether that company qualifies for tax exemption, you can ask your customer for the number. In some situations, this number will appear on a state-issued certificate.

Individual Taxpayer Identification Number

The IRS issues the Individual Taxpayer Identification Number to certain nonresident and resident aliens, their spouses, and their dependents when ineligible for SSNs. Arranged in the same format as an SSN , the ITIN begins with a 9. To get an individual tax id number, the applicant must complete Form W-7 and submit documents supporting his or her resident status. Certain agenciesincluding colleges, banks, and accounting firmsoften help applicants obtain their ITIN.

Also Check: What Is The Tax Rate On Unemployment

Where Else Can I Find My Employer’s Ein While I’m Waiting For My W

- Try asking your employer .

- Get it from last year’s W-2, if you’re still working for the same company. This is assuming your employer kept the same EIN .

- If you work for a publicly-traded company , try an online search for their 10-K.

- On the 10-K, look for IRS Employer Identification No. or similar. It’s usually on the first page.

We don’t maintain, nor are we able to retrieve, your employer’s EIN.

Related Information:

How Long Does It Take To Get An Ein

The amount of time it takes your business to receive an EIN can vary. Your results will depend on how you apply for your business tax ID number in the first place.

- Online: If you apply for an EIN online, you may get an EIN number right away.

- Fax: With faxed applications, you should receive a fax back with your EIN within four business days.

- Mail: Send in your EIN application via mail and youll have to wait around four weeks for processing.

Recommended Reading: Where Is My State Income Tax

Register Your Business With Your State

Before completing your online application with the IRS, youll need to register your business with the state you plan to operate in. The entity type and registration information will be needed when filling out the tax ID number application.

The online application will ask you for your formation date, legal business name, address and the state where youre registered. Your business name must be approved by the state of operation prior to filling out your tax identification number application. A sole proprietor who must pay excise taxes could still obtain a tax ID number once a DBA is registered with the state.

What Is A Business Tax Id Number

Tax Identification Numbers, also known as Employer Identification Numbers , are assigned to a business by the federal government for identification and taxation reasons.

An EIN is similar to a Social Security number, except it pertains to businesses rather than individuals. Your own companys EIN can be found by reviewing certain documents or by contacting the IRS.

A federal tax identification number is issued by the federal government, but your states government may also issue you an identification number. The state identification number and federal tax identification number are separate numbers, but each is unique to the business for which it is assigned.

As well as preparing tax returns, opening business bank accounts and applying for loans on behalf of the business, the numbers are used to hire and pay employees.

Quick Jump-To Links

Don’t Miss: How Much Do You Pay In Taxes For Stocks

How To Apply For A Federal Tax Id Number

Once youve determined that your business needs a tax ID, youll work with the IRS to receive one. You can apply online other options include phone, mail or fax.

A federal tax ID number is free, so steer clear of any scams that try to get you to pay for an EIN. The IRS administers and grants tax ID numbers to businesses throughout the United States, so you can apply directly at IRS.gov.

Here are the three key steps:

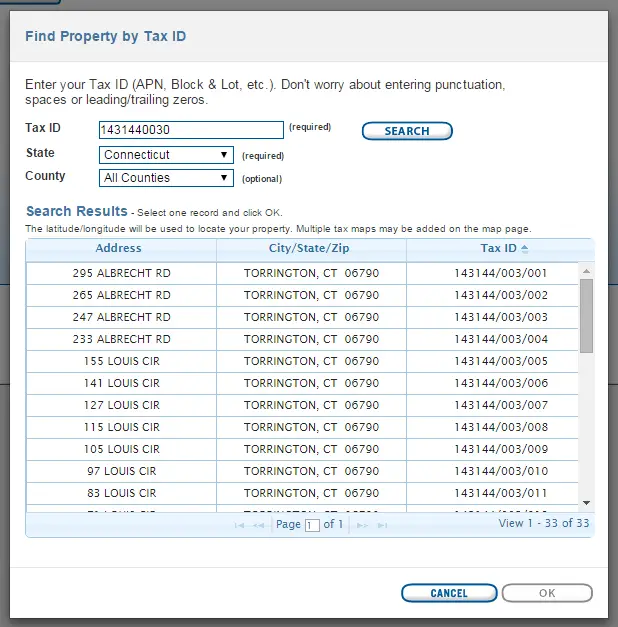

Finding Property Tax Id Numbers

If the ID number you need to find is for a property you own, you may already have the number in your files. Look on your last tax bill, the deed to your property, a title report or perhaps even on the appraisal report of your property to locate the property ID number. If you cant readily put your hands on any of this paperwork, or if the ID number you need to find is for a property you do not own, you have other search options.

Visit your local tax assessors website and search for the property by its address or, in some cases, the owners name. For some municipalities, you may also find this information on record at your courthouse. If youre unable to find the property ID number with these searches, call the tax assessors office for this information.

You May Like: How To Figure Capital Gains Tax

What Is An Ein

An EIN serves as a unique identifier for your company. Its used mainly for tax purposes. The IRS requires an EIN for any registered business with employees, corporations, partnerships, and businesses that file employment, excise, or alcohol, tobacco and firearms tax returns.

Your EIN serves as the primary ID of a business to the government. It’s also commonly referred to as a “tax identification number ” or “federal tax ID number.” You might use it to:

- File business tax returns

- Open a business bank account

- Apply for small business loans

- Obtain a business license

- File various business legal documents

Types Of Tax Id Numbers

- Social Security Number : In addition to its use for government services and identification, this nine-digit number keeps track of your earnings over the course of your lifetime as well as how many years you have worked. This number is issued to US residents, permanent residents, and temporary residents.

- Employer Identification Number : Also known as a Federal Tax Identification Number, or a Business Tax ID. The IRS assigns this nine-digit number to businesses operating in the US. Additionally, EINs go to estates and trusts with income to report.

- Individual Taxpayer Number : This number allows foreign nationals and those who may be ineligible for a social security number to pay taxes. The applicants information does not affect their immigration status or involve immigration enforcement. The nine-digit number is for tax purposes only.

- Adoption Taxpayer Identification Number for Pending U.S. Adoptions : This number is for children involved in domestic adoptions. Its a temporary number given to the adopting parents/taxpayers when they dont have the childs social security number.

- Preparer Taxpayer Identification Number : This number corresponds to those who prepare taxes such as your accountant. All paid tax preparers must obtain a PTIN. This number goes on all prepared tax forms and is an essential component of starting a tax preparation business if you work in this field.

Also Check: When Are Federal Taxes Due 2021

Looking Up Lost Or Misplaced Numbers

There are several possible ways to look up lost or misplaced EINs. You can try to locate paperwork that might contain your EIN. If that is unsuccessful, you can check with institutions and agencies to whom you may have provided the number. When contacting institutions make sure you have information on hand to verify that you are authorized to have access to the information.

You should be able to locate your ID number in the packet of information you received from the state when it issued you your number. Federal EINs can be found on the computer-generated notice sent by the IRS containing the number. You can also find the number on any state and federal tax returns your company has filed.

Atin Questions And Answers

The following are Questions and Answers regarding the ATIN program.

The Q& A provides information to taxpayers who need a taxpayer identification number for a child who has been placed in their home pending final adoption.

You May Like: When Are Louisiana State Taxes Due

How To Get An Ein

Applying for an EIN is easy it can be done online within minutes on the IRS website or by faxing or mailing a completed Form SS-4 to the IRS.

We recommend that businesses apply for an EIN as soon as possible because its crucial for basic business functions. You don’t need an EIN if you are a sole proprietor with no employees, but if you’re looking to scale your business, having an EIN early on is beneficial.

Applying for an EIN online is fastest, but you also have these options if youre based in a U.S. state or the District of Columbia:

- Mail: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

If you’re an international applicant and don’t have a legal residence or place of business in the U.S., you can apply for an EIN by one of these methods:

- Telephone: 941-1099

- Fax: 215-1627 if within the U.S., or 707-9471 if outside the U.S.

- Mail: Send your SS-4 form to Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999

If you call to request an EIN, fill out an SS-4 form ahead of time to have your answers prepared for the questions the agent will ask. If you’re filing via fax or mail, complete Form SS-4 and mail or fax it to the IRS. These methods take much longer than applying online while faxing can result in an EIN within four business days, mailed applications can take at least four weeks to process.

How To Get A Tax Id

You must register your address . Around 2 weeks later, you will get a tax ID by post1, 2. It will be a letter from the Bundeszentralamt für Steuern. It looks like this.

If you want your tax ID faster, go to the Finanzamt, and ask for it1, 2. You can do this a few days after you register your address. You dont need an appointment.

If you are homeless, you can get a tax ID at your local Finanzamt.

Recommended Reading: When Will I Receive My Child Tax Credit

The Tax Identification Number

Germany is following the example of many of its neighbors in the European Union and modernizing its tax system. By introducing the tax identification number , the Federal Ministry of Finance and the federal government want to simplify the taxation procedure and have already reduced bureaucracy.

The IdNo will replace the tax number for income tax in the long term. It will be permanently valid and will not change, for example, after a move, a change of name due to marriage or a change in marital status. The IdNo is an 11-digit number that contains no information about you or the tax office responsible for your tax matters.

Answer Five Short Questions

The first question requires you to select the type of EIN you are applying for such as a sole proprietorship, corporation, LLC, partnership or estate. You then need to choose the option that best describes why you are applying for an EIN. This can be to start a new business, for banking purposes or for a range of other reasons. The online questionnaire then requests your name and Social Security number before you can finish your application.

Also Check: When Can I Expect My Unemployment Tax Refund

Read Also: What Is The Easiest Online Tax Service To Use

What Is An Itin Used For

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

Nc Unemployment Tax Id Number

Your North Carolina unemployment tax ID number is your account number with the North Carolina Department of Revenue. This number identifies you as an employer and is used to track your unemployment tax liability. You will need your unemployment tax ID number when you file your quarterly unemployment tax return.

Don’t Miss: What Does Agi Mean For Taxes

Retreiving A Lost Tin Or Ein

If you have lost your documents establishing your TIN or EIN, you can retrieve your number from the IRS. You’ll need to call its toll-free customer service number, 800-829-1040, and get the help of an IRS representative, who will take steps to identify you before discussing confidential information.

When Does A Sole Proprietorship Need An Ein

A sole proprietor normally uses their own personal social security number for their business but even they must obtain an EIN to hire employees or files excise taxes. Learn more in our Does a Sole Proprietor Need an EIN guide.

Single-member LLCs should also generally obtain an EIN number and operate using their EIN number in order to maintain their corporate veil.

You May Like: Where To Find Real Estate Taxes Paid

Read Also: How To File My Own Taxes For Free

How Do I Create My Personal Account

-

If you are liable for income tax, or an adult in a tax household

You can create your personal space using the three identification elements that appear on your tax documents: your tax number, your online access number and your base taxable income.

You can also click on the FranceConnect icon and log in using an account you have with a participating partner : AMELI, L’Identité Numérique de La Poste, MobileConnect et moi or the Mutualité Sociale Agricole.

Once you have entered your e-mail address and chosen a password, you will receive an email containing a link which you must click on within 24 hours to confirm the creation of your personal account. Please remember your password for the next time you log in.

-

If you have a tax number, but are not liable for income tax

You can click on the FranceConnect icon and log in using an account you have with a participating partner : AMELI, L’Identité Numérique de La Poste, MobileConnect et moi or the Mutualité Sociale Agricole.

If you do not have a FranceConnect account, you will need to confirm your identity to create your personal account. You must either contact your local tax office and identify yourself to an employee, or fill in the form available in the Contact section of this site.

Once your identity has been verified, an e-mail will be sent to you indicating that you can create your personal space by entering your tax number and your date of birth on the log-in page of this site.

-

If you don’t have a tax number

Why You Need To Know Your Business Tax Id Number

The IRS requires most types of businesses to apply for an EIN. The exceptions are some sole proprietors and owners of single-member LLCs, who can use their social security number instead of an EIN. But even small business owners who don’t have to get an EIN often opt to get one, so that they’re able to separate their business and personal finances.

If the IRS requires you to get an EIN or if you choose to get one, these are some of the situations where you’ll need to provide your business tax ID number:

-

When filing business tax returns or making business tax payments

-

When applying for a business loan

-

When opening a business bank account

-

When applying for a business credit card

-

When issuing Form 1099s to independent contractors

Although each of these transactions doesn’t happen regularly, when you consider all of them together, you’ll need to provide your EIN at least a few times per year. So, this is a number worth committing to memory and storing safely. Ideally, you should retrieve your business tax ID before you complete any of the transactions above.

Read Also: How To Pay My Federal Taxes Online