Victims In Fema Disaster Areas: Mail Your Request For An Extension Of Time To File

Need more time to prepare your federal tax return? This page provides information on how to apply for an extension of time to file. Please be aware that:

- An extension of time to file your return does not grant you any extension of time to pay your taxes.

- You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

- You must file your extension request no later than the regular due date of your return.

Extensions For Those Serving In A Combat Zone

Military personnel serving in a combat zone on the due date automatically get an extension to file income tax returns and to pay taxes due. The extension period begins after you:

- Leave the combat zone or

- Youre released from the hospital.

You can add an additional 180 days to file, starting on the day that you first entered the combat zone.

Designated combat zones include/have included:

- The Persian Gulf

- Sinai Peninsula of Egypt

You won’t be charged interest on taxes or penalized during the extension period. The extension to file returns also applies to spouses of personnel serving in combat areas if a joint return is filed.

To claim a time extension to file a return or pay tax, write “COMBAT ZONE” on the income tax envelope and the top of the income tax return that you submit to us. If filing electronically, write “COMBAT ZONE” next to your name or on an address line , along with the date of deployment.

The due date for filing Massachusetts income tax returns and paying tax is the same as the federal date, and calculated as follows:

Topic No 304 Extensions Of Time To File Your Tax Return

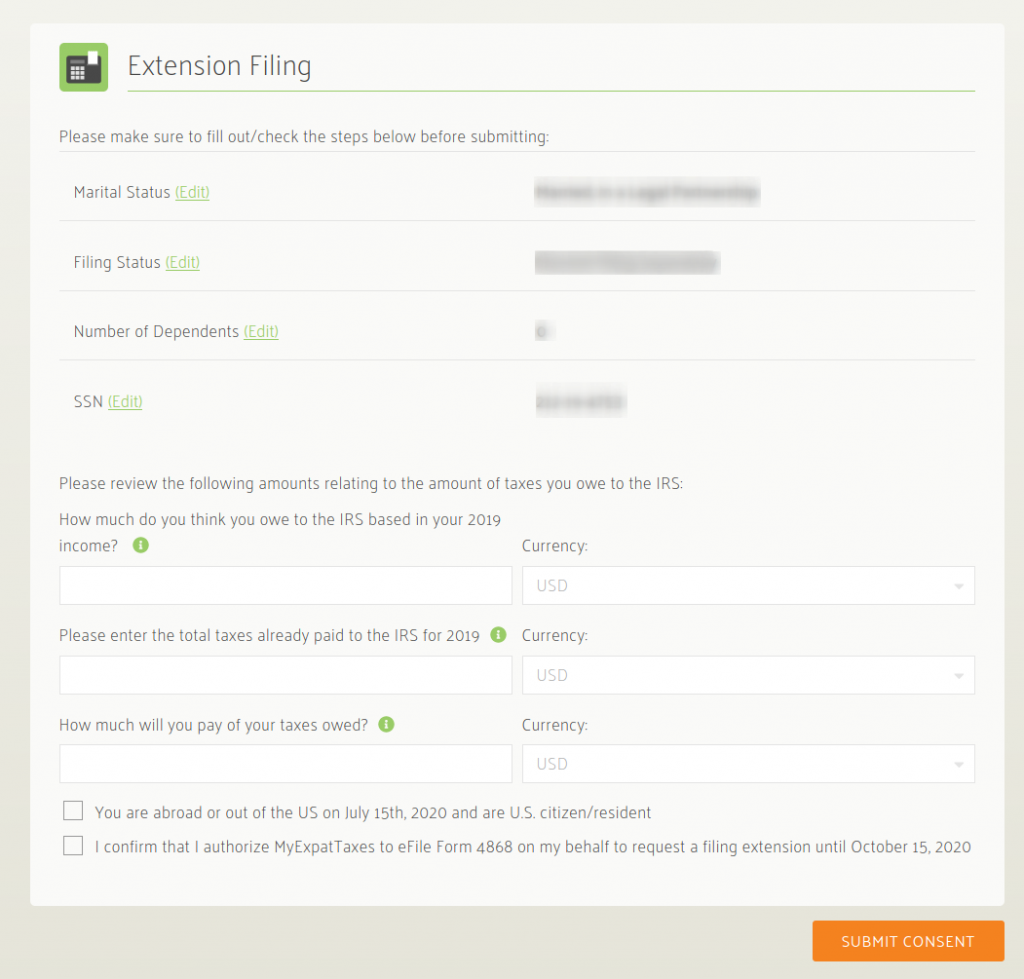

You may request up to an additional 6 months to file your U.S. individual income tax return. There are three ways to request an automatic extension of time to file your return. You must request the extension of time to file by the regular due date of your return to avoid the penalty for filing late. An extension of time to file is not an extension of time to pay. You may file your extension in any one of three ways listed below:

If you file the Form 4868 electronically, be sure to have a copy of your prior year’s return you’ll be asked to provide your prior year’s adjusted gross income amount for verification purposes. Once you file, you’ll receive an electronic acknowledgement that the IRS has accepted your filing. Keep this for your records. You should refer to your tax software or tax professional for ways to file and pay electronically using e-file services. Several companies offer free filing of Form 4868 through the Free File program.

Read Also: When Are Taxes Due 2021

Extension Of Time To File

An extension of time to file a return may be requested on or before the due date of the return. The extension is limited to six months. You may receive another 6-month extension if you are living or traveling outside the U.S. You must file the first 6-month extension by the April 15 deadline before applying for the additional extension of time to file by October 15.

Extensions for Members of the US Armed Forces Deployed in a Combat Zone or Contingency Operation. Deadlines for filing your return, paying your taxes, claiming a refund, and taking other actions with OTR is extended for persons in the Armed Forces serving in a Combat Zone or Contingency Operation. The extension also applies to spouses/registered domestic partners, whether they file jointly or separately on the same return. Complete the Military Combat Zone on your Extension of Time to File, FR-127.

Note: Copies of a federal request for extension of time to file are not acceptable.The extension of time to file is not an extension of time to pay. Full payment of any tax liability, less credits, is due with the extension request. If the tax liability is not paid in full with the extension, the request for an extension will not be accepted, and the taxpayer will be subject to a failure-to-pay penalty and interest on any tax due.

Volunteer Income Tax Assistance

The IRS’s Volunteer Income Tax Assistance program offers free basic tax return preparation to people who generally make $58,000 or less and people with disabilities or limited English-speaking taxpayers. While the majority of these sites are only open through the end of the filing season, taxpayers can use the VITA Site Locator tool to see if there’s a community-based site staffed by IRS-trained and certified volunteers still open near them.

Also Check: Do You Have To Pay Taxes On The Stimulus Check

Avoid Late Fees And Penalties

Because the IRS imposes late penalties for failing to file your taxes on time you can avoid these penalties if you are going to have to file your return after the deadline.

Remember, that if you are granted an extension to file your tax is still due in full by the April tax deadline each year. If you pay your taxes after the deadline, you will still incur late fees, interest, and penalties regardless of whether or not you have an extension to file.

You May Mail A Paper Return

Directions to print forms:

1. Click on the folders below to find forms and instructions. You can also search for a file. If you click on a folder and run a search, it will only search that folder.

2. Click a form to print it.

Note: Your browser may ask you to allow pop-ups from this website. Allow the pop-ups and double-click the form again. For the best user experience on this website, you should update your browser .

Mac Users: Safari may block pop ups on default. You can go to your Safari menu, preferences and then security to allow pop-ups.

You can also find printed forms:

- At your local District Office. See the CONTACT US link at the top of this page.

- At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or

- You can call 1-866-285-2996 to order forms to be mailed.

Browse or Search Forms

Recommended Reading: How To Track My Tax Refund Turbotax

Recommended Reading: What Is The Best Program To Do Your Taxes

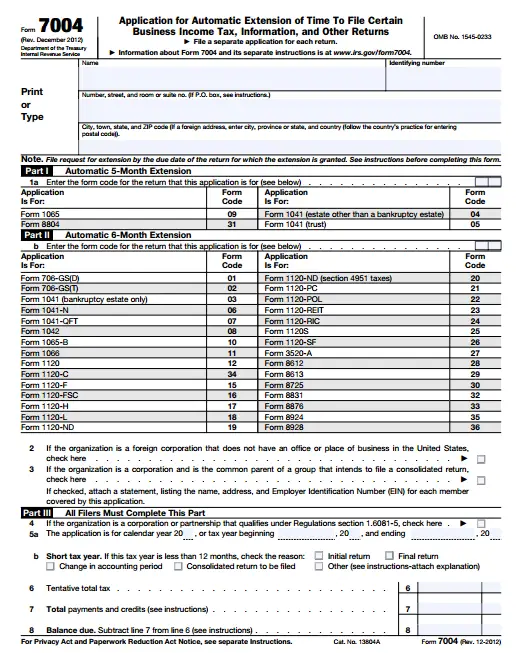

How And When To File An Extension On Business Taxes

If you can’t complete the tax return for your business by the filing date, you can request an extension of time to file. This article discusses how and when to file, what form to use, and other important information about extensions.

An extension of time to file is not an extension on paying taxes due. Even if you file an extension application, you must pay taxes due by deadline, in order to avoid late-payment penalties and fines.

How Long Is A Tax Extension

A tax extension gives you until October 17, 2022, to file your tax return.

However, getting an extension does not give you more time to pay it only gives you more time to file your return. If you cant file your return by the April 18 deadline, you need to estimate your tax bill and pay as much of that as possible at that time.

-

Anything you owe after the deadline is subject to interest and a late-payment penalty even if you get an extension.

-

You might be able to catch a break on the late-payment penalty if youve paid at least 90% of your actual tax liability by the deadline and you pay the rest with your return.

Recommended Reading: What Tax Return Does An Llc File

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2022 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $34,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $68,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct qualified charitable donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Overview: What Is A Tax Extension

When you need more time to get your small businesss tax ducks in a row, you can file for an IRS extension that delays your tax return due date for up to six months.

Usually, individual tax payments and returns are due by April 15. You may file for an automatic six-month extension, moving the return date to October 15. Business returns follow different due dates, but the filing process is nearly identical.

However, its a misconception that getting a tax extension pushes back your tax payment due date. Youre still required to pay your taxes by the original deadline, and, if you dont, youll face penalties. The IRS failure-to-pay penalty will run you 0.5% of your tax liability for every month your payment is late, up to 25%.

Of course, you wont know your exact tax liability until you finish filing your return, but youll have an idea of your income and small business deductions. You wont face a failure-to-pay penalty if you pay by tax day 90% of the filing years tax liability or 100% of the previous years.

Say youre a sole proprietor who needs an extension on filing your 2020 taxes. By April 15, 2021, youll need to pay either 100% of your 2019 tax liability or 90% of what youre expecting to owe for 2020.

You May Like: How Fast Can You Get Your Tax Refund

Business Tax Extensions: A Chart

| Business Type |

| 7004 or online |

The exact due date for a specific year may change if it falls on a weekend or holiday. Check this article on business tax return due dates for the exact dates for the current year.

Here are details on extension applications for specific business types:

- Sole proprietorship and single-member LLC tax returns, filed on Schedule C and included with the owner’s personal tax return, are due on April 15 for the previous tax year. If you want an extension, you must file the extension application for a Schedule C and personal return by the tax return due date of April 15.

For the 2020 tax year, the deadline for sole proprietors and single-member LLC tax returns filed on Schedule C with the owner’s personal tax return was extended to May 17, 2021. In Texas, Oklahoma, and Louisiana, the deadline was extended to June 15, 2021, in regions declared winter-storm disaster areas by FEMA.

What Do I Need To Know

Remember, extending the time to file your tax return generally doesnt extend the time to pay any taxes due.

Interest and penalties will generally start to accrue immediately after the due date. You should estimate what you think you might owe and send that amount with your extension. This may save you from being penalized for not paying timely. If you cant pay, you should still file an extension and then review your payment options.

If you believe youre due to receive a refund, you arent required to make a payment.

You May Like: What Is The Tax Rate In Georgia

Ways To File An Extension Application

The IRS offers several ways to apply for an extension:

- IRS e-file: This is the IRS’s electronic filing program. You can choose either guided tax preparation or Free File fillable forms. Be sure to start the process on the IRS website. If you go directly to a company website, you won’t be participating in the IRS’s Free File option.

- Electronic payment: If you make an electronic payment, the IRS will automatically process a filing extension.

- E-file with tax software or a tax professional: Check your tax preparation software or talk with your tax professional about how to file for an extension.

- Paper filing: You can download and print a paper form from the IRS website. You can also order a paper copy of form 4868 from the Forms and Publications by U.S. Mail page or by calling 800-TAX-FORM . Fill it out and mail it to the IRS according to the mailing instructions included with the form.

Facts About Filing For An Extension

IRS Tax Tip 2018-59, April 17, 2018

This years tax-filing deadline is today. Taxpayers needing more time to file their taxes can get an automatic six-month extension from the IRS.

There are a few different ways taxpayers can file for an extension.

-

IRS Free File. While taxpayers can use IRS Free File to prepare and e-file their taxes for free, they can also use it to e-file a free extension request. Midnight on April 17 is the deadline for the IRS to receive an e-filed extension request. Taxpayers can access Free File to prepare and e-file their return through October 17.

-

Form 4868. Taxpayers can request an extension using the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. The deadline for mailing the form to the IRS is April 17.

-

Electronic Payment Options. The IRS will automatically process an extension of time to file when taxpayers pay all or part of their taxes electronically by April 17. They dont need to file a paper or electronic Form 4868 when making a payment with IRS Direct Pay, the Electronic Federal Tax Payment System or with a debit or credit card. When paying one of these ways, taxpayers will select Form 4868 as the payment type. Taxpayers should print out a confirmation as proof of payment and keep it with their records.

Here are a couple things for people filing an extension to remember:

You May Like: How To Claim Dependents On Taxes

Who Is Required To File

I just moved to Virginia this year. Do I have to file? If so, which form?

For information regarding the thresholds for filing in Virginia, refer to Who Must File on this website. The What Form Should I File? tool is helpful in determining which form you may need to file as a Virginia resident.

I am under the filing threshold but had Virginia tax withheld that I would like to have refunded. Am I still required to file?

Yes, to receive a refund you must file a return. For information on which form to file please refer to What Form Should I File?

I am an active duty Military member who is currently stationed in Virginia. Am I required to file?

Virginia taxes the taxable pay of military service personnel with a Virginia Home of Record. If you are a legal resident of another state who is currently stationed in Virginia, your military income is not taxable in Virginia. However, if you have non-military income from Virginia sources, such as an off-base job, you may be required to file a Virginia return.

I am a military spouse. Am I required to file?

If you were married to an active duty service member who was in Virginia pursuant to military orders and you were in Virginia solely to be with your spouse, you may be eligible for a Military Spouse Exemption in Virginia pursuant to the Military Spouse Residency Relief Act.

Fax 1040 Tax Form: Your Ultimate Manual For Easy Filing

We are only a few months shy from the dreaded tax season, which undoubtedly leaves so many working professionals stressed and exhausted. In order to make this daunting task a bit more manageable, its highly recommended to sort everything out as early as you can. Do not wait until the last minute to accomplish whatever it is you need to file your taxes.

In this article, we will provide you with a comprehensive guide that covers the basic things you need to know about filing your tax from understanding the process to learning how to fax 1040 Tax Form.

Read Also: How To Get Property Tax Exemption

Filing A Business Tax Extension

The IRS posts the proper forms for filing an extension on its site, along with instructions and specifics about the regulations. IRS form 4868 can also be used by sole proprietorships that file a Schedule C with a personal return and single member limited liability companies .

Corporations, LLCs and more expansive businesses use IRS form 7004. As with an individual return, submitting this form is an automatic request for a six-month extension to file your businesss income taxes.

Federal tax extension forms can be submitted electronically. The IRS offers details on its site with online fillable forms, as well as details for . Many bookkeeping platforms integrate filing taxes into their platforms explore this option with your preferred tax filing or bookkeeping service.

Filing an official extension is not a way to avoid paying the taxes you owe. The expectation is to pay the anticipated amount of tax owed. The extension is for the sole purpose of providing the flexibility to file the remaining paperwork within the six-month extension.

There is no process for filing an additional extension beyond the one youre granted through October 15. A return can still be completed after this date, just expect to pay additional penalties. However, its a case where its definitely better late than never as to avoid additional penalties by further delaying the filing of a return. The IRS notes that a failure-to-file penalty is generally more than the failure-to-pay penalty.