The Value Of Your Real Property Increased More Than Is Reasonable Compared To The Previous Year

If your real property increased, say, 4% over last year, you may find this unreasonable , depending on the state your property is located in. For example, California law mandates that real property values not increase more than 2% per year, unless there is a change in ownership. In this case, a property tax appeal letter would certainly be warranted.

It Costs Little To Nothing Out Of Pocket

Appealing your property tax assessment costs little to nothing out of pocket. At most, youll be required to pay a nominal appeal filing fee, usually not more than $25 or $30. In many cases, this fee is waived.

Attorneys generally assist homeowners with property tax assessments on a contingency basis. Youll only pay for an appeal thats complex enough to require an attorneys assistance if it proves successful. Even then, youll pay out of your windfall.

So the only significant out-of-pocket expense that may be required from a routine property tax appeal is a home appraisal. Hopefully, youll earn back the $300 or $400 you spend on that when your property tax bill falls.

Check For Errors In The Municipality Assessment

You wouldnt be trying to appeal your property value assessment if you werent convinced that there was at least one error that will eventually force you to pay higher property tax levels. Therefore, compile each of the errors that you notice and formally list them. This way, you can easily reference this information later on when it comes time to formally appeal your property value assessment with your local municipality.

Read Also: When Do You Have To Pay Taxes On Crypto

When Is The Hearing Officer’s Decision Not Final

The county board of supervisors has the authority to adopt rules and procedures that set forth whether or not they will use hearing officers and whether a hearing officer’s decision is a binding or non-binding recommendation. They may also adopt a resolution that the appeals board has the discretion to accept or reject the hearing officer’s recommendation. This means that if either the county assessor or you do not want to accept the hearing officer’s recommendation, you may request in writing, within a specific time frame, a new hearing before the county appeals board. You should check with your clerk of the board to verify what applies to your county.

It Could Negatively Impact Your Homes Resale Value

Assessed value is not the same as appraised or market value. But it doesnt exist in a vacuum, either. Assessed value is one of several factors used by homebuyers and consumer-facing real estate data sources, like Zillow, to determine fair market value.

Unless local statutes explicitly limit year-over-year increases in tax assessed value, you can bet that buyers interested in your home will exploit the yawning gap between your tax assessed value and asking price during negotiations. If youre planning to sell your home in the near future, holding off on property tax appeals may actually be a wise financial move.

Recommended Reading: What Is The Tax Rate On Social Security

You Can Miss Your Hearing

Lets start with you protesting without showing up. Many tax fighters cant make hearings because of work or family responsibilities. Property owners sign up to protest but dont show up. But if you fill out an affidavit, get it notarized and mail it in, certified with a return receipt so you know they received it, they have to honor it. A hearing will be held, but you dont need to be there.

You can find the form on the state comptrollers website by searching for Property Owners Affidavit of Evidence. But you dont even need to send the form as long as you offer all the information it requests in a letter, get it notarized and send to the Appraisal Review Board.

Information sought includes: property address and owner, account number, property description, phone and email, date and time of scheduled hearing and information on whether the owner will attend the hearing. You also outline your case for lowering your appraisal and submit evidence. This way you can skip your hearing, but your evidence is still considered.

If you do use the form, check the top box on page 2 where it says, I do not intend to appear at the hearing in person, by telephone conference call or by videoconference. This affidavit and the evidence and/or argument submitted with it may be used at the hearing if I do not appear in person at the hearing.

You can also change your mind and let them know you plan to appear.

And make sure when it asks for Reasons for Protest you check Other.

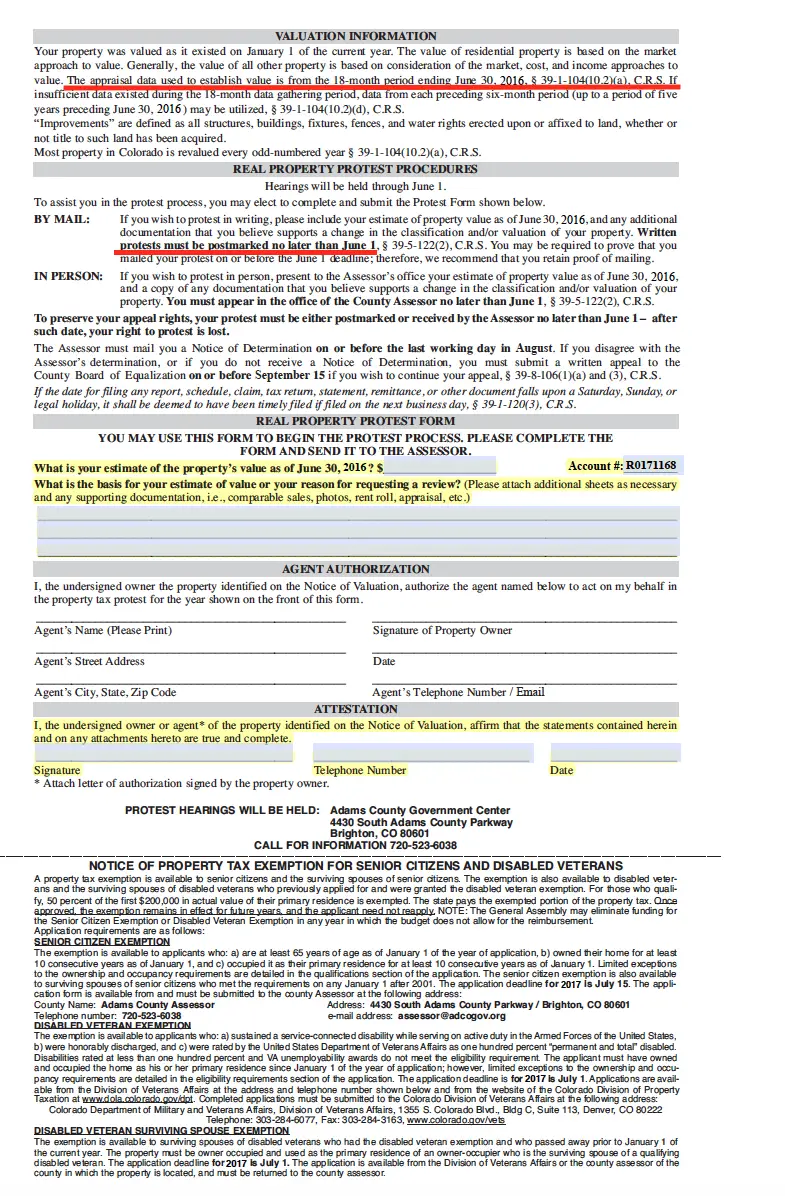

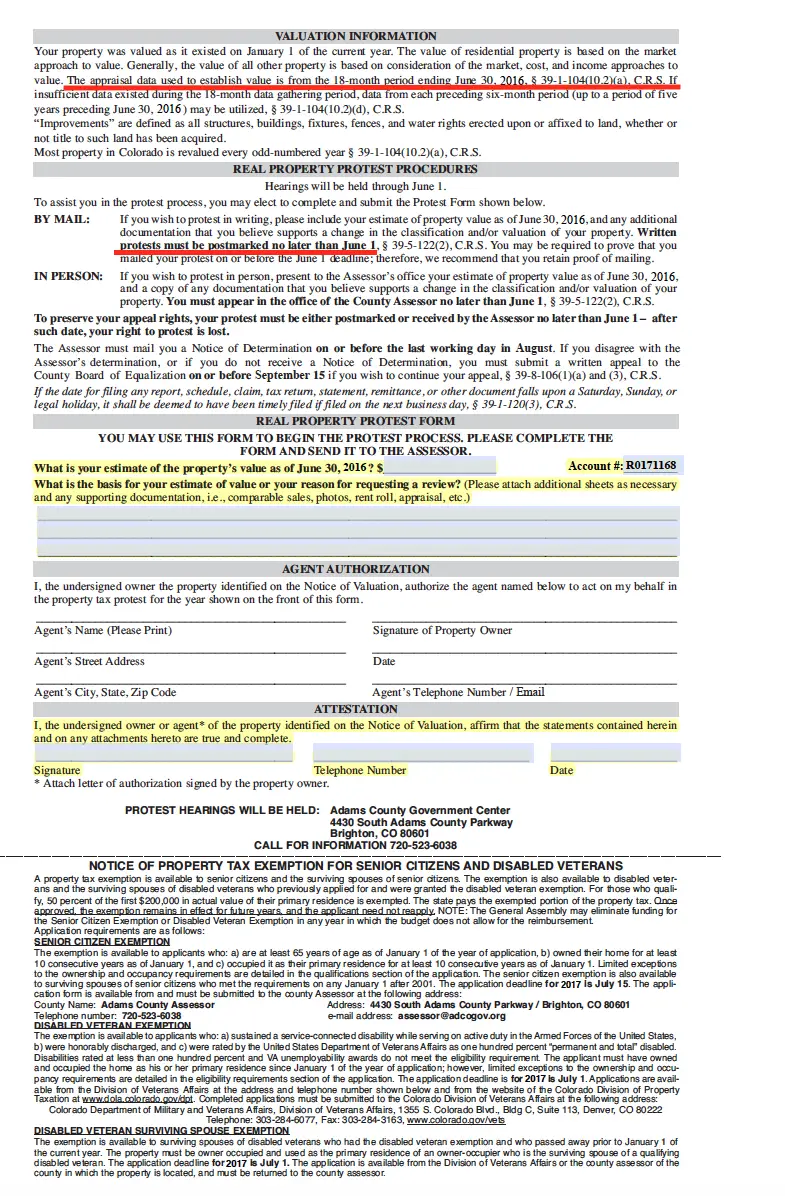

File Your Property Tax Appeal

If you decide that you do want to go through with an appeal, there will typically be a form you can fill out either online or at the office of your Board of Tax Assessors.

This year, most counties are only accepting requests to lower your property taxes via email because of the pandemic.

Either way, its simple to fill out the form or drop an email. Ive done a property tax appeal twice since buying my home. Each time, Ive only spent a few minutes sizing up market conditions and values based on comps. Then I filled out the paperwork to explain why I believed my appeal was warranted. Both times the county agreed with me.

A simple form email can suffice. Last time I filed an appeal, I wrote something like this:

Just remember to include these basics in your email:

Finally, be sure to check with your municipality before emailing them to see if theres any additional information you need to include.

Also Check: Can I Pay My State Taxes Online

How Can I Be Certain Comps Are Accurate

Look for the following signs that the sales youve selected are accurate comps.

Compare only sold homes: Weve said it before, but it bears repeating. Only sold listings count.

Pay attention to the listing description: Look for keywords and phrases that you think describe your home close to a bus stop, remodeled bathroom, new roof.

Study the photos carefully: How big is that backyard? Does the half bath have carpet on the floor? Look closely and zoom in on the photos and take notes on similarities and differences.

Visit the property and check out the area: Sometimes nothing substitutes for driving through the area and realizing that theres a pizza parlor next door, or that a home is close to a community pool.

Be certain its the same type of home: A ranch isnt comparable to a Victorian, and will attract different buyers.

Adjust for seasonality or market conditions: If youre listing in the spring or early summer, just as the market heats up, you can probably command a higher price than if youre selling mid-winter.

Partner with a top agent familiar with the area: Real estate agents have direct access to the most accurate comps data in the MLS. They also have years of experience spent studying shifts in local market trends and are your best source for determining a homes value.

Know How This Game Works

Maybe game is the wrong word. Theres absolutely nothing fun about it! But the property tax system is somewhat labyrinthine and you do need to know the rules. And the most important one is that the amount you pay in taxes depends on the value of your property.

A property owners chances of successfully appealing his or her property taxes depends upon whether the tax assessment is fair and accurate, says Anthony F. DellaPelle, a property tax attorney in Morristown, NJ.

In other words, the assessment of your home should reflect its fair . If those two figures dont line up, you should be able to reduce the assessmentand pay less.

If youre lucky, your tax assessor will agree to a reduction without requiring you to file a tax appeal, DellaPelle says.

But theres still a lot youll need to do to back up your claim.

Don’t Miss: How Much To Charge For Tax Preparation

After I Filed An Application I Have Decided Not To Go Through With It What Should I Do Will I Be Charged A Fee For Withdrawing

Under most circumstances, you are permitted to withdraw your application at any time prior to the hearing. In some counties, if the county assessor has indicated that evidence supporting a higher value than what is currently shown on the roll will be introduced at the hearing, you may not withdraw your application. It is within the law for an appeals board to decide to continue an appeal, even though the county assessor and you may have agreed to withdraw the appeal.

If you decide to withdraw your assessment appeal, you should notify the clerk of the board in writing as soon as possible so more time is not spent on reviewing your application. Most counties do not charge a withdrawal fee however, please check with your county’s clerk of the board for details.

Your Taxes Could Rise After An Assessment

Many jurisdictions prohibit tax assessors from raising property taxes on appeal. That isnt the case everywhere, though.

Check your assessors website for language indicating assessed value can rise or fall on appeal. This should be transparently stated.

If its possible the appeal could result in a higher tax bill, conduct an online assessment, if available, before formally appealing. The results arent binding or public, and the worst-case scenario is simply that you dont proceed with your appeal.

Don’t Miss: How To Find Tax Refund From Last Year

The Assessor Valued The Same Property Twice

Called a double assessment, the assessor may have valued the same real or personal property twicemeaning you could be on the line for twice the correct amount. This costly issue sometimes occurs due to a clerical error in the taxpayer name or address. For example, you may be sent a valuation notice under the names John W. Smith and Johnny Smith, or for 1523 W. Main and 1523 West Main.

Property Tax Appeals: When How & Why To Submit

Taxes are still one of the certainties in life , but the same cant be said for the amount of taxes paid. Thanks to the property tax appeal process, valuation amounts are never set in stoneas long as you take full advantage of your right to challenge an unfair assessment.

The appeal process kicks off with a simple property tax assessment appeal letter. Below is what you need to know about why you might need an appeal, completing and submitting these letters, how to ensure you dont make the mistake of missing important appeal deadlines, and a sample property tax appeal letter you can use as a reference.

Read Also: Do You File For Use Tax

How To Simplify Your Property Tax Appeals Process

The property tax appeal letter is just one piece of the process you also need to meet important deadlines and do thorough research to support your case, which takes time. TotalPropertyTax software has you covered on both those fronts.

TPT keeps you informed and prepared by managing the important dates associated with all stages of the property tax cycle. It also generates property tax assessment appeal letters and can help you quickly create appeal packages, including the appeal letter and any custom attachments you want to send. As you prepare your appeal, you can also use TPT to capture market, assessed, and taxable values across multiple notices, as well as easily compare values across notices and prior years for analysis.

Navigating The Property Tax Appeal Process In Tpt

If youre curious about what handling appeals looks like in TPT, heres a mini walkthrough:

In this example, weve created three hearingsone for each account. However, you can also assign multiple accounts to a single hearing if the assessor scheduled it in that manner.

You can always reference the TPT calendar to see all your important return, appeal, and tax bill dates at a glance. Simply select an item to get more details.

Don’t Miss: Do You Pay Sales Tax On Out Of State Purchases

What Are Comps In Real Estate

In real estate, the term comps short for comparables refers to recently sold homes that are similar to your house. To be a comp, the house must have similar characteristics, such as size, school district, and amenities.

Comps give you a range for its , which you can then add or subtract from based on your homes unique characteristics and features. For example, if you have a two-car garage and your neighbor has a one-car garage, your home might sell for more.

Once youve assembled your pool of similar properties, look at their sold prices. Active listings are not an accurate comparison point for your homes value until they sell.

Why? Even if the home down the street is listed for $500,000 it hasnt sold yet, so how do you know if its too high or too low?

Comps sold within the last 60 days are preferable because their sale price reflects current market conditions. However, recent sales arent always available, so you may have to pull comps from as long as six to 12 months ago.

I Am Unsure If I Should Designate My Application As A Claim For A Refund As Asked On Question Number 8 On The Application What Are The Advantages And Disadvantages To This

If your assessment is reduced after your hearing and your application has been designated to also serve as a claim for a refund, the county will automatically process a refund for you. However, if your application has not been designated to serve as a claim for refund and you are successful at the appeals hearing, you will be required to submit a separate ‘claim for refund’ form with the county board of supervisors.

A disadvantage of having your application also serve as a claim for refund is that it may shorten your time to make a decision regarding whether to pursue your claim in superior court when the outcome of your appeal is not in your favor. If the application is also your claim for refund, you must file your claim in superior court within six months of the date of the appeals board’s decision. If your application is not being designated as claim for refund, you will have six months from the appeals board’s decision to file a claim for refund with the county board of supervisors. Then, you will have six months from the time the board of supervisors denies your claim for refund to file your claim in superior court.

| Status of application |

|---|

Read Also: How Do I Find My Taxes

Shooting In Dallas Leaves 1 Dead Gunman At Large: Police

“So if you go take photos of condition issues with your house and get repair estimates from a contractor that things need to be fixed up and the house is devalued and not in great condition then those are things the appraisal district can use to justify a reduction in your value,” Crouch said.

Crouch also suggested you request evidence the tax appraisal district will use against you so you can research it and argue against it.

You should ask a realtor for comps in your area to do your own comparisons.

Also, appeal hearings are public. Go observe a hearing so you know what to expect before you are in front of the board.

A little effort could pay off in the long run.

“Do it in the most respectful, data-driven, data-supported way you can and if you take that approach you can win, and believe it or not the success rate is higher than you might think if you take the right steps,” Crouch said.

This article tagged under:

Look At Your Annual Notice Of Assessment

When people get their annual notice of assessment in the mail, thats when they typically get fired up about lowering their property taxes.

The key piece of information youll want to note on yours is the year-to-year change in your propertys appraised value.

In my case, the appraised value jumped from $140,000 to $170,770 in just one year.

Thats an increase of $30,770 a nearly 22% rise in a very short period of time!

When I first got this assessment in the mail, I thought that was crazy. However, as I went through the property tax appeal process, I came to find out that it wasnt as far-fetched as Id believed.

You can see this years value of a sample property in the shaded area below. Right next to it, youll see last years value.

Also Check: When Can You Withdraw From 401k Tax Free

How Do You Protest An Appraised Value

If you are dissatisfied with your appraised value or if errors exist in the appraisal records regarding your property, you should file a Form 50-132, Notice of Protest with the ARB. In most cases, you have until May 15 or 30 days from the date the appraisal district notice is delivered whichever date is later.