Sending In Your Tax Returns

In most cases, you cant submit old returns electronically. Instead, you need to mail them to the IRS or your state revenue department. Send your returns to the address on the tax return or tax return directions. If you receive a notice reminding you to file a return, use the address on that IRS letter.

If you are working with an IRS Revenue Officer, you should send the complete returns to that person. When in doubt, contact the IRS or state directly.

Recommended Reading: Is It Hard To Do Your Own Taxes

Blocking Search Engines From Indexing Its Free File Program Page

Citizens of the US that make up to $72,000 per year are eligible for free preparation and filing of tax forms through the IRS Free File program. However, TurboTaxs free file program page contains specific HTML tags which block search engines from indexing it. TurboTax has been deceiving customers which were eligible for the free submission into signing up for their commercial product. Starting December 30, 2019, under a new agreement from the IRS, TurboTax can no longer hide their free version services from search results.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

You May Like: Who Can Claim Education Tax Credit

Don’t Miss: Where Can You File Taxes Online For Free

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. But be aware the service may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

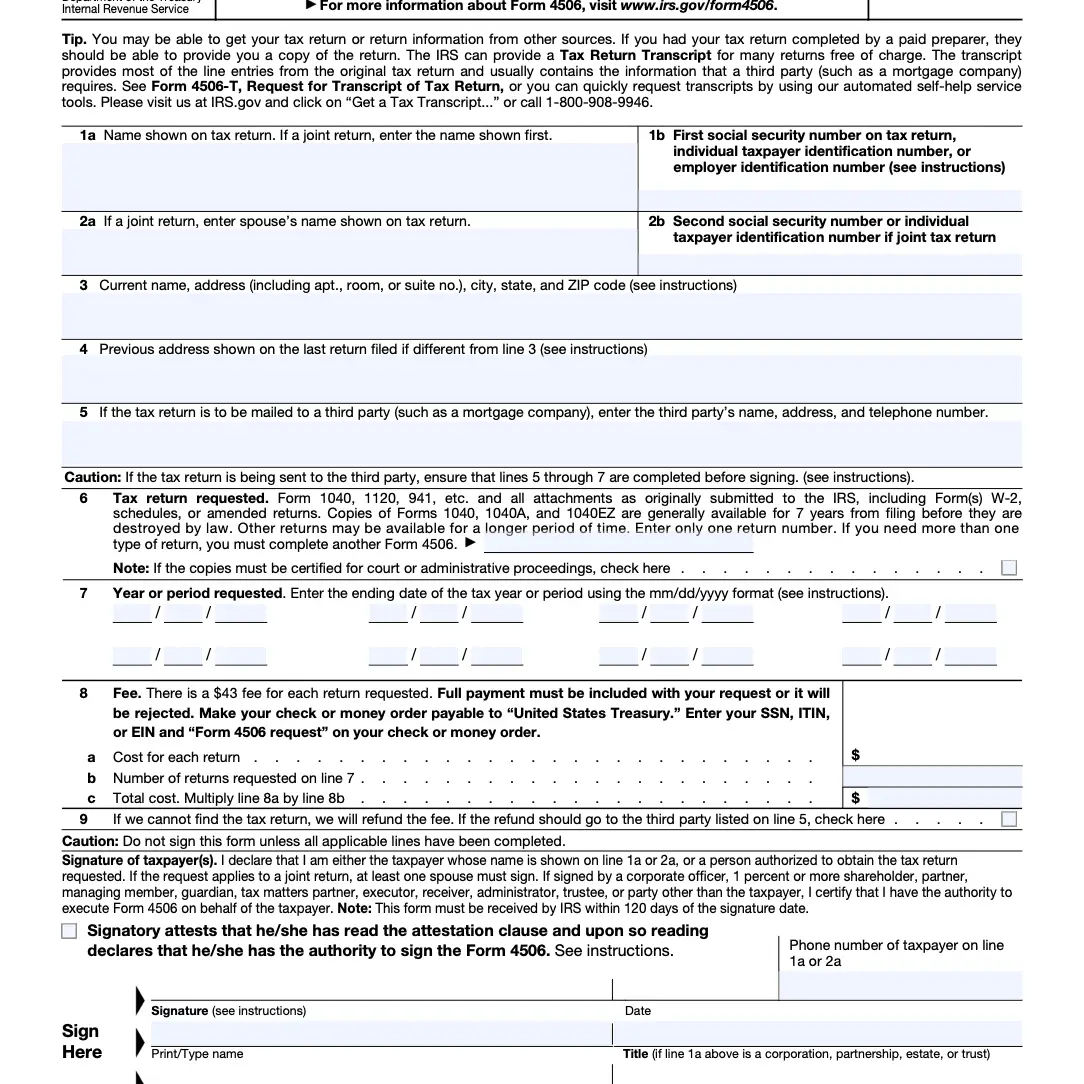

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Read Also: How To Retrieve 1040 Tax Return

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Read Also: How Much Federal Tax Should I Pay

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

There Are Fees For A Previously Processed Return

If you need an actual copy not a transcript of a tax return that was previously processed, it will cost $57 for each tax year.

You will need to complete Form 4506, Request for Copy of Tax return, and mail that to the IRS address listed on the form for your area.

Copies are usually available for the current year as well as the past six years. You will need to wait 60 day to get an actual copy of your return.

Facebook Comments

You May Like: How Do I File Previous Years Taxes With H& r Block

What Is A Transcript

Transcript is magic word with the IRS. It is their word for the electronic copy of your information at the IRS. They have tax return transcripts, and wage and income transcripts . A tax return transcript can help you get a copy of your return, or help you remember if that year you did even file a tax return. The wage and income transcript will be the data from all your income tax forms .

There are a few ways to obtain the transcripts. You can call the IRS and wait on hold for what feels like forever, and authorize them to send the information in the mail, generally takes 7-10 business days. There is a form you can fill out and mail to them, and get the information in the mail as well, the 4506-T . It is a single page form, fairly easy to fill out. Vital information at the top, tax form number is 1040 for your personal return , check the box of the type or types of transcripts you want, the years you want them for on the bottom, then sign date and mail off.

Why Should You Keep Some Tax Records Longer Than Seven Years

As a money nerd, I am planning to keep my older tax records indefinitely. Partially, because I think it is a good idea to have them. Also, because Ive managed to make all the files digital, and once they are scanned and saved, I have more important things to do with my time rather than delete old files on my computer. Also, as a business owner, I have found it interesting to revisit my income and even business expenses throughout my career as a financial planner.

Do You Have Tax Records Connected to Property?

When you own property , you should keep all tax records for at least three years after selling that property and filing the corresponding tax returns. That may include records for depreciation, amortization, or depletion deduction, all of which will figure into whether you are going to realize a gain or loss when you sell the property. Your taxable gain when selling a home, or disposing of property, is not necessarily the same as the difference between the purchase and sale prices.

Depending on where you live, you may need to keep state tax records longer than the IRS requires for … federal tax returns.

Getty

State Tax Record Retention Requirements

What Should I Do with My Old Tax Returns?

You May Like: Are Nonprofit Organizations Tax Exempt

How To Get A Copy Of Your North Carolina Return

If you need a copy of your North Carolina income tax return, you should mail a written request to:

Be sure to include your name as it appeared on the return, your current mailing address, social security number and the tax year of the return that you need. Please allow 20 days to receive the copy of your return. You cannot request a copy by telephone. The Revenue Department must have a written request signed by you. There is no charge for copies of your return.

Q4 I Got A Message That Says The Information I Provided Does Not Match What’s In The Irs Systems What Should I Do Now

Verify all the information you entered is correct. It must match what’s in our systems. Be sure to use the exact address and filing status from your latest tax return. If youre still receiving the message, you’ll need to use the Get Transcript by Mail option or submit a Form 4506-T, Request for Transcript of Tax Return.

Don’t Miss: How Much Will I Get Back In Taxes 2021

According To The Irs What Is The Period Of Limitations

The period of time when you are still able to amend your tax returns to claim a tax credit, or refund, is called the period of limitations, according to the IRS. During this time, the IRS may still assess you with additional tax liabilities. Specific examples of this are listed later in the article. Unless stated otherwise, a time period of limitations refers to years after the taxes were filed. Tax returns that were filed early are considered filed on the tax deadline, usually around April 15th. For 2020, this will be July 15th. However, the time period of limitations for returns filed on extension will be years from the actual date the taxes were filed.

Keep copies of your filed tax returns indefinitely. Having access to copies of your older tax returns may help in preparing future tax returns and making computations if you need to file an amended return. With the help of scanning and cloud storage, I dont see many reasons to delete older tax returns. I think we could all save a lifetime of tax returns on our computers without putting a dent in our storage limits.

Period of Limitations that apply to income tax returns via the IRS website

1. Keep records for three years if situations , , and below do not apply to you.

2. Keep records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later if you file a claim for credit, or refund, after you file your return.

Transcript Of Your Tax Return

We offer various transcript types free of charge. You can go to the Get Transcript page to request your transcript now. You can also order tax return and account transcripts by calling and following the prompts in the recorded message, or by completing Form 4506-T, Request for Transcript of Tax Return or Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript and mailing it to the address listed in the instructions. Form 4506-T-EZ was created only for Form 1040 series tax return transcripts. Allow at least 10 business days from when the IRS receives your request to receive your transcript.

Read Also: How To Mail Tax Return

Q5 How Do I Request A Transcript For An Older Tax Year When Its Not Available Online

Tax return and record of account transcripts are only available for the current tax year and three prior tax years when using Get Transcript Online. Note: There is a show all + expand button below the online tax account transcript type that may provide additional tax years you need. Otherwise, you must submit Form 4506-T to request a transcript for a tax year not available.

Tax return and tax account transcripts are also limited to the current and prior three tax years when using Get Transcript by Mail. To get older tax account transcripts, submit Form 4506-T.

Recommended Reading: How Do I Estimate Taxes For Self Employment

What’s On A Tax Transcript

A transcript displays your tax information specific to the type of tax transcript you request.

The IRS is responsible for protecting and securing taxpayer information. Because of data thefts outside the tax system, cybercriminals often attempt to impersonate taxpayers and tax professionals. Thieves attempt to gain access to transcript data which can help them file fraudulent tax returns or steal additional data of other individuals and businesses listed on transcripts.

The IRS better protects your information from identity theft by partially masking the personally identifiable information of everyone listed on transcripts. All financial entries remain fully visible to assist with tax preparation, tax representation and income verification. Anyone with a need to know will be able to identify the taxpayer associated with the transcript based on the data that still displays.

Don’t Miss: How To Know If You Filed Taxes Last Year

What Is A Tax Transcript

A tax transcript is basically a printout summary of the major data on your tax return, including a particularly important one: adjusted gross income, or AGI.

The IRS doesnt charge for tax transcripts, and you can get one online immediately . Youll need to register online with the IRS before you can access the Get Transcript online tool.

In most cases, when you need tax return info you can use a tax transcript. Ask whoever needs your tax information whether a tax transcript will be OK or if a copy of the return is required.

Can I File 2012 Taxes On Turbotax

TurboTax 2012 is Up to Date: You Can Start Your Taxes Today! The TurboTax Blog.

Can I do my 2014 taxes on TurboTax?

Now Accepted: You Can File Your 2014 Tax Return with TurboTax Today! TurboTax is accepting tax returns today so that you can get closer to your maximum tax refund. Last tax season about 75% of taxpayers received a tax refund close to $3,000.

Can I still file 2019 taxes on TurboTax?

Yes, with the 2019 TurboTax CD/Download software which is available at our past-years taxes page. TurboTax Online and the mobile app can no longer be used to prepare or file 2019 returns.

Read Also: What Is My Income Tax Rate

Read Also: What To Bring To Do Taxes

Internal Revenue Service Statistical Data

Electronic Records Reference Report

The National Archives does not have individual tax returns. Individual Federal tax returns are retained by the IRS and destroyed after a certain period of time.

- You can request old tax returns from the Internal Revenue Service . For more details, see:

- The Social Security Administration provides copies of old W-2s or related Social Security documents. For more details, visit:

How Do I Get My Actual Tax Return

IRS tax transcripts are not photocopies of your actual tax return with all the forms and attachments.

-

If you want an actual copy of an old tax return, youll need to complete IRS Form 4506 and mail it to the IRS.

-

Theres a $43 fee for copies of tax returns , and requests can take up to 75 days to process.

Also Check: Why Do You Have To Pay Taxes

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Do Expats Pay Us Taxes

How Can I Get A Copy Of My Tax Return

Taxpayers may request copies of any tax return or other previously filed document by completing a Tax Information Disclosure Authorization, Form R-7004. Instructions for the form can be found here.

As of July 17, 2015, the research fee for copies of tax returns authorized by R.S. 47:1507 are as follows:

- $15.00 for a copy of any tax return or other document for each year or tax period requested, regardless of whether the requested return or document is located.

- $25.00 for each certified copy of any return or other document for each year or tax period requested, regardless of whether the requested return or document is located.

All research fees for copies must be paid when you submit the Tax Information Disclosure Authorization, Form R-7004. Payments can be by check or money order made payable to the Louisiana Department of Revenue. Cash cannot be accepted. Credit card payments can be submitted in Louisiana File Online.

Also Check: How To Include Unemployment On Taxes

Q6 My Transcript Information Doesn’t Appear To Be Correct What Should I Do

In some cases, we may have changed the reported figures on the original return you filed due to input errors or incomplete or missing information. If we changed the figures on your return during processing, a tax return transcript will show your original figures, labeled “per return,” and the corrected figures labeled “per computer.” It won’t show amendments or adjustments made to the account after the original return has posted. If you filed an amended return or we adjusted your account after it was processed, request a record of account transcript. If the transcript obtained doesn’t appear to be correct or contains unfamiliar information due to possible identity theft, call us at .