Is It Better To Claim 1 Or 0 Allowances

The higher the number of allowances, the less tax taken out of your pay each pay period. This means opting for 1 rather than 0 allowances results in less of your paycheck being sent to the IRS. Choosing what is suitable depends on your personal circumstances. To avoid under or overpaying, it would be wise to seek guidance and use the IRS calculator.

What Do I Do On My W

The overhaul of the W-4 form was brought on by the Tax Cuts and Jobs Act of 2017. The new W-4 form was brought into use in 2020 to accommodate the changes required by that act.

Those changes make what once was a straightforward effort to have taxes withdrawn from your paycheck a bit more complicated. But according to the IRS, the new form will reduce both the number and size of taxpayer surprises that occur due to improper withholding.

For those who prefer that less cash be taken out of their paychecks throughout the year, here’s some information about some entries in the new form that will ensure that will happen in 2021.

Compile A List Of Washington Payroll Taxes

As there are so many federal and state payroll taxes to calculate, its best to start with a complete list of the payroll taxes youll be working with. Heres a quick refresher of the most common Washington state payroll taxes and their rates:

- Federal Income Taxes: Ranging from 10%-30% of taxable income withheld

- FUTA Tax: 6% of the first $7,000 paid to an employee each year paid out-of-pocket

- Washington UI Tax: Up to 8.03% on the first $62,500 paid to an employee each year, paid out-of-pocket

- Social Security Tax: 6.2% withheld and 6.2% paid out-of-pocket up to the $147,000 taxable wage base

- Medicare Tax: 1.45% withholding and 1.45% paid out-of-pocket

- Additional Medicare Tax: Additional 0.09% withheld from taxable employee income over $200,000 earned

- Washington Paid Family and Medical Leave: 0.6% of taxable employee income withheld up to the $147,000 taxable wage base

- WA Cares Fund Contributions: 0.58% of taxable income withheld up to the taxable wage base

Recommended Reading: How To File Lyft Taxes Without 1099

How Can I Save Tax On My Salary Above 30 Lakhs

An Individual could claim the following Tax Deductions:

What does 7 allowances mean on W4?

Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

What tax exemption should I claim?

You should claim 0 allowances on your 2019 IRS W4 tax form if someone else claims you as a dependent on their tax return. . This ensures the maximum amount of taxes are withheld from each paycheck. Youll most likely get a refund back at tax time.

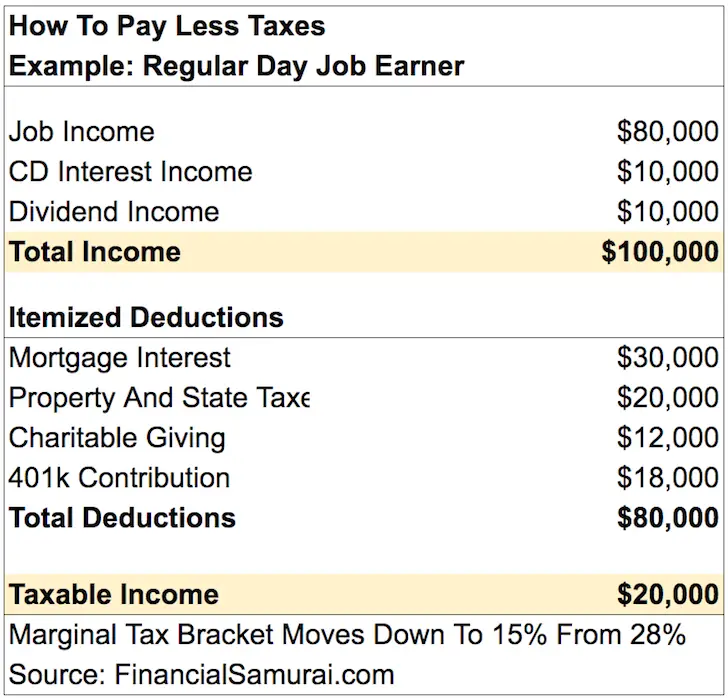

Cut Your Taxes Boost Your Savings

There’s no getting around it, you have to pay taxes. But you can reduce the amount of your paycheck that is subjected to them. Taking advantage of employer-sponsored programs that allow you to contribute pre-tax money toward routine expenses — such as health care, child care or retirement savings — can help your paycheck go further.

Take the 401, for example. These retirement accounts allow you save for your future while reducing your taxable income today.

Say you make $40,000 this year and contribute $2,000 of your salary to your 401. Instead of owing taxes on the full $40,000, you’re taxed only on $38,000. Your 401 contributions are taken off the top before the government dips in. In the 25% tax bracket, that little adjustment saves you about $500 a year in federal taxes. You get the benefit of a $2,000 contribution to your 401, but it effectively only cost you $1,500.

Some employers may match a certain portion of your 401 contributions, essentially giving you free money to invest in the plan. Take a pass, and it’s like passing up a raise. Some jobs allow new hires to join a 401 program immediately, while others may require you to wait three months to one year. See Why You’ll Love Your 401 to learn more about making the most of your 401.

Flexible-spending accounts are another great way to lower your taxable income while paying for routine expenses. The most common types are for health care, dependent care and commuting costs — things you would pay for anyway.

Recommended Reading: Where Is My Federal Income Tax Return

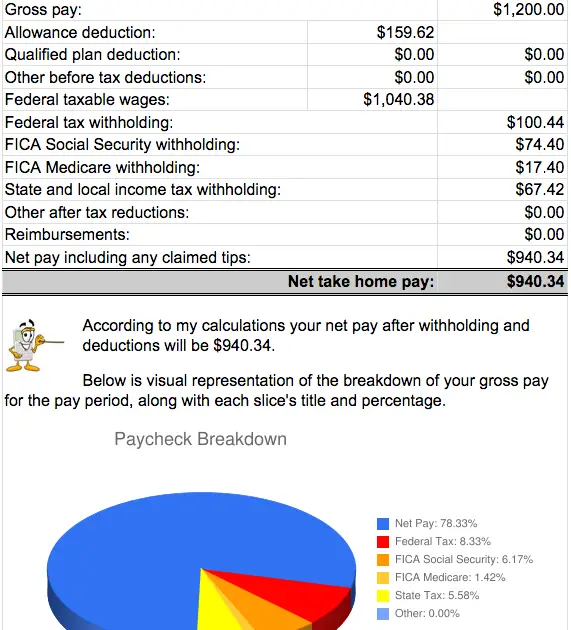

What Is The Average Amount Of Taxes Taken Out Of A Paycheck

The average tax wedge in the U.S. was about 28.4% for a single individual in 2021. The tax wedge isn’t necessarily the average percentage taken out of someone’s paycheck. Someone would have to pay just the right amount of taxes so that they wouldn’t owe or get a refund when they file their tax returnin that case, the average rate of 28.4% would apply.

Dont Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

By Stephen Fishman, J.D.

The United States has a pay as you go federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If youre an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, youll be better off if you dont have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way youll have more money in your pocket each month.

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.

You May Like: Do You Pay Taxes On Crypto Trades

What Is The Ltd Deduction On Paychecks

The long-term disability deduction covers a percentage of wages for employees who are injured or too sick to work for an extended period of time. When LTD is deducted pre-tax, employees pay slightly less for premiums, but are charged federal income tax on any benefits received. Post-tax LTD deductions, on the other hand, result in employees receiving slightly less take home pay each pay period, but their benefits arent subject to any further tax if they use them. Short-term disability is often taxed in the same manner.

This guide is intended to be used as a starting point in analyzing an employers payroll obligations and is not a comprehensive resource of requirements. It offers practical information concerning the subject matter and is provided with the understanding that ADP is not rendering legal or tax advice or other professional services.

Tax figures provided are as of the 2020 tax year

1Amount subject to withholding is governed by the federal Consumer Credit Protection Act.

Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

In Washington Some Taxes Are Exempt

Taxes can vary greatly depending on where and who is required to file. And when taxes are deducted from your paycheck, they can be even more variable.

Thats why many people wonder what taxes are deducted from their paycheck, when working in Washington because, unlike in other states, several taxes dont apply to local workers.

Read Also: What Are The 2020 Income Tax Brackets

What Happens If No Federal Income Tax Is Withheld

A withholding tax takes a set amount of money out of an employees paycheck and pays it to the government. The money taken is a credit against the employees annual income tax. If too much money is withheld, an employee will receive a tax refund if not enough is withheld, an employee will have an additional tax bill.

Account For Multiple Jobs

If you have more than one job, or you file jointly and your spouse works, follow the instructions to get more accurate withholding.

-

For the highest paying jobs W-4, fill out steps 2 to 4 of the W-4. Leave those steps blank on the W-4s for the other jobs.

-

If youre married and filing jointly, and you both earn about the same amount, you can check a box indicating as much. The trick: Both spouses must do that on their W-4s.

-

If you dont want to reveal to your employer that you have a second job, or that you get income from other non-job sources, you have a few options: On line 4, you can instruct your employer to withhold an extra amount of tax from your paycheck. Alternatively, dont factor the extra income into your W-4. Instead of having the tax come directly out of your paycheck, send estimated tax payments to the IRS yourself instead.

You May Like: How To Find Real Estate Taxes Paid

Time Your Large Purchases To Be Write

Ensure that you always time the large purchases accordingly. If you think you have a deductible upcoming expense, then look into whether youll be able to pay for it this year instead of leaving it for the next year. That way, you can get some additional mortgage interest worth deducting the next year.

Fatten Your Paycheck And Still Get A Tax Refund

OVERVIEW

If you usually get a tax refund, but would like to start putting more money in your pocket every month, we can help. Yes, you still have to fill out a W-4 form. But we’ve developed a quick and easy guide to assist you.

|

Key Takeaways To fatten your paycheck and receive a smaller refund, submit a new Form W-4 to your employer that more accurately reflects your tax situation and decreases your federal income tax withholding. To receive a bigger refund, adjust line 4 on Form W-4, called “Extra withholding,” to increase the federal tax withholding for each paycheck you receive. Tax withholding calculators help you get a big picture view of your refund situation by asking detailed questions. |

When you file your taxes and get a tax refund, most people celebrate. But have you ever taken a second to think about what a refund means? Over the course of the year, you paid more federal income tax than you owed. In other words, you gave Uncle Sam an interest-free loan.

If you’d rather have a bigger paycheck and a smaller refund, you can control this. All you have to do is submit a new Form W-4 to your employer to adjust your federal income tax withholding.

Recommended Reading: What Income Do You Have To File Taxes

How Many Allowances Should I Claim If I’m Single

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

Update Your 401 Contributions

Contributing to your company-sponsored 401 has a couple of major benefits. First, many companies have an employer match program, where the employer contributes either $0.50 or $1 for every $1 you contribute, up to a certain amount. That’s free money!

Secondly, your contributions are not taxed at the time of the contribution. This means that what you elect to put in your 401 is exactly what is deposited, without the government withholding tax up front . Therefore increasing your 401 contributions means keeping more of each paycheck, even if that money isn’t going to a savings account.

Recommended Reading: How Much Tax Do I Have To Pay On Unemployment

What Should I Claim On My W

You no longer need to claim allowances on your W-4, but there is a section for claiming dependents in Step 3. This section allows you to list all of your dependents, making sure the appropriate Child Tax Credit amount is deducted from your withholding. Fill out this section if you are the sole earner, or if you are married filing jointly and have the highest paying job. If you are single with multiple jobs, you would also only need to fill out this section for your highest paying job.

Taxes On 401 Contributions

Contributions to a traditional 401 plan come out of your paycheck before the IRS takes its cut. Youll sometimes hear this referred to as pre-tax income, and it means two things: 1) you wont pay income tax on those contributions, and 2) they can reduce your adjusted gross income.

An example of how this works: If you earn $50,000 before taxes and you contribute $2,000 of it to your 401, thats $2,000 less youll be taxed on. When you file your tax return, youd report $48,000 rather than $50,000.

A few other notable facts about 401 contributions:

-

In 2021, you can contribute up to $19,500 a year to a 401 plan. If youre 50 or older, you can contribute $26,000.

-

In 2022, the contribution limit increases to $20,500 a year. If youre 50 or older, you can contribute $27,000.

-

The annual contribution limit is per person, and it applies to all of your 401 account contributions in total.

-

You still have to pay some FICA taxes on your payroll contributions to a 401.

-

Your employer will send you a W-2 in January that shows how much it paid you during the previous calendar year, as well as how much you contributed to your 401 and how much withholding tax you paid.

See more ways to save and invest for the future

-

Our retirement calculator will show whether youre on track for the retirement you want.

-

Stocks are a good long-term investment even during periods of market volatility. Heres what to know.

Don’t Miss: How To View Tax Return Online

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

How To Calculate Payroll Deductions

Calculating payroll deductions is the process of converting gross pay to net pay. To do this:

Also Check: Can You File An Extension For Taxes

Don’t Overpay The Irs By Having Too Much Tax Withheld From Your Paycheck

The United States has a “pay as you go” federal income tax. This means you must pay your income taxes to the IRS throughout the year, instead of paying the whole amount due on April 15. If you’re an employee, this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS.

The average taxpayer gets a tax refund of about $2,800 every year. This is because they have too much tax withheld from their paychecks.

In effect, taxpayers who get refunds are giving the IRS an interest-free loan of their money. Nevertheless, many taxpayers like getting refunds. Indeed, there were widespread complaints when many taxpayers received smaller refunds for 2018 than in past years because the IRS recalculated their withholding to take into account the changes brought about by the Tax Cuts and Jobs Act.

If you like getting a refund, go ahead and overpay your withholding. Some people view this as a form of forced savings. However, you’ll be better off if you don’t have too much tax withheld. Ideally, your withholding should match the actual amount of tax you owe for the year. This way you’ll have more money in your pocket each month.

The amount of income tax your employer withholds from your regular pay depends on two things:

- the amount you earn, and

- the information you give your employer on Form W4.

Tax preparation software can also calculate your withholding.