Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

Property Tax Exemptions Available In Florida

Tue Mar 31 2020

We wrote recently about how the Florida homestead exemption can help homeowners save money on their taxes by reducing the taxable portion of their homesâ value. There are other ways to save on your taxes as well.

Here, weâll highlight eight types of property tax exemptions and deductions available in Florida.

Please note that this post is meant to be purely informational and is not intended as advice. If youâre interested in personalized advice about your situation, be sure to consult with a tax advisor.

Prorating Business Income And Expenses

If some of your revenue-generating activities take place on a reserve and the rest off a reserve, the tax exemption under section 87 of the Indian Act may be prorated. Part of your income will therefore be taxable, and part will be exempt from tax. In such a case, your business expenses will generally be allocated to the taxable part of your income in the same ratio, unless another allocation can be shown to be more reasonable.

Don’t Miss: Otter Tail County Tax Forfeited Land

% Disabled Veterans Homestead Exemption

You can qualify for this exemption on your homestead if you have a disability rating of 100% or individual unemployability from the Veterans’ Administration and you receive 100% disability payments from the VA. Your disability must be service connected. If you qualify, 100% of the value of your residence homestead will be exempted.

Interest And Investment Income

Throughout the following text, for purposes of the tax exemption under section 87 of the Indian Act, the CRA uses the term Indian because it has a legal meaning in the Indian Act.

If your investment income is situated on a reserve, it is exempt from tax under section 87 of the Indian Act. The courts have established that determining whether income is situated on a reserve, and thus exempt from tax, requires identifying the various factors connecting the income to a reserve and weighing the significance of each factor. This is referred to as the connecting factors test.

On July 22, 2011, the Supreme Court of Canada released its decisions in the cases of Estate of Rolland Bastien v. Her Majesty the Queen and Alexandre Dubé v. Her Majesty the Queen . In both cases, the SCC found that the interest income was situated on a reserve and exempt from tax.

The CRA will apply these decisions in similar situations to exempt an Indian’s interest income from tax for the 2011 and following tax years.

A similar situation means that all of the following conditions are met:

Read Also: Www.1040paytax

Property Tax Exemption Program For Senior Citizens And People With Disabilities

Available to:Taxpayers who meet one of the following requirements as of December 31 of the year before the taxes are due:

- At least 61 years of age or older.

- Retired from regular gainful employment due to a disability.

- Veteran of the armed forces of the United States receiving compensation from the United States Department of Veterans Affairs at one of the following:

- Combined service-connected evaluation rating of 80% or higher.

- Total disability rating for a service-connected disability without regard to evaluation percent.

Program benefits:The qualifying applicant receives a reduction in the amount of property taxes due. The amount of the reduction is based on the applicant’s income, the value of the residence, and the local levy rates.

Qualifying activity:Own and occupy a primary residence in the State of Washington and have combined disposable income of Income Threshold 3 or less. Beginning in 2020, Income Threshold 3 is based on the county median household income of the county where the residence is located. See income thresholds.

Reporting/documentation requirements:

Which Properties Are Eligible For A Property Tax Exemption

To be eligible for exemption, a property needs to meet two criteria:

Some of the most common tax-exempt property types are:

- Churches or places of worship.

- Institutions of public charity.

- All properties used exclusively for public purposes, including public hospitals, schools, burial grounds, etc.

- Certain kinds of personal property, including in most cases property that creates energy, enables commerce, or conserves nature.

- Qualifying wetlands or native prairie lands.

- There are many other exempt property types also, besides those listed above. See Minnesota Statute § 272.02 for the longer list of exemptions.

Recommended Reading: How Does H And R Block Charge

Veteran Property Tax Exemption

Members of the Armed Forces and veterans are often able to exempt themselves from various taxes, including property tax. The details vary widely by what state youre in, but its any potential veterans exemption is definitely worth checking on. Depending on your situation, you may be able to exempt a certain amount of property value or even get a complete waiver from property taxes. There may also be tax benefits available for qualifying unremarried surviving spouses. In either case, that could potentially save you thousands.

Investment Income Example 1

Charles does not live on a reserve. He invested in a fixed-rate term deposit for a 1-year term with a credit union located on a reserve. At the end of the term, the credit union deposited the interest into Charles account with the credit union, located on a reserve.

The interest income earned by Charles meets all of the conditions to be exempt from tax. It was earned from a term deposit entered into with a financial institution located on a reserve, the interest income was paid into a location on a reserve, the interest rate was fixed, and the interest could be calculated at the time the investment was obtained.

Don’t Miss: Notice Of Tax Return Change Revised Balance

Registered Retirement Savings Plan Income

If you earn exempt income only and you have contributed to an RRSP, you cannot deduct your contributions on your tax return. By the same token, any withdrawals of your original RRSP contributions will not be taxable. However, since your exempt income did not create any RRSP contribution room, you will have to pay a penalty under Part X.1 of the Income Tax Act for your non-deductible contributions to your RRSP. Any investment earnings you withdraw from the RRSP will be taxed in the same way as interest and investment income.

If you earn taxable income and contribute to an RRSP, the normal rules on claiming RRSP deductions apply to you .

Goods And Services Tax/harmonized Sales Tax

The GST applies to most supplies of property and services made in Canada. The HST applies to most supplies of property and services in the provinces of Nova Scotia, New Brunswick, Newfoundland and Labrador, Prince Edward Island, and Ontario.

Purchases of property and services by Indians may be relieved from GST/HST. For more information, see GST/HST and Indigenous peoples.

Oher taxes specific to First Nations and Indigenous governments may also apply. All individuals, including Indians, have to pay these taxes if they apply. The following taxes may apply on lands governed by a First Nation or an Indigenous government:

Don’t Miss: How To Appeal Property Taxes Cook County

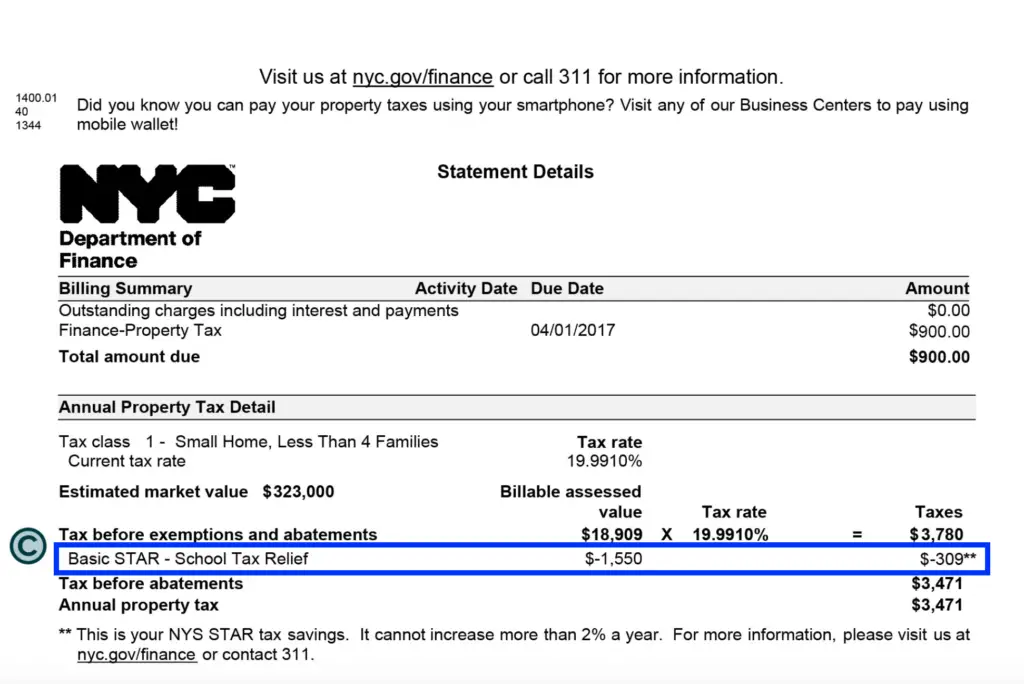

Property Tax Exemptions For Homeowners

A homestead exemption helps you save on taxes on your home. An exemption removes part of the value of your property from taxation and lowers your taxes. For example, if your home is valued at $100,000 and you qualify for a $20,000 exemption, you pay taxes on your home as if it was worth only $80,000.

An Application for Residential Homestead Exemption can be found at the Forms Page under the Residential Exemption Section .

Connecting Factors For Business Income

If your business income is situated on a reserve, it is exempt from tax under section 87 of the Indian Act. The courts have established that determining whether income is situated on a reserve, and thus exempt from tax, requires identifying the various factors connecting the income to a reserve and weighing the significance of each factor. This is referred to as the connecting factors test.

Your business income is generally exempt from tax when the actual income-earning activities of the business take place on a reserve. If your business activities are mostly carried on off a reserve, your business income would generally be considered taxable because the exemption under section 87 does not apply.

When applying the connecting factors test to business income, the courts have indicated that the most significant connecting factors are:

- where the income earning activities of the business take place

- the type of business and the nature of the business activities

- where the management and decision making activities of the business take place

- where the customers are located

Other connecting factors that the courts have found to be less significant are:

- whether or not you live on a reserve

- whether you maintain an office on a reserve or take business orders from a location on a reserve

- whether your books and records are kept on a reserve

- whether your administrative, clerical, or accounting activities take place on a reserve

Note

Also Check: How Much Does H& r Block Charge For Doing Taxes

Persons With Disabilities Exemption

Provides property tax savings with an annual reduction in the equalized assessed value of a property. Homeowners eligible for this exemption this year must be disabled or become disabled during the 2020 tax year. This exemption usually requires annual renewal, however it will be auto-renewed this year due to the COVID-19 pandemic.Automatic Renewal: Yes, for tax year 2020 only, this exemption will automatically renew.More Information

Have You Inherited Your Home

Homeowners who have inherited their home may qualify for a money-saving homestead exemption. A new Texas law enacted in 2019 makes it easier for heir property owners to qualify for a homestead exemption by creating more accessible application requirements. Property owners who are receiving a partial homestead exemption on heirship property can now apply for a 100 percent homestead exemption even when the home has co-owners.

Please click here to see the entire brochure.

For any questions or additional assistance, you are encouraged to call an HCAD representative at the numbers and location listed on the contact page.

Also Check: Tax Lien Investing California

Subscription Issues Donotpay Can Help

If you are looking to test out a service, think twice before disclosing your payment info. Companies will often ask you for your credit card details even whensigning up for a free trialthey charge you once the trial expires.

Use ourvirtual credit card, and don’t worry about unwanted charges!

Our credit card gets automatically approved for any free trial, but it rejects any real charges since there is no money on it.

DoNotPay will locate andcancel all your unwanted subscriptions without you having to deal withcustomer service reps.

We can also help yourequest refunds from companies or take them tosmall claims court if they refuse to cooperate.

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

Don’t Miss: Buying Tax Liens In California

Al Property Tax Exemption: Do You Qualify

The housing market has gone through the roof over the past year. Home sales in hot markets often sell within the first day for prices well above the asking price. Guess what is next? Higher property taxes! Many people over the age of sixty-five donât realize or forget that they are likely eligible for an exemption from payment of the State of Alabamaâs portion of their property tax. Take a minute and read over the Homestead Exemptions page of the Alabama Department of Revenueâs site to see if you are eligible.

Here are the requirements that you must meet:

- You must be age 65 or older.

- You must own and occupy the single-family residence on which you intend to claim the exemption.

- You must apply for the exemption in advanceâ¦by December 31 for the next calendar year.

Get started by contacting your local county office or courthouse. They can tell you about the process for your county.

If you are disabled or blind, you may also qualify for the exemption assuming your disability qualifies as permanent and total. Two forms of proof of disability are required. Examples include a letter from your physician, employer and/or the Social Security Administration. Qualifying for the stateâs property tax exemption can save you hundreds of dollars. To learn more answers about your property tax situation, click the FAQs link here.

For weekly insights, follow The Welch Group every Tuesday morning on WBRC Fox 6 for the Money Tuesday segment.

IMPORTANT DISCLOSURE INFORMATION

How To Qualify For A Tax Exemption

Of course, there are qualifying rules for all these tax breaks, and the first of these is your age. As noted, these exemptions are generally reserved for those who are age 65 or older. Only one spouse must typically be 65 or over if youre married and you own your property jointly.

New York will allow you to continue claiming your exemption if your spouse was over 65 but is now deceased. Texas will do this as well, but only if the surviving spouse is age 55 or older.

Age 65 is by no means a universal rule, however. Its just 61 in Washington State, andNew Hampshire will increase your exemption over the years as you age, sort of like giving you a birthday present each year, although you do have to be at least age 65.

Many locations require that youve owned your home for a prescribed period of time. Its 12 months in New York, but if you qualified at your previous residence, you can carry that period of ownership over to your new home. Cook County, Illinois has a similar rule.

And you must live in the property. It must typically be your residence. New York offers a slim exception to this rule if you must move into a nursing home, provided that you still own your home and your co-owner or spouse still lives there. But exemptions rarely apply to investment, commercial, or rental properties.

Recommended Reading: How To Buy Tax Lien Properties In California

How Do Tax Exemptions Work In Your Favor

Small Business Taxes, The Complete Idiots Guide to Starting a Home-Based BusinessGuide to Self-Employment, The Wall Street JournalU.S. News and World Report

There is no downside to a tax exemption: The term has a specific meaning in tax law: Federal, state, and local governments create them to provide a benefit to specific people, businesses, or other entities in special situations.

Bottom line: Those who are entitled to them save on taxes.

A tax exemption, as most taxpayers experience it, is the right to subtract some portion of income or some amount of money from top-line income. That income is ignored, so the taxes owed are reduced.

Veterans With Disabilities Exemption

Provides veterans with a service-connected disability as certified by the U.S Department of Veteran Affairs with a reduction in the equalized assessed value of their property. This exemption usually requires annual renewal but will be auto-renewed this year due to the COVID-19 pandemic.Automatic Renewal: Yes, for tax year 2020 only, this exemption automatically renews.More Information

You May Like: How To Buy Tax Liens In California

Why Do You Need An Ag/timber Registration Number

You qualify for tax exemption on the purchase of some items that are used to produce your agricultural and timber goods for sale if you are a rancher, farmer, or timber producer dealing with the following:

- Beekeeping

- Fiber crops production for sale

- Operating commercial fish farms

- Future Farmers of America or 4-H

- Teaching agricultural vocational courses

- Veterinary businesses making ranch and farm calls

- Growing plants for sale within commercial nurseries

- Farming or ranching to raise and grow agricultural products for sale

You need to have a valid agricultural and timber registration numberthe Ag/Timber Numberif you want to claim a tax exemption.

Property Tax Exemptions For Real Estate Costs

In Florida, state and local real estate taxes are typically deductible from your federal tax returns, including taxes you paid at closing if you bought your home during the tax year in question. Other closing costs may also be deductible, including settlement fees and prepaid mortgage interest.

Note that the total amount you can deduct for state and local real estate costs is $10,000 for married couples filing jointly and $5,000 for those filing singly or separately.

Also Check: How Much Does H& r Block Charge To Do Taxes