Applying For A Taxpayer Identification Number For A Natural Person

The taxpayer identification number is a form of personal identification that is essential for purchasing goods or services, entering into contracts, opening bank accounts, etc.

Portuguese nationals with a valid Citizens Card already have a TIN allocated to them.

If you are not in the aforementioned category, find out how to apply for a TIN.

What Is A Tax Identification Number

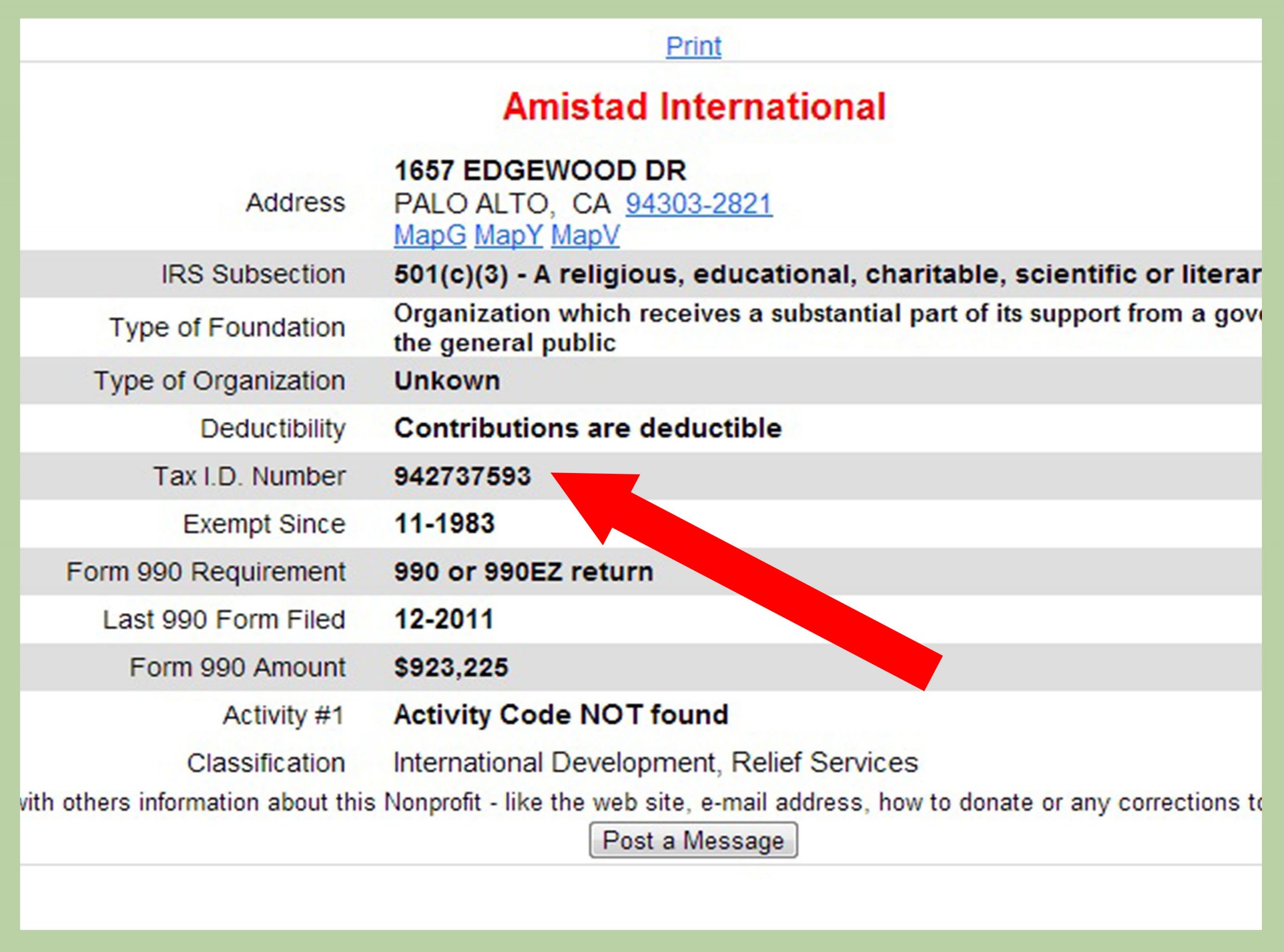

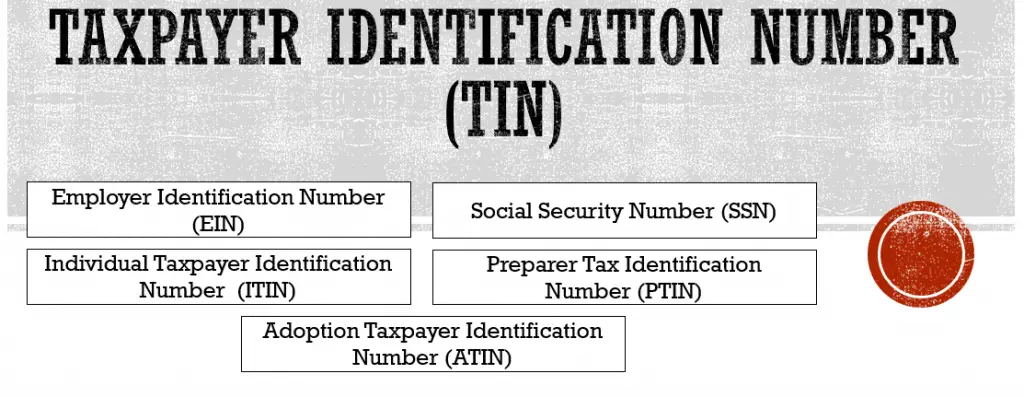

A tax identification number is a unique identifier for a person or a business. Some examples are the Social Security number for an individual , Individual Tax Identification Numbers , and Employer Identification Numbers . People, businesses, nonprofit organizations, and other entities need a number to file taxes and other documents. To keep things consistent, all these numbers have nine digits. A TIN comes from the federal government through either the Internal Revenue Service or the Social Security Administration .

The IRS mandates that businesses get an EIN, also called a business tax ID number. It allows the IRS to classify businesses according to the kind of goods and/or services they provide. It also gives the entity a unique piece of identifying information to use on official records.

When you’re starting a new business, there are four ways to get assigned an EIN by the IRS. Two of them give you your number on the spot, so you are ready to start using it right away. Of the other two, one is only available from outside the United States, and the other takes about four weeks.

If you lose your EIN, you can call the Business & Specialty division of the IRS at 800-829-4933. You will need to give identifying information for security reasons so that your personal information stays safe.

Child And Dependent Care Credit

The Child and Dependent Care Credit is a federal tax benefit that can help you pay expenses for child or adult care that is needed to work or to look for work. The 2021 American Rescue Plan temporarily expands the credit for tax year 2021 , making it fully refundable. This means the credit can provide money back even if you dont owe taxes. It is worth up to $4,000 for one dependent or up to $8,000 for two or more dependents. Learn more here.

You May Like: When Are Taxes Due This Year

How Much Will It Cost Me To Apply For My Tin

Applying for TIN is totally free IF YOU DO IT ON YOUR OWN and if you have not incurred any tax penalty based on the time-frame given according to the LAW to obtain your TIN, either as an individual or as a company. There are no fees to be paid unless you intend to employ third parties to assist you in registering and obtaining the TIN.

S To Get A Tax Id Number

1. Decide if you really need an Employer Identification Number.

- Any business that withholds taxes on employees’ payroll needs an EIN to ensure that payments to the IRS are properly credited.

- New businesses need an EIN to pay taxes or open business accounts or lines of credit with vendors.

- Corporations and business partnerships must get an EIN per IRS regulations.

- Estates, trusts, and nonprofit organizations also need an EIN.

- Sole proprietorships don’t have to get an EIN, but they can if they prefer to do business that way instead of using the owner’s Social Security number. That helps keep personal and business matters separate.

2. Once you know you need an EIN, you can apply for one with the Internal Revenue Service in one of four ways: online, by fax, in the mail, or by phone . The application form is Form SS-4 if you’re looking for it on the IRS website.

3. The next step is choosing the right kind of EIN for the type of business you operate. Some possibilities are sole proprietorship, corporation, LLC, partnership, nonprofit, or estate.

4. You also need to state why you are applying at this time. This could be a new business, or maybe you’ve been operating under your personal Social Security Number and want to set up an EIN to move away from that. Your request might also be related to hiring new employees or setting up a pension plan. Finally, you need to fill in what field you’re in and what products or services you offer and give your name and SSN to complete the form.

Don’t Miss: What Is The Tax In North Carolina

American Opportunity Tax Credit

This credit is worth up to $2,500 and can help reduce educational expenses to attend college. The credit is only available for the first four years of a students post-secondary education. Eligible students must be pursuing a degree or another recognized credential.

This non-refundable credit is worth up to $2,000 per household. It can be used to help reduce any post-secondary educational expenses and isnt limited to people attending college.

Note: You CANNOT claim the Earned Income Tax Credit with an ITIN.

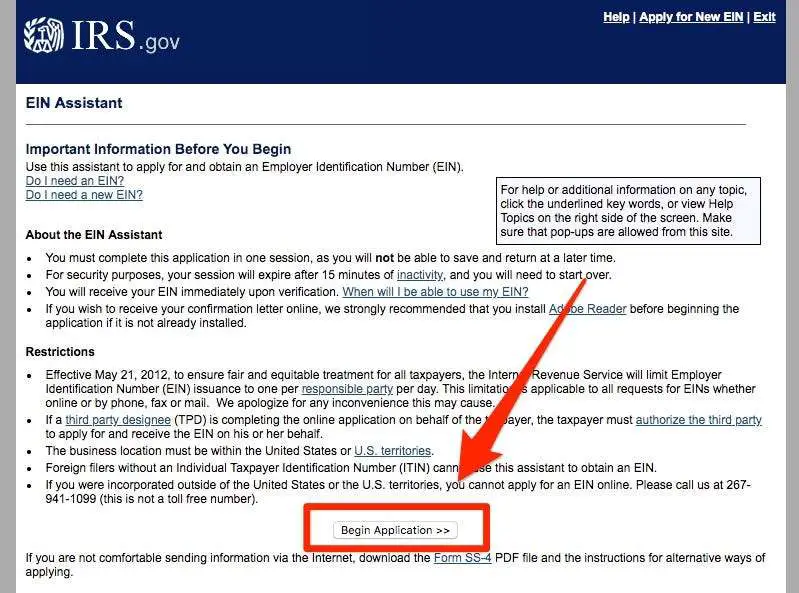

How To Apply For An Ein

You can apply for an EIN from the IRS in a few different ways. The fastest and preferred way to apply is online. However, heres a look at all four of your options:

- Online. The IRS provides a user-friendly online application platformthe EIN Assistantthat you can use to request a number for your business. If you opt to use the online tool, you will need to complete your application in a single session. Theres no option to save your work and return later to pick up where you left off. If you leave your session inactive for 15 minutes, a security measure kicks in and youll have to start your application over from the beginning.

- Fax. You may also apply via fax. You can download and complete Form SS-4 from the IRS website. If your principal business address is located in the U.S., you can fax your completed form to 855-641-9535. You can look up other fax number options on the IRS website.

- Telephone. If youre applying for an EIN from an international location, you have the option to complete your application over the phone. Applicants can call 267-941-1099 Monday to Friday from 6:00 am to 11:00 pm EST.

- Mail. The IRS also allows you to apply for an EIN via mail. You can send in a completed Form SS-4 to the following address as long as your business is located in the U.S.:

Internal Revenue ServiceCincinnati, OH 45999

You can look up alternative mailing addresses for your EIN application on the IRS website.

You May Like: Do You Pay Taxes On Workers Comp

When Should My Business Consider An Ein

Some businesses may be able to operate without an EIN. However, according to the IRS, you may need to apply for one if your business plans to:

- Pay employees

- Operate as a corporation or partnership

- File employment, excise, tobacco, firearms or alcohol tax returns

If youre unsure whether your business needs an EIN, you can talk to a certified accountant or tax professional for guidance regarding your individual situation.

How Do I Apply For An Itin

If you want to file a tax return but cannot obtain a valid SSN, you must complete IRS Form W-7, Application for IRS Individual Taxpayer Identification Number. Form W-7 must be submitted to the IRS with a completed tax return and documents verifying identity and foreign status. You will need original documents or certified copies from the issuing agencies. The instructions for Form W-7 describe which documents are acceptable.

Parents or guardians may complete and sign a Form W-7 for a dependent under age 18 if the dependent is unable to do so, and must check the parent or guardians box in the signature area of the application. Dependents age 18 and older and spouses must complete and sign their own Forms W-7.

You can use this checklist to help prepare your application.

There are three ways you can complete the ITIN application:

Read Also: How To Save For Taxes

How To Apply For A Tin In Singapore

As an individual:

- You should apply for your TRN by registering an IRAS Unique Account, or signing up at the SingPass website.

- To complete the application, the system will require you to submit your National Registration Identity Card Number , or a Foreign Identification Number .

- Once you submit your application, the IRAS will review everything and then send you a Tax Reference Number within 5 working days.

The application process for entities, however, is a little bit different. Instead of applying through the IRAS, they are required to obtain their UEN from government agencies like:

- Accounting and Corporate Regulatory Authority: ACRA issues UENs to local businesses and foreign companies.

- Ministry of Manpower: MOM issues UENs to trade unions.

- The Registry of Societies: ROS issues UENs to registered societies.

- Ministry of Culture, Community, and Youth: MCCY issues UENs to non-profit organizations and charities.

Apply For Your Tax Id Number Online

Do you need your Tax ID Number fast? Applying for your Tax ID Number online is the best option. When you apply online through a third-party tax ID service, you can get your Tax ID Number in an hour. The tax ID service will collect and verify your information and give you a Tax ID Number that can then be used immediately on official forms and documents.

Recommended Reading: How Much Time To File Taxes

Tax Identification Number Definition Types And How To Get One

Consumer Reports

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Investopedia / Ellen Lindner

How Do I Find My Tin

Because Taxpayer ID Number is an umbrella term, individuals, businesses and organizations don’t apply directly for it. They need to apply for the appropriate identification number included under the TIN umbrella — such as an SSN, EIN or ITIN.

Those doing business with a company can find its Tax ID Number on financial forms or by contacting the company or its representatives. The IRS has rules for releasing EINs. Since May 2019, “only individuals with taxpayer identification numbers — either a Social Security number or an individual taxpayer identification number — may request an employer identification number,” according to the IRS. “This new requirement ⦠will provide greater security to the EIN process.”

Continue Reading About TIN

Don’t Miss: How Does Business Tax Work

Finding An Individual Tax Id

Though there are pros and cons to doing it, if you have a Social Security number, you can use that as your tax ID, even in business. If you work for someone else as an employee, you get a W-2 no later than Jan. 31 of each year, and the SSN is there at the top. If you need a copy of a form from a previous year, you can get it from the employer who issued it. Employers must keep these for at least four years after you leave the company. Your tax return, like the 1040, the 1040A, or the 1040EZ lists your SSN at the top of the first page.

If you don’t have a Social Security number, but you have filed taxes in the past, you may have used an Individual Tax Identification Number on the forms in the space where the SSN usually goes. That number is valid if used in 2013 or later unless the IRS has notified you that you need to renew. If you do need to renew, use form W-7 to ask for a new ITIN. That process takes about seven weeks. If you have a valid ITIN, but you cannot find it, call 1-800-908-9982 from within the United States for help.

If you lose your Social Security card, you can apply for a new one online if you have a driver’s license or another form of state identification. You can also fill out a paper form and turn it in to the local Social Security Administration office you’ll need to take your birth certificate and a photo ID.

Adoption Tax Identification Number

In the case of domestic adoption of children, if the adoptive parents are unable to obtain the childs Social Security Number for tax purposes, they can apply for an Adoption Tax Identification Number . Certain conditions must be met, such as the adoption has to be pending and the child should be a U.S. citizen or permanent resident.

Also Check: How To Track My Tax Refund Turbotax

How To Get A Steuernummer

You get a Steuernummer when you register your business with the Finanzamt. You get the tax number by mail, 2 to 6 weeks later1. If it takes longer, ask your local Finanzamt on the phone or in person.

The Steuernummer is unique, but not permanent. If your business moves to a different Finanzamt‘s area, it will get a new Steuernummer1.

When you get your Steuernummer, you must put it in your Impressum. It’s the law.

Where To Find Your Tax Id

If you already have a tax ID, you can find it here:

- Your employer and your tax advisor know your tax ID. Ask them.

If you lost your tax ID, there are 2 ways to find it:

- Go to the nearest Finanzamt, and ask for it. They will tell you your tax ID1, 2. You don’t need an appointment.

- Fill this form, and the Finanzamt will send you a letter with your tax ID. It takes up to 4 weeks1. They will send it to the address you registered, not anywhere else.

Don’t Miss: When Are Tax Payments Due

Requirements For A Belgian National Register Number

The documents required for an NN application will depend on what you are applying for. Exact requirements for a Belgian National Register Number will usually depend on the local municipality you are making your application through. If you are applying for a Belgian residency permit or Belgian work permit, you will typically need to provide valid ID, a work permit or proof of reason for staying in Belgium, proof that you can support yourself during your stay, proof of accommodation, a medical certificate and a certificate to show that you do not have a criminal record. If you are setting up a business in Belgium, you will need to follow certain steps such as making sure you have obtained the necessary business permit if required, registering your business and opening up a business bank account.

How To Get Your Tax Id

You get a tax ID when you register your address for the first time. 2 to 4 weeks after you register your address, you get a letter from the Bundeszentralamt für Steuern. Your tax ID is in the top right corner.

If you registered your address before, you already have a tax ID. You just need to find it.

If you can’t register your address, fill this form and mail it to your local Finanzamt with a copy of your passport. You will get your tax ID by post 2 to 4 weeks later.

If you want your tax ID faster, go to the Finanzamt after your Anmeldung, and ask for it1, 2. You can do this 3 business days after your Anmeldung. You don’t need an appointment. Bring your personal ID.

Also Check: Are Donations To Churches Tax Deductible

How Can I Find My Tin Online

The agency that issues your TIN provides you with an official document with your unique identifier. Because it is a sensitive piece of information, you can’t go online to retrieve it. If you can’t remember or lose your documents, you should contact the issuing agency, such as the SSA, to get your TIN again.

What Is Excluded From The Estate

Generally, the Gross Estate does not include property owned solely by the decedents spouse or other individuals. Lifetime gifts that are complete are not included in the Gross Estate . Life estates given to the decedent by others in which the decedent has no further control or power at the date of death are not included.

Also Check: How Fast Can You Get Your Tax Refund

The Tax Identification Number

Germany is following the example of many of its neighbors in the European Union and modernizing its tax system. By introducing the tax identification number , the Federal Ministry of Finance and the federal government want to simplify the taxation procedure and have already reduced bureaucracy.

The IdNo will replace the tax number for income tax in the long term. It will be permanently valid and will not change, for example, after a move, a change of name due to marriage or a change in marital status. The IdNo is an 11-digit number that contains no information about you or the tax office responsible for your tax matters.