How To Calculate Social Security Tax

Its fairly easy to calculate your Social Security tax. You multiply your earningsup to $147,000by your Social Security tax rate, depending on whether youre an employee or are self-employed.

For example, lets say Michael works for a company and earns a salary of $150,000 in 2022. The Social Security tax applies to the first $147,000 of his wages, so his tax liability is $9,114: his $147,000 income multiplied by 6.2% .

If hes working for himself and earns the same $150,000, hell owe the full Social Security tax on his first $147,000 of income. So his liability would be $18,228: $147,000 multiplied by 12.4% . However, his tax bill may be lowered if he qualifies for the self-employment tax deduction.

Donât Miss: Hours For Social Security Office

Why Did I Get Two Social Security Checks This Month

MILLIONS of Supplemental Security Income claimants will see two checks this month as the holidays approach. This will apply to the 8million people that are projected to receive SSI in 2022, according to the Social Security Administration. … Further, the more you earn the less your SSI benefit will be.

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

Dont Miss: Free Tax Filing H& r Block

Also Check: How Can I Find My Previous Tax Returns

Social Security Division In A Divorce

Most working people in our country know that as part of the taxes taken out of your pay, part goes towards social security taxes. Fewer people realize that the amount of money we stand to receive upon retirement can be more significant if their spouses work record were to be taken into consideration instead of their own.

You can have both your work record and your spouses compared to one another by the Social Security Administration, and whichever results in a higher payout to you, then that is the one that will be applied.

What happens, then, if you get a divorce from your spouse? Are you still able to take advantage of your ex-spouses social security benefits and receive them instead of your own? Todays blog post from the Law Office of Bryan Fagan, PLLC, will go over that subject and include some other pertinent information on Social Security and divorce in general.

Withholding Taxes From Social Security

Older taxpayers can avoid a big bill at tax time or a penalty for underpaying taxes by having the government withhold taxes from their Social Security benefits.

Question: I’m about to sign up for Social Security. Do I need to also sign up to have taxes withheld from my benefits?

Answer: You aren’t required to have taxes withheld from your Social Security benefits, but voluntary withholding can be one way to cover any taxes that may be due on your Social Security benefits and any other income. A portion of your Social Security benefits will be taxable if your incomesuch as from freelance work, a taxable pension and IRA withdrawals, or nontaxable interestplus half of your Social Security benefits add up to more than $25,000 if single or $32,000 if married filing jointly .

There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax time. You can file Form W-4V with the Social Security Administration requesting to have 7%, 10%, 12% or 22% of your monthly benefit withheld for taxes. Or you can have taxes withheld from other income, such as an IRA withdrawal or a pension, or send quarterly estimated tax payments to the IRS with Form 1040-ES for more information).

Also Check: How Long Does Doing Your Taxes Take

You Probably Have To Pay Fica But That’s Ok

So, no one likes to pay tax, but there’s reason to be somewhat tolerant of Social Security tax. For one thing, employees don’t typically pay the whole thing. If you work for someone else, the employer pays 6.2%, too. Granted, the whole bill comes to you if you’re self-employed.

But the tax provides you with benefits that would likely cost you insurance premiums to replicate. Yes, Social Security is best known for its Old-Age, Survivors, and Disability Insurance . That’s the payment you get when you retire, and accounts for nearly three-quarters of benefits paid out by Social Security.

But you also get disability coverages that are worthwhile. You might feel superhuman now. But the Social Security Administration estimates a quarter of today’s 20-year olds will become disabled before the current full retirement age of 67. Additionally, 68% of private sector workers don’t have long-term disability insurance.

For these reasons, most financial advisors will tell you to pay into Social Security if you can even if you are exempt .

Social Security Tax Rates

The Social Security program provides benefits to retirees and those who are otherwise unable to work due to disease or disability. Social Security often provides the only source of consistent income for people who can no longer workespecially for those with modest earnings histories.

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability.

Social Security benefits are capped at a maximum monthly benefit amount based on earnings history. To prevent workers from paying more in taxes than they can later receive in benefits, there is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap.

For 2022, the maximum amount of income subject to the OASDI tax is $147,000, capping the maximum annual employee contribution at $9,114. For 2023, the maximum amount of income subject to the tax is $160,200, capping the maximum annual employee contribution at $9,932.40. The amount is set by Congress and can change from year to year.

Also Check: What Is Georgia State Tax

Retirement Information Ira Topics Pension Exclusions Social Security Benefits

Q. Im planning to move to Delaware within the next year. I am retired. I am receiving a pension and also withdrawing income from a 401K. My spouse receives social security. What personal income taxes will I be required to pay as a resident of Delaware? I also would like information on real estate property taxes.

A. As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. However, persons 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income . Eligible retirement income includes dividends, interest, capital gains, net rental income from real property and qualified retirement plans , such as IRA, 401 , and Keough plans, and government deferred compensation plans . The combined total of pension and eligible retirement income may not exceed $12,500 per person age 60 or over. If you are under age 60 and receiving a pension, the exclusion amount is limited to $2,000.

Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income.

Also, Delaware has a graduated tax rate ranging from 2.2% to 5.55% for income under $60,000, and 6.60% for income of $60,000 or over.

For information regarding property taxes you may contact the Property Tax office for the county you plan to live in.

Taxing Social Security Benefits Is Sound Policy

Social Security beneficiaries with higher incomes pay income tax on part of their benefits. Those with incomes below $25,000 pay no tax on benefits, while those with the highest incomes pay tax on as much as 85 percent of their benefits. This arrangement is sound for several reasons:

- The substantial proceeds from taxing Social Security benefits are credited to the Social Security and Medicare trust funds, strengthening the programs financing.

- The taxation of benefits is broadly progressive, since people with low incomes pay nothing and the tax rate on benefits increases with income.

- As an earned benefit, Social Security should be subject to tax, like other earned benefits, such as employer pensions.

- Social Securitys tax treatment is more favorable than that of private defined-benefit pensions, primarily because of the protections for low-income beneficiaries.

Recommended Reading: What Documents Do I Need For Taxes

Are Taxes Taken Out Of Disability Benefits

Home » Frequently Asked Questions » Are Taxes Taken Out of Disability Benefits?

Taxes are not taken out of disability benefits whether its for Social Security Disability Insurance and Supplemental Security Income . The Social Security Administration will never automatically withhold taxes. In fact, in many cases, you do not have to pay federal income taxes on these benefits at all. Pennsylvania also does not tax SSDI or SSI benefits.

However, if you receive SSDI benefits and also have substantial additional income from investments and rental property, you may need to pay taxes. There are limits on how much you can make without filing taxes. Additional income can push you over this limit.

Determining If Youll Owe Social Security Benefit Taxes

The Social Security Administration sets the following thresholds when calculating Social Security benefit taxes based on your combined income and tax filing status:

|

Taxation Level |

|

|---|---|

|

Any amount |

More than $34,000 |

Source: Social Security Administration. Married Filing Separately column assumes you lived with your spouse at any point during the year. If this is not true, refer to the All Other Tax Filing Statuses column.

If you fall into the 0% taxation range for your tax filing status, you wont have to worry about paying any taxes on your benefits at all. If you land above this range, you will owe taxes on your benefits and you can figure out how much using the formula below.

Things are a little trickier for married couples filing separately than for other tax filing statuses. If you lived together at any point during the year, you will owe taxes on up to 85% of your benefits, regardless of your combined income. But if you didnt live together at all, youre subject to the same taxation rules as individuals, heads of household, and qualifying widows.

Donât Miss: Social Security Office Bear Me

You May Like: Can I Submit Old Tax Returns Online

No Matter How You File Block Has Your Back

The Tax Is Also Subject To An Income Cap

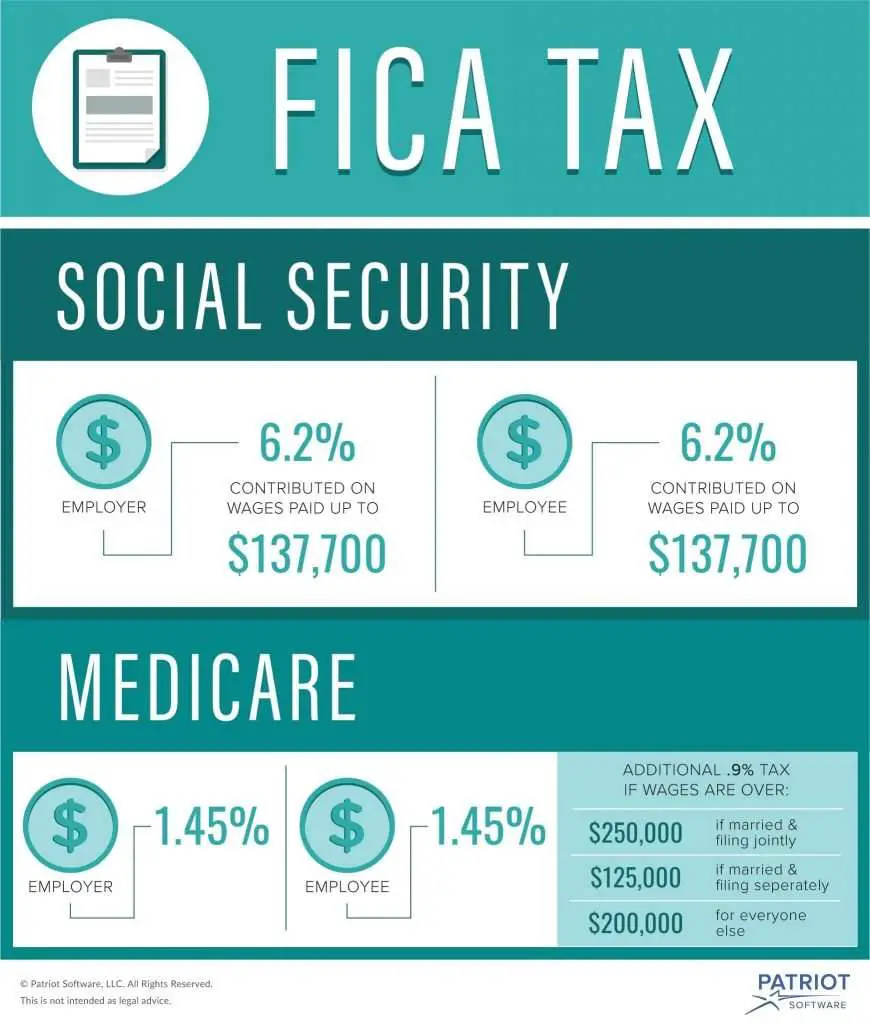

The Old-Age, Survivors, and Disability Insurance program taxmore commonly called the Social Security taxis calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers.

The Social Security tax rate for employees and employers is 6.2% of employee compensation, for a total of 12.4%. Those who are self-employed are liable for the full 12.4%.

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act . On your pay statement, Social Security taxes are referred to as OASDI, and Medicare is shown as Fed Med/EE. Both Social Security and Medicare are federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

Don’t Miss: How Does Mileage Work For Taxes

Taxes Don’t Need To Eat Away At Your Monthly Checks

Social Security benefits can go a long way toward helping you enjoy a more financially secure retirement. However, you may not collect as much as you think.

Your monthly checks are subject to both state and federal taxes, and these taxes can take a significant bite out of your benefits. If you’re going to be depending on Social Security to pay the bills in retirement, taxes could wreak havoc on your financial plans.

Fortunately, there are ways to avoid taxes on your benefits. With the right strategy, you may be able to get out of paying them altogether. Here’s how.

Image source: Getty Images.

Nonresident Alien Students Only

F-1 and J-1 students are considered nonresident alien for tax purposes during the first 5 calendar years they are present in the U.S. NRA students are not subject to Social Security/Medicare tax withholding while working on campus or while working for off-campus employers under Optional Practical Training or Curricular Practical Training .

Section 3121 of the U.S. Internal Revenue Code specifies criteria by which an international student may be exempt from Social Security/Medicare taxes:

Occasionally off-campus employers of international students on OPT/CPT are unfamiliar with this IRC section and withhold Social Security/Medicare tax in error. International students should follow this guide and work with their off-campus employer to have their portion of Social Security/Medicare tax refunded.

You May Like: Do You Pay Taxes On Cash Out Refinance

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

Virginia Taxes And Your Retirement

Youve worked hard, and now youre ready to move on to the next chapter of your life. As you enter retirement, dont let confusion about your taxes keep you from enjoying everything Virginia has to offer.

With a few exceptions, if a source of income is taxable at the federal level, its taxable to Virginia as well. This includes most sources of retirement income, including:

- 401, 403, and similar investments

- Tier 2 Railroad Retirement

- Traditional IRAs

Individual Retirement Accounts

With a traditional IRA, you usually can deduct the amount you contributed to the account from your federal taxes. Therefore, your distributions are usually taxable.

A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account when you earn it. Since youve already paid the tax due, you usually dont pay tax on your distributions.

Social Security

Virginia does not tax Social Security benefits. If any portion of your Social Security benefits are taxed at the federal level, you can subtract that amount on your Virginia return. This also applies to Tier 1 Railroad Retirement.

Age Deduction

Virginia offers qualifying individuals ages 65 and older a subtraction that reduces the amount of their income subject to Virginia income tax:

- If you were born on January 1, 1939, or earlier, you can subtract $12,000

- If you were born on January 2, 1939, or later, the amount of allowed subtraction is based on your income.

Personal Property and Real Estate Taxes

You May Like: How Much Of My Paycheck Goes To Taxes