What Happens When You File Jointly

The biggest change, tax-wise, that you might notice is that credits you qualify for as an individual might no longer be applicable for your joint familys income. As an example, if you currently qualify for the GST/HST credit, but your partners income is much higher than yours, you might not qualify for it once youre filing together.

But heres what doesnt happen: You dont get taxed on your income as a couple. If you earn $40,000, youll still only owe the tax you already owed on that $40,000, even if your partner earns $200,000. In some places, your family income is taxed all together, but in Canada your personal earned income is still subject to the same rates as it was before.

How To File Your Taxes And What Is The Difference Between Married Filing Jointly And Married Filing Separately

All married couples can file jointly by reporting their taxable income, expenditures, and deductions on one Form 1040, or if they opt for filing separately, each of them has to fill out their own Form 1040 based on their individual income.

While there are some minor differences when filing jointly vs separately, there isnt a significant difference in the filing process itself. Even if you opt for filing separately, you still need to provide some information about your spouse, such as your spouses full name and date of birth and their Social Security Number or ITIN .

Whichever filing system you choose, you need to be aware of the taxes and deductions you are responsible for by deciding on that particular option, and also, you need to remember that you can change your mind at any point during the process.

If you ever found yourself perplexed by taxes, you dont have to wait any longer to find out why taxes are so complicated!

Reasons To File Jointly

You might be able to get a lower tax rate

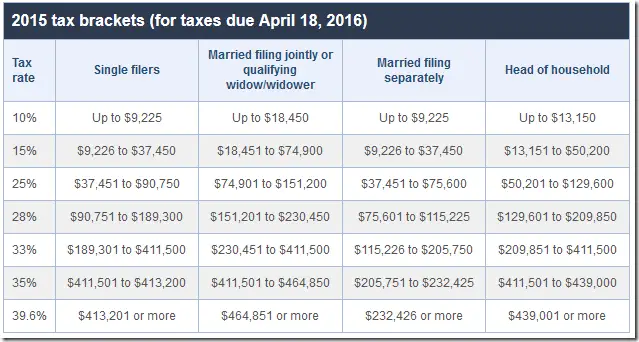

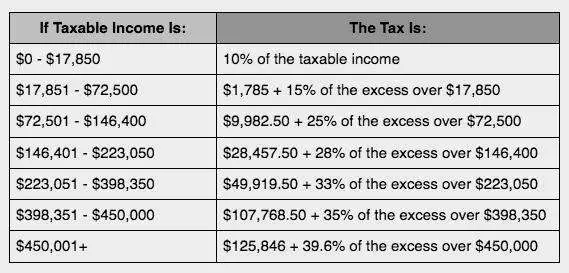

In most cases, filing jointly will benefit a married couple. When married filing jointly, you typically get lower tax rates, and you must file jointly to claim some tax benefits. When deciding whether to file jointly or separately, you should consider your tax rate, your income, and what deductions and credits you are eligible for.

Also Check: Is Plasma Donation Money Taxable

Qualifying Widow Status When One Spouse Is Deceased

The tax code allows you to file a joint return with your spouse for the tax year in which they die. Then you might be able to file as a qualifying widow for two more years going forward, or perhaps as head of household. Otherwise, you’d then have to file as a single taxpayer.

A qualifying widow cant remarry during the two years during which this filing status is available, and they must have a child or stepchild who they can claim as a dependent and who lived with them through the entire tax year. Foster children don’t count.

Choose Software That Allows For Refund Optimization

Unlike our neighbours to the south, here in Canada theres no such thing as filing jointly with a spouse or domestic partner. However, using whats known as refund optimization, you can reduce your overall tax bill by playing with certain credits and deductions in a way that will benefit you as a couple. Contributed $200 to a Save The Pigeons charity? Either one of you will be able to claim the deduction but it will likely save you more if its reported in one spouses return. The software you choose should be able to link your return with your spouse/domestic partners and tell you where it makes most sense to include deductions like these.

Read Also: How To Get Tax Form From Doordash

Other Major Tax Changes

- For contributions to flexible health spending arrangements, the dollar limitation has been updated to $2,700.

- For taxpayers who hold a Medical Savings Account for self-only coverage, the annual deductible must be at least $2,350 and no more than $3,500.

- The foreign earned income exclusion has increased to $105,900.

- The basic exclusion on the estates of decedents is now $11,400,000.

- The annual exclusion on gifts hasnt changed and remains at $15,000.

- The tax credit for qualified adoption expenses has increased from $13,810 to $14,080.

Taxes: Single Vs Married

When filing federal income taxes, everyone has to choose a filing status. There are five filing statuses: single, married filing jointly, married filing separately, head of household and qualifying widow/er with dependent child. Most people are only eligible for one or two of the statuses and your status is likely to change at some point in your life. One common change is going from filing single to filing married. In this article, lets look at how your tax situation could change when your filing status changes from single to married.

Planning your familys finances goes beyond just taxes. Find a local financial advisor today.

You May Like: Doordash Taces

Consequences Of Filing Your Tax Returns Separately

On the other hand, couples who file separately receive few tax considerations. Separate tax returns may give you a higher tax with a higher tax rate. The standard deduction for separate filers is far lower than that offered to joint filers.

- In 2021, married filing separately taxpayers only receive a standard deduction of $12,500 compared to the $25,100 offered to those who filed jointly.

- If you file a separate return from your spouse, you are automatically disqualified from several of the tax deductions and credits mentioned earlier.

- In addition, separate filers are usually limited to a smaller IRA contribution deduction.

- They also cannot take the deduction for student loan interest.

- The capital loss deduction limit is $1,500 each when filing separately, instead of $3,000 on a joint return.

Understanding Personal Income Taxes

Personal income tax is the tax that governments levy on income that is generated by individuals. Taxes are a governments main source of revenue, and the government uses it to fund public investments, services, and to pay obligations. Personal income tax is applied to all sources of income for an individual that includes, but is not limited to:

- Property income

- Capital gains income

- Business income

In the United States, the Internal Revenue Service is responsible for the collection of taxes and for enforcing tax laws. The Canadian counterpart is known as Canada Revenue Agency .

Also Check: Is Money From Donating Plasma Taxable

You Want To Protect Your Own Finances Or Need To Follow State Law

Lastly, not to plant the seeds of doubt, but filing separately might be smart if you suspect your spouse may be committing tax fraud, is behind on tax payments, or owes child support, because you’ll be protected from shady behavior and your refund won’t be held up by the IRS.

Also keep in mind that if you and your spouse work or live in different states, your state may require you to file separately in your state and jointly for your federal returns to ensure you won’t be taxed twice on the same income. The exception to this rule is if you live in a community property state where all marital assets are considered joint property.

Benefits Of Filing Separately

Some people wish to retain their financial independence even when they are married. If youre one of them and youre wondering do married couples have to file jointly?, the answer is no. There are some benefits to consider when filing your tax returns separately from your spouse.

One of the benefits is avoiding a higher tax rate if you have higher income thresholds as individual earners, as well as the benefit of security from prosecution in case of any illegal action of your partner.

| Did you know: You dont have to hire a tax preparer to be in charge of your taxes you can learn how to do taxes on your own. |

Read Also: Taxes For Door Dash

Who Can File Jointly

If you just got married, congrats! But you may not be able to file jointly just yet.

You need to have been married before January 1 of this year to file last years taxes jointly. So if you got married on December 31 of last year or earlier, you can file together. But if you got married on or after January 1 of this year, you must file separately this tax season.

Tax Credit And Deduction Changes

The Earned Income Credit has been increased for married couples filing jointly to $6,728 for 2021. This represents a minor increase from the maximum in 2021.

The maximum amount can be claimed if you have three or more qualifying children. There are also other factors to take into account, such as your income.

A significant change is to the financial penalty levied for not maintaining a minimum level of health coverage. Under the Tax Cuts and Jobs Act , this is now $0, a reduction of $695 from 2018.

Read Also: Do Tax Preparers Have To Be Licensed

Should You And Your Spouse File Taxes Jointly Or Separately

OVERVIEW

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Advantages of filing jointly

There are many advantages to filing a joint tax return with your spouse. The IRS gives joint filers one of the largest standard deductions each year, allowing them to deduct a significant amount of their income immediately.

Couples who file together can usually qualify for multiple tax credits such as the:

Joint filers mostly receive higher income thresholds for certain taxes and deductionsthis means they can earn a larger amount of income and potentially qualify for certain tax breaks.

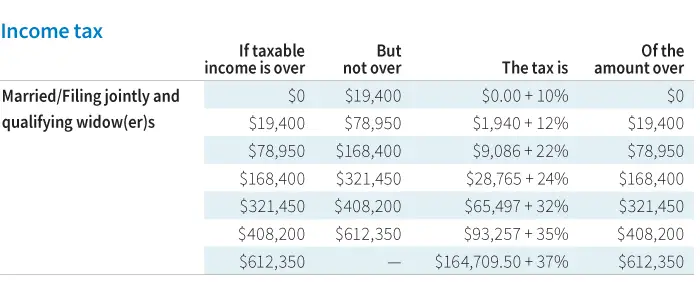

There Have Been Some Significant Changes To The Irs Tax Brackets

- The standard deduction for married taxpayers filing jointly has been increased to $25,100. This is a $300 increase from the previous year.

- For heads of households, the standard deduction will be $18,800, up $150.

- The personal tax exemption hasnt changed from 2018. The Tax Cuts and Jobs Act stipulated that the personal exemption has been removed.

- For married couples filing jointly, the top rate of tax has remained the same at 37%. To qualify for the maximum rate of tax, you must have earned more than $628,300.

You May Like: How To File Taxes From Doordash

Watch Out For The Upsell

The CRA divides its certified software categories into free products and products with pay what you want model, and paid products and products with free offerings. The second category is largely made up of companies that have a bare bones filing platform that is free, but once on their site, they may do everything they can to upsell you on paid products, and perhaps push you into thinking you need them when you might not. Youve been warned!

Paid products, like audit protection plans, an insurance that assures that should the CRA audit you, their company will serve as an intermediary, are more controversial. Full tax audits are exceedingly rare And as Toronto tax attorney David Rotfleisch told Global News, should you be audited, you might be better off hiring a bone fide accountant or tax attorney to help you rather than relying on someone with unspecified qualifications. Rotfleisch said:

The unknown is the level of expertise of the people providing the representation services,

He went on to point out if the representatives do not have the proper expertise, the taxpayers situation may very well be prejudiced.

When Does It Make Sense To File Separately

Newlyweds may want to consider filing separately if one partner has a lot of out-of-pocket medical expenses.

A common misconception is that because you’re married, you need to file jointly. The truth is that you have a choice. Here’s when it might not make financial sense to file jointly, and you might fare better filing individually.

Filing jointly would push you into a higher tax bracket

If that’s the case, it might be more advantageous to file separately, Zimmelman says. And should it be more beneficial for one spouse to itemize and the other to take the standard deduction, filing separately might be the better route for you.

One of you has out-of-pocket medical expenses

The IRS only allows taxpayers to deduct medical expenses that are greater than 7.5% of their adjusted gross income. Says Zimmelman: “If you have a lot of medical expenses, but your spouse has a high AGI, you’ll be able to claim more if you file without them.”

So you’re not on the hook for the other’s debt

While there are some tax perks that come with filing a joint return, it also means that your finances are, legally speaking, linked. In turn, you’re both liable for each other’s debts, penalties, or other issuesthink defaulting on student loans, owing taxes, owing back child supportthat could complicate financial matters, points out Zimmelman.

Neither of you have children or dependents

Read Also: Csl Plasma Taxes

Newlyweds And Income Tax Withholding

When you get married, it’s a good time to check your income tax withholding and make sure you’re not having too much – or too little – withheld from your paycheck. It is important to file a new Form W-4, with the Married checkbox selected, with your employer after your marriage. When you do, it may be equally important to adjust the amount of withholding on the Form W-4. For example, if you and your spouse make similar incomes, you may need to have more income tax withheld to avoid a potential tax bill next year.

On the other hand, if your spouse has little or no income, your income tax bill when you file jointly may be considerably less. You may need to have less income tax withheld to avoid having the IRS hold too much of your money all year.

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Don’t Miss: Doordash And Taxes

A Spouses Unpaid Debts And Taxes Can Gum Up Your Business Filing

Back taxes and unpaid student loan debt cause issues during tax season. If your spouse failed to file taxes in previous years or is delinquent on student loan payments, the IRS can seize your joint federal tax refund. A sizable refund owed to your business might get snatched up, and that wont feel good.

In general, couples should file their taxes separately until both spouses have their taxes in order.

Your Medical Expenses Are Very High

For the 2020 tax year, filers can begin to deduct medical expenses once the total amount exceeds 7.5% of their adjusted gross income . When spouses’ incomes are combined, the threshold can be exceptionally hard to meet. Further, it’s usually not worth doing unless the deductible amount is higher than the standard deduction for married couples who file jointly.

Filing separately would allow both spouses to begin deducting qualified medical expenses after they exceed 7.5% of their own AGI. Remember, though, that itemizing deductions will disable either spouse from claiming their separate standard deduction .

Don’t Miss: Employer Tax Id Lookup

Joint And Several Liability

One of the primary features of Married Filing Jointly status is joint and several liability for the spouses. IRS Publication 501 contains the following cautioning language: Both of you may be held responsible, jointly and individually, for the tax and any interest or penalty due on your joint return. One spouse may be held responsible for all the tax due even if all the income was earned by the other spouse. This means that if the tax is unpaid, each spouse can be held personally responsible for payment. Also, if the tax return is selected for audit, both spouses have the responsibility to provide documentation to support the accuracy of the information contained in the return. If one spouse incorrectly reports the tax, both spouses may be responsible for any additional taxes levied by the IRS. This is true even if all the income is earned by one spouse.

What Do I Do If I Used The Wrong Filing Status

If you didnt know better and filed single after you were married or filed married a year early, youll need to amend your tax return. You might owe a little more in taxes, or you might get a bigger refund. If you dont amend your tax return, you might get charged penalties if the IRS notices you filed incorrectly.

If you filed separately or jointly and didnt know it was better to file the other way, you have the option to amend your tax return. Or, you can decide its not worth it to amend. The reason you dont have to amend is that its your option whether to file joint or separate.

Read Also: Tsc-ind Ct