Claiming The Standard Mileage Deduction

If you decide to go with the Standard Mileage Deduction over the Actual Expense Method, all you have to do is track your qualifying miles and multiply it by the cents per mile deduction for the year . Remember, only the number of miles traveled for business purposes is deductible.

The IRS’ standard mileage rate in 2021 is 56 cents per mile.

This method was introduced so small business owners did not have to track a mileage log or keep all their vehicle expense receipts . It’s as easy as that. Multiply your total miles by the deduction rate and compare it to maintaining the actual expenses for write-offs.â

Dont Claim That A Hobby Is Actually A Business

If you sustain a business loss for three out of five consecutive years, the IRS might call you up, claiming that youre pursuing a hobby and not actually running a business. Youll need to prove that you actually had the intent to make a profit and clarify the reasons why you didnt.

If the IRS decides your business is actually a hobby, they might disallow any business expenses you have previously written off, meaning you could be on the hook for back taxes and penalties.

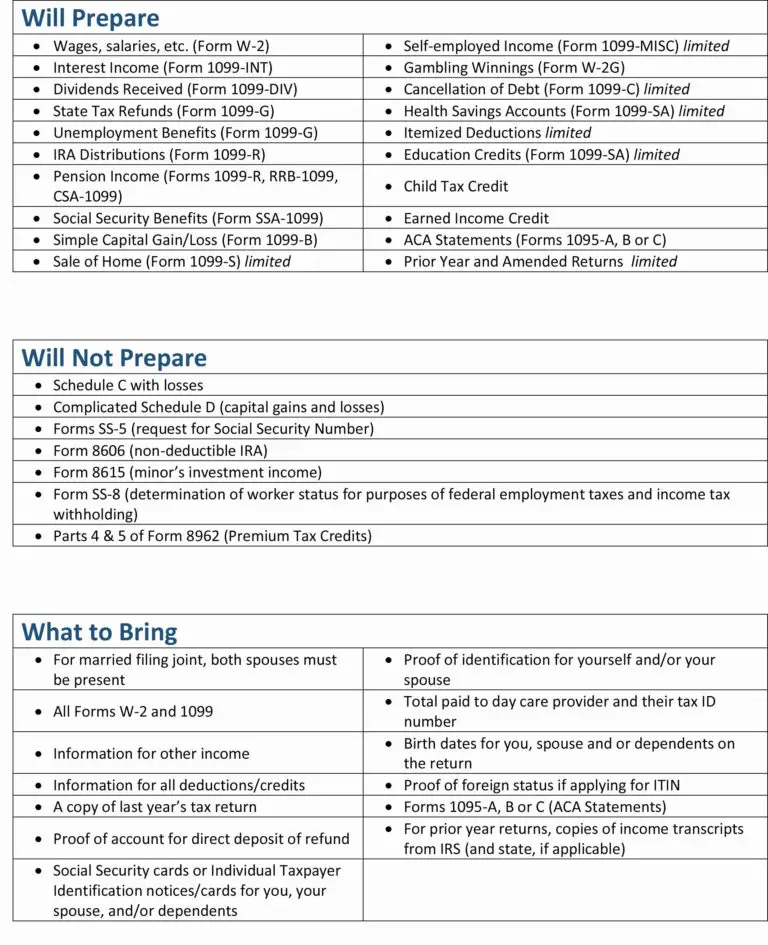

Do I Have To Pay Taxes On A 1099 Form

Typically, income that has been reported on a 1099 is taxable. However, there are many exceptions and offsets that reduce taxable income. For example, let’s say a taxpayer has a gain from the sale of a home, meaning the selling price was higher than the original cost basis. The taxpayer might not owe taxes on that gain since they may qualify for an exclusion of up to $250,000, depending on their tax situation. It’s best to consult a tax professional if you’re unsure whether you need to pay taxes on your 1099 income.

Recommended Reading: How Much Tax Is Deducted

As A Business Owner Do You Need To Send A 1099

In short, no, you dont need to send a 1099-K to someone youve paid by credit card or third-party network. The credit card company or third-party network is responsible for sending it.

Note, if a PSE doesnt send a 1099-K, the penalty the IRS charges them can be large. The penalties for not filing one range from $30 to a maximum of $3,339,000.

Records You Need To Keep For Self

In order to claim mileage deductions for self-employed, you must keep adequate and timely records of your mileage as proof. You must also keep all records and receipts for at least 3 years from the date you file your tax return. Read below to find out the records you need to keep according to the mileage deduction method you choose.

Recommended Reading: Do You Pay Taxes On Social Security Disability

Why Should You Consider To Avoid Paying Taxes On Your 1099

When you’re self-employed or a contractor, you’re often paid with 1099 instead of a W-2. This can be beneficial because your income isn’t taxed on the employee side but taxed at your marginal rate as an independent contractor. However, if you receive too much of 1099 income, it can result in a higher tax bill than if you’d been paid as an employee. You need to know this to avoid paying taxes on your 1099 eventually.

First, you earned it. You worked hard for that money. You deserve it. And if you didn’t make it, you don’t deserve it. So unless you have a good reason for how to avoid paying taxes on your 1099 , then there is no reason to avoid them.

Second, the money is yours. If someone wants to give you money, they should be able to do so without going through any red tape. This is especially true if they are giving you the money because they want something in returnlike a service or product that you provide them with. If they don’t want to provide you with their money, that’s fine too because plenty of other people will happily take their money and give them what they want in return . Hence, you can avoid paying taxes on your 1099.

The easiest way to avoid paying taxes on your 1099 is by never receiving one in the first place! However, if your employer does issue one, you have options for reducing its impact on your taxable income. Third, keeping things simple makes everything easier for everyone involved, especially regarding taxes!

Which Miles Can Be Deducted

Not every mile counts as a tax deduction. The following are eligible for tax deductions:

- Miles driven to pick up passengers

- Miles driven with a passenger in the car

- Miles driven returning from drop-off points to a place to wait for another ride request

- Any other mileage related to the business

The first drive of the day, from your home to the location where you wait for passengers, cannot be deducted for business mileage. Likewise, your last ride commuting home cannot be deducted. These miles are considered commuting miles, which are not deductible. In addition, any driving done for personal reasons during the day , cannot be deducted. Even if they are done between rides.

Read Also: Will Rav4 Prime Qualify For Tax Credit

How To Avoid Paying Taxes On Your 1099 Income: 6 Must

Melissa Pedigo has been a CPA for over 20 years and she is one of the only CPA copywriters in the world. With a vast knowledge of U.S. tax and accounting, sheâs able to write about tax and finance topics from a unique perspective…as an industry expert. When sheâs not writing or being an accounting nerd, youâll find her watching and playing tennis, reading, tending to her half-grown garden, and studying foreign languages

Every taxpayer wants to know that one secret IRS loophole: the one that will magically bring their tax payments down to zero, clear their pores, and water their lawn. Unfortunately, that particular secret doesnât exist.

But did you know there are six tricks that freelancers, 1099 independent contractors, and other self-employed people can use to significantly lower their tax bill â and itâs all completely legit?

In fact, the IRS specifically builds provisions for these situations right into the tax code. Welcome to the world of tax avoidance, the completely legal art of reducing, minimizing, and avoiding taxes!

Most freelancers overpay their taxes. Letâs make sure youâre not one of them. Below, weâll share one trick to reduce your self-employment tax, and five tricks for lowering your income tax.

But first, letâs go over the basics.

Contents

The Irs Gets Your 1099s Too

Any Form 1099 sent to you goes to the IRS too, often a little later. The deadline is Jan. 31 for mailing 1099s to most taxpayers, but some are due Feb. 15.

Others are due to the IRS at the end of February. Some payers send them simultaneously to taxpayers and the IRS. Although most payers mail taxpayer copies by Jan. 31, they may wait a few weeks to collect all IRS copies, summarize them, and transmit them to the IRS. This is usually done electronically.

You May Like: What Is Tax Deadline For 2021

Who Needs To Get A 1099 Form

Usually, anyone who was paid $600 or more in non-employment income should receive a 1099. However, there are many types of 1099s for different situations. Also, there are many exceptions to the $600 rule, meaning you may receive a 1099 even if you were paid less than $600 in non-employment income during the tax year.

Are Uber And Lyft Drivers Self

If you drive for Uber or Lyft, you are self-employed. As a driver for either company, you are an independent contractor rather than an employee. As an independent contractor, you provide transportation services to individuals. While working for Uber or Lyft, you set your own work hours and usually provide your own car and other resources necessary to do your job.

Recommended Reading: How Do You Get Your Tax Return

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

What Exactly Counts As Business Mileage

There’s a common misconception out there among self-employed workers and claiming mileage for taxes. Let’s clear that up first. What counts as business mileage? Well, a commute or miles from home to work or office, coffee shop, or other location where you do business does NOT count as deductible business mileage.

That’s because that is considered a commute and not an activity that generates a revenue stream for your company. Driving to your office is simply a personal commute to work.

Instead, business mileage is for trips while doing business. Driving accrued while doing business means you use a car solely for business. This includes activities like driving to clients for lunch or meetings, going to a conference, running errands related to your work, and more.

You May Like: Will The Tax Deadline Be Extended

How Do Uber And Lyft Drivers Count Income

You must report all income you earn, even if you dont receive any tax forms from Uber or Lyft. This includes income from any source, no matter how temporary or infrequent. Since you may not receive a tax form for all income sources, its important to be able to track your own income.

You will likely receive two tax forms from Uber or Lyft if you meet certain requirements. Form 1099-K reports driving income, and Form 1099-NEC reports any income you earned outside of driving, including incentive payments, referral payments, and join and support payments.

You usually receive a Form 1099-K if you make more than $20,000 and provide at least 200 trips. If you are a resident of Vermont, Virginia, or Massachusetts, you will receive Form 1099-K if you earn at least $600 in rides. If you are a resident of Illinois, you receive Form 1099-K if you earn at least $1,000 in rides. There is no minimum ride requirement for residents of these states.

You will receive Form 1099-NEC if you make at least $600. Include the total income from the tax form on your tax return.

Form 1099-K income will not be reduced by any fees or commission that Uber or Lyft charge you. You will need to report these fees under your business tax deductions. Otherwise, you will pay taxes on more income than you should.

Organize Your 1099 Receipts

Relying solely on your bank account or credit card statements to meet IRS requirements is not recommended or reliable. Even small businesses must classify and organize their form 1099 to avoid any tax troubles. Here are a few methods to keep track of employment tax and organizing your form 1099:

1. Label receipts

While it may look like a small business or an independent contractor can only incur so many expenses, they may multiply without enough anticipation. Therefore, it is essential to note your business receipts as and when they occur to avoid any miscalculation or neglect.

Labelling a particular receipt also helps in categorizing them in account books later. For instance, you might want to write dinner at the back of a receipt for a business dinner shared with an investor.

2. Digital receipts

Receipt scanners and mobile phone cameras are inarguably a boon for a small business or an independent contractor looking for organizing 1099 receipts. Digitizing business expense receipts and payments protects you against the risk of losing any receipt or the drying out of the ink. A digital receipt is also easier to organize and quicker to locate.

3. Classification of receipts

Organizing business receipts by category will make your tax calculation a breeze and allow you to refer to a particular transaction or payment without having to go through never-ending files. You can classify receipts based on the following categories:

Advertising and promotion

Insurance fees

Recommended Reading: Are Taxes Due By Midnight May 17

Can You Use Either Deduction Tracking Method

If you use standard mileage in your first year of driving for Uber or Lyft, then you can choose whether you want to use actual car expenses or standard mileage in the future. If you use actual expenses the first year, then you must continue to use actual car expenses for as long as you drive with that vehicle. The exception is leased carswhatever method you pick the first year you must stick with for the duration of the lease period.

Back Up Your Information

Even the best-planned and carefully organized storage systems can fail through no fault of your owna lost phone, crashed laptop, broken hard drive, or even a fire or flood can wipe out physical or digital documentation. Back up your digital receipts regularly to the cloud or an external thumb drive so you’re covered in case of a hardware or software failure.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Don’t Miss: When Do I File Business Taxes

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.

File Your Quarterly Estimated Tax

Paying your quarterly estimated tax is the last component of 1099-misc expenses.

While paying the entire amount once and for all during the tax season may be easy for a few small businesses and independent contractors, IRS also provides for those who wish to spread their tax payment. An employer can conveniently spread the tax payments over the year through estimated quarterly payments.

Estimated tax payment can be prepared using a quarterly tax calculator on the figures from last year for further convenience.

At the end of the year, this estimation may turn accurate, or you have to pay a little more tax based on your earnings. However, there is also a fair chance of owning an income tax refund, which is again based on your earnings.

The greatest advantage of using a quarterly estimated tax method is that a major chunk of your tax is regularly paid, which reduces the burden during the tax season.

Recommended Reading: Does Contributing To Roth Ira Reduce Taxes

What Is The 1099 Form Used For

The 1099 form is used to report non-employment income to the Internal Revenue Service . Businesses are required to issue a 1099 form to a taxpayer who has received at least $600 or more in non-employment income during the tax year. For example, a taxpayer might receive a 1099 form if they received dividends, which are cash payments paid to investors for owning a company’s stock.

What If The Amount On Your 1099

![[How To] 1099 Processing in Dynamics GP [How To] 1099 Processing in Dynamics GP](https://www.taxestalk.net/wp-content/uploads/how-to-1099-processing-in-dynamics-gp-sikich-llp.png)

If you receive a 1099-K and the number theyve reported as gross payments doesnt match your records, first ensure youre looking at the right amounts. The 1099-K is reported in gross amounts, but your monthly statements might be reported in net amounts. Ensure youre looking at the correct total.

If you still believe there is an error on your 1099-K, you should contact the PSE that is listed on the form. They can help you investigate the difference. Keep all of your records as documentation of the discrepancy.

One common error to watch out for is duplicate transactions. If a client pays you via credit card, theyre not supposed to also include this amount on the 1099-NEC they issue at year-end. However, some small business owners arent familiar with the reporting rules and issue a 1099-NEC to anyone who received payments greater than $600, regardless of the payment method used.

If a client pays you via credit card and issues a 1099-NEC for those payments, you could have twice the business income reported to the IRS on your behalf. Reach out to your client and ask them to issue a corrected Form 1099 k.

Read Also: Where To File 2017 Taxes

Tax Trick #: Put Money In Your Retirement Accounts

In addition to insurance expenses, you can also deduct contributions to your retirement account.

Self-employed individuals have the option to create a variety of retirement plans, including:

- ð SIMPLE IRAs

Contributions to your retirement account allows you to defer taxes on the money you put in, until you cash out your plan!

How much you can defer will vary from plan to plan and year to year. The IRS updates their guidelines annually, but for some context, in the 2022 tax year you can contribute:

| Account Type | |

|---|---|

| 401s | Up to $61,000 |

Not every 1099 worker makes enough to create retirement accounts from their profits, but itâs definitely something full-time freelancers will want to consider!