How Do I Obtain A Copy Of A Prior Year Return

Returns prior to 2018 are not available through our system.

If you electronically filed your return with us previously you will be able to print a copy of your return by selecting the Prior Year tab on the My Account page. You will then need to click on View or Print Return next to the return you need to print or view. If your return was never e-filed and accepted, we will be unable to provide a copy in PDF format.

If you do not remember your username or password and your email address has changed or is deactivated, you can use request a change of email address by completing the form at the following link and then complete and fax the form to us at 706-868-2326. You can also attach the E-mail Change Request Form in an e-mail. Be sure to include a valid form of ID. If you do not know the old email address associated with the account please include two forms of identification. If the account is a married filing joint account identification must be included for both the taxpayer and the spouse.

You can also request a copy of your prior year return directly from the IRS. Copies of prior year federal returns can be obtained through the IRS however there is a cost as opposed to our regulations, we provide it for free.

The following article is from the IRS website:

Q3 How Long Must I Wait Before A Transcript Is Available For My Current Year Tax Return

If you filed your tax return electronically, IRS’s return processing takes from 2 to 4 weeks before a transcript becomes available. If you mailed your tax return, it takes about 6 weeks. If you didn’t pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. Refer to transcript availability for more information.

Once your transcript is available, you may use Get Transcript Online. You may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call . Please allow 5 to 10 calendar days for delivery. You may also submit Form 4506-T, Request for Transcript of Tax Return. The time frame for delivery is the same for all available tax years.

Q3 What If I Can’t Verify My Identity And Use Get Transcript Online

Refer to Transcript Types and Ways to Order Them for alternatives to Get Transcript Online. You may use Get Transcript by Mail or you may call our automated phone transcript service at to order a tax return or tax account transcript be sent by mail. Please allow 5 to 10 calendar days from the time we receive your request for your transcript to arrive. The time frame for delivery is the same for all available tax years.

Read Also: Who Do I Call About My Federal Tax Refund

If You Dont Expect To Get A Tax Slip

You have 2 options:

- Option 2:

- Estimate your income without tax slips

If you cant get a slip in time to file your taxes, you can estimate your income manually. Add up your pay stubs or financial statements to estimate the income to report, and any related deductions and credits you can claim.

Include a note with your return stating the name and address of the issuer of the slip, the type of income, and what you are doing to get the slip.

- If you file electronically: Keep all of your documents in case the CRA asks to see them later.

- If you file by paper: Attach a copy of the pay stubs or statements and your note to your paper return. Keep the original documents.

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

Also Check: Where Do I Get My Unemployment Tax Form

How To Access Old Tax Returns

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006. This article has been viewed 48,000 times.

Accessing old tax returns may be necessary if you need to look up specific information about your income or your expenses. You can also use old tax returns as proof of your financial history for a mortgage or loan application. As a taxpayer, you are able to access a transcript or an official copy of old tax returns in just a few easy steps. A transcript is free to access, but each official copy of your old tax returns will cost you $50 USD as of March 2019.

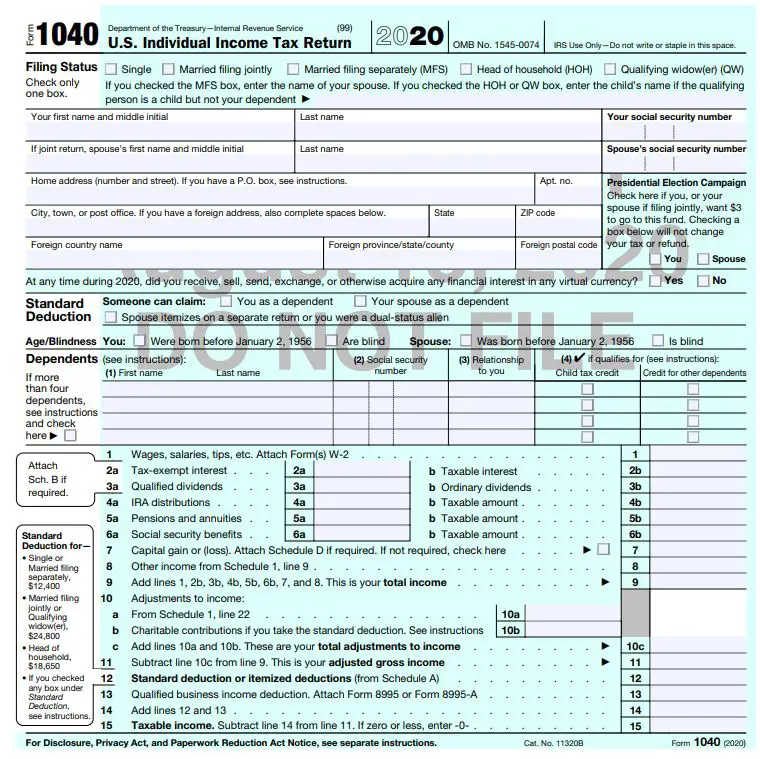

How Do I Get A Copy Of The 2020 Return I Filed In Turbotax Online

If access to your 2020 return has expired, you’ll get a link with instructions on how to regain access.

Related Information:

Also Check: What Will I Get Back In Taxes

How Do I Check The Refund Status From An Amended Return

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Two Ways To Check The Status Of A Refund

- Online via INTIME

- Inquiries can be made on refund amount from 2017 to the current tax season.

Note: If a direct deposit of your Indiana individual income tax refund was requested, once DOR initiates the deposit, our system will reflect the date the request was processed. Normally, it takes seven business days for your financial institution to receive and process the funds.

For more information on refunds, use INTIMEs secure messaging to contact DOR Customer Service.

Information regarding the $125 Automatic Taxpayer Refund and $200 additional ATR issued in 2022 will not be displayed or available via INTIME. Both ATRs will be sent separately from your 2021 Individual Income Tax refund . .

You May Like: Are Charitable Contributions Still Tax Deductible

Irs Transcripts Are Free

Your other option is to order a tax transcript from the IRS rather than an actual copy of your return. The IRS makes two types of transcripts available: a tax return transcript and a tax account transcript, and both are free. A transcript is more or less a summary of the information included in your return and your payment and refund histories.

Mail in Form 4506T-EZ if you want a tax return transcript, or Form 4506T if you want a tax account transcript. You can also request a transcript online from the Get Transcript Online page of the IRS website, or even call the agency, although the IRS isnt taking phone calls in spring 2020 due to the coronavirus pandemic.

It will take from five to 30 days to get the transcript, depending on whether you make the request online or via USPS mail, and theyre only available for four years the current year and the previous three.

Read Also: How To Buy Tax Lien Properties In California

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News

Recommended Reading: Which States Have No Income Tax

The Tool Displays Progress In Three Phases:

- Return received

- Refund approved

When the status changes to approved, this means the IRS is preparing to send the refund as a direct deposit to the taxpayer’s bank account or directly to the taxpayer in the mail, by check, to the address used on their tax return.

The IRS updates the Where’s My Refund? tool once a day, usually overnight, so taxpayers don’t need to check the status more often.

Taxpayers allow time for their financial institution to post the refund to their account or for it to be delivered by mail. Calling the IRS won’t speed up a tax refund. The information available on Where’s My Refund? is the same information available to IRS telephone assistors.

Can I Contact The Irs For Additional Help With My Taxes

While you could try calling the IRS to check your status, the agencys live phone assistance is extremely limited. You shouldnt file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if youre eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if its been 21 days or more since you filed your taxes online, or if the Wheres My Refund tool tells you to contact the IRS. You can call 800-829-1040 or 800-829-8374 during regular business hours.

You May Like: Do Unemployment Benefits Get Taxed

Q4 I Got A Message That Says The Information I Provided Does Not Match What’s In The Irs Systems What Should I Do Now

Verify all the information you entered is correct. It must match what’s in our systems. Be sure to use the exact address and filing status from your latest tax return. If youre still receiving the message, you’ll need to use the Get Transcript by Mail option or submit a Form 4506-T, Request for Transcript of Tax Return.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Also Check: Do My Taxes Myself Online

Customer File Number And Form 4506

Because the full Taxpayer Identification Number no longer is visible, the IRS has created an entry for a Customer File Number for both individual and business transcripts. This is an optional 10-digit number that can be created usually by third-parties that allow them to match a transcript to a taxpayer. The Customer File Number field will appear on the transcript when that number is entered on Line 5 of Form 4506-T, Request for Transcript of Tax Return and Form 4506T-EZ or Form 4506-C, IVES Request for Transcript of Tax Return.

Heres how it would work for a taxpayer seeking to verify income for a lender: The lender will assign a 10-digit number, for example, a loan number, to the Form 4506-T. The Form 4506-T may be signed and submitted by the taxpayer or if the lender is an IVES participant, a Form 4506-C, IVES Request for Tax Transcript signed by the taxpayer and submitted by the lender. The Customer File Number assigned by the requestor on the Form 4506-T or Form 4506-C will populate on the transcript. The requestor may assign any number except the taxpayers Social Security number. Once received by the requester, the transcripts Customer File Number serves as the tracking number to match it to the taxpayer.

How To Fix Address Matching Problems When Ordering Online

When entering the information into the IRS address matching system note the following:

- The address entered must match the address already on file with the IRS exactly.

- The address on file is typically the address on your most recent tax return.

- Spelling out the word street rather than using the abbreviation st. can be enough to cause an error.

- Addresses on the IRS system are auto-corrected through a post office program and may not match what you put on your tax return.

We suggest the following if you run into problems:

- Have your taxes in front of you and enter the address carefully as it is on your return.

- If you entered your address as it appears on your return and it doesnt work, try using the standardized version of your address.

- To get a standardized version of your address: 1) go to www.usps.com 2) Click Look Up a Zip Code 3) Enter Street Address, City, State 4) Click Find

Also Check: When Are Federal Taxes Due In Texas

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund. If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund. The Department will notify the debtor of the set-off and will refund any balance which may be due. The agency receiving the amount set-off will also notify the debtor and give the debtor an opportunity to contest the debt. If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund. For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.