What Does It Mean When A Tax Certificate Is Issued

: a certificate issued to the purchaser of property at a tax sale that certifies the sale and entitles the purchaser to a tax deed upon expiration of the period for right of redemption if all taxes and charges have been paid voided the tax certificate when it was determined that the original owner was exempt from

Lower Your Property Taxes In 10 Minutes

Everyone likes to save money, especially when it comes to taxes. But, did you know that you may be overpaying on your property taxes? If you purchased a home and never filed for the homestead tax exemption, then you are graciously over-paying your taxes.

Below, Ive outlined everything you need to know about the homestead tax exemption and the simple process for applying. Just make sure you complete and submit the application before the deadline of March 1.

How Does Florida Compare To The National Average

Florida is ranked 30th out of 51, including Washington, DC, when it comes to the highest tax rate in the United States. At an average home price of $156,200, this amounts to $1,718 per year on property taxes. The lowest property tax rate is 0.28% in Hawaii. The average cost of housing in Hawaii is $504,500, and annual property taxes are $1,405. The highest property tax rate is 2.29% in New Jersey.

Read Also: What Age Do You Have To File Taxes

Property Tax Exemptions Available For Health

If you upgraded your home for medical purposes , the cost of those upgrades that exceeds 7.5 percent of your adjusted gross income may be deducted.

This deduction is somewhat complex, though: if the updates added to your homeâs value, youâre only allowed to deduct the difference between the expense and your homeâs increased value.

Claim All Tax Breaks To Which You’re Entitled

Florida allows for reduced property taxes if the homeowner meets certain requirements. The chief programs in Florida are summarized here.

Contact your local tax appraiser for complete details on these and other Florida exemptions, including any required forms you need to complete and the deadline for filing. For contact information for the tax appraiser’s office in your county, see the website of the Florida Department of Revenue.

Property taxes are not always straightforward, as you can probably appreciate from this short article. Depending on the complexity of your situation, you might want to seek help from a property lawyer. To find an experienced real estate lawyer in Florida, check out Nolo’s Lawyer Directory.

Also Check: Why Do I Owe So Much State Taxes

Once Approved Do I Have To Make An Annual Application To Retain My Homestead Exemption

No, once the initial application has been approved , the exemption will be automatically renewed each January and a renewal notice will be mailed to you . If you are still eligible, no action is required. However, it is your responsibility to notify the property appraiser if your eligibility for exemptions has changed.

Appeal The Taxable Value Of Your Home

Florida authorities compute your property tax by multiplying your home’s taxable value by the applicable tax rate. For example, imagine that the tax appraiser has placed a taxable value of $200,000 on the Petersons’ home. If the tax rate is 1%, the Petersons will owe $2,000 in property tax.

If you can reduce the taxable value of your home, your property tax bill will obviously be lower. Using the example above, if the Petersons appeal the $200,000 taxable value of their home, claiming that it’s not worth as much as the state believes, they might convince the state to reduce the taxable value. If the appeals board agrees, and reduces that value to $150,000, the Petersons will owe only $1,500 in property taxes.

If you believe that the tax appraiser has misjudged the value of your home, or if the taxable value is higher than that of similar homes in your area, you might want to pursue an appeal. The Florida Department of Revenue offers guidance to homeowners seeking to file such an appeal.

Read Also: How To File Taxes Doordash

While Florida Does Not Levy A Personal Income Tax Both

How to lower property taxes in florida. To put that figure into perspective for a typical homeowner, the savings would lower a monthly mortgage payment by about $68. Since my property tax bill is now twice my mortgage payment, i’m on it. According to the tax foundation, florida residents paid lower taxes in 2009 than the national average.

Every year, i take a few steps to lower my property taxes. The states average effective property tax rate is 0.83%, which is lower than the u.s. Longtime floridians are paying less in property taxes than new floridians, if they remember to file on time!

3309 northlake blvd, suite 105 palm beach gardens, fl 33403 Longtime residents / seniors may qualify for an exemption if they have lived in florida for 25 years or more or are 65 years of age or older, and who meet certain income thresholds and have a home worth less than $250,000. Florida counties with the lowest median property taxes.

On tuesday, voters in florida overwhelmingly approved a bill to lower property taxes across the state, to the advantage of many looking to move into 55+ communities. Property taxes in florida come in a bit below national averages. Todays real estate market finds many properties that are overvalued when it comes to tax purposes.

That comes out to $2,353 per year in taxes on a home worth $250,000.

Pin on Property Tax

Who Is Exempt From Paying Property Taxes In Florida

If you own real estate, you will likely be paying property taxes. However, much of Floridas reputation as a tax-friendly state stems from the numerous exemptions it allows homeowners. First and foremost is the Homestead Exemption, which provides an exemption of up to $50,000 to those who own property in the state and make it their permanent home.; Other exemptions include:

- Homestead exemption for people 65 and over: Any residents eligible for the homestead exemption who are 65 years of age or older could receive an additional $50,000 exemption. Specific income limits may apply.

- Disabled veterans homestead property tax discount: For permanently disabled veterans, 65 and older, who lived in Florida when they entered military service.

- Widows and widowers exemptions: A $500 exemption for widows and widowers unless they remarry.

- Disability exemption: A $500 exemption for Florida residents who are totally and permanently disabled.

- Disabled veterans: Ex-service members who are permanent residents of the state and disabled at least 10% in war are eligible for a $5,000 exemption.

- Blind persons: Every blind Florida resident qualifies for a $500 exemption.

You May Like: Do I Have To File Taxes If I Receive Unemployment

Portability You Can Take It With You

If I sell my home and buy a new one, will I lose all the tax savings Ive accumulated over the years?

No. Floridas Save Our Homes provision allows you to transfer all or a significant portion of your tax benefit, up to $500,000, from a Florida home with a homestead exemption to a new home within the state of Florida that qualifies for a homestead exemption. This is referred to as portability.

E file for Portability when E filing for your Homestead Exemption, .

If you have already filed for a Homestead Exemption and need only to file for Portability, .

How does portability work?

If your new residence has a higher market value than your former residence, the portability amount is determined by subtracting the assessed value of the former home from its market value. For example, if the market value of your previous home is $250,000, but the assessed value is $150,000 because of the SOH benefit, then the assessed value of your new home will be reduced by $100,000, and the 3 percent SOH cap will continue on that portion of your new homes assessed value. If the new residence has a lower market value, you can transfer a percentage of the difference from your previous property to your new home. To qualify for portability, you must establish your new residence on or before January 1 of the third year after leaving or selling your prior residence.

Important points to consider when filing for Portability:

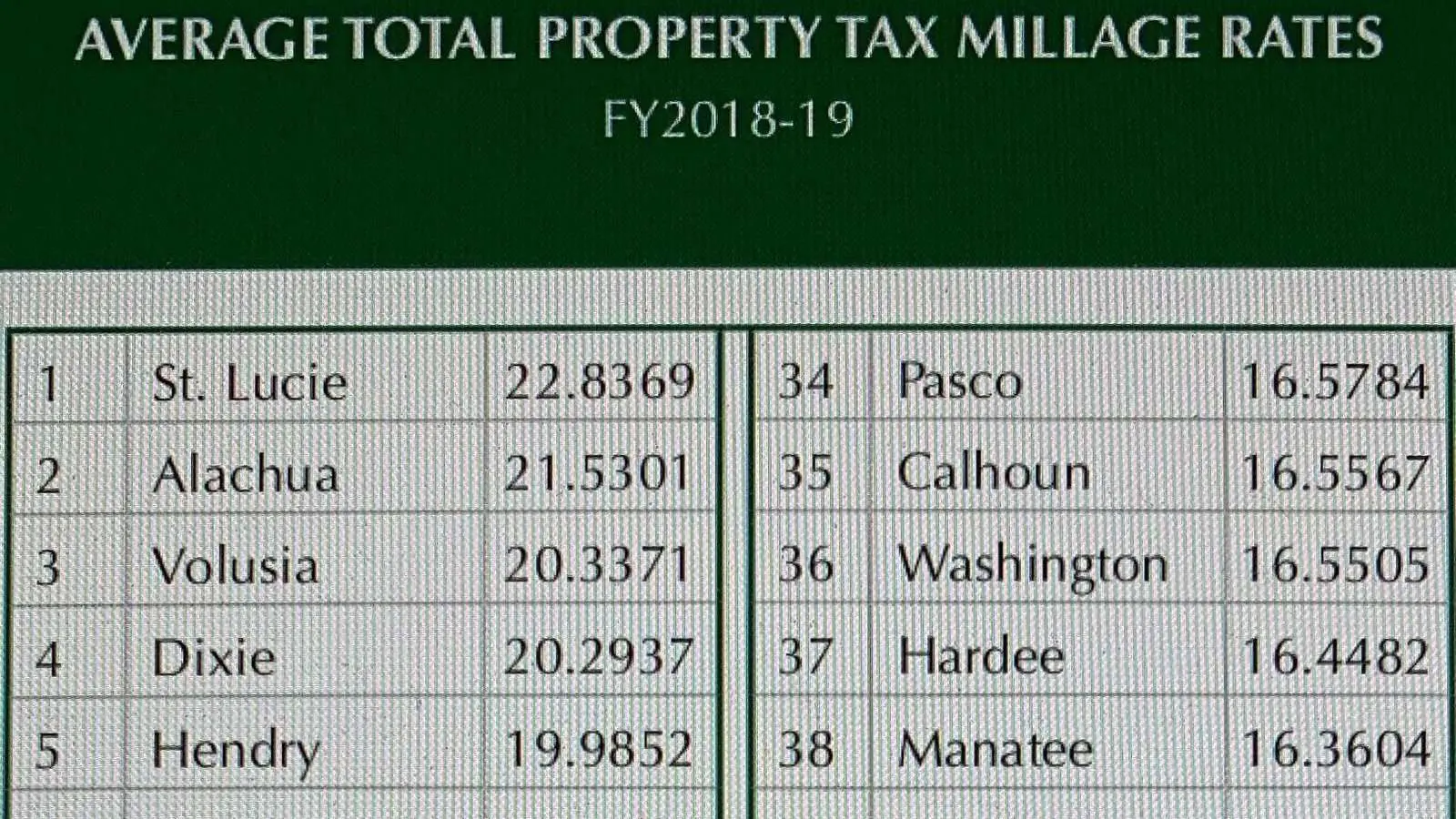

Lowering Property Taxes In Florida Your Propertys Location May Change The Situation

Homeowners in Florida may pay more or less in annual taxes depending on what county they live in and what their property value is.

There are several counties in Florida in which homeowners pay less than $800 on average in property taxes, such as Dixie County, Franklin County, and Levy County for example.

In case your property is not located in one of those counties, that is fine. You can take a more strategic approach and save hundreds of dollars yearly by using some other options.

Read Also: How To See My Past Tax Returns

Florida Property Tax Rates

Property taxes are collected on a county level, and each county in Florida has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in Florida.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across Florida. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in Florida.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the Florida property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free Florida Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Florida.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

Keep in mind that assessments are done on a property-by-property basis, and our calculators cannot take into account any specific features of your property that could result in property taxes that deviate from the average in your area.

Your City Tax Bill Explained

If you own property in Florida, you pay taxes. Its a fact of life and the basis of our states revenue structure. In Florida, we dont pay state income taxes, and property taxes are the single largest revenue stream for city and county governments. In the fall, when the tax bills are published, local elected officials hear a lot of comments, concerns and questions about property taxes. And because your City Council is the elected body closest to the people, City officials especially get a lot of these questions during budget season.

As you open your tax bill, there are a few facts to keep in mind. A major misconception that City officials frequently hear is that some residents believe the City Council is responsible for their entire tax bill or at least a significant majority of it. In fact, if you look at your entire tax bill, you will see more than a dozen different taxing authorities in St. Lucie County. In the end, the City Council is responsible for the millage rate for only two lines on your bill: City of Port St. Lucie and City of PSL Voted Debt, which was voter approved to pay for the Crosstown Parkway. If you do the calculations, those two portions make up only about 25% of your total tax bill. Some of the other major taxing authorities on your bill include St. Lucie County and the St. Lucie County School District.

That could be the result of several factors including:

Recommended Reading: How To Calculate Sales Tax From Total

Make Sure You’re Not Paying More In Florida Property Taxes Than You Have To

By Brian Farkas, Attorney

As a Florida homeowner, you are probably well aware that your house and land are subject to local property taxes. For many residents of the Sunshine State, property taxes represent a significant part of their financial burden. Of course, you want to ensure that you are not overpaying. So how might you lower your property tax bill?

There are two primary methods of reducing your tax burden. The first method is available to all homeowners. The second depends on whether you meet qualifications that are articulated within Florida’s tax laws. If you meet any of those qualifications, you may seek tax relief using both methods.

What About A Home Assessed At $70000

With this home, the first $25,000 in assessed value would be exempt from property taxes. The next $25,000 would be taxed at the regular rate. The remaining $20,000 in value would be exempt from all property taxes except school taxes. A home with this value would see a tax bill of $686 without exemptions . The homestead exemption would reduce the weight to $25,000, and the taxes would fall to $245, or a savings of $441.

Ensure that you are paying fair rates on homeowners insurance

The insurance advisors at White Cloud Insurance are ready to help you choose the right coverage. To pay your property taxes, visit the government website;here. If you need comprehensive homeowners coverage, we can assist you. Use the convenient;contact form, call us at 305-556-1488, or send us a message at .

Also Check: Can You Refile Your Taxes

Dont Lose Standing To Challenge The Assessment You Are Required To Timely Pay The Tax To Challenge The Tax On The Trim Notice

A recent Florida case underscores the importance of the deadlines associated with successfully challenging a tax assessment.; In Sowell v. Faith Christian Family Church of Panama City Beach, Inc., Case No. 1D17-3365 , the property owners failure to pay assessed property taxes before the deadline deprived the trial court of jurisdiction to entertain a challenge to the tax assessment.; In the Sowell case, a landowner filed suit in circuit court, challenging the denial of a tax exemption. ;However, the landowner did not pay the taxes due and owing on the property until May 11, 2017meaning the taxes were delinquent by operation of the law after April 1, 2017.; Section 197.333, Florida Statutes, states that taxes become delinquent on April 1 following the year in which they are assessed or immediately after 60 days have expired from mailing of the original tax notice, whichever is later.

S For Getting Your Real Estate Taxes Lowered In Duval County:

As always, if you have any questions feel free to;;or;.

Cheers!

Recommended Reading: How To Grieve Property Taxes

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

No one likes paying property taxes. Theyre a necessary evil, and theyve been providing funding for local schools and governments since the 1950s. Although you cant entirely get out of property taxes, there are some ways that you might be able to reduce how much you pay if youre willing to invest a little effort. In Florida, the average property owner pays about $1,700 or $1,800 in property taxes each year.

Depending on what county you live in and what your property values are, you may pay more or less in annual taxes. Regardless, you can take a proactive approach and take a few basic steps to potentially save hundreds of dollars a year. If you dont want to do this on your own, you can hire professionals to help you every step of the way.

What is a Homestead Exemption?

Act Quickly for Current Year Savings