How We Can Help

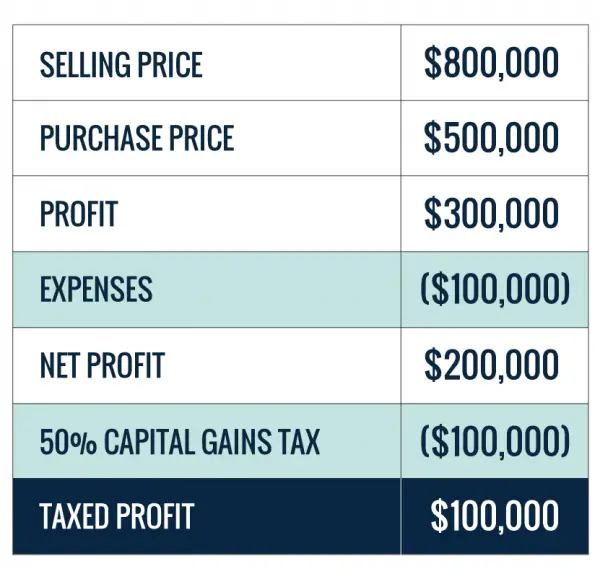

As you can see, capital gains taxes can vary depending on tax deferral choices, appreciation rates, your holding period, and your overall income situation over time.

Besides helping you buy and sell real estate, our Elevate team is happy to connect you with great accountants and are ready to grow with you. This means we can also work together with your accountant to analyse your unique real estate position and help you make better investment decisions throughout your real estate investing journey.

How To Avoid Capital Gains Tax On Real Estate

Home prices have nearly doubled in the last 10 years and that could mean you owe some serious taxes if you are selling your home. After bottoming out around $259,000 in 2011, the average sale price of a house has marched steadily upward to more than $453,000 at time of writing. Like many trends, the pandemic may have accelerated this but housing prices had already been rising for years. This has come as great news for homeowners looking to sell. They stand to make some real money.

Unfortunately, with real money comes real taxes. If you sell real estate for a profit you will owe capital gains taxes on the money. Unfortunately, unlike the taxes held from wages, the IRS doesnt take that money up front. Youll have to calculate it and cut a check. There are ways to make that hurt less though. If you want help minimizing your tax bill from a home sale, consider working with a financial advisor.

Can Home Sales Be Tax Free

Yes. Home sales can be tax free as long as the condition of the sale meets certain criteria:

- The seller must have owned the home and used it as their principal residence for two out of the last five years . The two years do not have to be consecutive to qualify.

- The seller must not have sold a home in the last two years and claimed the capital gains tax exclusion.

- If the capital gains do not exceed the exclusion threshold , the seller does not owe taxes on the sale of their house.

Read Also: What Does Excise Tax Mean

How The Tax On Capital Gains Works For Inherited Homes

What if youre selling a home youve inherited from family members whove died? The IRS also gives a free step-up in basis when you inherit a family house. But what does that mean?

Lets say Mom and Dad bought the family home years ago for $100,000, and its worth $1 million when its left to you. When you sell, your purchase price is not the $100,000 your folks paid, but instead the $1 million its worth on the last parents date of death.

You pay capital gains tax only on the difference between what you sell the house for, and the amount it was worth when your last parent died.

Do I Qualify For Partial Exclusion Of Gain

Even if you dont meet the eligibility test for full exclusion of gain, you may qualify for partial exclusion.

People can qualify for partial exclusion if they sold their home because of a work-related move, a health-related move, or a major unforeseeable event such as the death of a spouse or their home being destroyed or condemned.

Check the IRS site for more details about which situations and circumstances qualify.

Recommended Reading: How Much Tax Do I Need To Pay

Reporting Home Sale Proceeds To The Irs

You must report the sale of a home if you received a Form 1099-S reporting the proceeds from the sale or if there is a non-excludable gain. Form 1099-S is an IRS tax form reporting the sale or exchange of real estate. This form is usually issued by the real estate agency, closing company, or mortgage lender. If you meet the IRS qualifications for not paying capital gains tax on the sale, inform your real estate professional by Feb. 15 following the year of the transaction.

The IRS details which transactions are not reportable:

- If the sales price is $250,000 or less and the gain is fully excludable from gross income. The homeowner must also affirm that they meet the principal residence requirement. The real estate professional must receive certification that these attestations are true.

- If the transferor is a corporation, a government or government sector, or an exempt volume transferor

- Non-sales, such as gifts

- A transaction to satisfy a collateralized loan

- If the total consideration for the transaction is $600 or less, which is called a de minimus transfer

How To Avoid Capital Gains Tax As A Real Estate Investor

If the home youre selling is not your primary residence but rather an investment property youve flipped or rented out, avoiding capital gains tax is a bit more complicated. But its still possible. The best way to avoid a capital gains tax if youre an investor is by swapping like-kind properties with a 1031 exchange. This allows you to sell your property and buy another one without recognizing any potential gain in the tax year of sale.

In essence, youre swapping one investment asset for another, says Re/Max Advantage Plus White. He cautions, however, that there are very strict rules regarding timelines and guidelines with this transaction, so be sure to check them with an accountant.

If youre opting out of the rental property investment business and putting your money in another venture that does not qualify for the 1031 exchange, then youll owe the capital gains tax on the profit.

Recommended Reading: How Much Do You Get Back In Tax Returns

Convert Your Home Into A Short

No one says you have to rent the property out to long-term tenants.

Run the numbers to calculate how it would perform as a vacation rental on Airbnb instead. You might just find it cash flows better.

Just watch out for local regulations designed to restrict short-term rentals some cities effectively ban Airbnb rentals.

What short-term fix-and-flip loan options are available nowadays?

How about long-term rental property loans?

We compare several buy-and-rehab lenders and several long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

The Tax Implications Of Selling Inherited Property

If you inherited a property and later sell it, you will only be liable for capital gains tax based on its current market value at the time of death. If you held the property for more than 365 days in a year, you will be taxed on the gain at the same rate as on ordinary income. You will have to pay 5 percent or 15% if you held the property for 366 days or more, depending on your tax bracket and the number of days you held the property. The tax consequences of selling your inheritance are critical if you want to protect it. You will only be required to pay income tax on the gain if the property was held for less than 365 days. If you held the property for more than 36 hours during the previous year, you will be charged a tax on the gain of 5% if you fall in the lowest two tax brackets and 15% if you fall in the highest two.

You May Like: Where’s My State Taxes

What Is The Capital Gains Tax Rate

Your capital gains tax rate will depend on your current tax bracket, the length of time youve held the asset and whether the property was your primary residence. Well look at that below.

Its also important to know the type of asset youre dealing with, because while most long-term capital gains are taxed at rates of up to 20% based on income, there are situations in which higher rates apply.

When Do You Have To Pay Capital Gains Tax On A Property

Generally, if a property is sold for a gain, capital gains tax will apply. But there are always exceptions. For example, no CGT applies if the property is a persons main residence, i.e. their home.

Another common exception is if the property was purchased before September 20, 1985. But keep in mind that any significant improvements or renovations made since that date may be treated as a separate asset under law and consequently subject to CGT.

Meanwhile, small business concessions on CGT may also apply if the property is used in relation to a business and the taxpayer passes a variety of tests.

You May Like: Why Do I Owe State Taxes This Year 2021

Mistake #: Make A Bad Real Estate Investment In The Rush To Avoid Capital Gains Tax On Commercial Property

One of the other big mistakes is getting into a 1031 exchange and suddenly facing the 30-45 day identification period. Sometimes, people end up making bad decisions about commercial real estate during this time crunch. It is always better to make a plan ahead of time, and wait to begin the 1031 exchange so you have access to the best investments in the current market.

Investors may think, I could buy this property, even though its not a great investment. Id rather do that, than pay the alternative taxes. We certainly would never want you to be in that position. If you were going to complete a 1031 Exchange, we want to make sure that youve planned it well, so that you avoid some of these common mistakes that investors make.

So, just to recap, calculate the capital gains taxes on your commercial property long before you consider selling. Make sure that youre using a qualified intermediary, whos a credible, bonded, and insured resource. You want to make sure youre not relying on inexperienced CPAs, accountants, or attorneys in another field. Be sure to plan well in advance of your commercial real estate sale so that you dont end up in a position of either making a bad investment decision or paying taxes.

What we want for all of our clients and for you is to make sure that youre making financially successful commercial real estate decisions.

Topic No 701 Sale Of Your Home

If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse. Publication 523, Selling Your Home provides rules and worksheets. Topic No. 409 covers general capital gain and loss information.

Don’t Miss: What Do You Claim On Your Taxes

Check If You Qualify For Other Homeowner Exceptions

Had to move in under two years? You may still qualify for a partial exemption from capital gains taxes on your primary residence.

The IRS offers several exceptions for homeowners who were forced to move, whether for a change of job, health issue, or other unforeseeable events. If you lived in the property for less than two years and were forced to move, speak with your accountant about any partial capital gains exemptions you might qualify for.

How Much Is Floridas Capital Gains Tax

Because Florida doesnât have a capital gains tax, the amount you pay depends on the federal tax rates.

This depends on several factors, including:

- Your federal tax bracket

- Your filing status

- How long youâve owned the house

- Whether the home was your primary residence or investment property

Short-term capital gains are taxed differently than long-term capital gains. The difference is how long you owned the property â short-term ownership of a year or less taxes capital gains like regular income. If you’ve owned it for more than a year, your tax uses the more favorable long-term rate.

Also Check: How Much Is Tax In Ct

Special Asset Classes For Long

The following table includes types of assets and their respective capital gains tax rates.

|

Collectibles |

|

|

Unrecaptured gain under section 1250 for real property |

There are special rules that apply for gifts of property or inherited property, patents or certain types of investment income like commodity futures. For tax purposes, these dates are calculated from the day after the original purchase to the date of sale of the property.

Take the first step towards the right mortgage

Rocket Mortgage helps you get started wherever you are in your journey.

Business Income Isn’t A Capital Gain

If you operate a business that buys and sells items, your gains from such sales will be consideredand taxed asbusiness income rather than capital gains.

For example, many people buy items at antique stores and garage sales and then resell them in online auctions. Do this in a businesslike manner and with the intention of making a profit, and the IRS will view it as a business.

- The money you pay out for items is a business expense.

- The money you receive is business revenue.

- The difference between them is business income, subject to self-employment taxes.

Let a tax expert do your investment taxes for you, start to finish. With TurboTax Live Full Service Premier, our specialized tax experts are here to help with anything from stocks to crypto to rental income. Backed by our Full Service Guarantee.You can also file your own taxes with TurboTax Premier. Your investment tax situation, covered. File confidently with Americas #1 tax prep provider.

Recommended Reading: How Do I Get An Extension On My State Taxes

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Nursing Home Stays And The Ownership And Use Test

For people who’ve moved to a nursing home, the ownership and use test is lowered to one out of five years in your own home before entering the facility. And time spent in the nursing home still counts toward ownership time and use of the residence. For example, if you lived in a house for a year, then spent the next five in a nursing home before selling the home, the full $250,000 exclusion would be available.

Recommended Reading: What Does It Mean To Amend Your Taxes

You May Not Be Entitled To The Capital Gains Exclusion If You Are The Sole Owner Of The Property

If you own the property solely, you are not eligible for the exclusion, and you must pay capital gains tax on any profits you make from it. If the property is owned by two individuals who have used it as their primary residence for two out of the five years preceding the sale, the income tax benefits of capital gains will be combined to the extent that each individual deducts up to $250,000.

Capital Gains Tax Rates 2022

If you are filing your taxes as a single person, your capital gains tax rates in 2022 are as follows:

-

If your income was between $0 and $41,675: 0%

-

If your income was between $41,676 and $449,750: 15%

-

If your income was $459,750 or more: 20%

If you are filing your taxes as married, filing jointly, your capital gains tax rates are as follows:

-

If your income was between $0 and $83,350: 0%

-

If your income was between $83,351 and $517,200: 15%

-

If your income was $517,200 or more: 20%

If you are filing your taxes as the head of household, your capital gains tax rates are as follows:

-

If your income was between $0 and $55,800: 0%

-

If your income was between $55,801 and $488,500: 15%

-

If your income was $488,500 or more: 20%

Last but not least, if you are filing your taxes as married, but filing separately, then your capital gains tax rates are as follows:

-

If your income was between $0 and $41,675: 0%

-

If your income was between $41,676 and $258,600: 15%

-

If your income was $258,600 or more: 20%

Read Also: What Is Ca Use Tax

How Long Do You Need To Live In A House To Avoid Capital Gains Tax

This one’s pretty simple. Once you’ve owned your home for 12 months, you automatically qualify for a 50 percent discount on your capital gain. This is known as the 12-month rule. So let’s say you bought a property for $200,000, lived there for 13 months, and then sold for $300,000, your capital gain is $100,000.

Managing The Sale Date

You could mitigate this tax burden by controlling the year in which title and possession passes out of your hands and, therefore, the year in which you report the capital gain on the transaction. In other words, you can set the transfer of ownership to a year in which you expect to have a lower tax burden.

According to the Internal Revenue Service , “some or all net capital gain may be taxed at 0% if your taxable income is less than $80,000.” Therefore, if you have no active income and minimal passive income, including the gain on the sale of your investment property, you may avoid paying taxes on your minimal capital gain. However, if your income is steady and paying tax on the gain looks inevitable, you may want to consider using the IRC Section 1031 exchange.

Read Also: Is Ein Same As Sales Tax Number