Keep Electronic And Paper Backups

While you’ll want to hold onto paper receipts to document your expenses, a receipt can get lost or damaged, or even fade over time. Protect receipts and other documentation by keeping a digital copy of your expenses. This can be as simple as:

- Scanning your receipts to store as images or PDFs, or asking that they be emailed to you if thats an option

- Keeping electronic rent receipts

- Saving PDFs of utility bills

Check in on the electronic documentation you have as part of your regular check-in process to make sure you have a digital backup of all your receipts before you put them into long-term storage.

Keep A Daily Business Journal

When you have a daily business tax receipts journal, this can come in handy when filing your taxes. If you do not have a place to store all of your receipts, we recommend keeping a daily business journal. This will allow you to write down the date and description of each expense right from the get-go.

To make it even easier to track your expenses, we recommend using software like QuickBooks Online. With this program, you can easily organize and sync all your gross receipts taxes anywhere with an internet connection. You never have to worry about losing any information using a cloud service.

In addition, the information that you enter into the program will be automatically transferred to your tax program at the end of the year. If you are looking for a way to make this process easier, it is helpful to use QuickBooks Self-Employed.

Scan Receipts And Keep Them At Least Six Years

Yes, the IRS can come knocking for documentation and audit you up to six years back in some cases. However, hoping that the ink on your Home Depot receipt hasn’t faded away is a whole other issue. The IRS allows taxpayers to scan receipts and store them electronically. But keep a back-up, because crying about your hard drive crashing isn’t going to help you any more than “My dog ate my receipts.”

Don’t Miss: When Are Property Taxes Due

Use A Business Account And Card

Its good practice to use a credit card or debit card to cross-check details with your paper receipts. When you use cash, you can lose track of the transactions. Having a separate business account and credit card helps you avoid mixing your business with personal expenses.

If all the transactions are related to your business, you can claim the fees associated with that account! These can include the annual fees on a points card and the interest from a balance carried from one month to the next.

The Total Receipt Organization Guide

Get on top of receipt organization with these tips on how to scan and organize receipts for easier expense tracking and reporting.

Copy link

Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and save time and hassle doingaccounting.

Discover a mammoth round-up of receipt organization tips and learn best practices for how to save receipts, scan receipts, and organize receipts for better receipt management.

Also Check: How To File My 2015 Taxes

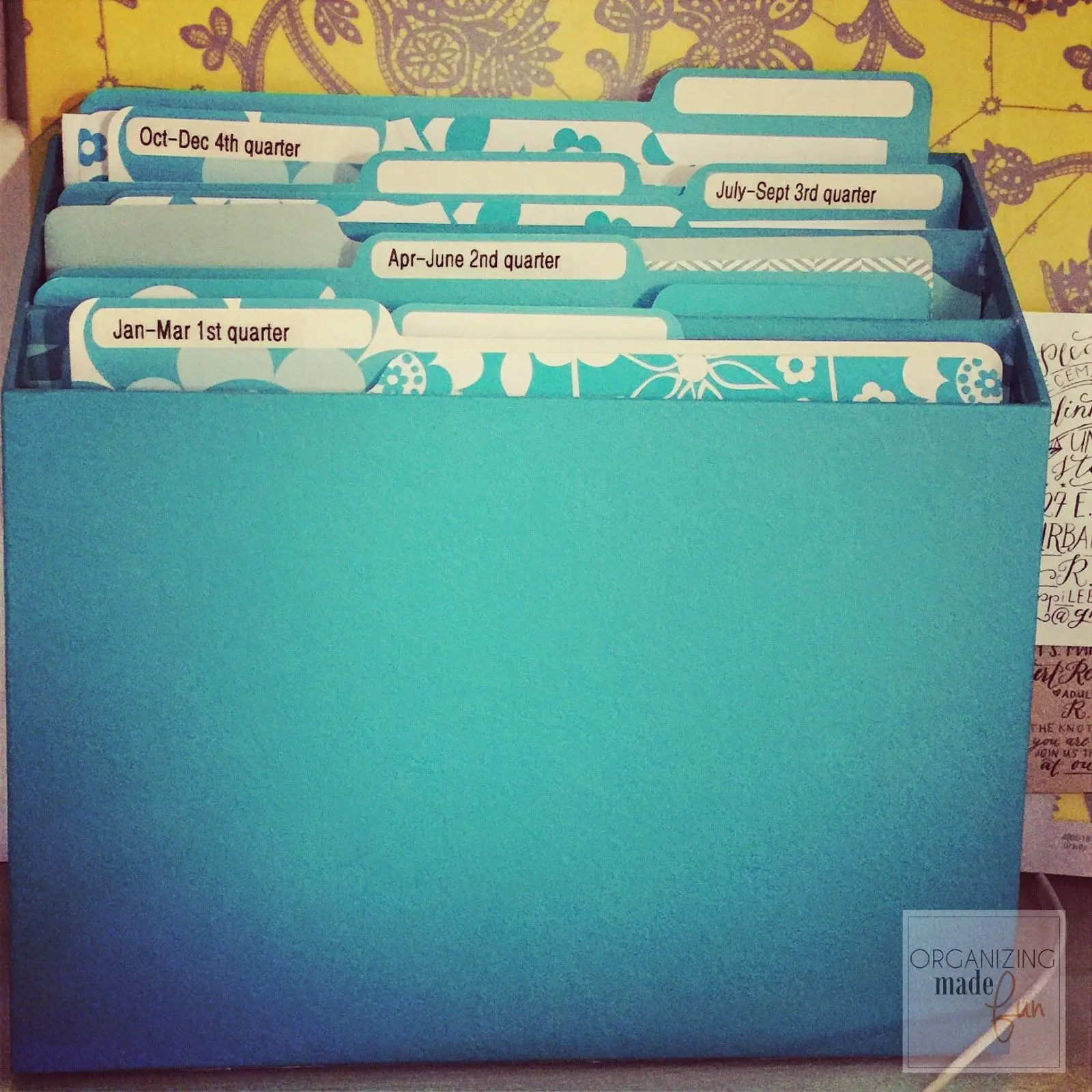

When Your Income Tax Is Filed

Because so many income tax returns are now filed online, it’s no longer common or necessary to send your expense receipts in when you file your income tax. Instead, put all your relevant receipts for the tax year in a single folder labeled by year, such as “Tax Receipts 2019,” and add the folder to your filing cabinet, whether digital or physical.

If you ever have any dispute with the Canada Revenue Agency, IRS, or get audited, your receipts will be crucial evidence.

Tax Preparation Toolkit For Contractors And Trades

We know youre dreading it, but its got to be done and with a little preparation, you can fulfill your tax obligations without any stress.

Our simple, easy-to-understand toolkit will teach you how to get organized for tax season. Download your free tax preparation toolkit to learn what information and key documents you need to prepare so youre ready for the tax filing deadline.

Theres even a printable checklist that lists all the documents youll need as a contractor and tax write offs you shouldnt miss out on. Get the prep out of the way so you can get back to running your business. Download your toolkit today.

Don’t Miss: When Is Tax Filing Day

Using A Document Management Software

Tools like Dext Prepare, HubDoc, and Expensify let you and your team easily store receipts and invoices in the cloud. You simply use your phone to take pictures of your physical documents, then upload them to a mobile app that extracts all the data .

Because these tools integrate with most cloud accounting software, you can:

- Review the data before you upload it

- Significantly reduce manual bookkeeping entries

Not only is receipt-tracking software a great way to stay organized on the go, images of your receipt will also remain stored in the cloud for convenient retrieval during an audit.

Make Notes On The Back Of Receipts

While COVID-19 is keeping a lot of us indoors, you might have meal and entertainment receipts from before the pandemic. And you could be in a position to meet with clients just a few months from now.

For these expenses, write who you met with and the purpose of the meeting on the back of the receipt right after the meeting so youre not struggling to remember details later.

Reminder: You can deduct 50 percent of your total meal and entertainment expenses for business purposes.

Also Check: How Much Do Corporations Pay In Taxes

Choose A Privacy Officer And A Security Assessment

Each business and entity needs to have these two things as directed by the HIPPA. It is not necessary to hire someone new.

A responsible person who knows how to manage PHI should be enough. Efforts should be properly showcased in meeting the rules.

The business associate agreements have to be reviewed. The officer is also assigned with planning a review of the security policies and conducting a risk analysis on the data security and IT system. In case of any incident or breach, it should be informed as well.

Keep A Business Journal

You need to provide supporting documentation about your business expenses. A business journal can serve that purpose. It also serves a couple of other purposes.

It helps you discover how youre spending your time and how youre growing your business. This can be in the form of a calendar. That can detail who youre meeting with and the business purpose behind the meetings.

You May Like: How Do Tax Right Offs Work

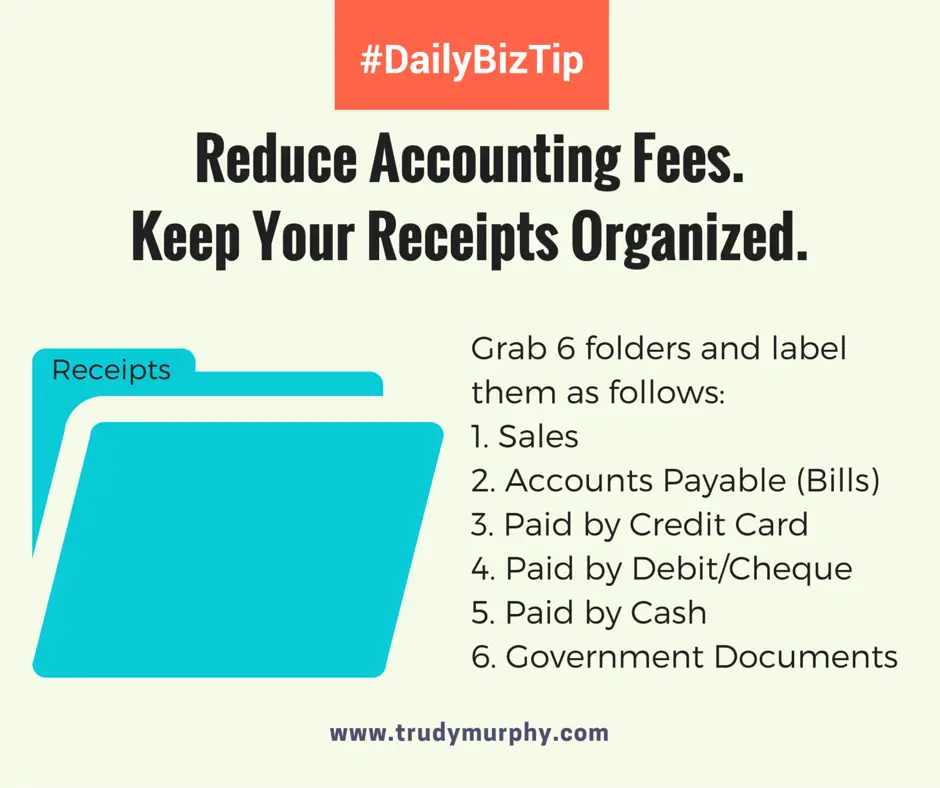

Figuring Out Your Expense Categories

If you are a label maker geek like me, it will be tempting to jump right in and start printing. Do yourself a favor though and make a plan first. Start by asking yourself what your business expenses/tax deductions are.

Most of my expenses are for supplies that I use to create blog content , but I have expenses for advertising, dues/memberships, and travel, too.

Since random expenses come up with any business, I also needed a miscellaneous receipts category. Depending on your businesses needs, your categories could be completely different than mine.

The Best Way To Keep Receipts For Your Business

The CRA requires that all business records and supporting documents be kept for a period of six years from the end of the last tax year they relate to.

There are two options when it comes to receipts filing.

You can:

- Store documents physically in paper file folders

- Organize your receipts electronically using online accounting software or digital folders

Determining the best way to keep receipts will partially depend on whether you prefer to store paper or digital documents.

Don’t Miss: Are Homeschool Expenses Tax Deductible

Keeping Track Of Your Receipts Is Important Especially For Small Business Owners And Entrepreneurs

August 17th, 2017 | By: The Startups Team | Tags: Management, Productivity

âWould you like a receipt?â We hear this question so often in daily life, we almost just tune it out with an automatic âNo thanks.â But, keeping track of your receipts is actually very important, especially for small business owners and entrepreneurs. This is because if your tax returns are audited they need to be able to meet the strict substantiation requirements of the IRS.

Mark J. Kohler, author of The Business Ownerâs Guide to Financial Freedom, notes âItâs true that you could argue whatâs called âthe Cohen Rule,â that you can use âother credible evidence,â or rely on IRS Publication 463 which says that you donât need to keep receipts for expenses under $75, but why get into a fight? Arguing with the IRS can cost you a lot more time and money than just keeping your receipts.â.

And relying on bank or credit card statements isnât enough because while they provide proof a total purchase, they donât show the itemization and detail the IRS requires. So, now that we know why itâs important to keep our receipts, how do you keep all those little bits of information organized?

So Why Should You Store Sort And Organize Receipts Electronically

If you cant spare half an hour a week to literally put extra money in your pocket and make your tax submission at the end of the financial period a breeze then youre in the wrong place.

But if youre open to organizing your receipts electronically, and the benefits this will provide, read on

Don’t Miss: How Taxes Work On Stocks

Resolution #: Spend Time On Taxes Every Week

Just as you cant expect to stay in shape if you only exercise once a year, you cant expect to stay on top of your taxes if you only make them a priority during tax season. Start the new year off strong and schedule tax preparation time each week. Taking just thirty minutes at the end of the week to reconcile your books, electronically file your receipts, plan for quarterly payments, and more will get you organized and ready for next years tax time.

Getting your business taxes organized is easier with guidance from someone whos done it themselves many times before. By working with a SCORE mentor, youll have the support of an experienced professional who can guide you through the tax preparation process and help you be prepared for tax season. Contact a SCORE mentor today.

I Boughtwhat 7 Strategies To Organize Receipts Like A Boss

Organizing receipts can be very time consuming, especially without a good strategy. Check out these clever strategies to organize receipts like a boss.

Does the phrase “organize receipts” mean putting your receipts in a shoebox and then handing them over to your accountant?

If it does, then you may need a new strategy to organize your paperwork. You could be missing receipts or not get a crucial tax deduction because you didnt write down the business reason or the franchise location the deduction was for.

The worst-case scenario is that you cant prove that you had incurred the expenses and lose those deductions in an audit.

You can save yourself future headaches down the road by organizing your receipts. Your account will love you for it.

Read on to learn the top 7 tips to keep your business receipts organized.

Also Check: How To Get Tax Exempt Status

How To Organize Receipts Electronically

Home » Blog » How to Organize Receipts Electronically

Organizing your receipts electronically can save you a lot of pain.

For every minute spent organizing, an hour is earned Benjamin Franklin

Benjamin was on to something with that quote.

Its true for life, and its even more valid when thinking about tax season. Just think of all the receipts that you have received this year do you have a plan on how to organize those receipts? Or are you waiting for the perfect day or hoping everything will just organize itself?

Every day you neglect to put in a little bit of effort is a day that adds up at the end of the year, when you realize youve run out of time. The pressure to get your taxes done is enormous. Even more so when youre scrambling because you dont have the right paperwork to make claims or deductions.

But fear not, a solution is at hand. With just a bit of organization, you can ease and even remove your tax season headaches.

How To Organize Business Receipts

Each time you sell something or make a purchase, you give or take a receipt. You provide receipts to customers after they buy something at your business. And, you receive receipts when you purchase items.

For example, if a customer purchases a coffee from you, you give them a receipt to show they bought the item.

Organizing receipts helps keep your important financial documents in order while also taking the panic and stress out of tax preparation. Maintaining receipt records can make an auditing process easier and keep your accounting books accurate.

When it comes to organizing your small business receipts, you can either store them physically or electronically . Find out how to store receipts for business using the two methods below.

Recommended Reading: How Much Is Payroll Tax In Texas

Keep Your Filing System Organized

One last thing that you can do is to keep your filing system organized. You can organize receipts and keep them in envelopes. If your envelopes cant be found because theyre misplaced or unorganized, that makes your job that much harder to produce receipts.

You need to keep your systems organized. You can have a filing cabinet that you use for business receipts and other documents. Your job is to file them correctly the first time.

Dont get lazy and put files and papers in their wrong place thinking that youll fix it later. You wont and you wont be able to find your papers when you need them.

What To Include In Your Expense Records

Depending on the type of business you work in, you may be eligible for a variety of deductions for expenses you may not even think about documenting. These may include:

- Home and office related expenses, like utility bills and the bills from home repairs. This also includes internet and phone bills, as well as the cost of maintenance and any renovations.

- Vehicle expenses and business mileage. In addition to your business and personal mileage, you should also be tracking fuel costs, repair and maintenance bills, receipts related to licensing and registration, tire costs, and lease or rental statements.

- Education costs, including tuition, associated fees, textbooks, and other necessary supplies.

- Child care expenses, such as pay stubs reflecting payments via a reimbursement account at work or receipts for child care while you were doing charitable work.

- Medical expenses, such as health insurance premiums paid for you and your family, as well as any out-of-pocket costs.

- Other assorted expenses, such as moving costs, charitable donations, investment and tax planning expenses, the cost of work uniforms , and business supplies.

Ensure all your deductions are accounted for by saving receipts for taxes in the correct place. By checking in regularly, youâll keep your workload manageable and prevent yourself from getting overwhelmed at tax time. Youâll also have the opportunity to take notes about a particular transaction while it is still fresh in your mind.

You May Like: Are Gifts To 529 Plans Tax Deductible

Back Up Your Information

Even the best-planned and carefully organized storage systems can fail through no fault of your owna lost phone, crashed laptop, broken hard drive, or even a fire or flood can wipe out physical or digital documentation. Back up your digital receipts regularly to the cloud or an external thumb drive so you’re covered in case of a hardware or software failure.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Our Advice: Keep Digital Records

Most of our daily activities are online nowadays, so why not add record keeping to the list? The good news is that the IRS accepts scanned or digital receipts when it comes to tax filing. There are just a few requirements to make sure that your digital filing system is in compliance:

- You should keep the electronic storage system for as long as deemed necessary to uphold tax laws.

- The electronic storage system that you choose should be able to index, save, retrieve, and make copies of the receipts.

- The digital copies of receipts and tax documents must clearly and accurately retain the same details as the originals.

The IRS defines an electronic storage system as any system for preparing or keeping your records either by electronic imaging or by transfer to an electronic storage media. Going by that definition, you may decide to purchase a scanner and an external hard drive or a flash memory card to back up receipts you scan into your phone or computer. Or you may prefer to keep written records, which can easily be added to a spreadsheet to help with better organization. Whatever you decide, though, make sure you capture details from the entire receipt. This includes the date, address of the business, and the total purchase price.

Alternatively, you may use a receipt-tracking app to organize and save your receipts.

Recommended Reading: Am I Eligible For Child Care Tax Credit