California Franchise Tax Llc Exemption

In 2020, Californias state legislature passed a bill exempting some businesses from paying the California Franchise Tax during their first taxable year. California LLCs, LPs, and LLPs formed between January 1, 2021 and December 31, 2021 do not have to pay the California Franchise Tax for their first taxable year. Those businesses will begin paying the California Franchise Tax during their second taxable year in business. See California Assembly Bill 85 for more information.

Can You Help Me Form A Business

Wed love to help you incorporate in California or form your California LLC. Our Sacramento, CA office is staffed with locals who know the ins and outs of forming and maintaining a business in California. Hire us and well even throw in a California business address for you to use on your filings so you can keep your home address off the public record.

Types Of Businesses Operating In California

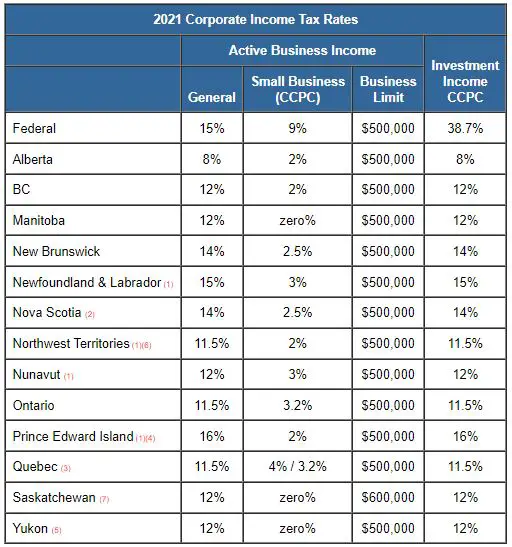

The California State Tax liability for a business and its owner depends upon the entity structure and the income level of the business shareholders, owners or partners. Based on whether your business is a C Corporation, an S Corporation, an LLC, a Partnership or a Sole Proprietorship, youll have a different state tax structure.

Recommended Reading: Are You Taxed When You Sell Your Home

Filing Requirements For Corporations And Partnerships Without Income

The tax filing requirements for corporations and partnerships depend partially upon whether the business is foreign or domestic. A domestic corporation or partnership is an entity that does business in the state where it was formed. A foreign corporation or partnership is an entity that operates in a different state, or in some cases, a different country from where it was formed.

As noted above, both S corporations and C corporations are generally required to file an annual tax return. However, exceptions might apply depending on whether the corporation is foreign or domestic. For example, certain domestic corporations may be exempt from income reporting requirements under 26 U.S. Code § 501. However, as the IRS notes, a foreign corporation is typically required to file a tax return even if it has no income effectively connected with the conduct of a trade or business in the United States during the taxable year.

As mentioned previously, it is not necessary for a domestic partnership to file a tax return if the domestic partnership neither receives income nor intends to claim credits or deductions. Even if a foreign partnership has no income, it is mandatory to file a return if the business makes an election for example, to amortize organization expenses.

Can Cannabis Workers File For Unemployment Insurance Or State Disability Insurance Benefits

Yes. Cannabis workers must meet all Unemployment Insurance or State Disability Insurance eligibility requirements in order to receive benefits.

The UI program pays benefits to workers who have lost their job. For an overview of the UI program, visit Unemployment Insurance.

The SDI program includes both Disability Insurance and Paid Family Leave, which provide short-term benefits to eligible workers who have a full or partial loss of wages due to a non-work-related illness, injury, or pregnancy. For an overview of the SDI program, visit Disability Insurance and Paid Family Leave.

Read Also: Why Do We Have To File Taxes

More About The Business Income Tax

Doing business in California can be more expensive than you might think, especially if you’re running a small business. The income tax for both business and personal income in California is higher than in other states, and many businesses are also subject to double taxation.

The Franchise Tax Board administers the business income tax in California. In most cases, the rules of the Franchise Tax Board are the same as those of the IRS, but this is not true in all circumstances.

Pass-through entities, which include both LLCs and S corporations, must pay both personal and business income taxes. Many small businesses operate as pass-through entities, and in California, their tax burden will be higher than in other states. At the federal level, pass-through entities are not subject to double taxation.

Because of this tax rule, a pass-through entity’s tax burden can almost double, based on several factors, like the entity’s net income and how much personal income the owner earns from the business. Because of California’s high taxes, business owners must carefully consider the pros and cons of establishing a business in this state.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

Who Is Considered Liable To Pay California Self Employed Tax

It’s not uncommon to be confused about whether you are liable to pay self employment taxes in California. You might be under the impression that the small business youre running isn’t taxed or you might think that your little side hustle doesn’t create any tax liabilities. It’s imperative to understand who is liable to pay these taxes in California.

The IRS considers you to be self-employed if you:

-

Are practicing a trade or operating a business as an independent contractor or as a sole proprietor

-

Are a member of a partnership that carries on a trade or business

-

If you’re otherwise in business for yourself, including a part-time business

For example, you could be a freelance designer or writer, and you’ll be considered self employed for taxation. The same applies to professionals such as tutors, lawyers, physicians, etc who are not employed by an organization and are in business for themselves.

Also Check: What Is The Tax Bracket For 2021

How To Avoid Tax On Sale Of Business

If you own a business for more than a year, you may be eligible for the long-term capital gains tax rate, which is less than the ordinary income tax rate. You must have kept the assets for more than a year in order to qualify.

An installment sale is another method to reduce your taxes. This spreads the tax burden out over several years rather than paying it all at once.

You should also think about selling your business as a CRST. If youre not sure whether or not to sell, its critical that you consult with an experienced attorney before making any decisions. You can also defer payment of taxes on the sale if you structure it as a gift.

Second, if you satisfy specific criteria, you can exclude up to $250,000 of profit from the sale of your firm.

Third, you may be able to deduct expenses associated with selling your firm. Advertising costs, legal fees, and any other related expenses are all examples of this.

Finally, if you reinvest the proceeds from the sale into another qualified business within 60 days, you may be able to avoid paying taxes on the sale entirely.

Hand-Picked For You:

My Llc Or Corporation Is Suspended Do I Still Owe The California Franchise Tax

Yes. Youll have to make your franchise tax payment for that year plus pay a $250 penalty to the California Franchise Tax Board. On top of that, youll continue to owe the California Franchise Tax until you reinstate your suspended business. Youll need to revive your business first even if you simply want to dissolve your California corporation or dissolve your California LLC.

Also Check: When Will I Get My Federal Tax Refund 2021

Consult With A Tax Professional

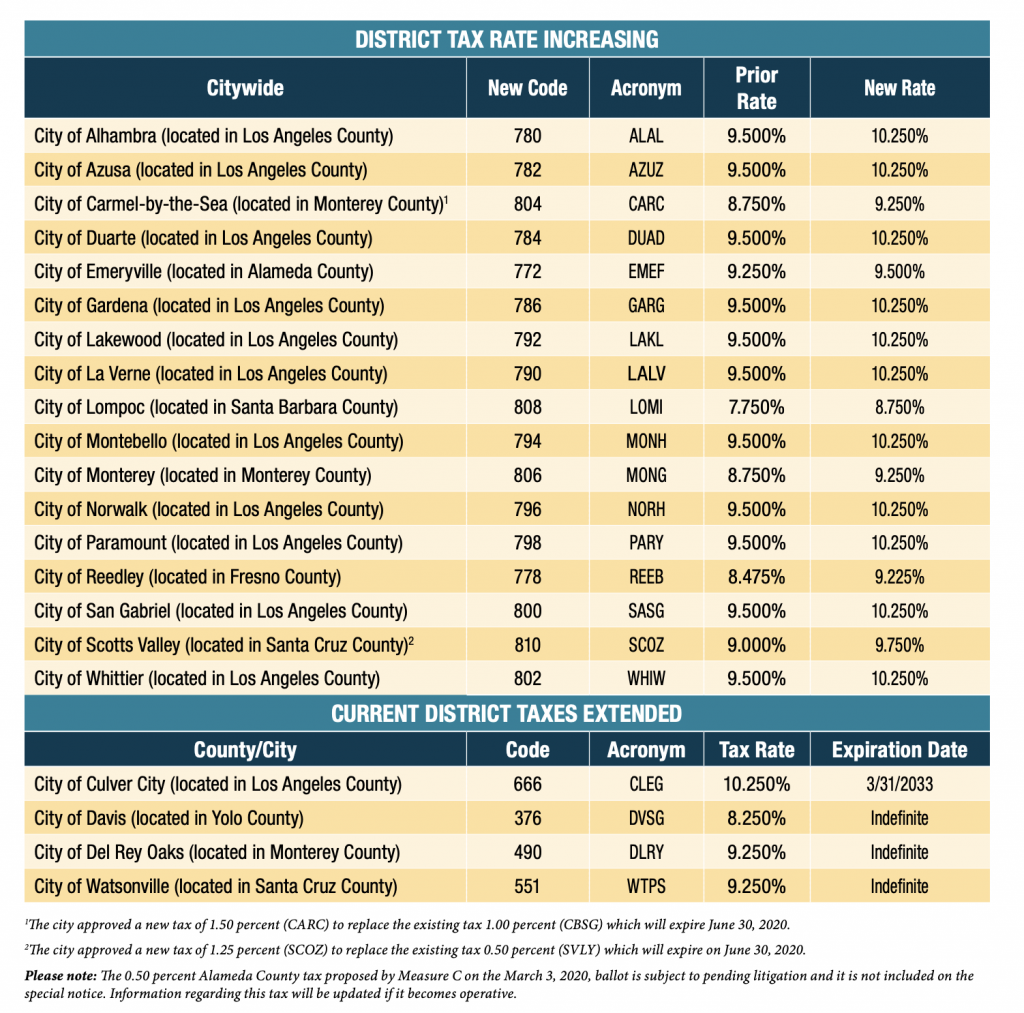

If youre concerned or uncertain about your tax obligations under California state law, take the time to find a tax consultant you can seek out for advice. A local professional will know how to navigate federal, state, and municipal tax requirements and can give you the guidance you need.

If youre just setting out to start your business now, an accountant can also help you put together a plan and contemplate your business entity options. As you can tell from these varying tax rates, few decisions are more consequential for your business than that of the business structure itself.

The more informed and prepared you are as a business owner, the better off your business will be.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. 1-800Accountant assumes no liability for actions taken in reliance upon the information contained herein.

What Is Self Employment Tax In California

When you’re employed by someone, be it in a part-time or full-time job, your employer is responsible for withholding taxes from your paycheck. It’s their responsibility to not only withhold taxes but to also pay them to the government.

Things are a bit different when you’re working for yourself, or in simpler words, when you’re a self employed individual. Your clients won’t be withholding taxes on your behalf. It’s entirely your responsibility to withhold and pay taxes on the income generated from your business.

For taxation, self-employed people are deemed to be independent contractors, since theyre not employed by the client. Thus the California independent contractor tax rate applies to all earnings from the business. The collections are performed by the Franchise Tax Board. They’re responsible for collecting personal and corporate income tax for the State of California.

Read Also: What Is The Best Online Tax Software

Freeze Method For Selling A Business

There are several ways to sell a business. One of the most popular is the freeze approach. The companys operations are frozen until the sale is completed. This can assist to guarantee that the firm remains healthy and sells quickly. It also allows the seller to avoid any taxes that may be due on the transaction.

There are a few things that you can do to make sure that the freeze method is successful. The first is to make sure that all employees are aware of the situation and that they understand what is happening. It is also important to have a plan in place for how the company will be run after the sale is complete. This plan should be communicated to all employees as well. Finally, it is important to make sure that the company is in good financial condition before putting it into freeze mode.

If youre thinking of selling your firm, the freezing technique may be a good alternative for you. It can aid in the smooth sale of your company and might also help you avoid any taxes that are owed. To discover more about the freeze approach and how it may benefit you, get in touch with a tax professional.

Deducting California Income Tax

If you pay California income tax, the IRS allows you to claim a deduction on your federal tax return for them. You can claim a state income tax deduction if you itemize deductions on your federal return. Due to the Tax Cuts and Jobs Act, state and local tax deductions, including state income taxes, are limited to $10,000 per year.

Don’t Miss: How Much In Taxes Do I Pay Per Paycheck

What If A Cannabis Business Cannot Get A Business Checking Account With A Bank

If your cannabis business cannot get a checking account, you are still required to pay payroll taxes. Contact your local Employment Tax Office to make arrangements with an EDD representative.

You must submit California payroll taxes at least quarterly, sometimes sooner based on the total amount of Personal Income Tax withholding of your deposit. Learn more about your payroll filing responsibilities at Required Filings and Due Dates.

Records to keep include, but are not limited to:

- Records of payments or payroll records .

- Other information necessary to determine payments issued to employees.

Employers are required to keep payroll records for a minimum of four years.

Records must include the following information for each worker:

- Social Security number.

- Dates and amounts of payment.

- Pay period covered.

How Do You Check If Youve Paid State Taxes

If you want to make sure your state taxes were paid, contact the California Department of Revenue to see if your payment was received. The contact information is as follows:

If you dont pay California income taxes, you will likely incur penalties and fees. This is the case when you dont:

- Have enough taxes withheld from your paycheck

- Pay electronically when youre required

- Have insufficient funds to pay

View the California states Penalty reference chart for more information.

Recommended Reading: Can I File My Business And Personal Taxes Separately

How Do Tax Relief Services Work

Before a taxpayer becomes a client, an investigation is generally completed. An investigation includes reviewing the taxpayer’s tax transcripts and financial situation to determine the best course of action. A tax company who promises certain outcomes before reviewing a taxpayer’s tax history and financial situation, is not being truthful.

A reputable tax resolution service can help individuals file unfiled tax returns, obtain maximum deductions, stop bank levies, stop wage garnishments, help with audits, possibly remove or lower tax fines, help with tax liabilities, get the taxpayer back into full tax compliance and most importantly prevent future actions from the taxation authorities while keeping your best interest and financial situation in mind.

Do Businesses With No Income Need To File Taxes In California

Do businesses with no income need to file taxes in California? Even if your business has no income, you may have to file a tax return. Sacramento CPAs explain filing requirements for LLCs, corporations, and more.

There are many reasons a business might not receive income. For example, if the business recently launched, the owner may still be in the process of finding clients or purchasing equipment. In other cases, no income is generated because the business is inactive, even if formal dissolution has not taken place. Whatever the reason may be, its important for business owners to understand their tax filing requirements, which differ depending on how the business is structured. If youre a small business owner in California, and your company had no income this year, continue reading to learn whether you are required to file a tax return. Then, contact our Sacramento tax accountants for assistance with all of your bookkeeping, business planning, and tax preparation needs.

Recommended Reading: What Is The Sales Tax In Colorado

Exceptions To The First Year Annual Tax

For tax years beginning on or after January 1, 2021, and before January 1, 2024, LLCs that organize, register, or file with the Secretary of State to do business in California are not subject to the annual tax of $800 for their first tax year.

Short form cancellation

If you cancel your LLC within one year of organizing, you can file Short form cancellation with the SOS. Your LLC will not be subject to the annual $800 tax for its first tax year.

Dubai Court Orders Man To Pay $125b To Denmark In Tax Case

A British man accused by Denmark of masterminding a $1.7 billion tax fraud has been ordered by a Dubai court to pay Copenhagens tax authority $1.25 billion, court filings seen Friday show, just days after another Dubai court rejected an extradition order for him.

The order by the Dubai Court of Appeal against Sanjay Shah comes as part of a civil case filed four years ago by Denmarks tax authority, who have been pursuing him as part of their investigation in one of the countrys largest-ever tax fraud case.

Shah has maintained his innocence in the case while fighting extradition. A spokesman for Shah, Jack Irvine, said Shahs lawyers planned to appeal the ruling. That appeal would be heard by Dubais Court of Cassation, the emirates highest court.

Denmark has accused Shah of masterminding an elaborate tax scheme for three years beginning in 2012 involving foreign businesses pretending to own shares in Danish companies and claiming tax refunds for which they were not eligible.

The Danish tax authority, Skattestyrelsen, filed the civil case in Dubai against Shah in 2018. In its decision Wednesday, the Dubai Court of Appeal said Denmark had sought $1.9 billion from Shah and his alleged accomplices.

During his time in Dubai, the hedge fund manager ran a center for autistic children that shut down in 2020 as Denmark tried to extradite him. He also oversaw a British-based charity, Autism Rocks, which raised funds through concerts and performances.

Also Check: Can You File 2 Years Of Taxes At Once

Is Buying A Commercial Property A Good Investment

The commercial real estate market is very hot right now and prices are at all-time highs. Many people are wondering if buying a commercial property is a good investment. The answer is that it depends on a number of factors. If you are looking to buy a property for your business, then it is a good investment. However, if you are looking to buy a property as an investment to rent out, then you need to be careful. The market is very volatile and prices could drop suddenly. You need to do your research and talk to a professional before making any decisions.

It is possible to make a profit with commercial real estate investment, but you must be willing to accept some risk. Choosing a property with a large number of tenants is one way to make money in real estate. Retail real estate in high-traffic areas is particularly well-suited to them. If youre new to commercial real estate, you could also be interested in triple net properties. Commercial properties have an annual return on investment of up to 12% for properties purchased at a price of up to 12%. The owner of a commercial property is more likely to own a small business than a large one. In most cases, businesses close at night so that you do not have to work unless they do.