State Unemployment Tax Act

In addition to FUTA, most states impose unemployment taxes as well. Its the states responsibility to pay unemployment benefits to certain eligible workersand they fund this liability using payroll taxes.

Each state has unique rules and rates for this tax. Some of these state taxes are better for employees, while others are better for businesses.

For states with unemployment tax, the concept is fairly straightforward. Taxes are imposed on businesses based on the claims rate. If a business has lots of former employees filing for unemployment benefits, the tax rate imposed on that business will be higher.

In essence, state unemployment taxes can be compared to insurance. Fewer claims translate to lower rates.

Assume An Employer Does Not Defer The Employer’s Share Of Social Security Tax By Reducing Its Deposits During A Quarter And That When The Employer Files Its Form 941 The Employer’s Liability For All Employment Taxes For The Quarter Has Been Fully Paid As A Result Of Deposits Made During The Quarter Can The Employer Then Choose To Defer The Payment Of The Employer’s Share Of Social Security Tax Already Deposited By Claiming A Refund Or Credit On Its Form 941

No. Employers that have already deposited all or any portion of the employer’s share of Social Security tax during the payroll tax deferral period may not subsequently defer payment of the tax already deposited and generate an overpayment of tax, including for the first calendar quarter. However, to the extent the employer reduces its liability for all or part of the employer’s share of Social Security tax based on credits claimed on the Form 941, including the Research Payroll Tax Credit, the FFCRA paid leave credits, and the employee retention credit, and has an overpayment of tax because the employer did not reduce deposits in anticipation of these credits, the employer may receive a refund of Social Security tax already deposited.

What Is Income Tax

Income tax is money taken from an employee’s wages. The federal government, most state governments and some local governments collect income taxes to fund their programs. The Internal Revenue Service sets the laws and rules for how federal income tax is calculated and collected. Each employee pays a different amount of income tax depending on their personal elections and wages earned. As a business, you don’t actually pay this tax for your employees, but you are required to withhold it from their pay and remit it to the IRS or the applicable state or local tax authorities.

This government database lists the state and local governments that currently collect income taxes.

You May Like: Buying Tax Liens California

Outstanding Returns And Annual Reconciliation

Online Payroll Tax provides a wage breakdown function which automatically totals the wage payments that constitute either taxable or exempt wages and calculates the amount of tax payable.

Annual reconciliations must be completed by 21 July, or earlier if the individual clients circumstances require it.

All WA wages must be lodged for the entire current financial period. If the insolvent client pays interstate wages, lodge the Australian taxable wage details for the entire current financial period.

How To Do Payroll Yourself For Your Small Business

Payroll for your company doesnt have to be an impossible task. If youre looking to learn how to manually process payroll yourself, you have some options.

Below, we walk you step by step through what each process entails, as well as which option might be best for your business. Remember, this post is for educational purposes only. For specific advice, be sure to consult with a professional.

Read Also: Otter Tail County Tax Forfeited Land

May An Employer That Has Control Of The Payment Of Wages Within The Meaning Of Section 3401 Of The Internal Revenue Code Motion Picture Project Employer Defer Deposit And Payment Of The Employer’s Share Of Social Security Tax Without Incurring Failure To Deposit And/or Failure To Pay Penalties

Yes. An employer described in section 3401 or section 3512 of the Code may defer deposit and payment of the employer’s share of Social Security tax for which it is liable under the Code. The employer for whom services are provided who does not have control of the payment of wages may not defer deposit and payment of the employer’s share of Social Security tax.

Enter State Tax Details

Below is a screenshot along with a brief explanation of the information that is required for state taxes, if applicable. The layout will vary depending on the state in which you do business and your employees reside, so skip the sections below that dont apply to you.

If you are lucky enough to live in one of the seven states without a state income tax then you will not see an option to enter your state withholding account number option on the setup screen you will likely, however, need to answer a question about your state unemployment insurance rate.

Its not a good idea to file tax returns or make tax payments without this number. If you do, you run the risk of not receiving credit for the payment because it will be difficult for the EDD to identify you without an account number.

before

To e-file and e-pay your taxes, youll need to provide bank information for the account you want to use for payroll tax payments. Click the green button that shows Lets go beside Connect Your Bank to get started

Don’t Miss: How Does H And R Block Charge

Payment When Filing Via A Paper Return

To ensure your payment is posted to your tax account, you must include the eight-digit Colorado Account Number on your check or money order.

Omitting your CAN may delay processing and/or cause the account to have a balance due, which will result in your business receiving a Balance Due letter from the Department.

A Federal Employer Identification Number is not the same as the CAN and will not post the payment to your account.

How Can I Get A Refund If I Overpaid My Payroll Tax

Your employer is required by law to file an annual return by February 28 following the calendar year for which the annual return applies. The annual return will indicate whether you, as an employee, have overpaid or underpaid payroll tax for the year. If you underpaid the tax, your employer is required to collect extra tax from you and remit the amount to the GNWT. If you have overpaid, your employer must refund the overpayment to you.

Read Also: Where’s My Tax Refund Ga

How Does The $100000 Next

An employer that accumulates liability for $100,000 or more in employment taxes on any day during a monthly or semiweekly deposit period must deposit the employment taxes the next business day. The regulations under sections 3111 and 6302 of the Internal Revenue Code provide that liability for the employer’s share of Social Security tax is accumulated as wages are paid. The deferral under section 2302 of the CARES Act is a deferral of deposits, not a deferral of the tax liability. Accordingly, the $100,000 next-day deposit rule must be applied without regard to the deferral of the employer’s share of Social Security tax. However, the amount deposited may be reduced by the deferred portion of the employer’s share of Social Security taxes. For example, if an employer accumulates $110,000 of employment tax liabilities and defers deposit of $20,000 for the employer’s share of Social Security tax, the employer must still deposit the next day under the $100,000 rule but is only required to deposit $90,000 .

Calculate Your Federal Unemployment Tax On Form 940

If you are an employer and pay wages of $1,500 or more in any calendar quarter of the previous year, or if you had one or more employees who worked at least 20 or more different weeks, then you have a responsibility to pay FUTA. If so, report the amount of tax you owe for the year on Form 940 by January 31.

However, you must determine the amount of tax you owe each quarter and make a payment when the cumulative amount for the year reaches $500. If after one quarter you owe less than $500, carry it forward and evaluate the amount again after the next quarter.

You May Like: How To Look Up Employer Tax Id Number

How To Pay Late Payroll Taxes

On This Page, You can easily know about How To Pay Late Payroll Taxes.

Running a small commercial enterprise isnt any small feat there may be plenty to preserve up with, such as making well-timed deposits of taxes you withheld out of your personnel paychecks. If youve got neglected the deadline, do not worry! You can nevertheless make your price . The simplest manner to pay past due payroll taxes is through the Electronic Federal Tax Payment System . If you have no installation of an account with FTPS yet, move beforehand and do this as quickly as feasible. EPS is simplest a set device and may not calculate the quantity you owe for you, so test your Form 941 or the awareness youve got acquired from the IRS approximately past due bills to ensure you pay the appropriate quantity.

Types Of Payroll Taxes

While the withholding percentage may vary from employee to employee, all employees are subject to a minimum of federal payroll taxes. These taxes are specified in the Federal Insurance Contributions Act and include federal income, Social Security, federal unemployment, and Medicare taxes. These tax-withholding rules apply regardless of whether employees are part-time, seasonal, or full time.

In addition to the minimum required federal payroll taxes, different states may require specific withholdings as well. Here are some additional details on federal and state payroll taxes important for employers to understand in order to ensure payroll tax compliance:

Level

Recommended Reading: How To Buy Tax Liens In California

What Constitutes Payroll Tax

Payroll taxes are taxes levied by employers or employees and are generally calculated as a percentage of the wages an employer pays to its employees. Income taxes are generally divided into two categories: deductions from the employee’s wages and taxes paid by the employer based on the employee’s wages.

Deduct Other Required Amounts From Gross Pay

Employers are also required to deduct amounts for social security, Medicare, and federal unemployment taxes.

Keep in mind that the employer must calculate each tax withholding for each individual worker.

The business reports the information and submits payment to each taxing authority.

- Social Security provides an income to retired people and those who are disabled.

- The tax rate is 6.2% for 2015. Once an employee has reached a gross cumulative pay of $118,500, no additional Social Security tax is withheld.

- Medicare provides medical coverage for the elderly and people who are disabled.

- The 2015 tax rate is currently 1.45%. All wages are subject to this tax.

- Employers pay into both a state unemployment tax and a federal unemployment tax system.

- Both systems provide income to people who are out of work.

- You should pay the required state tax first.

- The federal tax calculation allows you to receive a credit for taxes youre paid into your state system.

Also Check: What Does Locality Mean On Taxes

Canadian Payroll Calculator 2021

Canadian Payroll Calculator the easiest way to calculate your payroll taxes and estimate your after-tax salary.

If you have a job, you receive your salary through the monthly, bi-weekly or weekly payroll. But do you know what is payroll and how is it calculated? How do you calculate your take-home pay? How do you calculate your payroll deductions? We know, and well show it to you.

Payroll is the process where the employer calculates the wages and distributes it to the employees. The company withholds taxes, CPP and EI contributions from the paycheque, and the remaining amount is paid to the employees.

In Canada there are federal and provincial income taxes paid, while CPP is a contribution to the Canada Pension Plan, and EI is a contribution to the Employment Insurance program.

The federal income tax deduction depends on the level of the annual income, and it ranges between 15% and 33%. The provincial income tax deduction also depends on the annual income, but it has different rates from province to province.

Contributions to the Pension Plan guarantees that the contributor or his/her family will receive a partial replacement of earnings in case of retirement, disability or death. Residents of Quebec are contributing to the Quebec Pension Plan , while all other Canadian workers are contributing to the Canada Pension Plan .

Learn The Difference Between The Employment Taxes Most Businesses Need To Withhold: Payroll Vs Income Tax Presented By Chase For Business

If your business issues paychecks, you need to withhold various federal, state and local taxes for the government. Payroll tax and income tax are the most common employment taxes. Understanding the differences between them and making sure you manage withholding properly are two of the most important parts of payroll management.

You May Like: How Can I Make Payments For My Taxes

Changing Amounts On Form W

Employees may change the amounts on Form W-4 at any time and as often as they wish. There is no time limit on how long Form W-4 stays in effect it remains in effect until the employee changes it. At termination, Form W-4 continues in effect for withholding of FICA taxes for payments made after the termination date.

The most current Form W-4 must be signed by the employee and kept in the employees payroll folder to verify the amount of federal income tax withholding.

When To Pay Federal Payroll Taxes As An Employer

Tax code determines which employers pay FICA and Medicare taxes monthly, semi-weekly, or the next day.

Employers who follow the monthly deposit schedule must make payments by the 15th of the next month.

Employers who follow the semi-weekly deposit schedule and pay their employees between Wednesday and Friday must file payroll taxes by the following Wednesday. Those who pay their employees between Saturday and Tuesday have until the next Friday to file taxes with the IRS.

FUTA tax payments are made quarterly to the IRS and are due before the end of the first month, after the end of the quarter.

Also Check: 1040paytax.com Official Site

Gather All Of The Payroll Information For Each Pay Period

As an employer, you may process payroll weekly, bi-monthly or once a month.

Regardless of how often you pay, you need to gather the necessary records to compute gross wages.

- You need to maintain updated payroll records for each employee.

- While some companies keep spreadsheet records, you can operate more efficiently by using payroll software.

- Your records should indicate each employees current salary. For hourly workers, you need to document the hourly rate of pay, including overtime pay. Payroll software can calculate which employee hours should be counted as overtime.

- Hourly workers should post their time using a formal timecard. You need a specific process in place to track the exact number of hours worked each day. Employers should be required to immediately post their time each day, so that your records are always current.

What Are Payroll Taxes

![Types of Taxes We Pay in the US [INFOGRAPHIC] Types of Taxes We Pay in the US [INFOGRAPHIC]](https://www.taxestalk.net/wp-content/uploads/types-of-taxes-we-pay-in-the-us-infographic-tax-relief.jpeg)

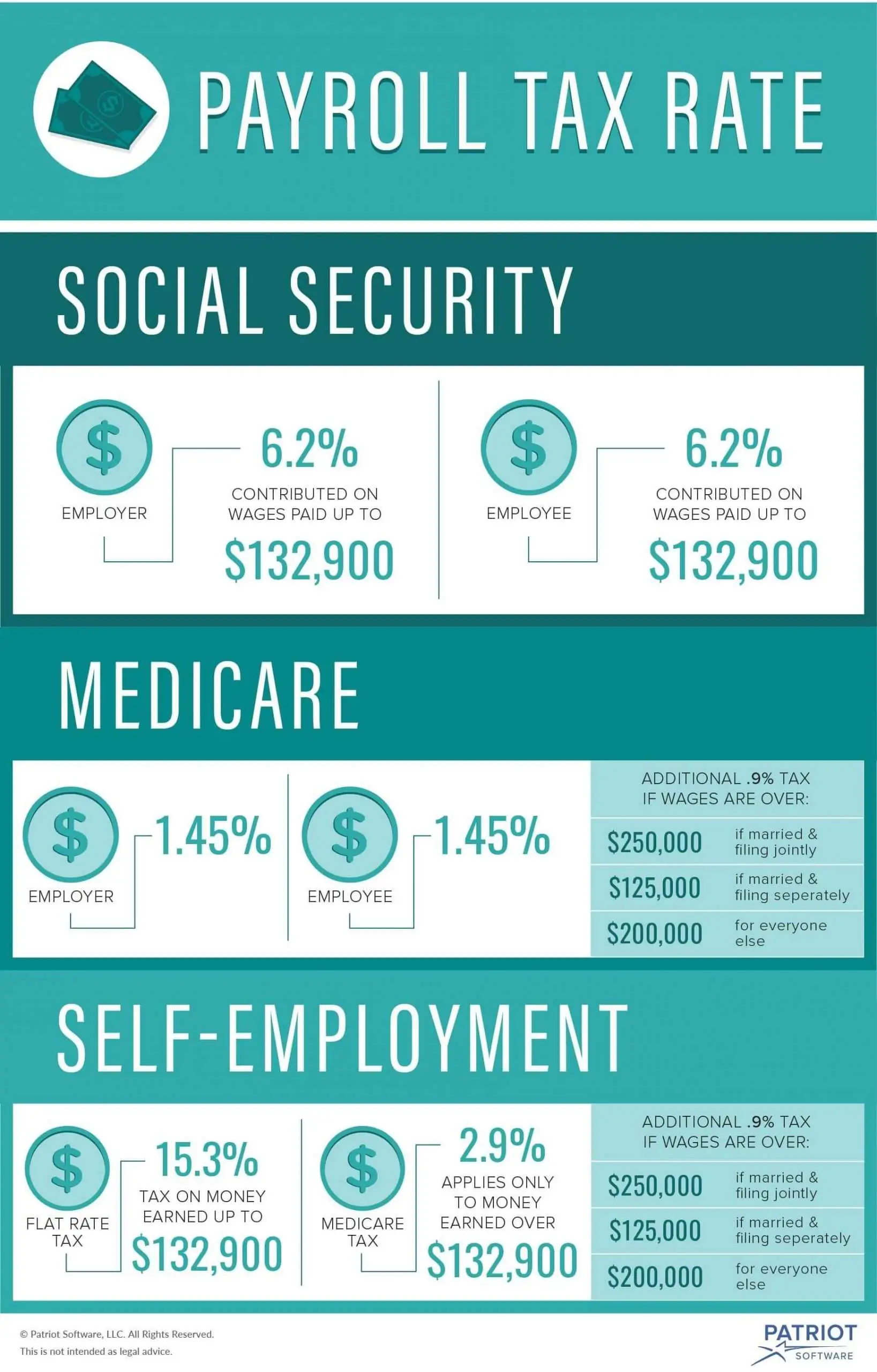

Payroll taxes are taxes based on salaries, wages, commissions and tips an employee makes. They are withheld from their paychecks by their employer, who then pays them to the government. Payroll taxes are used to fund social insurance programs like Social Security and Medicare and show up as FICA and MedFICA on pay stubs.

Its important not to confuse federal payroll taxes with federal and state income taxes, even though both are taken out of an employees pay. The difference between these two taxes is that payroll taxes fund specific social programs, while income taxes go to the U.S. Treasurys general funds. Additionally, every worker pays a flat payroll tax rate, while income taxes vary based on an employees earnings.

Don’t Miss: Michigan.gov/collectionseservice

How Do I Calculate My Employees Payroll Taxes

Youll need three things to figure out an employees payroll taxes. First, youll need the amount of the workers taxable wages for the pay period. Second, youll need to look at the workers W-4, which will show their number of withholding allowances. Then, youll need to consult the IRS worksheets and withholding tables in Publication 15 to find the amount to withhold for federal income taxes. Depending on your state and municipality, you may need to do a similar process to figure out state and/or local taxes. Youll also need to factor in the amount due for Social Security and Medicare, which take 6.2% and 1.45% of the workers income respectively.