Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Roth Conversions Can Be An Effective Strategy For Managing Your Taxes In Retirement But Only In The Right Situations

A Roth conversion involves moving funds that are held in either a traditional IRA or a standard 401 into a Roth IRA. The benefit of doing a Roth conversion is twofold: a lower tax burden in retirement and reduced required minimum distributions .

This conversion process is not as simple as it sounds. Before you count on the prospect of lower taxes and more freedom to hold money in your account, look at these six must-know facts about Roth conversions.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

A qualified distribution from a Roth IRA is tax-free and penalty-free. To be considered a qualified distribution, the 5-year aging requirement has to be satisfied and you must be age 59½ or older or meet one of several exemptions .

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Recommended Reading: Is Past Year Tax Legit

Pros And Cons Of A Roth Ira Conversion

Roth IRAs are available to people who earn a specific amount of money, which means if you make more than the earnings threshold, you’re not eligible for a Roth IRA. Unfortunately, you’re stuck paying taxes on withdrawals from your retirement account when you finally retireor maybe you’re not.

Many retirement savers not eligible for a Roth IRA do a conversion to reduce the taxes they pay in retirement, moving their money from a traditional IRA to the Roth variety. This strategy is known as a Roth conversion. It’s also called a backdoor Roth IRA conversion because it allows people not ordinarily eligible due to their income to set up a Rothsneaking in the back door, so to speak.

How To Pay The Tax Bill From A Roth Conversion

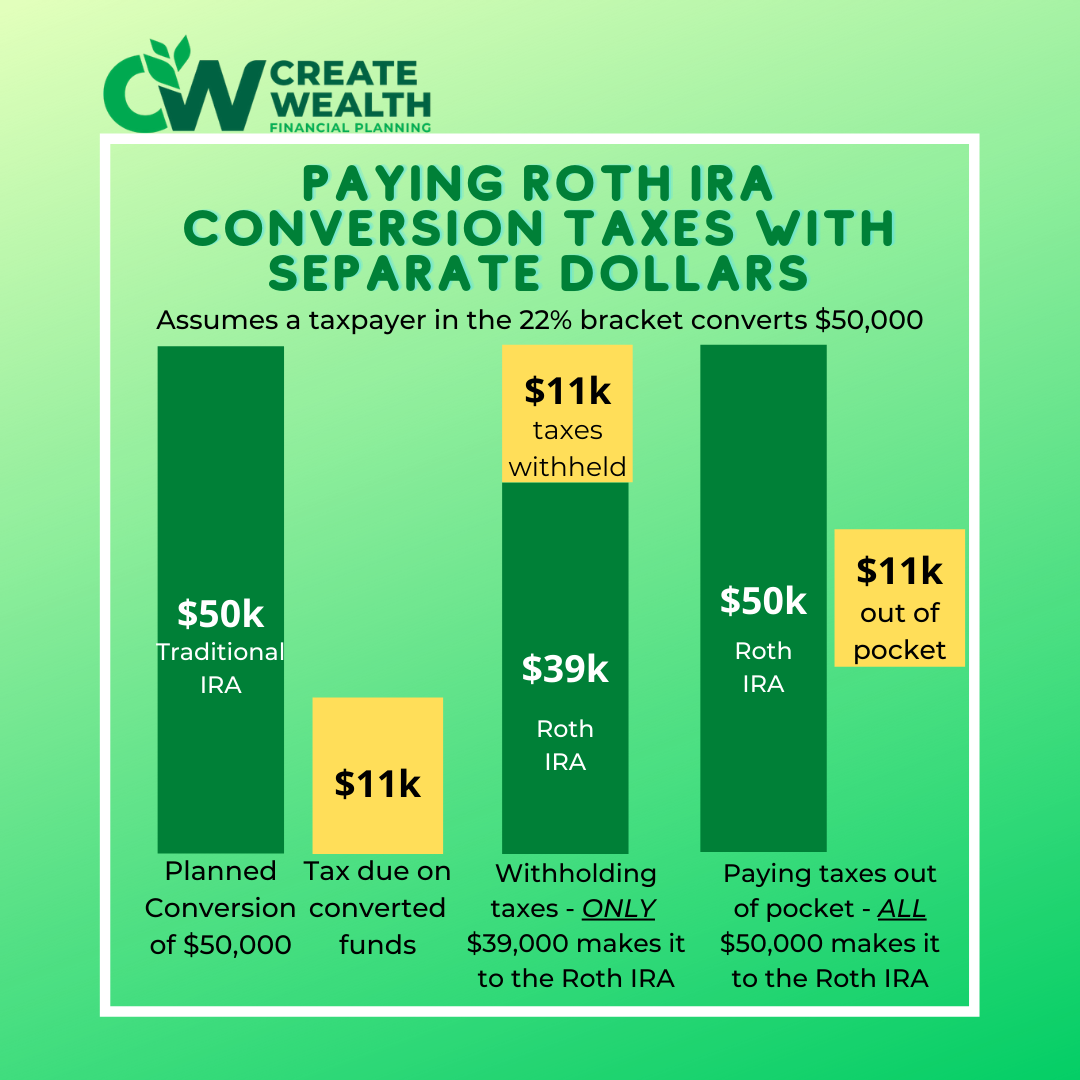

Regular readers will know how strongly I believe in Roth conversions. Typically, when discussing Roth conversions, not enough attention is paid to the tax incurred. Depending on the size of the conversion, you could wind up with a pretty large tax bill .

For people who may want to convert a large amount of tax-deferred dollars to a Roth IRA, it raises an interesting question: How do you pay the tax from a Roth conversion?

Roth conversion overview

To ensure everyone is on the same page, its helpful to take a step back and look at what a Roth conversion entails. A Roth conversion means moving money from a traditional IRA that is tax-deferred into a Roth IRA. Assets inside of a Roth IRA potentially grow tax-deferred, and any qualified distributions are tax-free.

The downside, as mentioned earlier, is that youll be paying income taxes on the amount converted. So long as youre able to pay the tax bill, theres no limit on how much money you can convert to a Roth in a given year.

How best to pay the Roth conversion tax

Lets imagine you want to convert $60,000 to a Roth IRA and are in the 25 percent federal tax bracket. Setting aside state income taxes, youd owe the IRS $15,000. The best way to pay the tax on your Roth conversion is with savings that are liquid and arent in a retirement account.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

You May Like: Can You Write Off Refinance Closing Costs On Taxes

What Else Could A Conversion Affect

Health care is an important part of the Roth conversion puzzle. If the conversion would push your taxable income above a certain threshold, your Medicare Part B premiums could go up. Converting too much could also cause a larger percentage of your Social Security benefits to be taxed. If you are under age 65 and not yet eligible to qualify for Medicare, and no longer covered by an employer plan, then you likely are looking at Affordable Care Act Marketplace plans for your health insurance needs. ACA plans provide premium tax credits to families whose income falls between 100% and 400% of the federal poverty level. However, theres a subsidy cliff at the 400% poverty level, meaning if you make $1 too much, you have to pay the full-priced premium. These subsidies can equate to thousands of dollars a year, so disqualifying yourself through Roth conversions can be a serious cost.

Theres some good news, though. The American Rescue Plan Act of March 2021 increased the subsidies and allowable income for 2021 and 2022. This gives those on Marketplace plans an opportunity to convert to a Roth IRA without losing their health insurance subsidies because of the temporary increase in income.

What Portion Of A Roth Conversion Is Taxable

Roth IRA Conversion Tax Estimator1 Unlike a Traditional IRA, there is no income tax on qualified withdrawals from a Roth. If all of the contributions you have made to non-Roth IRA over the years were tax-deductible, then you will owe income tax on 100% of the amount you wish to convert.

Don’t Miss: Where Can I Get Tax Forms

What Is The Backdoor Roth Ira And How Does It Work

If your income is too high to contribute to a Roth IRA outright, the Backdoor Roth IRA offers a potential workaround. This strategy has consumers invest in a traditional IRA first since these accounts dont come with income limitations in terms of who can contribute. From there, a Roth IRA conversion takes place, letting those high-income investors take advantage of tax-free growth and future distributions without having to pay income taxes later on.

A Backdoor Roth IRA can make sense in the same scenarios any Roth IRA conversion makes sense. This type of investment strategy intends to help you save money on taxes later at the cost of higher taxes now, in the year you make the conversion.

The big disadvantage of a Backdoor Roth IRA is a whopping tax bill, youre hoping to lower your tax liability in the future. Thats a noble goal but, once again, the Backdoor Roth IRA only makes sense in situations where tax savings can truly be realized.

Roth Ira Conversion Calculator

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Also Check: Who Do I Call About My Tax Return

Whats The Difference Between A Traditional And A Roth Ira

The biggest difference between a Roth IRA and a traditional IRA is the timing of the taxes you pay. Contributions to traditional IRAs are tax-deductible, but withdrawals in retirement are taxable. Roth IRAs function in the opposite way. Contributions to Roth IRAs arent tax-deductible, but qualified withdrawals in retirement are tax-free. Essentially, its a matter of paying taxes now or later .

Roth Conversions Are Available For 401s Too

Roth conversions aren’t just for your traditional IRA balances. If you’ve left a job and still have funds in your former employer’s 401, you can convert some or all of that money to a Roth IRA. This is an alternative to the conventional, nontaxable 401 rollover that would move your savings into a traditional IRA.

A 401 Roth conversion is taxed in the same way as an IRA conversion. You’d owe income taxes on pre-tax contributions, plus any earnings.

As with an IRA, if you have any nondeductible contributions in your 401, the taxation gets more complicated. Generally, you’ll incur taxes for converting the pro-rata share of pre-tax funds in your account. If you don’t have nondeductible contributions, things are more clear-cut. You’d simply pay taxes on the entire converted amount.

Recommended Reading: How Do Taxes Work With Robinhood

How Much Do You Pay In Roth Conversion Taxes

Roth conversions are treated like ordinary income and taxpayers have to include the balance on their tax returns. How much you have to pay in taxes depends upon the amount of the conversion plus your adjusted gross income. Heres what you need to know. A financial advisor could help you put a tax plan together for your retirement investments and goals.

Can I Convert Money From A Traditional 401 To A Roth Ira

Yes, once retired or while still working if your plan permits in-service withdrawals from your 401. Then you can convert your traditional 401 either through a direct rollover to a Roth IRA or by rolling funds over to a traditional IRA, and then converting to a Roth IRA.

Tip: For more detail, see Converting your traditional IRA to a Roth IRA which includes a Roth conversion tool and a checklist.

Also Check: How Do I File Federal Taxes For Previous Years

What Are The Tax Benefits Of A Roth Conversion

We talk a lot about diversifying the assets in your portfolio, but its also helpful to diversify your tax strategy. For some, a Roth conversion can offer:

- Protection against uncertainty. No one can predict what tax rates will be, or how theyll change over time. Current tax rates and estate tax exemption amounts expire in 2025 and are subject to change as part of the Build Back Better plan. You can hedge your tax risk by having money in a broader range of taxable and tax-advantaged accounts. That way, youll minimize the risk that changes to the tax code will diminish the value of your investments.

- Tax-free withdrawals in retirement. Unlike withdrawals from a traditional IRA, qualified Roth IRA withdrawals are generally tax-free. If you are under age 59½ at the time of the withdrawal, you may be subject to tax and penalty, unless an exception applies.

- Tax-free growth. Roth IRAs don’t have required minimum distributions during your lifetime, so your money can stay in your account and keep growing tax-free.

- Tax-free inheritance. When your beneficiaries inherit IRA assets, in most cases they are required to distribute those assets within 10 years of your passing. For traditional IRA assets, those distributions will be considered taxable income, while assets in a Roth IRA are tax-free.

If youre ready to get started, we offer tutorials to make the process easy.

Roth Ira Conversion Examples

Whenever youre dealing with numbers, its always helpful to demonstrate the concept with examples. Here are two real-life examples that I hope will illustrate how the Roth IRA conversion works in the real world.

Example 1Parker has a SEP IRA, a Traditional IRA, and a Roth IRA totaling $310,000. Lets break down the pre-and post-tax contributions of each:

- Traditional IRA: Consists entirely of after-tax contributions. Total value is $200,000 with after-tax contributions of $40,000.

- Roth IRA: Obviously all after-tax contributions. Total value is $30,000 with total contributions of $7,000.

Parker is wanting to only convert half of the amount in his SEP and Traditional IRA to the Roth IRA. What amount will be added to his taxable income in 2022?

Heres where the IRS pro-rata rule applies. Based on the numbers above, we have $40,000 in total after-tax contributions to non-Roth IRA. The total non-Roth IRA balance is $280,000. The total amount that is desired to be converted is $140,000.

The amount of the conversion that wont be subject to income tax is 14.29% the rest will be. Heres how that is calculated:

Step 1: Calculate non-taxable portion of total Non-Roth IRAs: Total after-tax contributions / Total Non-Roth IRA Balance = Non-Taxable %:

$40,000 / $280,000 = 14.29%

Step 2: Calculate the non-taxable amount by converting the result to Step 1 into dollars:14.29% x $140,000 = $20,000

Based on the above information, what will be Bentleys tax consequence in 2022?

You May Like: Can You Pay Taxes Online

How To Do A Roth Ira Conversion

If you decide that a Roth IRA conversion makes sense for you, heres what you need to do to make it happen:

- Put money into a traditional IRA . Youll have to open and fund a new account if you dont have one already.

- Pay taxes on your IRA contributions and earnings. If you deducted your traditional IRA contributions , you have to give back that tax deduction now.

- Convert the account to a Roth IRA. If you dont yet have a Roth IRA, youll open one during the conversion.

There are a few ways to do the conversion:

- Indirect rollover. You get a distribution from your traditional IRA and put it in your Roth IRA within 60 days.

- Trustee-to-trustee rollover. Ask your traditional IRA provider to transfer the funds directly to your Roth IRA provider.

- Same trustee transfer. If the same provider maintains both of your IRAs, you can ask that provider to make the transfer.

How Can I Manage Taxes On A Roth Conversion

Tax deductions can also help offset the tax cost of a Roth IRA conversion. For example, you may be able to take a tax deduction for donations to qualified charities. In general, by making charitable contributions with cash, you can deduct your charitable contribution up to 60% of your adjusted gross income . The deduction is usually limited to 30% of AGI for donations to some private foundations and some other organizations, as well as for contributions of non cash assets. Note, however, that if your itemized deductionswhich include charitable contributionsdo not exceed the standard deduction, there wouldn’t be any tax benefit from those charitable contributions. So be sure to consult with your tax advisor to plan your charitable strategythere are techniques that can help ensure you enjoy the potential tax benefits of your charitable giving.

Learn more at FidelityCharitable.org

Don’t Miss: Where’s My Tax Refund Ny

How To Pay Taxes On A Roth Conversion

Converting to a Roth IRA requires filing Form 8606, Nondeductible IRAs, with your Form 1040 tax return. You would report the taxable amount of your conversion on this form, then transfer it to your tax return. You should receive a Form 1099-R from your financial institution after the end of the year, reporting the amount of the conversion. The IRS receives a copy of this form as well.

You can elect to have taxes withheld from the converted amount if you don’t want to have to deal with this when you file your return. You would still have to report the event on Form 8606, but you would also report the amount of taxes that were already withheld and paid so you dont have to deal with a higher tax bill at the time you file.

You can make estimated tax payments in advance throughout the year to cover the tax on the additional income.

How Should I Pay Tax On A Roth Ira Conversion

Q. I have read that, unless you have available cash to pay the taxes on the Roth IRA conversion, it doesnt make sense to convert. Is this true and are there any circumstances when it might make sense or be acceptable to pay the taxes from the IRA itself?

Investor

A. Lets take a closer look at converting a traditional IRA to a Roth IRA.

When you convert, you are voluntarily paying the income taxes on your IRA now so it will grow tax-free in the future.

People who convert a traditional IRA to a Roth do so because they believe they are in a lower tax bracket now then they will be when they are retired, said Bernie Kiely, a certified financial planner and certified public accountant with Kiely Capital Management in Morristown.

Indeed, most people are in a higher tax bracket when they are working than when they are retired, he said.

Conventional wisdom says the most efficient way to convert a traditional IRA to a Roth IRA is to pay the required income tax out of a taxable account and not from the IRA itself, Kiely said. The reasoning for this is you want to have the most amount growing tax free in your Roth IRA.

He offered this example:

If you have sufficient funds in a taxable bank account to pay the taxes you will have $100,000 in your Roth account growing tax free, he said. If you cant cover the tax then you would have to have $22,545 withheld from the IRA and only $77,455 would wind up in your Roth.

Don’t Miss: Can You E File Arkansas State Taxes