Do I Have To Pay Taxes On Stocks Robinhood

As always, you won’t have to pay tax on a stock simply because its value increased. You will, however, need to pay tax on any profits you make when you sell stock. Stocks held less than one year are subject to the short term capital gains tax rate, which is the same tax rate you pay on your ordinary income.

Make Sure You Know What You’ll Pay Before You Sell Your Shares

One of the best tax breaks in investing is that no matter how big a paper profit you have on a stock you own, you don’t have to pay taxes until you actually sell your shares. Once you do, though, you’ll owe capital gains tax, and how much you’ll pay depends on a number of factors. Below, you’ll learn the key factors in determining how much tax you’ll owe after a stock sale.

The basics of capital gainsUnder current tax law, you only pay tax on the portion of sales proceeds that represent your profit. To figure that out, you generally take the amount you paid for the stock, and then subtract it from what you received when you sold it. If you had a loss, then not only do you not have to pay tax, but you can also use it as a deduction against other capital gains, and sometimes against other types of income.

The tax laws also distinguish between long-term capital gains and short-term capital gains. If you’ve owned a stock for a year or less, then any gain on its sale is treated as short-term capital gain. You’ll pay the same tax rate that you pay on other types of income, and so the amount of tax due will vary depending on what tax bracket you’re in.

Selling stock at a profit is always nice, but it comes with a tax hit. Knowing what you’ll owe can make you think twice about whether you really want to sell at all.

How Capital Gains Taxes Workand How You Can Minimize Them

Small Business Taxes, The Complete Idiots Guide to Starting a Home-Based BusinessGuide to Self-Employment, The Wall Street JournalU.S. News and World Report

Its easy to get caught up in choosing investments and forget about the tax consequencesparticularly, the capital gains tax. After all, picking the right stock or mutual fund can be challenging enough without worrying about after-tax returns. Likewise, selling a home can be a daunting task, even before you consider the tax bill.

Still, figuring taxes into your overall strategyand timing when you buy and sellis crucial to getting the most out of your investments. Here, we look at the capital gains tax and what you can do to minimize it.

Don’t Miss: Do You Pay Transfer Tax On Refinance In Florida

Which Assets Qualify For Capital Gains Treatment

Capital gains taxes apply to what are known as capital assets. Examples of capital assets include:

- Real property used in your trade or business as rental property

Also excluded from capital gains treatment are certain self-created intangibles, such as:

- Literary, musical, or artistic compositions

- Letters, memoranda, or similar property

- A patent, invention, model, design , or secret formula

The Tax Cuts and Jobs Act, passed in December 2017, excludes patents, inventions, models, designs , and any secret formulas sold after Dec. 31, 2017, from being treated as capital assets for capital gain/capital loss tax purposes.

How To Pay Lower Taxes On Stocks

Here are five strategies that might make an impact on your tax bill:

- Buy and hold. Holding onto your investments for a year or more may help you secure the lower long-term capital gains tax rate for dividends and money you make selling stock.

- Open a traditional or Roth IRA. These accounts offer multiple tax advantages that might add up to significant tax savings over the long term.

- Contribute to your 401 or 403 plan. With pre-tax contributions and deferred taxes on earnings, your contributions could reduce your taxes today and tomorrow.

- Hold dividend-paying stocks in tax-advantaged accounts. Any tax-advantaged retirement account might reduce your tax liability. For instance, dividends earned on stocks in a 401 or individual retirement account arent taxed until you make qualified withdrawals. And in most cases, dividends earned in a Roth IRA are not taxable, provided you follow withdrawal rules.

- Use short-term capital losses to offset long-term capital gains. By investing strategically, you may be able to balance out losses and gains to reduce the amount of taxable income you receive from selling stocks.

You May Like: Do I Pay Taxes On Cryptocurrency Gains

The Basics On How To Pay Taxes On Stocks

If you sell stock for less you bought it for, you wont owe any income tax on the losses. In fact, you may be able to use this loss to reduce your taxes. If you sell stock for more than you paid, however, youll have a profit and may need to pay taxes on that gain.

If youve owned the stock for less than a year before selling it at a profit, youll owe taxes on it at your regular income tax rate. If you owned the stocks for more than a year, the long-term capital gains tax rates apply. These rates are dependent on your overall income, but may be 0%, 15% or 20%.

You can use SmartAssets capital gains calculator to estimate the taxes youll owe. The calculator can also figure the estimated capital gains taxes on profits from sales of other assets, such as real estate, collectibles and cryptocurrency.

A basic strategy for reducing taxes on stock sale profits is to hold stocks that have appreciated since purchase for at least a year before selling them. This ensures profits on stock sales will be taxed at the usually lower capital gains rate. Another approach is to sell stocks that have declined in value in order to generate a loss that can be used to shelter gains.

Understand The Tax Implications When You Invest

If you earn money through your investments, it will likely affect your taxes. There are a number of strategies you can employ to possibly reduce the taxes on stocks. You may wish to work with a tax professional to understand how various approaches work for your personal circumstances. And Stashs Tax Resource Center can help you stay on top of important tax dates and forms.

Read Also: Where Do I Go To Pay My Property Taxes

What Is Subject To Tax

It’s important for all investors to know that any gains they make is considered taxable income.

“People think sometimes that they’re going to make a lot of money in this market and that they won’t be subject to the same taxes,” said Sheneya Wilson, CPA and founder of Fola Financial in New York. Instead, profits from sales of stocks as well as any dividends earned are subject to capital gains taxes.

Other assets are taxed, as well. For instance, investors pay capital gains taxes on cryptocurrencies, some bonds and some mutual funds.

“This is surprise unintended income that you might have to report,” said Gorman.

Do I Pay Taxes On Stocks I Don’t Sell

If you dont sell shares of stock that you own, there are no capital gains taxes due, even if the shares increase in value. If you hold the stocks until you die, they would pass to your heirs, who may or may not owe taxes on the inheritance. If the stock pays a dividend, these payments would be taxable to you while holding the shares, but this is not a capital gains tax.

Don’t Miss: Can I File Taxes After Deadline

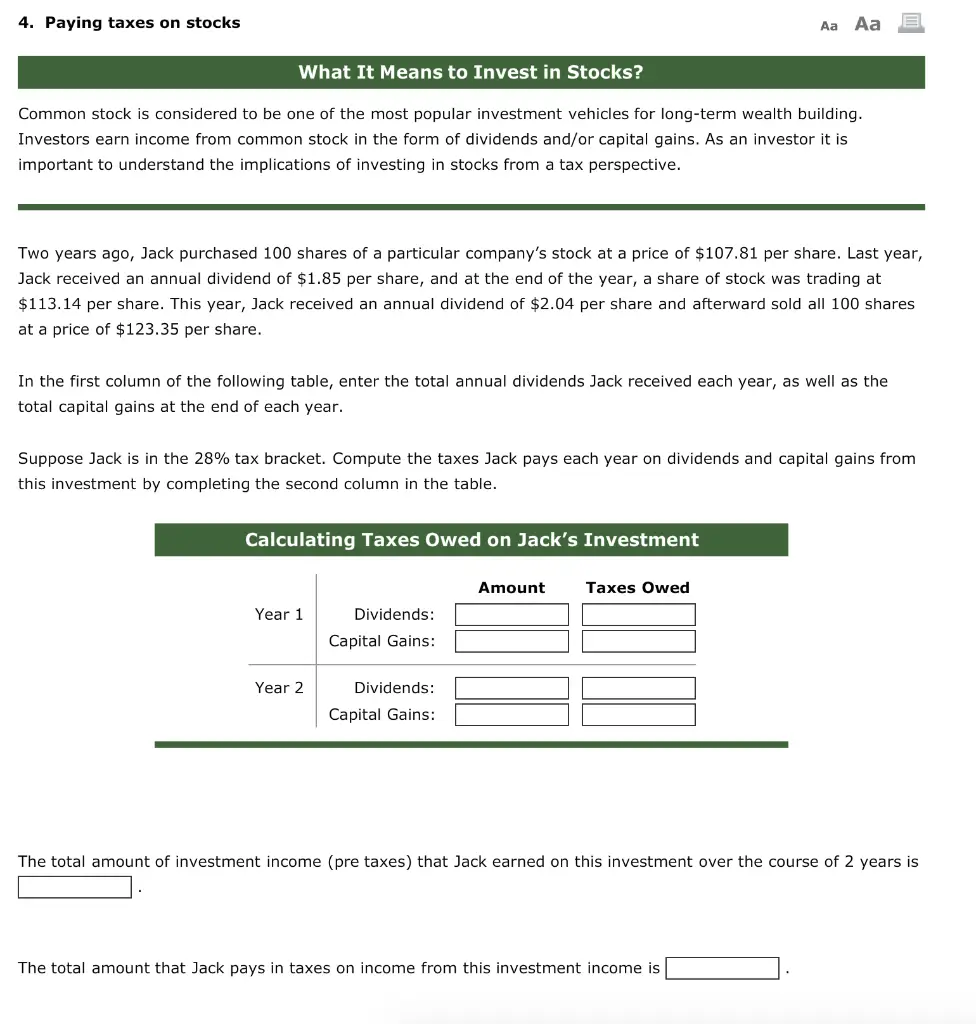

How Are Capital Gains Taxes Calculated

When you sell a stock, you dont pay capital gains tax on the entire amount of the sale you only pay it on your profit from the sale.

To calculate how much tax you owe, you must subtract how much you paid for the stock, along with any commissions and reinvested dividends, from how much you sold it for.

Offsetting Short Term Capital Loss

Any short-term capital loss from the sale of equity shares can be offset against short-term or long-term capital gain from any capital asset. If the loss is not set off entirely, it can be carried forward for eight years and adjusted against any short-term or long-term capital gains made during these eight years.

It is essential to consider that a taxpayer will only be allowed to carry forward losses if he has filed his income tax return within the due date. Therefore, even if the total income earned in a year is less than the minimum taxable income, filing an income tax return is a must for carrying forward these losses.

Are you planning to save taxes? Do you want to invest in mutual funds for the same?

The Fi Money app helps you choose from various tax-saving mutual fund schemes. All you have to do is complete your mandate and instruct the app to deduct a fixed amount, say, â¹12,000, on the first of every month and invest in an Equity Linked Savings Scheme of your choice. Investing in mutual funds with Fi Money is smart, simple and secure.

Recommended Reading: Who Can I Talk To About My Taxes

Example Of How To Calculate Profits From A Stock Sale

Let’s say you bought 10 in Company X for $10 apiece and paid $5 in transaction fees for the purchase. If you later sold all the stock for $150 total, paying another $5 in transaction fees for the sale, here’s how you’d calculate your profits:

Cost basis = $100 + $10 = $110Profits = $150-$110 = $40

So, in this example, you’d pay taxes on the $40 in profits, not the entire $150 total sale price.

Now that you’ve determined your profits, you can calculate the tax you’ll have to pay. The taxes you owe depend on your total income for the year and the length of time you held the shares.

Hold Onto It Until You Die

This might sound morbid, but if you hold your stocks until your death, you will never have to pay any capital gains taxes during your lifetime. In some cases, your heirs may also be exempt from capital gains taxes due to the ability to claim a step-up in the cost basis of inherited stock.

The cost basis is the cost of the investment, including any commissions or transaction fees incurred. A step-up in basis means adjusting the cost basis to the current value of the investment as of the owners date of death. For investments that have appreciated in value, this can eliminate some or all of the capital gains taxes that would have been incurred based on the investments original cost basis. For highly appreciated stocks, this can eliminate capital gains should your heirs decide to sell the stocks, potentially saving them a lot in taxes.

Read Also: What Is New York State Tax Rate

Will My Broker Give Me A Form

In a word: yes.

If you sold any investments, your broker will be providing you with a 1099-B. This is the form you’ll use to fill in Schedule D on your tax return. The beauty of this is that it’s generally plug-and-play. Everything you need can be ripped right off of the 1099-B and inputted into the tax return.

Furthermore, if you received dividends from stocks or interest from bonds, you should also receive a 1099-DIV or a 1099-INT. Often, you’ll all of these forms in a single package from your broker, which is supposed to be sent to you no later than Jan. 31.

How Are Stocks Taxed On Robinhood

IRS Publication 550 explains the rules in much greater detail, but investments managed through Robinhood get taxed the same way as other investments. Dividends are still divided into qualified and ordinary dividends, with qualified dividends being taxed at a lower rate. Stocks, too, are taxed normally.

As always, you wont have to pay tax on a stock simply because its value increased. You will, however, need to pay tax on any profits you make when you sell stock. Stocks held less than one year are subject to the short term capital gains tax rate, which is the same tax rate you pay on your ordinary income. Stocks held longer than a year get taxed at the more favorable long term capital gains rates of 0, 15 or 20 percent, depending n your income level.

As usual, you are free to report a capital loss as well as gains on your tax return. Remember the wash sale rule when doing so, however. If you sell a stock at a loss but then buy an identical or very similar stock within 30 days, you have participated in a wash sale and cannot claim the loss on your tax return. The same is true if you buy the same stock 30 days before you sell it. The prevents taxpayers from intentionally racking up losses as a tax-reduction strategy.

Note, too that sometimes Robinhood gives account holders free stock. You may get a free stock for joining the site or for referring a friend. If those stocks exceed $600 in value, both you and Robinhood must report the money to the IRS as income.

Also Check: What Does Agi Mean For Taxes

Short Term Capital Gains Tax

If you sell equity shares listed on a stock exchange within 12 months of purchase, you may make a short-term capital gain or incur a short-term capital loss . You make a short-term capital gain when you sell shares higher than your purchase price.

STCG = Sale price â Expenses on Sale â Purchase price

A flat tax rate of 15% is applicable on your short-term capital gains irrespective of your income tax slab.

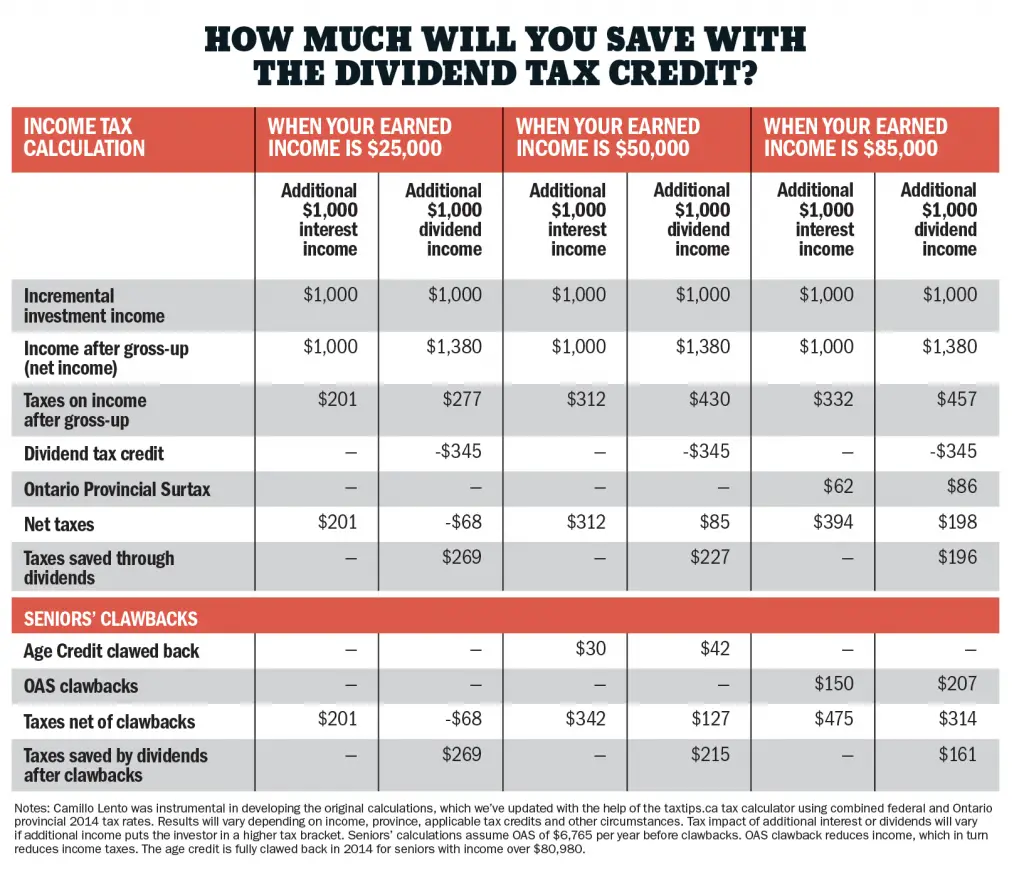

How Are Dividends Taxed

Dividends are income paid out to shareholders of a stock, mutual fund or other investment. They’re typically paid quarterly or monthly, in cash or shares, and are taxable based on your income and the type of dividend paid.

- Qualified dividends come from investments in U.S. or qualifying foreign companies whose stock you’ve held for at least 61 days of a 121-day holding period. Qualified dividends are taxed at long-term capital gains rates.

- Non-qualified or ordinary dividends, which include most dividends paid to shareholders, are taxed at short-term capital gains rates.

IRS requirements for qualified dividends can be complicated. Fortunately, if you’ve earned dividends of $10 or more from any investment, you’ll receive Form 1099-DIV or Schedule K. These forms report your dividend income as either qualified or ordinary dividends, so you don’t have to make the distinction yourself.

Also Check: When Is Nys Accepting Tax Returns 2021

How The Capital Gains Tax Works

Say you bought 100 shares of XYZ Corp. stock at $20 per share and sold them more than a year later for $50 per share. Lets also assume that you fall into the income category where your long-term gains are taxed at 15%. The table below summarizes how your gains from XYZ stock are affected.

| How Capital Gains Affect Earnings | |

|---|---|

| Profit after tax | $2,550 |

In this example, $450 of your profit will go to the government. But it could be worse. Had you held the stock for one year or less , your profit would have been taxed at your ordinary income tax rate, which can be as high as 37% for tax years 2021 and 2022. And thats not counting any additional state taxes.

How Capital Gains Are Taxed On Stocks

The tax rates for the capital gains you earn on your stocks are going to be determined by both your tax filing status as well as your adjusted gross income . You will end up being taxed between 0% and 20% of your profit, depending on your filing status. You will likely end up paying either 15% or 20% if your AGI is greater than either $41, 676 as a single filer or $83,350 as a married couple filing together.

In addition to the capital gains tax, high-net-worth individuals or high-earners might end up being on the hook for additional taxes for their investment profits. The net investment income tax can add an additional 3.8% tax on top of your capital gains tax if your modified adjusted gross income is above $200,000 for single filers or $250,000 for married filing jointly.

You May Like: How To File Old Taxes On H& r Block

How Do I Know If I Have To Report

If you sold any stocks, bonds, options or other investments in 2020, then you will need to report it on your tax return on Schedule D. TurboTax and other mainstream tax preparation software vendors will generally do this for you after asking you to input some data.

If you sold stocks at a profit, you will owe taxes on gains from your stocks. If you sold stocks at a loss, you might get to write off up to $3,000 of those losses. And if you earned dividends or interest, you will have to report those on your tax return as well.

However, if you bought securities but did not actually sell anything in 2020, you will not have to pay any “stock taxes.”

Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales

Put more into your piggy bank with tax-planning strategies for capital gains.

Getty

Lets say you own stock that may generate a big capital gain when you sell it. It could be shares in Apple AMZN that you purchased a long time ago, founders stock in a startup that turned into a hot IPO company, or shares from employee stock option exercises or restricted stock vesting that have appreciated substantially. While most securities held over one year qualify for the favorable rate on long-term capital gains, the total tax can still be significant.

The complex federal tax code provides a few ways, depending on your income, personal financial goals, and even your health, to defer or pay no capital gains tax. If you follow the rules and consult tax experts when needed for the more sophisticated techniques, these tax-planning opportunities below are not tax dodges or loopholes that will get you in trouble with the IRS. Most are considered tax expenditures .

Also Check: What All Do I Need To Do My Taxes