How Is The Required Income Tax Amount Determined

People may use an online income tax calculator to determine how much they owe.

- Transactions in Indian Rupees on December 31 of a particular year

- The total sum of money someone makes yearly is their annual pay.

- Generating income from unusual channels, such as investments, rental income, etc.

- A recurring payment to help with housing and transportation costs.

You may determine a persons total tax burden. This can be done by providing precise values for the variables mentioned in the preceding sentence.

Any money left over after TDS has been taken out may be deposited immediately via Challan 280. This is the governments internet gateway. The government has 30 days to issue a taxpayer a check for the difference if their refund request results in more payout than their tax bill.

The income tax calculator will help you to get all the information about income tax.

The Internal Revenue Codes Sections 234A and 234F explain how interest and penalties are applied to late-filing taxpayers. Therefore, its crucial to note the cutoff date for filing your income tax returns.

Additionally, remember that the date for submitting your taxes may change. This depends on your tax situation. Salary earners typically have time till July 31 of the assessment year to file their tax returns. You can stay updated with the income tax calculator.

Effects of exemptions on the total level of income tax

Proven Safe & Reliable

This service is safe, reliable and in accordance with all state and government regulations. In order to process your payment, Point and Pay, the credit card service provider, charges a nominal convenience fee based on the amount of the transaction. Fees are as follows:

| Payment Type |

|---|

| 2.5% of amount to charge |

| Debit Card |

| $2.00 flat fee |

Transaction Portal Services And Aids

The TransAction Portal is a free service for individuals, businesses, and tax professionals to access and manage accounts with the Montana Department of Revenue and the Gambling Control Division of the Department of Justice.

Contact Customer Service

To be the nation’s most citizen-oriented, efficiently administered, state tax agency.

DOR Mission Statement

- Make payments online using the TransAction Portal.

- Request a Payment Plan

- You can request a payment plan for making tax payments through TAP. Requesting a payment plan requires you to be logged in. Learn more about Requesting a payment plan.

- Payment Vouchers

- You may also make payments by mail using a payment voucher. The appropriate payment vouchers for each tax taype are available in our Forms Repository.

Also Check: When Will Unemployment Taxes Be Refunded

If You Owe More Than $50000 In Taxes

If the amount of tax you owe at the time you request an installment agreement exceeds $50,000, youll need to provide the IRS with additional information about your personal finances. In this situation, you must request the payment plan on Form 9465-FS and attach a Collection Information Statement on Form 433-F. The IRS will then perform a more thorough review of your assets and liabilities to determine whether you qualify for an installment agreement.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Also Check: How Do I Do My Taxes Online

Pay With Credit/debit Card

NOTE: A convenience fee will be automatically calculated and charged for the use of this service. The City of El Paso is prohibited by law, from absorbing the costs of providing this convenience. The City of El Paso will accept Visa, MasterCard, and Discover credit/debit cards.

To pay with an E-Check :

NOTE: DO NOT get the routing number from a deposit slip.

Recommended Reading: How To Request An Extension On Your Taxes

Gather All Necessary Documentation

Before you start the process of filing your personal income tax online, its important to have all the necessary documentation ready. This includes documents such as your W-2 form, 1099 form, and any other income statements. Also, its a good idea to organize these documents in a folder or file to keep them all in one place.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: How Do Roth Ira Contributions Affect Taxes

How Do I Manage My Plan To Avoid Default

In order to avoid default of your payment plan, make sure you understand and manage your account.

-

Pay at least your minimum monthly payment when its due.

-

File all required tax returns on time and pay all taxes in-full and on time .

-

Your future refunds will be applied to your tax debt until it is paid in full.

-

Make all scheduled payments even if we apply your refund to your account balance.

-

When paying by check, include your name, address, SSN, daytime phone number, tax year and return type on your payment.

-

Contact us if you move or complete and mail Form 8822, Change of AddressPDF.

-

Confirm your payment information, date and amount by reviewing your recent statement or the confirmation letter you received. When you send payments by mail, send them to the address listed in your correspondence.

There may be a reinstatement fee if your plan goes into default. Penalties and interest continue to accrue until your balance is paid in full. If you received a notice of intent to terminate your installment agreement, contact us immediately. We will generally not take enforced collection actions:

-

When a payment plan is being considered

-

While a plan is in effect

-

For 30 days after a request is rejected or terminated, or

-

During the period the IRS evaluates an appeal of a rejected or terminated agreement.

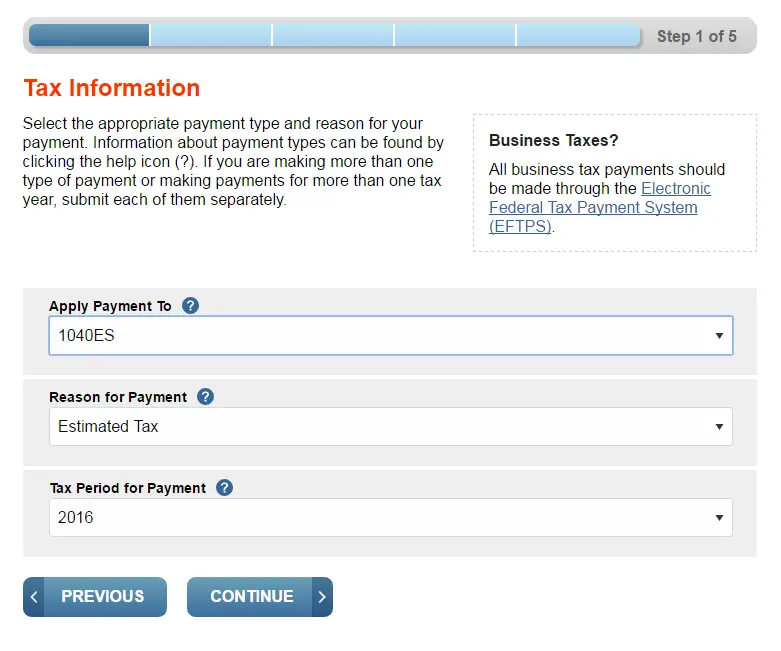

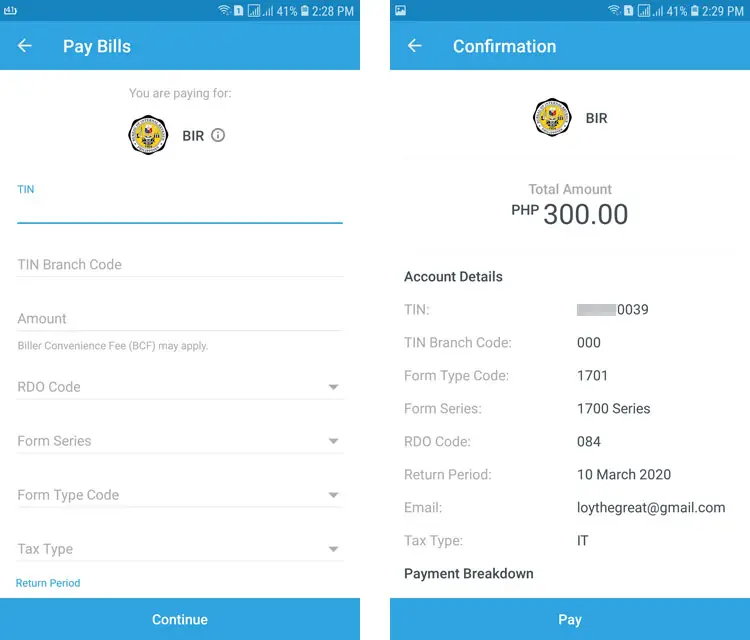

Electronic Federal Tax Payment System

You can also pay your tax bill using the government’s Electronic Federal Tax Payment System . You’ll use your Social Security number or Individual Taxpayer Identification Number , a personal identification number , an internet password, and a secure browser to make a payment through this system. It can take up to five days to process your enrollment in this service, and you can complete the initial paperwork online or over the phone. With EFTPS, you can schedule payments up to 365 days in advance, and you’ll receive an immediate confirmation upon payment.

Recommended Reading: What Is The Sales Tax In Mississippi

How To Dispute Interest You Owe

We may reduce the amount of interest you owe only if the interest is applied because of an unreasonable error or delay by an IRS officer or employee.

For more information on reducing the amount of interest you owe, see details on Interest Abatement.

To dispute interest due to an unreasonable error or IRS delay, submit Form 843, Claim for Refund and Request for AbatementPDF or send us a signed letter requesting that we reduce or adjust the overcharged interest. For more information, see Instructions for Form 843PDF.

What Are The Browser Requirements Of The Online Payment Agreement Tool

OPA is supported on current versions of the following browsers:

-

Internet Explorer or Microsoft Edge

-

Mozilla Firefox

In order to use this application, your browser must be configured to accept session cookies. Please ensure that support for session cookies is enabled in your browser, then hit the back button to access the application.

The session cookies used by this application should not be confused with persistent cookies. Session cookies exist only temporarily in the memory of the web browser and are destroyed as soon as the web browser is closed. The applications running depend on this type of cookie to function properly.

The session cookies used on this site are not used to associate users of the IRS site with an actual person. If you have concerns about your privacy on the IRS web site, please view the IRS Privacy Policy.

You May Like: How To Find The Tax Of Something

Trumps Tax Returns Are Out: Heres How He Was Able To Pay So Little So Often

Former U.S. President Donald Trump, joined by former First Lady Melania Trump, arrives to speak at the Mar-a-Lago Club in Palm Beach, Fla., on Nov. 15. A House committee on Friday released six years of the ex-presidents tax returns. Alon Skuy/AFP via Getty Images/TNS

WASHINGTON Former President Donald Trumps seven-year battle to keep the public from seeing his taxes ended in defeat Friday as a House committee released six years of returns documenting his aggressive efforts to minimize what he paid the IRS.

Trump and his wife, Melania, paid $750 or less in federal income tax in 2016 and 2017, and zero in 2020, according to the returns released by the House Ways and Means Committee, which oversees tax legislation.

In three other years, Trump paid significant amounts of taxes although as a share of his income, the amounts were far below those of the average taxpayer. The returns show he paid $641,931 in 2015, just under $1 million in 2018 and $133,445 in 2019.

The 2018 payment came on reported adjusted gross income of $24.3 million an effective tax rate of 4%. By contrast, the average taxpayer in 2018 paid $15,322 in federal income taxes, with an average rate of about 13%, according to the IRS.

During the years in which Trump battled disclosure, much of the information he sought to keep secret about his pre-presidential finances became public anyway, largely from a 2020 New York Times investigation.

The newly released records, covering 2015-2020, add to that picture.

Facts About Irs Payment Plans

OVERVIEW

When you fall behind on your income tax payments, the IRS may let you set up a payment plan, called an installment agreement, to get you back on track. It is up to you, however, to take that first step and make a request for the installment agreement, which you can do by filing Form 9465. You can file the form with your tax return, online, or even over the phone, in some cases. But before you make the request, youll want to gather some facts about IRS payment plans.

Also Check: How Much To Charge For Tax Preparation

Don’t Miss: Can I File My Nys Taxes For Free

How Do I Determine If I Qualify For Low Income Taxpayer Status

If you believe that you meet the requirements for low income taxpayer status, but the IRS did not identify you as a low-income taxpayer, please review Form 13844: Application for Reduced User Fee for Installment AgreementsPDF for guidance. Applicants should submit the form to the IRS within 30 days from the date of their installment agreement acceptance letter to request the IRS to reconsider their status.Internal Revenue ServicePO Box 219236, Stop 5050Kansas City, MO 64121-9236

Personal Income Tax Background

The individual income tax is levied on the wages, salaries, dividends, interest, and other income that a person earns throughout the year. The tax is generally imposed by the state where the income is earned, although some states have reciprocity agreements with other states that allow income earned in another state to be taxed in the earners residence. In 2022, 41 states and the District of Columbia levy a broad-based individual income tax. New Hampshire taxes only interest and dividends, while Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not tax individual income of any kind. Tennessee previously taxed bond interest and stock dividends, but the tax was repealed effective in the tax year 2021.

You May Like: How To Pay Car Taxes Online Sc

Q: How Do I File My Personal Income Tax Return Online

A: To file your personal income tax return online, youll need to follow these steps:

Prepare And File Your Tax Return

Once youve chosen an e-filing service, youll need to prepare and complete your tax return. This involves entering all your income information, claiming any deductions or credits, and calculating your tax liability. Make sure to double-check your information to ensure it is accurate. When youre ready to file your tax return, submit it through the e-filing service youve chosen.

Recommended Reading: Can I File Taxes If I Receive Ssi

Stop And Start Dates For Underpayment Interest

In general, we charge interest on underpayments starting on the due date of the amount you owe and will continue to accrue until the balance is paid in full:

- Tax is due on the return filing date extensions to file do not extend the date for payment of the tax.

- Penalties and additions to the tax due dates vary by penalty type:

- Failure to File penalty, also called the delinquency penalty, is due on the return due date, or extended return due date if an extension of time is filed.

- Failure to Pay, Underpayment of Estimated Tax by Corporations, Underpayment of Estimated Tax by Individuals and Dishonored Check penalties are due on the date we send you a notice or assess the penalty.

- Accuracy-related penalties are due on the return due date, or extended return due date if an extension of time is filed.

If you received a notice, you will not be charged interest on the amount shown if you pay the amount owed in full on or before the “pay by” date.

What Does A Payment Arrangement Require

You must ask for a payment arrangement yourself. You can only get a payment arrangement if

- your financial difficulties are temporary, not long-term

- you do not have taxes in recovery by enforcement

- you have filed all required tax returns and reports to the Incomes Register

- you have paid all taxes that were included in a previous payment arrangement with the Tax Administration

The Tax Administration may reject your request for a payment arrangement. If your request is rejected, you will receive a letter concerning the matter by post and in MyTax. If you have activated electronic messages from the authorities on Suomi.fi messages, the letter will be sent only to MyTax. You will be notified of this by email. The letter will explain why your request was rejected.

Payment arrangements are made for a maximum duration of 2 years, and the smallest instalment is 20. If any taxes are included in the payment arrangement that are about to expire, the duration can be shorter than 2 years. In these circumstances, the end date of the arrangement is set at 6 months before the expiration date. The expiration of a tax debt takes place when five years have elapsed from the beginning of the calendar year following the year when the tax was imposed, collected or when it had fallen due.

Don’t Miss: How Much Is Tax In Florida

Who Must Pay Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

You may have to pay estimated tax for the current year if your tax was more than zero in the prior year. See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax.