How To Protest Your Property Tax Appraisal In 2022

In Texas, the appraisal districts individually accept and process protests according to the county regulations. Your first step in learning how to protest your property tax appraisal will begin by visiting the website of the appraisal district for your county.

The process for filling an official protest for your property taxes generally requires:

Home Tax Solutions Is Here To Help With Your Property Tax Bill

Even if youre disputing your property tax bill, you still need to pay the undisputed percentage of your bill on time. The undisputed percentage would be the cost of your property tax bill if the appraisal district accepts your proposed home value. In some counties, the full property tax bill may be due even if your property value is being protested. In either case, the Home Tax Solutions team can help you cover the cost of your property tax bill, and theres no penalty for early payment if you win your protest and get reimbursed for part of the payment. You can get started by filling out our application form online, or contact any of our five conveniently located Texas offices.

What Do I Put In The Protest

This is where you back up your argument on why you believe the value should be lowered. They don’t see the inside of a home, which could have a very different story from the outside.

Taking pictures of floors, walls, foundation, windows, kitchen, bathrooms etc., that need repairs or renovations can help build ones as to why the value given doesn’t match.

Some suggest getting estimates for how much it would cost to fix these issues and include that in the protest.

Upload all this documentation to your filling.

“I always advise people to stay on topic and the topic is unfortunately not taxes, the topic is value, thats how you help yourself is to really discuss the appropriate value. Suggested Will Wiggins, a consultant with North Texas Property Tax Service.

His phone has been ringing off the hook as he helps property owners navigate through this process.

Whenever it comes to a protest, youre actually protesting your market value and not your taxes, so when it comes to considering what your value should be, youre looking at other appraisals and you want to look at other sales in the market and you want to make sure that youre making and calculating the appropriate adjustments,” he said.

Don’t Miss: Pastyeartax Com Review

Damage From The Winter Storm In February There’s An Exemption For That Too

People can apply for a Temporary Exemption for Disaster Damage

The damage has to be at least 15 percent of the improvement value, to the structure, not the land.

“If you have a $200,000 home for instance and $100,000 is land and $100,000 is improvement, then you would have need to incurred $15,000 dollars worth of damage to qualify,” explained Wiggins.

People have to apply by May 28th and that is through their county’s appraisal district.

Do I Need To Make An Appointment To See An Appraiser Informally

No. To see an appraiser, all you need to do is come to our office and sign in and you will be seen in the order in which you signed in. For informal meetings with an appraiser concerning your propertys proposed market value, please arrive at least 15 minutes prior to office closing. If you have more than one property or have multiple issues to discuss with an appraiser, then you should arrive well in advance of DCADs closing times as all discussions with an appraiser should conclude at the close of DCADs business hours.

Read Also: How Taxes Work With Doordash

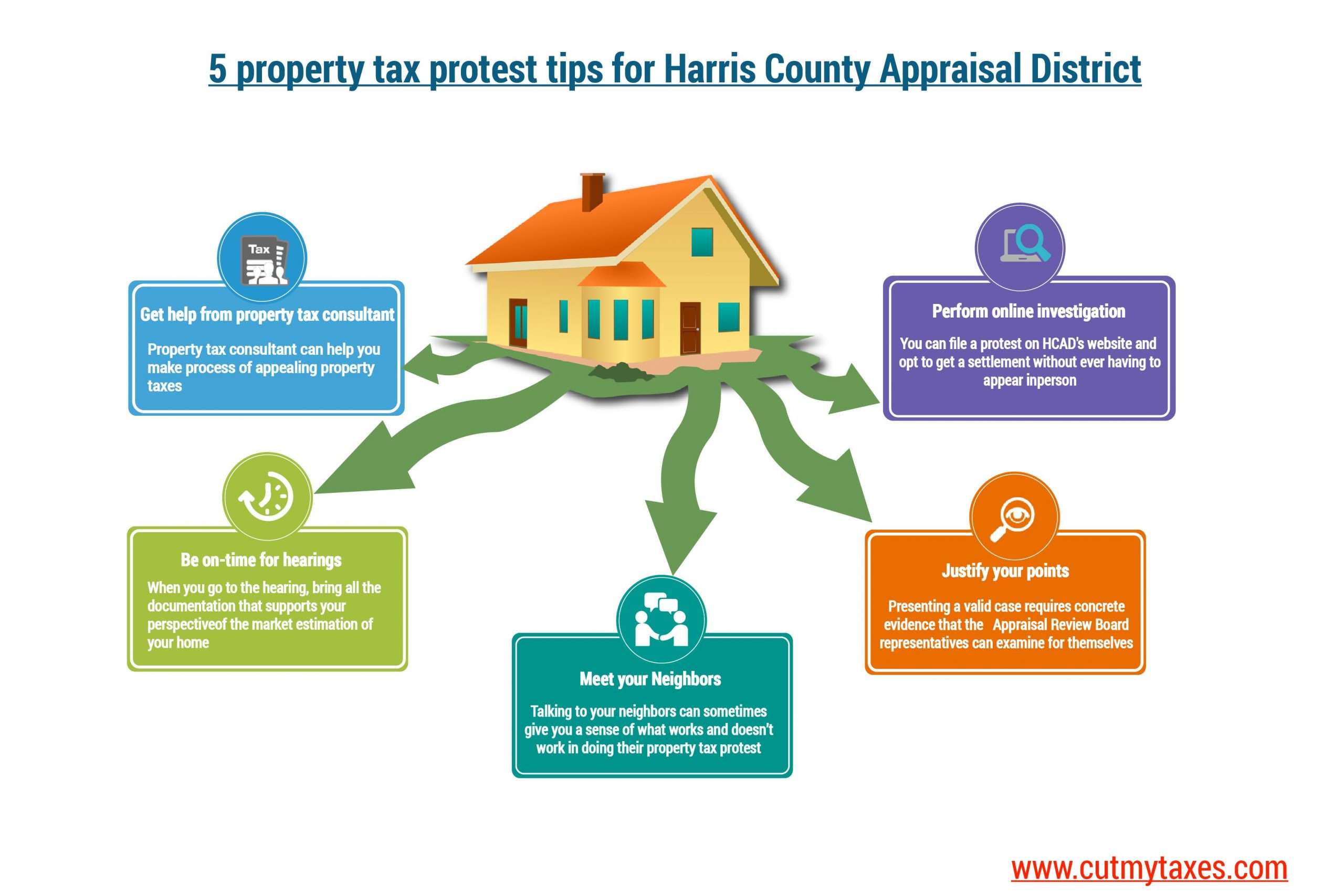

Hire A Firm To Protest Your Taxes

Some firms will protest your taxes for you. They might charge 50 percent of what they save you. So, if they take your tax bill from $3,000 to $2,000, thats a savings of $1,000, and theyll collect a $500 check from you. This might seem like a lot, but they are still saving you money in the end. There are large firms and small firms that do this, and based on my experience, I recommend a smaller firm. A larger firm isnt going to be as vested in protesting your taxes.

The Watchdog: The 2022 Strategy To Win Your Property Tax Protest Without Going To A Hearing

- May 1, 2022

My obsession with teaching Texas property owners how to protest your property taxes began in 2011 when my county appraisal district debuted online protesting. One Saturday night, in a matter of minutes, I entered my ideal home value, and the computer accepted it.

I called it The Price Is Right, and I won.

Phase two began in 2017 when I launched my Everybody File a Protest campaign. I even created a flag to support my little revolution.

As I explained, Appraisal districts will be overwhelmed with workloads like never before. Theres nothing wrong with this. Its your legal right as a Texan to file a protest every year, even if your taxes dont go up, and even if your school taxes are frozen because youre a senior or disabled.

Overload the system like never before, and in return, appraisers would have to settle cases in greater numbers than ever to clear their calendar by the states July deadline.

I know it worked because Denton County Chief Appraiser Rudy Durham blamed me in 2019 for his problems.

Theres a consumer watchdog that is encouraging people to file a protest, he complained. He wants to mess up the system and shut it down and prove a point.

Here now comes Phase 3 of my Watchdog Nation revolution. With the help of Glenn Goodrich of PropertyTax.io , we unveil a new plan.

One part is to use open records to request from the appraisal district its evidence they plan to use against you ahead of time.

You May Like: How To Calculate Taxes For Doordash

Resolute Property Tax Solutions

- COMPARE QUOTES

12225 Greenville Ave #770, Dallas, TX 75243

Resolute Property Tax Solutions is an industry leader in Property Tax Consulting. Our team of Property Tax Consultants is committed to saving you money by obtaining the lowest possible assessed value for your commercial or residential properties. At Resolute we are experienced, knowledgeable professionals who always stay well-informed on the latest Tax Code changes in order to maintain our superior customer service.

Why This May Be The Best Year Yet To Protest Your Property Tax Appraisal

Realtor Chandler Crouch shares more of his expertise on best practices for protesting your appraisal. He joined us on our Yall-itics Texas political podcast this week and offered a lot of valuable insight. Listen here:

Crouch said that it’s often the case that you can do a lot less work and get the value down with just an informal meeting with the appraiser. That may be especially true this year if we see the record deluge of protests some are predicting.

Lauer noted that the more people who file protests, the more pressure it will create for reviewers to work expeditiously since they have to meet deadlines.

So, there is that motivation for them to just get it through and get it done,” said Lauer.

Crouch has the same take: I think your odds of winning this year are higher than ever before just because they are trying to churn through the numbers. They want to make you happy so they can get you out of their office and get to the next person.

Read Also: Do You Have To Do Taxes For Doordash

What Are Valid Reasons To Protesting Appraised Values

The majority of the reasons for protesting the appraised value of your property are covered by the following three reasons.

1.Market Value Reasons The proposed appraised value of your property is simply too high.This typically happens when the appraisal district has incorrect information regarding your property such as property size.Also, if comparable properties in your immediate area are selling for less than your proposed appraised value, then you may have a legitimate reason to protest.

2.Unequal Valuation The Texas Constitution gives Texas property owners the right to equal and uniform taxation.This means that even if your proposed appraised value is in line with the market value, but comparable homes in your area are being appraised below market value, then you have a right to also have your home appraised below market value equally.

3.Denial of an Exemption You may want to protest when the Chief Appraiser denies you a requested exemption.If you have met all requirements for filing for an exemption, including meeting the deadline, and are denied, then you can file a protest and have a hearing before the ARB.

If you would like to get a more comprehensive guide written by our attorney for lowering your property taxes in Texas, then please visit this linkand fill out the required information and follow the instructions that will be emailed to you.

Proper Preparation Prevents Poor Performance

Preparing for your hearing is most crucial. The following ideas are some that I followed for every property I represented. As a property owner representing yourself you can greatly increase your chances of getting a value reduction if you apply the methods Im listing here. Appraisers will actually appreciate your due diligence.

The deadline to file your protest for the 2009 season is June 1st. When filing your protest, you want to fill out that you are protesting based on market value as well as unequal appraisal.

Request the House Bill 201 Evidence packet. This is the most important step you can take towards ensuring a successful protest. The HB contains all of the information which the appraisal district used to arrive at your property value. The information within this packet is also your main source for ammunition in getting your value reduced. For Harris County property owners, this packet will be made available online 14 days prior to your hearing date. Call the appraisal district for instructions on how to access it.

Pictures are worth a thousand words Take pictures of any disrepair on your property and of any negative influences surrounding your property. Qualified negative influences could be busy streets, water tower looming over your house, sewer plant nearby, commercial property bordering your residential, etc. Your noisy neighbors junked out car and overgrown grass probably will not qualify!

Don’t Miss: Doordash Tax Form

Knock Out Their Evidence Against You

The second strategy takes advantage of the confusion and work overload appraisal districts endure, especially if everybody files a protest.

According to the rules of this process, no evidence may be presented at a hearing by either the county appraiser or by you if this evidence isnt shown to the other side.

What kind of evidence? Photos, comparable properties, repair estimates. They are supposed to see what you have, and you should see what they have. They can see yours at a hearing or in the affidavit described above.

Their evidence against you, on the other hand, cant wait for the hearing. The district must produce your evidence before your hearing. It arrives via mail, email or through the districts website.

But they only have to give it to you if you ask for it.

Heres the important part. If they fail to provide the evidence ahead of time, they cant use it at the hearing. And appraisal districts are often not set up to easily distribute the information in a timely way. This is a sensitive pressure point, and you take advantage of it.

As Goodrich explains, I would advise anyone to make the 14-day evidence request almost as soon as you file the protest. That way you can say you gave the appraisal district ample time to fulfill the request.

He adds, Failure to provide evidence prior to the hearing would essentially be the same as the appraisal district saying they have no evidence at the ARB hearing.

Lets change that.

How Long Of A Wait Is There To See An Appraiser

The average wait time is typically less than 30 minutes however, during the week prior to the protest deadline, wait times may exceed 30 minutes to one hour. That is why it is recommended that you visit an appraiser on April 15 and shortly thereafter. There is little wait time early in the process. During lunchtime hours, wait times may exceed 30 minutes to one hour due to the number of taxpayers who visit our office during this time and the staff lunch rotations.

Early morning and late afternoon wait times are typically less than 30 minutes. During the last week of the protest period, due to the high volume of walk inactivity, property owners/agents may be limited to discuss only one account per visit. If a property owner has more than one account to discuss during the protest deadline week then DCAD would encourage them to file a written protest for all accounts on or before the protest deadline week and then return to DCAD for an informal review by an appraiser at least one day prior to their formal ARB hearing to try to resolve their issues. For informal meetings with an appraiser concerning your propertys proposed market value, please arrive at least 15 minutes prior to office closing.

If you have more than one property or have multiple issues to discuss with an appraiser, then you should arrive well in advance of DCADs closing time as all discussion with an appraiser should conclude at the close of DCADs business hours.

Read Also: Do I File Taxes For Doordash

How Do I Protest

In Texas, everybody has the right to protest their property tax appraisal. This can be done online, by mail or drop off depending on your county.

You have the right to protest as a property owner and what I ask people to do is, do your research, do a little bit of homework. I know the knee jerk reaction is to go ‘Oh my gosh my value couldnt be this high,’ but if you actually go talk to realtors because the value has gone up since Jan 1. because that is what our market is just doing right now,” said Cheryl Jordan, director of community relations at the Dallas Center Appraisal District.

In Dallas County for example, because of the pandemic, people either have to file electronically through the uFile system that’s found through an individual’s online account, mail it in or drop it off.

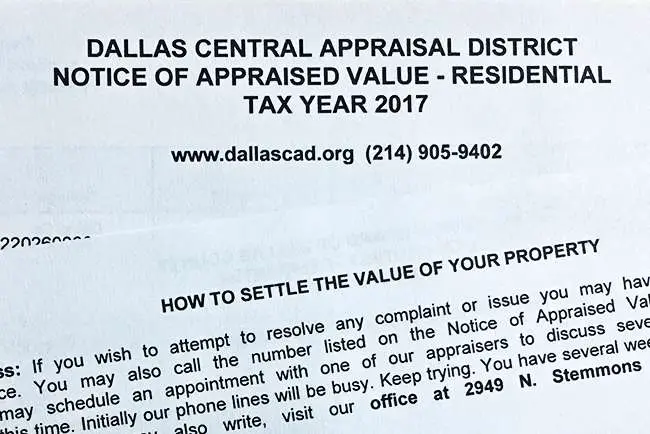

How To Protest Dallas County Property Taxes

Beginning May 1st, protests can be filed in writing or through the Dallas County Appraisal District website at www.dallascad.org using their Online Protest Program called uFile.The uFile Online Protest Program will be available for protesting residential and commercial property from May 1st through May 31st and will be available beginning May 17th for Business Personal Property.

Read Also: How To File Taxes Doordash

Property Tax Lookup/payment Application

Fax: 653-7888Se Habla Español

This program is designed to help you access property tax information and pay your property taxes online.

If you have questions about Dallas County Property Taxes, please contact , see our Frequently Asked Questions, or call our Customer Care Center at 214.653.7811.

Convenience Fees are charged and collected by JPMorgan and are non-refundable: ACH Fee = $0.00 each. Credit Card Fee = 2.15% of amount charged . Debit Card Fee = $2.95 per transaction.

We Have Never Seen A Real Estate Market Like This Said The Head Of The County Appraisal District

Soaring real estate prices for homes in DFW has led to big jumps in property tax bills for homeowners and contributed to climbing rents for apartment dwellers.

Property owners are pushing back.

Dallas County property owners are on track to submit a record number of protests to their appraised home value, according to the head of the Dallas County Appraisal District.

Our high-water mark was two years ago, said Ken Nolan, Executive Director of the Dallas Central Appraisal District. That year, Nolan said there were about 178,000 protests.

I can almost with 100% surety tell you we will pass 178 in the next couple of days, he told county commissioners at a Tuesday meeting.

The deadline for property owners to protest their appraisal was Monday, May 16th, or thirty days from the date they received the notice.

Nolan said this is the largest reappraisal his agency has done since its founding in the early 1980s. One reason is pandemic shutdowns cut into their work time in 2020, which subsequently affected 2021.

But the galloping value of homes is another reason.

In the 41 years weve been around, we have never seen a real estate market like this, he said, comparing Dallas to hot real estate markets like Miami. “Dallas is that place now.

Nolan said preliminary estimates of residential property values in the county increased 24% over 2021, while commercial property values increased 25%.

The state requires appraisals to be finalized by the end of July, Nolan said.

Also Check: Federal Irs Tax Return