Take Advantage Of Earned Income Tax Credit

Consider looking into the Earned Income Tax Credit if you earned less than $57,000. You may be eligible for a tax credit of up to $7,000 for 2020 and 2021, all based on your marital status, how many kids you have, and income. The tax credit reduces your tax bill, so you wont be taxed for your entire income anymore.

Time Your Mutual Fund Investments

There are tax-shrinking tips that apply to mutual funds, too — such as being mindful of when you sell shares of them. Funds generally distribute income to shareholders near the end of the year, and when they do so, their shares will fall in value by the amount of the distribution — because that portion of the shares’ value has been distributed to shareholders. That’s fine for those who have owned the shares for a long time, but if you bought just before the distribution, you’ll end up taxed on that distribution which covers the fund’s past year, even though you only owned your shares for a small portion of the year. So ask the fund company when its distribution is happening, and aim to buy shares after that.

Buy Shares Through Your Company

If your employer offers free shares or the right to buy shares at preferential rates through a government-approved scheme, such as the ShareIncentive Plan, Company Share Option Plan or Enterprise Management Initiative Scheme, the value of shares is exempt from income tax and National Insurance.

However, it’s not entirely tax-free. You’ll likely need to pay capital gains tax when you eventually sell your shares.

You May Like: How To Do Taxes For Cryptocurrency

Maximize Contributions To Your Retirement Plan

The money you put into your retirement fund isnt taxable and, therefore, a great way to lower your tax bill. As of 2020, you can place up to $19,500 per year into your retirement account same for 2021. Employers generally contribute a certain percentage to this money, and those who are self-employed can always open their own retirement account.

# 14 Hire Someone To Care For Your Children

In a two-earner family with kids? I bet you’re paying someone to care for your children at least occasionally. That qualifies you for a tax credit The credit is up to 35% of $3,000 or $6,000 spent on childcare. That includes summer day camps too. Unlike the child tax credit, there’s no phaseout on this one.

Read Also: How To Report Self Employment Income On Taxes

Are There Legal Ways To Low Your Taxable Income

You have to pay income tax on all of the income you make in a tax year.

However, there are some ways to decrease the amount of your income that is taxable. These are called tax deductibles. These deductions are there to incentivize good civil behaviour, like paying for healthcare, donating to charity, and saving for retirement.

If you are self-employed, then your business deductions also reduce your taxable income. Your business is taxed on its profit, not its gross income.

Do not try to reduce your taxable income by making up deductions or expenses. This is tax fraud and is illegal. If you are unsure, contact a tax specialist and get sound financial advice.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: How Much To Withhold For Taxes

Talk To A Tax Attorney

Need a lawyer? Start here.

Copyright ©2022 MH Sub I, LLC dba Nolo ® Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Pay Your Property Tax Early

If you pay your property tax early it will reduce your taxable income for the current tax year. Property tax is one of the more complicated ways of reducing taxable income. Before paying your property tax early, talk to your tax preparer to determine whether youre vulnerable to the alternative minimum tax.

Recommended Reading: How To Avoid Capital Gains Tax On Land Sale

Treasury Bills For Tax Free Short Term Savings

For someone who has a significant amount in cash in a bank, CD, or a money market fund earning interest, being able to not pay state taxes on your interest could really save some money. Thankfully for you there is a way by using short term treasury bills instead.

For example, lets take a look at a saver in California in the 24% federal tax bracket and 13.30% state tax bracket with $100,000 earning 1.75% in a bank CD.

Each year they receive $1,750 in interest, which is then taxed 24% federally and 13.3% by the State of California. After taxes, this saver is left with $1,044.75 for an effective after-tax yield of 1.04%

If that same saver used 4 week Treasury bills with the same yield, they would end up with $1,277.50, $230 more per year just by choosing a more tax efficient savings vehicle!

For those looking to boost their after tax savings with treasury bills you have a couple options:

Individual investors can use the U.S. Governments Treasury Direct website to buy and sell treasury bills . Treasury direct offers 4, 13, 26 and 52 week treasury bills.

You are also able to purchase treasuries in an online brokerage account. For clients of Arnold and Mote, we handle this for you. But if you are doing it on your own there are options available at numerous brokerages to buy individual Treasuries, or ETFs that hold only US Government Treasury bills. This can be an especially good option for those with savings in a bank account or CD over the FDIC insurance limit.

Accelerate Deductions And Defer Income

There are a handful of tax deductions that are recognized in the year in which you pay them, Greene-Lewis says. For example, if you own a home, you can deduct your mortgage interest. And if you make an extra mortgage payment on Dec. 31, you may be able to claim the interest in that payment on your 2021 return, according to Greene-Lewis.

Before doing this, be aware that under the Tax Cuts and Jobs Act passed in 2018, if you purchased a home after Dec. 15, 2017, you can deduct up to $750,000 in total mortgage interest instead of $1,000,000 for homes purchased before then, according to TaxAct, an American tax preparation software company.

IRS tax season 2021: How much will you pay in taxes over a lifetime?

Recommended Reading: What Is The Sales Tax Rate In Illinois

How To Reduce Your Taxes

This week we explain how one can reduce their taxes by utilizing the deductions properly followed by whats trending in markets and curated good reads .

Outline

Its better late than never to understand your personal finance because its your money and you are going to need it till you die. We procrastinate building good healthy habits and later regret it when we pay hefty medical bills

Similarly, in our wealth creation journey, here we end up paying the taxes, which we could have saved otherwise

Government be like:

But did you know, that you can save 50% of your taxes by utilizing your deductions cautiously!

So, to understand some easy-peasy ways to save taxes & increase our take-home salary using tax deductionshang along here!

For e.g.: if you have a home loan running, EMI will always be there as a major expense back of your mind. This EMI consists of two components interest payment & principal repayment. While this is an outflow, did you know, that both of them can help you reduce your taxes?

Likewise, the interest you pay on an education loan, life insurance premium and more such expenses that can also help you reduce your taxable income.

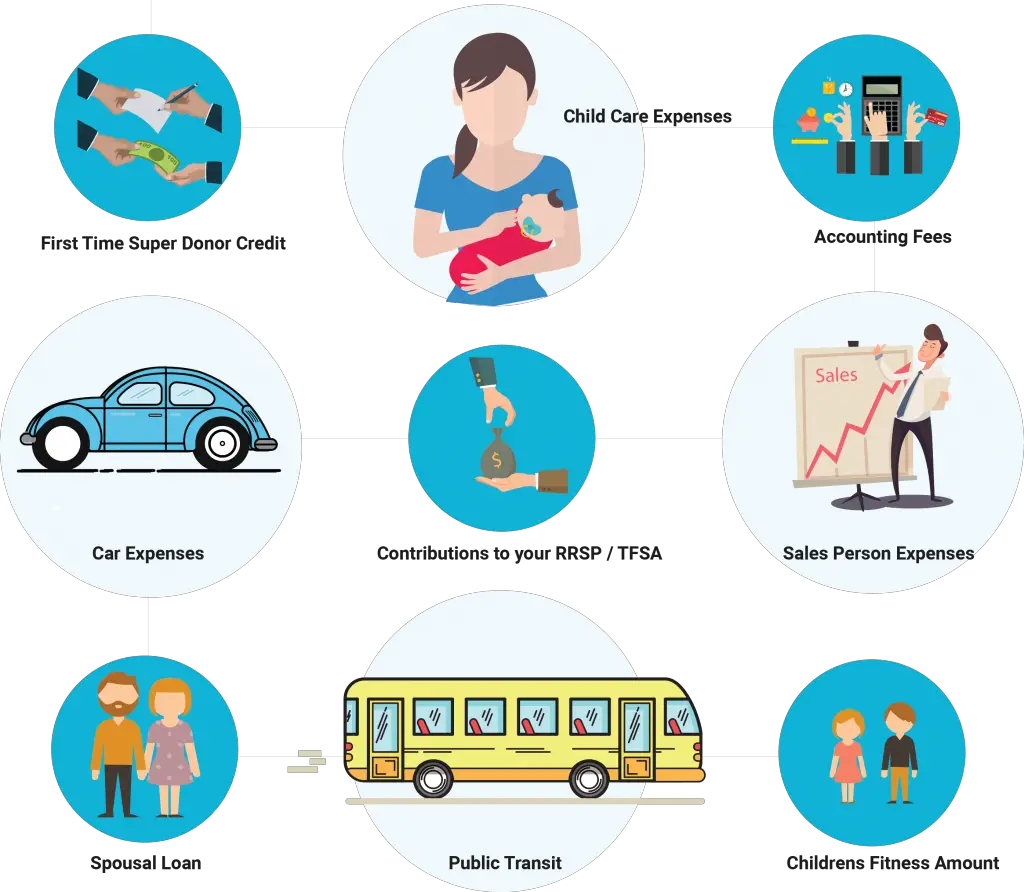

In the graphic below, we cover the majority of the ways to increase your take-home salary

Lets talk some numbers now

Take Tax Credits To Lower Your Business Income

Tax credits are the federal government’s way of encouraging businesses and individuals to do thingsor not do thingsthat affect the greater good.

For example, you can take tax credits for hiring employees, implementing environmentally friendly initiatives, providing access to disabled employees and the public, and providing health coverage for employees. Most are part of the General Business Credit, which is quite extensive so it’s quite possible that you qualify under some of its terms. Check with your accountant.

Don’t Miss: Do You Have To File Taxes By April 15th

Ways To Reduce High State Income Taxes

Although often overshadowed by the higher federal tax rates, state income taxes can take a large bite out of earnings. Thankfully, there are a few options to reduce your state tax bill.

For those in highly taxed states, simple changes like saving using treasury bills instead of bank CDs for your cash savings could knock off hundreds of dollars per year in your state tax bill. What else can you do? Here is a quick list:

Which states have the honor of having the highest income tax rates?

# 5 Deferred Compensation

Some employers offer plans that allow you to defer your compensations for years or even decades. Among doctors, these usually take the form of 457 plans. Like a 401, you get to choose and control the investments. Unlike the 401, it is still your employer’s money and subject to your employer’s creditors. A little caution is warranted, but most doctors use these plans if they are available to them, especially if offered by a governmental employer.

Don’t Miss: How To File New Jersey State Tax Extension

Let An Attorney Help You Lower Your Taxes

There are a number of ways to reduce your tax exposure, but these can shift as laws change. As you sit down to work on your tax planning, having a qualified tax attorney at the table with you can make all the difference. Get your questions answered and start the process of lowering your tax burden by speaking with a local tax law attorney.

Thank you for subscribing!

How To Reduce Your Tax Refund

Topics:

Are you looking forward to a big tax refund this year?

According to a recent survey by FinanceBuzz, the ideal situation for 79 percent of American taxpayers is receiving a tax refund, rather than owing money to the government or even breaking even on their taxes.

And for the most part, it looks like theyre getting their wish: In 2019, about 72 percent of tax returns filed resulted in a tax refund, for an average amount of $2,729, according to the IRS.

After all, who doesnt like getting a check for nearly $3,000?

But there are reasons to avoid getting a large tax refund.

“A tax refund is not free money,” says Alexa Serrano, Finder’s Banking and Investment editor. “It just means that you overpaid your taxes throughout the year.”

Because when you receive a tax refund, “thats your own money youre getting back,” says Pamela Yellen, founder of Bank on Yourself and a New York Times bestselling author. “Youre giving the government an interest-free loan, while getting a zero rate of return on your money.”

So what’s a smart taxpayer to do?

Key Takeaway: Understand your tax responsibilities.

- Keep more of your money throughout the tax year so you have more money to invest.

- Use last year’s tax return as a road map for this year’s taxes.

- If you receive a large refund, try increasing your allowances on your W-4.

- Minimize your tax liability as much as possible.

You May Like: Where Can I File My Taxes

The State Of The Tax Code

Tax code is complicated. However, the basic framework is simple. Your tax rate gets progressively higher as your income increases. The complexity arises from the various types of income as well as deductions and credits available to taxpayers that plan carefully.

Another layer of complexity arises when these deductions and credits phase out as incomes increase. The tax system is so complex for many reasons, from individuals who take advantage of loopholes in the code , to government-driven initiatives and incentives. And the sweeping tax code changes that resulted from President Donald Trumps 2017 Tax Reform and Jobs Act make things even more confusing.

States With The Highest Income Tax Rates :

These rates are based on the states highest marginal tax bracket, and is based on information from the Tax Foundation:

Higher state taxes mean that how you should save and invest could be radically different than someone who lives in a low or no income tax state, such as Florida.

What can those in high tax states do to help reduce their state tax bill? Heres a few quick tips:

Don’t Miss: How To Maximize My Tax Refund

Enroll In An Employee Stock Purchasing Program

If you work for a publicly traded company, you may be eligible to enroll in an Employee Stock Purchase Plan . By enrolling in your ESPP, you will divert after-tax dollars from your paycheck with the intent of purchasing shares of your company, and in many cases, you will be offered a discount on the stock price that is only available to employees.

You can choose how much after-tax dollars you want to contribute to your ESPP, which usually ranges between 1% to 10%. Keep in mind, however, the 2022 maximum contribution limit is $25,000 total per year.

The tax advantage of enrolling in an ESPP comes into play when you decide to sell your shares. While employees can choose to sell their shares immediately after purchase or at a later date, they’re rewarded for holding onto their shares for at least one year from the purchase date. Selling immediately means you pay ordinary income tax, while selling later means you pay a lower long-term capital gains tax therefore reducing your tax burden.

While it can be a good idea to take advantage of purchasing your employer’s stock at a discount, while also benefitting from holding your shares over the long term, make sure 1) you have enough cash to contribute and 2) the investment fits into your overall financial plan. Certain financial goals, such as paying off high-interest debt, saving up an emergency fund and contributing to an IRA or 401 and meeting any employer match should first be met before participating in a stock plan.

Calculate How Much Tax You’ll Pay

In Australia, income is taxed on a sliding scale.

The table below shows income tax rates for Australian residents aged 18 and over. It does not include the Medicare levy of 2%.

Tax rates 2021-22

|

Taxable income |

|

$9,967 |

This calculation does not include the 2% Medicare levy.

If you’re a foreign resident, a working holiday maker, or under age 18, see your individual income tax rates on the ATO website.

You May Like: When Did Income Tax Start

Donate Money Goods Or Stock To Charity

As mentioned earlier, you can take a tax deduction for donations to qualifying charitable organizations — and that includes donations made in the form of cash, stocks, goods, and even miles driven.

There are a bunch of rules regarding charitable donations you need to know about, though, such as:

Image source: Getty Images.

Defer Money Into Your 401

Another good way to reduce your tax burden is by deferring money from your paycheck into your 401 or similar retirement savings plan. You are not taxed on the money that gets withheld from your paycheck into your 401. For 2022, you can contribute up to $20,500 into your 401 while avoiding any additional taxes.

Make sure to check if your employer matches your 401 contributions and what percentage they match up to. Learn more from the IRS about 401 plans.

Also Check: Is Life Insurance Premium Tax Deductible

Keep A File Of Your Medical Expenses

Medical debt is one of the largest weights on American families, but did you know that it could be tax deductible? In general, you can deduct any qualified medical expenses that are more than 7.5% of your income for that tax year. So for example, if you make $40,000 a year but had $10,000 in medical expenses after the first $3,000 the remaining $7,000 could be deductible. Read more from the IRS about medical and dental expenses.