Cryptocurrency Challenges For Accurate Tax Reporting

As digital currencies become more and more ubiquitous in the domestic and international marketplace, both in terms of investment speculation and usage as a medium of exchange, tax authorities in the United States and internationally are making every effort to keep up. Unfortunately, the lack of clear guidance is only part of the problem as the very nature of cryptocurrencies poses a significant hurdle for taxpayers in tracking and reporting taxable gains and losses, and it is a problem that is getting more challenging.

The Internal Revenue Service , in Notice 2014-21, held that cryptocurrency is treated as property for federal tax purposes. This treatment has important implications. As property, cryptocurrency gains or losses must be recognized every time cryptocurrency is sold or used to make a purchase of goods or services. When the currency is traded for cash, it will be treated as investment income, for which long-term and short-term gain/loss rules apply.

Two of the more common instances where taxpayers may not realize the need to recognize gain or loss comes in the form of exchanging one cryptocurrency for another and in mining cryptocurrency. Since cryptocurrencies are property, exchanging one cryptocurrency for another one triggers a taxable event. Additionally, when cryptocurrencies are mined, the fair market value of the mined currency must be included in taxable income.

We Can Help

Recent News

Include Form 8949 With The Form 1040 Schedule D

The Form 8949 is included with the Form 1040 Schedule D, which reports your overall capital gains and losses. On this form, you list your totals for short-term and long-term capital gains and losses separately, as they receive different crypto tax rates.

The Schedule D also includes gains and losses from Schedule K-1s from any businesses, estates, and trusts. It also is where you will report crypto capital losses carried forward from previous years or those that you wish to carry forward to future years.

What To Do If You Made A Mistake On Your Cryptocurrency Tax Return

If you were not aware that their crypto transactions had a tax reporting requirement, you can submit a tax amendment to reduce your risk of an IRS audit. We dont yet know what the possibility of an audit is. Some people believe crypto transactions are untraceable because of the anonymous, decentralized nature of blockchain. However, crypto transactions are distributed public ledgers, which means anyone can view the ledger at any time. The anonymity goes away whenever someone associates a crypto wallet address with a name.

If you want to correct passed transactions not reported to the IRS, you can amend your tax return for whichever year you didnt include your crypto activities. You have three years from the date that you filed your return to amend it. Its a basic three-step process:

Of course, youll also need to send a check for any taxes that you owe or possibly receive a refund if you had losses.

If you are new to crypto, still arent holding it in a Solo 401k, and trying to figure out how much tax you owe for 2021, you can get a reasonable estimate using this crypto tax calculator.

Recommended Reading: How To Lower Your Tax Bracket

Earning Cryptocurrencies Through Mining

Cryptocurrencies are commonly acquired in two ways:

- bought through a cryptocurrency exchange

- earned through mining

Mining involves using specialized computers to solve complicated mathematical problems which confirm cryptocurrency transactions. Miners will include cryptocurrency transactions into blocks, and try to guess a number that will create a valid block. A valid block is accepted by the corresponding cryptocurrencys network and becomes part of a public ledger, known as a blockchain. When a miner successfully creates a valid block, they will receive two payments in a single payment amount. One payment represents the creation of new cryptocurrency on the network and the other payment represents the fees from transactions included in the newly validated block. Those who perform the mining processes are paid in the cryptocurrency that they are validating.

The income tax treatment for cryptocurrency miners is different depending on whether their mining activities are a personal activity or a business activity. This is decided case by case. A hobby is generally undertaken for pleasure, entertainment or enjoyment, rather than for business reasons. But if a hobby is pursued in a sufficiently commercial and businesslike way, it can be considered a business activity and will be taxed as such.

Do I Have To Pay Taxes On Income From Crypto Mining Staking Forks Or Airdrops

Often when you receive new crypto from interest payments, mining, staking, forks, or airdrops- this is considered income. You receive income at market value at the time of receipt of the coin and then you would pay any capital gains and losses depending on how long you hold the crypto before selling for another coin or cash.

Also, when you send crypto between accounts you own – for example from your Coinbase account to your Ledger wallet- this is not a taxable event. This is called a Self Transfer.

Also Check: How Much Time To File Taxes

Keep Records Of Your Crypto Transactions

The IRS is stepping up enforcement of cryptocurrency tax reporting as these virtual currencies grow in popularity. As a result, you need to keep track of your crypto activity and report this information to the IRS on the appropriate crypto tax forms.

The IRS estimates that only a fraction of people buying, selling, and trading cryptocurrencies were properly reporting those transactions on their tax returns. The agency provided further guidance on how cryptocurrency should be reported and taxed in October 2019 for the first time since 2014.

Beginning in tax year 2020, the IRS also made a change to Form 1040 and began including the question: “At any time during 2022, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?”

If you check “yes,” the IRS will likely expect to see income from cryptocurrency transactions on your tax return.

Crypto tax software helps you track all of these transactions, ensuring you have a complete list of activities to report when it comes time to prepare your taxes. The software integrates with several virtual currency brokers, digital wallets, and other crypto platforms to import cryptocurrency transactions into your online tax software. This can include trades made in cryptocurrency but also transactions made with the virtual currency as a form of payment for goods and services.

How To Report Cryptocurrency On Taxes

Filing your cryptocurrency gains and losses works the same way as filing gains and losses from investing in stocks or other forms of property.

There are 5 steps you should follow to file your cryptocurrency taxes:

Letâs walk through each one of these steps in detail.

Also Check: How Long Do You Have To Work To File Taxes

Consider Hiring A Professional

Preparing for cryptocurrency taxes can be complicated, especially since the laws surrounding them are constantly evolving.

If youve made a substantial income from cryptocurrency, it may be worth hiring a certified public accountant who specializes in this type of tax work, so you dont have the IRS chasing you down later.

Irs Considers Crypto As Property

Cryptocurrency is subjected to taxes overseen by the Internal Revenue Service . The Internal Revenue Service issued Notice 2014-21 in 2014 that stated cryptocurrency is considered âpropertyâ and not currency.

Simply put, cryptocurrency is treated the same as stocks, bonds, and other assets that qualify for capital gains taxes. There are also instances where crypto is treated as income and thus qualifies for income taxes.

Letâs understand this concept with an example. Kate bought $20,000 of Ethereum in August 2021 and sold it in October 2021 for $25,000, Kate would realize $5,000 as a capital gain.

On this capital gain, the amount of tax that must be paid by Kate is dependent on the tax bracket and the holding period .

But what if Kate hadnât bought the crypto ?

If she had received cryptocurrency through mining, airdrops, or as interest from lending, her income would then be subject to income taxes, the rate of which would depend on the income slab she comes under.

Now, the next question that could come to mind is – how will the tax be calculated? For this calculation, it is crucial to understand three essential concepts:

- Fair market value

Also Check: How Much Taxes Deducted From Paycheck Sc

How Is Crypto Taxed

If you buy, sell or exchange crypto in a non-retirement account, you’ll face capital gains or losses. Like other investments taxed by the IRS, your gain or loss may be short-term or long-term, depending on how long you held the cryptocurrency before selling or exchanging it.

- If you owned the cryptocurrency for one year or less before spending or selling it, any profits are typically short-term capital gains, which are taxed at your ordinary income rate.

- If you held the cryptocurrency for more than one year, any profits are typically long-term capital gains, subject to long-term capital gains tax rates.

For short-term capital gains or ordinary income earned through crypto activities, you should use the following table to calculate your capital gains taxes:

How Do I Determine Cryptocurrency Gains Or Losses

Whether a cryptocurrency transaction results in a gain or a loss depends on the units cost basis and value at the time of disposal.

Cryptocurrency is disposed of when it is sold, traded, or used as a form of payment. The cost basis is the whole cost of acquiring your cryptocurrency this includes the purchase price, the value of the cryptocurrency you gave up to get it, or the amount reported as income if the cryptocurrency was earned.

- The taxable gain on the sale of the cryptocurrency is the difference between the cost basis and the values of the cryptocurrency at the time of disposal.

Cryptocurrency transactions must be disclosed on Form 8949 of your tax return regardless of whether they resulted in a gain or loss.

Read Also: How To Avoid Federal Taxes

Guide For Cryptocurrency Users And Tax Professionals

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes, which the Canada Revenue Agency is doing by presenting this guide.

Reporting As Either Income Or Capital Gain

Generally, if disposing of cryptocurrency is part of a business, the profits you make on the disposition or sale are considered business income and not a capital gain. Buying a cryptocurrency with the intention of selling it for a profit may be treated as business income, even if its an isolated incident, because it could be considered an adventure or concern in the nature of trade.

If the sale of a cryptocurrency does not constitute carrying on a business, and the amount it sells for is more than the original purchase price or its adjusted cost base, then the taxpayer has realized a capital gain.

Capital gains from the sale of cryptocurrency are generally included in income for the year, but only half of the capital gain is subject to tax. This is called the taxable capital gain. Any capital losses resulting from the sale can only be offset against capital gains you cannot use them to reduce income from other sources, such as employment income. You can carry forward your capital losses if you do not have any capital gains against which to offset those losses for the year or any of the preceding three years.

For more information on capital gains, see Guide T4037, Capital Gains.

You May Like: Does Llc Pay Self Employment Tax

How To Report Taxes On Cryptocurrency Mining

Eivind Semb

Have you received any cryptocurrency from mining? Unsure about how crypto mining is treated for tax purposes, or just want to know more about how to report income from mining for the next tax season? In this article, we will explain everything you need to know related to the taxation of crypto assets received from mining. We will also go into detail about how and which costs you are allowed to deduct to reduce your total tax burden.

The Irs Has The Paperwork Youll Need

The onus remains largely on individuals to keep track of their gains and losses. As a reminder, the IRS has added a question to tax return forms asking filers whether they received, sold, exchanged, or otherwise disposed “of any financial interest in any virtual currency.”

To make sure you stay on the right side of the rules, keep careful records.

-

You’ll need records of the fair market value of your crypto when you mined it or bought it, as well as records of its fair market value when you used it or sold it.

-

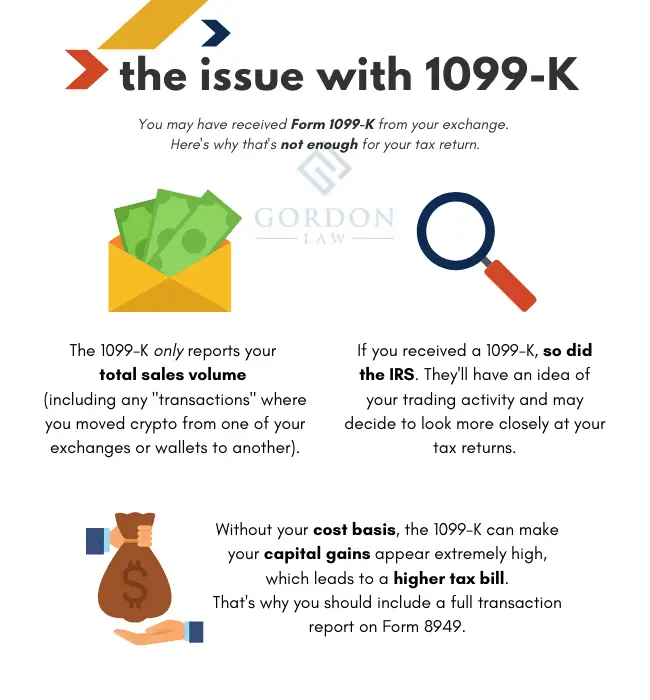

A Form 1099-K might be issued if youre transacting more than $20,000 in payments and 200 transactions a year. But both conditions have to be met, and many people may not be using Bitcoin or other cryptocurrencies 200 times in a year. Whether you cross these thresholds or not, however, you still owe tax on any gains.

Nerdy tip: While popular tax software can import stock trades from brokerages, dont expect it to import data from your crypto brokerage. Youll need special software to bridge that gap. If you only have a few dozen trades, however, you can record your trades by hand.

» Calculate your crypto profit or loss

Also Check: Why Do We Get Tax Refunds

How To Report Cryptocurrency On Taxes 5 Important Steps

Since cryptocurrency is still relatively new, it isnt always easy to find tax experts who know about it. To help investors like you, we broke tax reporting for cryptocurrency down into a 5-step process that is easy to follow. When youre done reading, youll know How To Report Cryptocurrency On Taxes and how to list all of your crypto transactions on your tax return.

Cryptocurrency Sales Are Taxable Events Similar To Selling A Stock

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

Yiu Yu Hoi / Getty Images

If youre looking to invest in cryptocurrency, you can do so through cryptocurrency exchanges and some brokerage accounts. While some cryptocurrency holders have seen massive gains, all crypto investors need to understand the tax requirements for cryptocurrency.

Crypto sales may be taxable, even if you dont get a tax form for your crypto account. Keep reading to learn more about how cryptocurrency is taxed.

Recommended Reading: Do You Pay Taxes On Stocks

How Do I Report My Cryptocurrency Trading On My Taxes

As this asset class has grown in acceptance, many platforms and exchanges have made it easier to report your cryptocurrency transactions.

You might receive Form 1099-B from your trading platform for capital asset transactions including those from crypto. Regardless of whether or not you received a 1099-B form, you generally need to enter the information from the sale or exchange of all assets on Schedule D. You can use Form 8949 if you need to provide additional information for, or make adjustments to, the transactions that were reported on your 1099-B forms. You will also need to use Form 8949 to report capital transactions that were not reported to you on 1099-B forms. If more convenient, you can report all of your transactions on Form 8949 even if they do not need to be adjusted. Sometimes it is easier to put everything on the Form 8949.

If you are using Form 8949, you first separate your transactions by the holding period for each asset you sold and then into relevant subcategories relating to basis reporting or if the transactions were not reported on Form 1099-B. Assets you held for a year or less typically fall under short-term capital gains or losses and those you held for longer than a year are counted as long-term capital gains and losses.

Which Crypto Tax Accounting Method Is Best For You

Even though LIFO and HIFO can help you shield yourself from paying hefty taxes, FIFO is the most common method among taxpayers.

It must also be noted that if you intend to use the LIFO or the HIFO method for gains calculations, you have to keep a detailed record of all your transactions. Only then you can calculate the gains in a hassle-free manner.

This was all about calculating your capital gains, but what if you incur losses? Letâs explore tax losses and how harvesting those losses can help you minimize your tax obligations.

You May Like: When Does The Irs Start Accepting Tax Returns For 2021

What Forms Should I Receive From My Crypto Platform

To document your crypto sales transactions you need to know when you bought it, how much it cost you, when you sold it and for how much you sold it. This information is usually provided to you by your trading platform on a Form 1099-B, Proceeds From Broker and Barter Exchange Transactions. However, not all platforms provide these forms. Typically, they can still provide the information even if it is not on a 1099-B.

If you were mining crypto or received crypto awards then you should receive either Form 1099-MISC, Miscellaneous Income, or 1099-NEC, Nonemployee Compensation. These forms are used to report how much you were paid for different types of work-type activities.

When these forms are issued to you, they are also sent to the IRS so that they can match the information on the forms to what you report on your tax return.

TurboTax Tip: Cryptocurrency exchanges won’t be required to send 1099-B forms until tax year 2023. If you dont receive a Form 1099-B from your crypto exchange, you must still report all crypto sales or exchanges on your taxes.