Make Sure Your Financial Institutions Can Find You

You should receive year-end statements from each brokerage or other financial institution by the end of January, or a few days later if the mail is slow.

Its up to you to make sure you have received all your statements. Most of us remember to update our address with creditors who send us bills every month, but its easy to have financial institutions lose track of our addresses when we move.

Another reason to make sure your bank or brokerage has your current address is that you dont want your account to end up on the unclaimed list, potentially to be turned over to your state!

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

How To Report Long

Part II for long-term transactions is a mirror image of Part I for short-term transactions. Again, you need to use a separate Form 8949 for each box checked regarding transactions and basis reported to the IRS.

- Transactions and your basis reported to the IRS . You know this because the Form 1099-B that you received indicates this information.

- Transactions reported to the IRS . You have to figure your basis based on your own records .

- Transactions not reported to the IRS . For example, if you sold a vacant lot for cash, the transaction is not reported to the IRS.

Once the form have been populated, amounts in each column are totaled. The net result is entered on Schedule D as follows:

- If Box D is checked: line 8b of Schedule D

- If Box E is checked: line 9 of Schedule D

- If Box F is checked: line 10 of Schedule D

Transactions may be combined or listed on separate forms for spouses filing a joint return.

You May Like: How To Calculate Payroll Taxes In Texas

How To Record An S Corporation Stock Sale

An S corporation is a business with 100 or fewer shareholders that has the liability protection of a corporation but is taxed like a partnership. This means that the owners include a portion of the corporations profits and expenses on their personal tax return, based on how many shares they own. Since the corporation must provide all of the owners information regarding what to include on their returns and to ensure that there are no more than 100 shareholders at any time, the S corporation must keep track of who owns its shares. A sale of S corporation stock takes place anytime a shareholder surrenders stock in exchange for property or a written promise to pay the shareholder in the future.

Update the S corporation’s stock ledger. A corporate stock ledger details who owns the S corporations shares. Each ledger might use its own notations, but the ledger should detail who transferred the stock, how much was exchanged, and the name of the new owner. The contact information of the new owner should also be included. This includes the owners phone number and address. Read More:How to Dissolve a Business Partner From a Corporation

Tips

-

Consider hiring professional help when preparing your tax returns if you are an S corporation shareholder.

References

How You Report A Gain Or Loss And How Youre Taxed

The two-page Schedule D, with all its sections, columns and special computations, looks daunting and it certainly can be.

To start you must report any transactions first on Form 8949 and then transfer the info to Schedule D. On Form 8949 youll note when you bought the asset and when you sold it, as well as what it cost and what you sold it for. Your purchase and sales dates are critical because how long you hold the property determines its tax rate.

If you owned the asset for a year or less, any gain would typically cost you more in taxes. These short-term sales are taxed at the same rate as your regular income, which could be as high as 37 percent on your 2021 tax return. Short-term sales are reported in Part 1 of the form.

However, if you held the property for 366 days or more, its considered a long-term asset and is eligible for a lower capital gains tax rate 0 percent, 15 percent or 20 percent, depending upon your income level. Sales of long-term assets are reported in Part 2 of the form, which looks nearly identical to Part 1 above.

Read Also: Can I File My Past Taxes Online

How To Pay Taxes On Stocks

If you sell stocks at a profit, you will owe taxes on those gains. Depending on how long youve owned the stock, you may owe at your regular income tax rate or at the capital gains rate, which is usually lower than the former. To pay taxes you owe on stock sales, use IRS Form 8949 and Schedule D. A financial advisor who serves your area can help you with tax planning for your investments and retirement.

Who Needs To Use Form 8949

The IRS Instructions for Form 8949 state that it is used to report sales and exchanges of capital assets. Form 8949 is used by both individual taxpayers as well as corporations and partnerships. Form 8949 is used with the Schedule D for the return you file, including Forms 1040 and 1065, along with most other common tax return forms. See page 1 of the IRS Instructions for a complete list.

Recommended Reading: How To Pay State Income Tax

For Reporting Accurate Capital Gains & Losses On Form 8949

Because of the flaws in Form 8949 requirements, and the overwhelming work involved in completing the 8949 in the IRS ideals, TradeLog Software utilizes a method for reporting accurate capital gains and losses based on the IRS requirements for taxpayers. Specific rules for traders and investors reporting investment income and expenses can be found in IRS Publication 550. Using this method, a Form 8949 can be generated with the software, and provide accurate tax reporting.

In order to fully comply with IRS tax reporting requirements as outlined in Publication 550, TradeLog uses the following process for entering trades on Form 8949:

For over a decade, TradeLog has been helping active traders and investors alike to better understand and report their capital gains on Schedule D. As IRS requirements for Form 8949 reporting continue to evolve, let TradeLog help you navigate the many challenges that generating accurate reporting requires.

Distributing The T5008 Slips

You can send recipients an electronic copy of their T5008 slips, on or before the last day of Februaryfollowing the calendar year to which the information return applies, but they must have consented in writing or by email to receive the slips electronically.

Note

If you file your information return over the Internet or on electronic media, do not send us the paper copy of the forms that make up the return.

If you are filing on paper, send us each T5008 slip , along with the T5008 Summary, on or before the last day of February following the calendar year to which the information return applies. Send these forms to:

T5008 ProgramPost Office Box 1300, LCD JonquièreJonquière QC G7S 0L5

Send two copies of the T5008 slip to the recipient on or before the last day of February following the calendar year to which the information return applies.

You do not have to keep a copy of the T5008 slips. However, you have to keep the information from which you prepared the slips in an accessible and readable format.

Note

When a business or activity ends, you have to send the appropriate copies of the T5008 slips to the recipients and us no later than 30 days after the date the business or activity ended.

Don’t Miss: How Can I Get Prior Year Tax Returns

Change Of Residency To California

If you are a California resident who sold property located outside California on the installment basis while a nonresident, your installment proceeds while a California resident are now taxable by California.

Example 4

On July 1, 2009, while a nonresident of California, you sold a Texas rental property in an installment sale. On May 15, 2010, you became a California resident and on August 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

Your capital gain income and interest income received on August 1, 2010, are taxable by California because you were a California resident when you received the proceeds.

Example 5

On September 1, 2008, while a nonresident of California, you sold stock in an installment sale. On June 1, 2010, you became a California resident and on October 1, 2010, you received installment proceeds comprised of capital gain income and interest income.

Determination

Your capital gain income and interest income received on October 1, 2010, are taxable by California because you were a California resident when you received the proceeds.

What Will I Owe In Taxes On My Stock Gains

Here’s where it gets tricky. The amount you owe in taxes on your stocks will depend on what tax bracket you’re in. Short-term capital gains are taxed as ordinary income, just like your paycheck.

We don’t need to go through every bracket here , but for most investors, the rate is tolerably low. For example, a married couple filing jointly with taxable income of $81,051 to $172,750 will be in the 22% bracket. So, if that’s you, and you earned $1,000 in short-term trading, you’ll be paying $220 in capital gains taxes.

If you sold stock that you owned for at least a year, you’ll benefit from the lower long-term capital gains tax rate. In 2021, a married couple filing jointly with taxable income of up to $80,800 pays nothing in long-term capital gains. Those with incomes from $80,801 to $501,600 pay 15%. And those with higher incomes pay 20%.

There’s also a 3.8% surtax on net investment income, which applies to single taxpayers with modified adjusted gross incomes over $200,000 and joint filers with MAGI over $250,000. Net investment income includes, among other things, taxable interest, dividends, gains, passive rents, annuities and royalties.

And remind yourself to set aside money for the tax man when you enjoy gains on your stocks in the years to come.

Also Check: How Much Property Tax Do I Pay

States With Capital Gains Preferences Should Eliminate Them

States that tax capital gains income at a lower rate than wage, salary, and other ordinary income should eliminate this special treatment. Taxing capital gains at the same rate as ordinary income would mitigate the increase in wealth concentration and could raise significant revenues.

Eliminating capital gains preferences in the eight states that had them in 2011 would raise some $500 million per year, the Institute on Taxation and Economic Policy estimates. Rhode Islands elimination of its capital gains preference in 2010 brings in over $50 million in additional revenue per year. Vermont and Wisconsin scaled back their preferences to raise revenue in the wake of the Great Recession. New Mexico reduced, from 50 percent to 40 percent, the share of capital gains that are exempt from taxation in 2019.

Only one state without an income tax currently taxes capital gains at all. Washington State recently enacted a tax on extraordinary profits from the sale of financial assets of over $250,000 per year, which will take effect in 2022. The remaining non-income-tax states could levy a tax on just this type of income.

Capital Gains Reporting Process

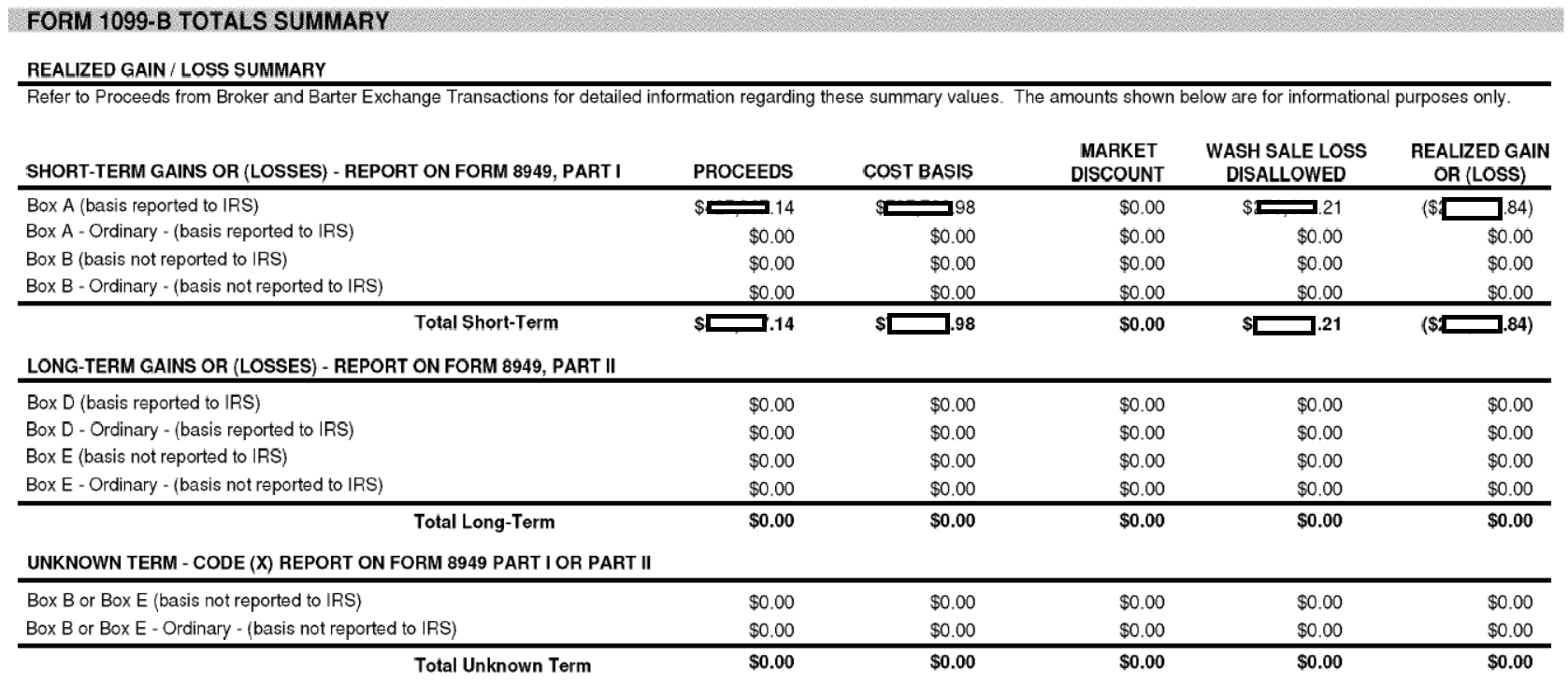

When filing your taxes, you gather all your 1099-B forms for the year, divide them between short- and long-term holding periods and enter the information onto the capital gains tax form, IRS Form 8949.

Youll end up with net amounts for short- and long-term capital gains/losses, which you transfer to Schedule D of Form 1040. These net amounts determine the amount of capital gains tax youll have to pay for the year.

If you have a capital loss, you can apply up to $3,000 of the loss to reduce ordinary income. Any excess capital losses can be carried forward and applied to reduce your ordinary income in future years.

Read Also: How To Access Past Tax Returns

Publicly Traded Partnerships: Tax Treatment Of Investors

Publicly traded partnerships have become popular investment vehicles as investors look for higher distribution yields than stocks are paying.1 Unfortunately, what is often touted as “dividend income” are really partnership distributions that cannot be directly compared to dividends paid by corporations.

For example, the December 2017 issue of Kiplinger’sPersonal Finance has an article, “Our Top Dividend Picks,” that lists two PTPs as high-yield dividend companies but only identifies one of them as in fact a partnership and the “dividends” as distributions.2 To an unknowing investor, the discussion of cash flow and the high yield from a PTP might seem attractive, especially if the investor is unaware of any tax reporting requirements of PTPs beyond what is required when holding stock in a company. This could cause a tax reporting nightmare for the investor.

Prior literature has often discussed investing in a PTP from a general perspective without regard to an understanding of PTPs from a tax investment perspective.7 Missing in the discussion of PTPs are the often-complicated reporting requirements for individual investors in completing their annual income tax return8 and possible traps for tax-exempt investors due to unrelated business taxable income issues.

Publicly traded partnerships

Tax considerations

PTP ownership example

Implications

Footnotes

When Do You Have A Capital Gain Or Loss

Usually, you have a capital gain or loss when you sell or are considered to have sold capital property. The following are examples of cases where you are considered to have sold capital property:

- You exchange one property for another

- You give property as a gift

- You settle or cancel a debt owed to you

- You transfer certain property to a trust

- Your property is expropriated

- The owner of the capital property passes away

Disposing of Canadian securities

If you dispose of Canadian securities, it’s possible that you could have a gain or loss on income account . However, in the year you dispose of Canadian securities, you can elect to report such a gain or loss as a capital gain or loss. If you make this election for a tax year, the CRA will consider every Canadian security you owned in that year and later years to be capital properties. A trader or dealer in securities or anyone who was a non-resident of Canada when the security was sold cannot make this election.

If a partnership owns Canadian securities, each partner is treated as owning the security. When the partnership disposes of the security, each partner can elect to treat the security as capital property. An election by one partner will not result in each partner being treated as having made the election.

To make this election, complete Form T123, Election on Disposition of Canadian Securities, and attach it to your 2021 income tax and benefit return. Once you make this election, you cannot reverse your decision.

Don’t Miss: What If I File Taxes Late

Completing The T5008 Slip

Before completing the T5008 slips, see Chapter 3 Filing methods. We can process your T5008 information return more efficiently if you follow those instructions.

For more information about filing requirements and on the filing methods available, go to Internet file transfer .

Foreign currency reporting

Complete all T5008 slips in Canadian currency. Use the exchange rate that was in effect at the time of the transaction or an average rate that includes the transaction period.

Foreign currency is usually converted to Canadian funds before it is credited to the recipient’s account. However, certain taxpayers keep foreign currency accounts and choose to convert their account balances themselves. If you get proceeds of disposition in a foreign currency and deposit the amounts to your client’s foreign currency account without converting them to Canadian funds, you can report in the foreign currency that applies. Identify foreign currency amounts by entering in box 13 the applicable currency code under International Standard 4217.

Joint ownership

Complete only one T5008 slip to report a transaction even if more than one person owns the securities. Include the names of the joint owners on lines 1 and 2 of the recipient area of the T5008 slip.

Aggregate reporting

Recipient’s name and address

Enter any other information, such as the name of a second recipient for a jointly owned security.

In all cases, enter the recipient’s full mailing address as follows:

Year

Void

Note

| Other |

Notes

Worksheet For Basis Adjustments In Column

If the basis shown on Form 1099-B isn’t correct, do the following.

|

| 1. |

Read Also: What Will I Get Back In Taxes