How Do I Manage My Plan To Avoid Default

In order to avoid default of your payment plan, make sure you understand and manage your account.

-

Pay at least your minimum monthly payment when it’s due.

-

File all required tax returns on time and pay all taxes in-full and on time .

-

Your future refunds will be applied to your tax debt until it is paid in full.

-

Make all scheduled payments even if we apply your refund to your account balance.

-

When paying by check, include your name, address, SSN, daytime phone number, tax year and return type on your payment.

-

Contact us if you move or complete and mail Form 8822, Change of AddressPDF.

-

Confirm your payment information, date and amount by reviewing your recent statement or the confirmation letter you received. When you send payments by mail, send them to the address listed in your correspondence.

There may be a reinstatement fee if your plan goes into default. Penalties and interest continue to accrue until your balance is paid in full. If you received a notice of intent to terminate your installment agreement, contact us immediately. We will generally not take enforced collection actions:

-

When a payment plan is being considered

-

While a plan is in effect

-

For 30 days after a request is rejected or terminated, or

-

During the period the IRS evaluates an appeal of a rejected or terminated agreement.

How Do I Determine If I Qualify For Low Income Taxpayer Status

If you believe that you meet the requirements for low income taxpayer status, but the IRS did not identify you as a low-income taxpayer, please review Form 13844: Application for Reduced User Fee for Installment AgreementsPDF for guidance. Applicants should submit the form to the IRS within 30 days from the date of their installment agreement acceptance letter to request the IRS to reconsider their status.Internal Revenue ServicePO Box 219236, Stop 5050Kansas City, MO 64121-9236

How Do I Revise My Payment Plan Online

You can make any desired changes by first logging into the . On the first page, you can revise your current plan type, payment date, and amount. Then submit your changes.

If your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount. If you are unable to make the minimum required payment amount, you will receive directions for completing a Form 433-F, Collection Information StatementPDF or Form 433-B, Collection Information Statement for BusinessesPDF and how to submit it.

To convert your current agreement to a Direct Debit agreement, or to make changes to the account associated with your existing Direct Debit agreement, enter your bank routing and account number.

If your plan has lapsed through default and is being reinstated, you may incur a reinstatement fee.

Also Check: Do You Pay Taxes If You Sell Your House

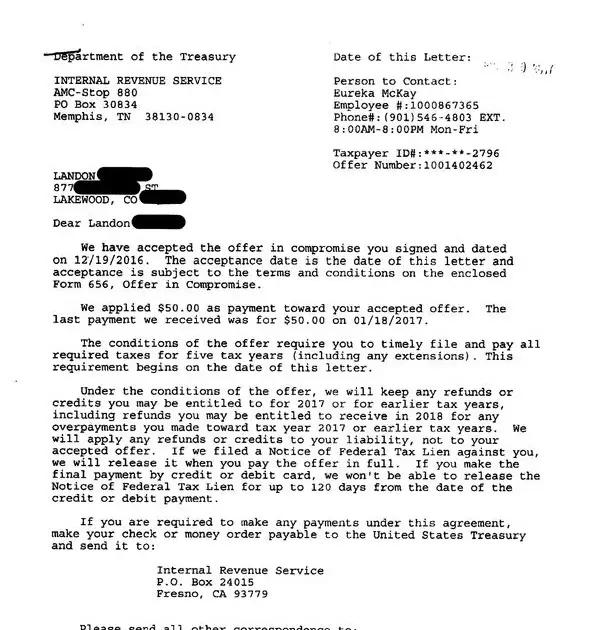

Tax Refunds Or Other Payments Can Be Used On Taxes In Payment Arrangements

If your tax refund is used on taxes included in a payment arrangement, this decreases the total amount of taxes included in the arrangement. After this, you can choose how to continue with your payment arrangement:

- You can pay the next instalment normally according to the payment plan. If the amount of refund used is enough to cover one or multiple instalments, your payment arrangement may end sooner than originally planned.

- Alternatively, you can consider the use of your refund as a payment made, and subtract this amount from your next payment. Remember to continue following the payment arrangement as normal after this. This way, your payment arrangement will end according to the original payment plan.

If you make a payment intended for other taxes, but you do not have taxes on which it could be used at the time of payment, it will be used on your taxes in a payment arrangement.

You can see the payment schedule of your payment arrangement and check the remaining balance in MyTax.

Can I Set Up A Payment Plan For My Taxes

The IRS will let you pay off your federal tax debt in monthly payments through an installment agreement.

If you haven’t filed yet, step through the File section of TurboTax until you reach the screen How do you want to pay your federal taxes? Select the installment payment plan option, Continue, and follow the onscreen instructions.

If you already filed, or you can’t find this option in TurboTax, you can apply for a payment plan at the IRS Payment Plans and Installment Agreements webpage. Make sure you’ve filed your return before applying through their site.

Most states offer an installment payment plan as well, although the procedure varies from state to state.

The easiest way to get the info you need is by searching the internet with the phrase state tax payment plan . You can try to contact your state Department of Revenue for details.

Related Information:

Recommended Reading: What Time Do Taxes Need To Be Filed

What Are The Benefits Of Paying My Taxes On Time

By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and for failing to pay taxes they owe by the deadline.

If you’re not able to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. There’s also a penalty for failure to file a tax return, so you should file timely even if you can’t pay your balance in full. It’s always in your best interest to pay in full as soon as you can to minimize the additional charges.

Facts About Irs Payment Plans

OVERVIEW

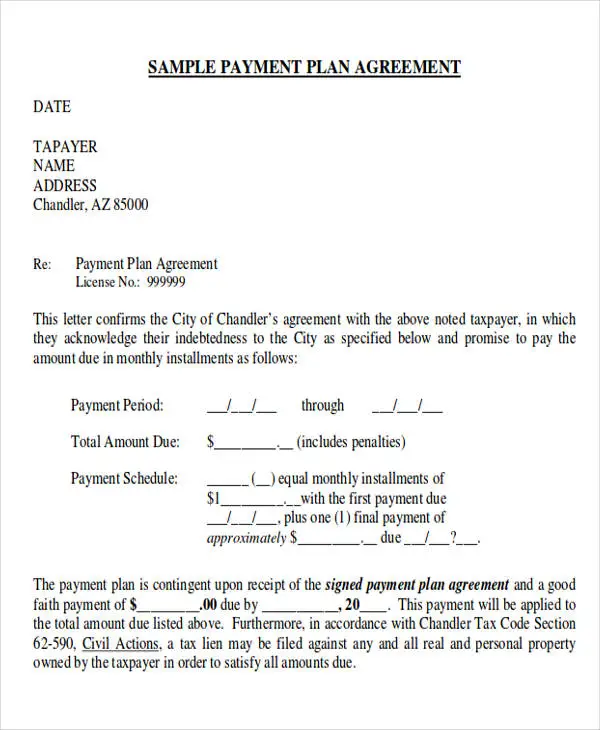

When you fall behind on your income tax payments, the IRS may let you set up a payment plan, called an installment agreement, to get you back on track. It is up to you, however, to take that first step and make a request for the installment agreement, which you can do by filing Form 9465. You can file the form with your tax return, online, or even over the phone, in some cases. But before you make the request, you’ll want to gather some facts about IRS payment plans.

Also Check: How Much To Charge For Tax Preparation

How Do I Pay Taxes In A Payment Arrangement

You will receive a payment plan and payment instructions for the taxes in the arrangement by post. You will also receive the payment plan in MyTax. See the instructions: How to find letters, tax decisions and tax certificates in MyTax.

Follow the payment plan and pay the taxes in equal-sized monthly instalments. Always use the payment arrangement reference number when making the payments. The first due date will be within one month from the date when your request was granted. The length of the payment plan or the size of the instalments cannot be changed afterwards.

However, you can make payments in your arrangement at a faster rate or in bigger instalments than what is required by your payment plan. Always remember to use the payment arrangements reference number.

Continue paying your other taxes not included in the arrangement normally, following the instructions you have received on your tax decision or in MyTax. Please note that self-assessed taxes that are not included in a payment arrangement cannot be paid in advance before the start of the month in which they fall due.

A payment arrangement does not affect the amount of late-payment interest. Even if the payment date of a tax is postponed due to a payment arrangement, late-payment interest is still imposed on the tax from the day after the original due date up until the date when the tax is paid. The rate of late-payment interest is 7% in 2022.

What Is A Violated Installment Agreement

The Department can cancel a payment plan after it begins, if it has been violated. A payment plan is considered violated if you do not:

- Sign and return the waiver that was included with your paperwork

- Make the full monthly payment on time

- File and pay any tax return due

- Provide a completed Statement of Income and Expenses when requested

If your payment plan is in violation and is subject to being canceled, the Department will notify you in writing.

Read Also: How Do I Find My Personal Property Tax In Missouri

Can My Payment Arrangement Lapse

When a payment arrangement is in force, the Tax Administration’s automatic system makes regular checks on how the taxpayer makes the payments. Your payment arrangement will lapse if

- you do not follow the schedule of the payment plan

- you leave other taxes unpaid while you are on the plan

- you do not file your tax returns, such as tax returns on your self-assessed taxes or income taxes.

The automatic system will notify you if your payment arrangement lapses. A notice on the lapse of the payment arrangement will also be shown in MyTax.

Pay It Individual Tax Payments

Below you will find links for methods to pay your Maryland tax liability. If you are unable to pay the full amount due, you should still file a return and consider making payment arrangements. We will process your return and then send you an income tax notice for the remaining balance due for nonpayment of taxes.

If you file and pay electronically by April 15, you have until April 30 to make the electronic payment, using direct debit or a credit card. Electronic payment options eliminate postage costs, the potential for lost mail and possible penalties for late payments.

Read Also: Who Qualifies For Ev Tax Credit

Can I Set Up A Payment Plan

You may request a formal payment plan agreement from the department on an individual income return liability if you have received a Notice of Final Assessment or Notice of Intent to Offset Federal Income Tax Refund. Please visit My Alabama Taxes at https://myalabamataxes.alabama.gov to submit a payment plan request. You will need to provide the last 4 digits of your Social Security Number in addition to the letter ID of any letter received from the Alabama Department of Revenue .

if you have received a Notice of Final Assessment or Notice of Intent to Offset Federal Income Tax Refund, select the Individual Income Tax payment plan is located under quick links for individuals.

If you have received a Final Notice Before Seizure or Certificate of Lien for Taxes from the Collection Services Division, select the Collections Payment Plan under Payment Quick Links.

ACH withdrawal from a valid checking or savings account is a requirement for IIT payment plans. Minimum payment is $25.00 per month not to exceed 24 months

State and Federal Refunds will continue to be captured and applied to an amount due during the life of a payment plan.

if you have received a Notice of Final Assessment or Notice of Intent to Offset Federal Income Tax Refund, select the Individual Income Tax payment plan is located under quick links for individuals.

State and Federal Refunds will continue to be captured and applied to an amount due during the life of a payment plan.

If You Owe More Than $50000 In Taxes

If the amount of tax you owe at the time you request an installment agreement exceeds $50,000, youll need to provide the IRS with additional information about your personal finances. In this situation, you must request the payment plan on Form 9465-FS and attach a Collection Information Statement on Form 433-F. The IRS will then perform a more thorough review of your assets and liabilities to determine whether you qualify for an installment agreement.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Also Check: How Do I Do My Taxes Online

Am I Eligible For A Waiver Or Reimbursement Of The User Fee

Waiver or reimbursement of the user fees only applies to individual taxpayers with adjusted gross income, as determined for the most recent year for which such information is available, at or below 250% of the applicable federal poverty level that enter into long-term payment plans on or after April 10, 2018. If you are a low-income taxpayer, the user fee is waived if you agree to make electronic debit payments by entering into a Direct Debit Installment Agreement . If you are a low-income taxpayer but are unable to make electronic debit payments by entering into a DDIA, you will be reimbursed the user fee upon the completion of the installment agreement. If the IRS system identifies you as a low-income taxpayer, then the Online Payment Agreement tool will automatically reflect the applicable fee.

What Is A Payment Plan

A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. You should request a payment plan if you believe you will be able to pay your taxes in full within the extended time frame. If you qualify for a short-term payment plan you will not be liable for a user fee. Not paying your taxes when they are due may cause the filing of a Notice of Federal Tax Lien and/or an IRS levy action. See Publication 594, The IRS Collection ProcessPDF.

Read Also: How To Get Tax Refund

What Happens When I Request A Payment Plan

When you request a payment plan , with certain exceptions, the IRS is generally prohibited from levying and the IRSs time to collect is suspended or prolonged while an Installment Agreement is pending. An IA request is often pending until it can be reviewed, and an IA is established, or the request is withdrawn or rejected. If the requested IA is rejected, the running of the collection period is suspended for 30 days. Similarly, if you default on your IA payments and the IRS proposes to terminate the IA, the running of the collection period is suspended for 30 days. Last, if you exercise your right to appeal either an IA rejection or termination, the running of collection period is suspended by the time the appeal is pending to the date the appealed decision becomes final. Refer to Tax Topic No. 160 – Statute Expiration Date and Tax Topic No. 202 Tax Payment Options.

What Does A Payment Arrangement Require

You must ask for a payment arrangement yourself. You can only get a payment arrangement if

- your financial difficulties are temporary, not long-term

- you do not have taxes in recovery by enforcement

- you have filed all required tax returns and reports to the Incomes Register

- you have paid all taxes that were included in a previous payment arrangement with the Tax Administration

The Tax Administration may reject your request for a payment arrangement. If your request is rejected, you will receive a letter concerning the matter by post and in MyTax. If you have activated electronic messages from the authorities on Suomi.fi messages, the letter will be sent only to MyTax. You will be notified of this by email. The letter will explain why your request was rejected.

Payment arrangements are made for a maximum duration of 2 years, and the smallest instalment is 20. If any taxes are included in the payment arrangement that are about to expire, the duration can be shorter than 2 years. In these circumstances, the end date of the arrangement is set at 6 months before the expiration date. The expiration of a tax debt takes place when five years have elapsed from the beginning of the calendar year following the year when the tax was imposed, collected or when it had fallen due.

Don’t Miss: How To Find State Tax Id Number

Setting Up A Payment Plan

To set up a payment plan youll need:

- the relevant reference number for the tax you cannot pay, such as your unique tax reference number

- your bank account details

- details of any previous payments youve missed

HMRC will ask you:

- if you can pay in full

- how much you can repay each month

- if there are other taxes you need to pay

- how much money you earn

- how much you usually spend each month

- what savings or investments you have

If you have savings or assets, HMRC will expect you to use these to reduce your debt as much as possible.

If youve received independent debt advice, for example from Citizens Advice, you may have a Standard Financial Statement. HMRC will accept this as evidence of what you earn and spend each month.

If Your Company Is In Tax Debt

HMRC will ask you to propose how youll pay your tax bill as quickly as you can. They will ask questions about your proposal to make sure it is realistic and affordable for you.

You must reduce your debt as much as possible before setting up a payment plan. You can do this by releasing assets like stock, vehicles and shares.

HMRC may ask company directors to:

- put personal funds into the business

Read Also: Where Do I Find My Property Taxes On My 1098

What Are The Browser Requirements Of The Online Payment Agreement Tool

OPA is supported on current versions of the following browsers:

-

Internet Explorer or Microsoft Edge

-

Mozilla Firefox

In order to use this application, your browser must be configured to accept session cookies. Please ensure that support for session cookies is enabled in your browser, then hit the back button to access the application.

The session cookies used by this application should not be confused with persistent cookies. Session cookies exist only temporarily in the memory of the web browser and are destroyed as soon as the web browser is closed. The applications running depend on this type of cookie to function properly.

The session cookies used on this site are not used to associate users of the IRS site with an actual person. If you have concerns about your privacy on the IRS web site, please view the IRS Privacy Policy.