Gold Bullion Taxes In The Uk

In the United Kingdom, there are some frustrating laws regarding precious metals, and ones that put many investors off. Simply put, you need to pay a 20% VAT on silver, platinum and palladium, and even if you buy overseas, pay those hefty shipping charges and avoid taxes, they can still sting you. In this case, the items are checked as they arrive in the country and the recipient receives a note telling them that they need to pay an additional 20% on their order, as well as a fee imposed by the delivery service.

There are no such charges for gold bullion, but you will be forced to pay capital gains tax, which is what you pay on the profits that you make from the sale of bullion. Basically, if you buy gold for £1,000 and sell it for £1,200, regardless of when you sell it or whom you sell it to, you will need to pay a 28% tax on that £200. You can get around this by sticking to legal tender bullion, including coins like the Gold Britannia and Gold Sovereign, as well as other coins produced by the Royal Mint.

How To Sell Gold And Other Precious Metals Tax Free Updated 10/1/2010

See 10/1/2010 Update Below

Keith Fitz-Gerald from MoneyMorning.com wrote a negative article on gold yesterday called Warning: You May Not be Making as Much on Gold as You Think.

In this article Fitz-Gerald was trying to warn gold investors by trying to rain on their parade about all the taxes they would have to pay on their gains. This negativity may convince some not to invest in precious metals, so I made a comment to his post telling the readers of MoneyMorning that there are solutions available to avoid paying taxes on the gains one has made on gold.

So far my comment hasnt been posted. EDIT: The comment has now been posted, #18.

Fitz-Gerald wrote

Unbeknownst to most investors, gold is considered a collectible not a capital asset. In plain English, this means that despite the fact that many people believe they are investing in gold, the Internal Revenue Service believes that they are collecting it.

Precious metals are a completely different story. Profits from these investments can be subject to a 28% maximum tax rate if held for more than 12 months. And if they are sold in less than a year, the profits count as ordinary income.

There was also a comment by a poster named Dave that I referenced as misleading. Daves comment was

UPDATE 10/1/2010

How To Sell Gold Without Paying Taxes

Easy.

Its certainly a smart ass answer.

But its the general truth at the moment.

Physical bullion IRA tax exceptions aside. In general, if a US citizen sells bullion for more than they bought it for, the IRS will want its cut of the profits.

Render to the IRS, that which is the IRS.

What was the cost basis on the bullion you sold?

If your cost basis was lower than what you sold your bullion for, a portion of the profit goes to the IRS.

EXAMPLE: I bought this silver in 2008 for $12 oz. I just sold it for $15 oz. The IRS is going to want its cut of the $3 profit.

Same holds true for any precious metal and or other collectible. And yes paper bugs, same rules apply even in some annual fee charging surreal ETF proxy, not just bullion alone.

Now dumbed down misinformation abounds online, so chances are high you have seen people generalize things. Often claiming bullion is taxed at a 28% rate. Although they often forget to attach the word maximum to that claim.

Currently you have to be making over $155k a year as a single tax filer, or over $300k year filed jointly, to be taxed that highly on your bullion profits.

Median US citizens makes about $60k per year, so average people selling bullion for a profit will likely be in a federal tax bracket lower than 28%.

Read Also: Can I Pay My State Taxes Online

Gold Reporting On Cash & Cash Equivalent Payments

For bullion buying and selling privacy statutes, there are specific IRS reporting requirement rules which bullion dealers in the USA must comply. Reporting rules when buying bullion trace their roots to Anti-Money Laundering laws.

Here at SD Bullion, we have purposely set up our bullion payment policies so that the high 99% percentile of customer bullion purchases remain private, without additional paperwork or any IRS reporting required.

For bullion selling to dealers, some products sold in specific volumes get reported in high amounts, and this legal requirement traces its roots to 1980s CFTC rules regarding the futures contract sizes and stipulations. We cover those stated products and sell back volumes below.

Do I Have To Pay Tax If I Sell Gold

Tax on Selling Physical Gold Individuals selling physical gold would be subject to a 20% tax rate, as well as a 4% cess on long-term capital gains, or LTCG. Long-term gains, on the other hand, are taxed at a rate of 20.8 percent with indexation benefits.

Also Check: Where Is My 2020 Tax Return

What Is Capital Gains Tax

CGT is the tax you pay on the profit or gain that youve made on an item when it is sold. It applies to assets that you own, such as bullion, property or shares. Capital Gains Tax differs from Income Tax in that only the gain made on the sale of the asset is taxable. For example, if you bought a coin for £250 and sold it for £700, the CGT would apply to the £450 profit you made from the sale. CGT is usually charged at a rate between 20-28%. However, you dont have to pay CGT if your total gains within a financial year fall below the tax-free allowance of £12,300 *. It is the responsibility of the individual investor to declare any Capital Gains Tax payable.

How To Sell Gold And Silver Tax

You can trade an unlimited amount of gold and not pay the tax when using the self-directed Roth retirement account. Or, you can postpone the gold taxes with the 1031 IRS exchange. The Internal Revenue Service requires you to report any physical gold sales on Form 1099-B.

Do you have to file taxes on gold and silver?

- Gold and silver bars that are 1 kilogram or 1,000 troy ounces require the filing as well. American Gold Eagle coin sales do not require a Form 1099-B filing. 5 The tax bill for all of these sales is due at the same time that your ordinary income tax bill is due.

Recommended Reading: Do Minors Need To File Taxes

Tax Example And Offset Possibilities

As an example, assume you purchase 100 ounces of physical gold today at $1,330 per ounce. Two years later, you sell all of your gold holdings for $1,500 per ounce. You are in the 39.6% tax bracket. The following scenario occurs:

Cost basis = = $133,000

Sale proceeds = = $150,000

Capital gains = $150,000 – $133,000 = $17,000

Tax due = 28% x $17,000 = $4,760

Capital losses on other collectibles can be used to offset a tax liability. For example, if you sell silver at a $500 loss, then you can net these amounts and only owe $4,260. Or, you can save the $500 as a loss carry forward for the future.

Is Gold Exempted In The Capital Gain Tax In Your Country

First, understand the gold taxation laws in your country. Does your country consider bullion as part of its legal currency? Does your government enforce laws that exercise capital gain taxes on your collectibles?

In British law, gold sovereigns and Gold Britannia coins are Capital Gains Tax-free because they are considered British legal currency. Therefore, any profit you get from your investments, regardless of the value or quantity, is free!

Also, the gold sales tax in the United States depends on state laws. The IRS is responsible for the 1099 B reports, but specific states have the power to levy certain taxes on businesses and individual.

The taxes and costs can add up and overwhelm you unless you are doing business in a state that doesnt have strict gold tax laws.

If you are a seller and you take a loss during your gold trading endeavors, you will not pay tax for that. In fact, you can write off losses amounting to $3,000 a year.

Read Also: When Is The Due Date For Taxes

Tax Planning For Gold Investments

There are three three common strategies you can take to minimize capital gains taxes on gold:

Avoid physical assets

There are several ways that you can invest in gold, but often investors will invest directly in whats known as gold bullion. This just means that you own literal, physical quantities of gold.

As an alternative, you can also invest in products that invest in physical bullion, effectively purchasing the metals on your behalf. For example, you can buy an ETF that holds quantities of physical gold in its portfolio. In this case you will own gold bullion by proxy.

This can increase your tax bill substantially. In fact it almost certainly will.

Ordinarily, capital gains are taxed at three brackets: 0%, 15% and 20%. You cant pay more than 20% in taxes on investment profits, and to reach that top tax bracket you need to have made around $450,000 as a single taxpayer and $500,000 as a joint taxpayer in that tax year.

However, the IRS considers physical quantities of metal to be a collectible. For collectibles, such as coins, art and bullion, the standard tax rate is 28%. As a result, owning physical gold, or owning funds that themselves own physical gold, means that you can pay a higher maximum capital gains rate of 28%.

Hold your investments for at least one year

Consider a 1031 exchange

A 1031 exchange could offer you more flexibility, allowing you to defer the tax bill on a capital gains so long as you reinvest those profits in another investment asset.

When Do You Pay Taxes On Precious Metals

Lets say you bought several American Eagle gold coins and a few 1 oz silver bars and now what? At what point do you have to pay taxes?

Its actually quite simple. Lets break down precious metal ownership into 3 phases:

- When buying:when making a precious metal purchase, the only tax you should think of is the VAT .

Gold: When buying investment gold , you pay no taxes because, in most countries, investment gold is VAT-free. Buying silver, however, is a different story.

Silver, Platinum, and Palladium: As an industrial product, silver is subject to VAT, with rates varying from country to country. The same goes for platinum and palladium the PGM group metals. You will find more details on this below.

- When storing:In short, owning precious metals is pretty much tax-free. Unlike real estate, precious metals are not subject to annual taxes and they are not taxed as part of your income. Instead, you can just keep them, follow their spot price, and sell them at the right moment. However, bear in mind that in some countries such as Switzerland, the precious metals you store have to be included in your wealth tax declaration.

- When selling: finally, when it comes to selling, theres one main tax to have in mind: the capital gains tax. It exists almost everywhere, with rates varying in different countries. Unlike VAT, this tax applies to all precious metals, including gold.

Recommended Reading: How Much Money To Do Taxes

Precious Metals And Gst/hst

According to subsection 123 of the Excise Tax Act, a precious metal is part of the definition of Financial Instrument. This is important because Financial Instruments are not subject to GST/HST on their sale.

Precious Metals

Precious metals are bars, ingots, coins or wafers of gold and platinum that are refined to a purity level of 99.5%. Silver is also a precious metal if it is refined to a purity level of 99.9%.

If a precious metal that meets the definition of financial instrument are sold, there is no GST/HST charged.

Scrap Gold

An issue that the Canada Revenue Agency typically has with sellers of precious metals, is the sale of scrap gold. Scrap gold is not refined to a purity of at least 99.5% and thus GST/HST is chargeable on the sale. Where this gets complicated is through the following example:

- Lebron sells scrap gold to Steph

- Steph purchases more scrap gold and then sends it all to a refiner

- The refiner smelts down the gold and turns it into 99.5% pure and

- The refiner takes a fee for the service and then ships the 99.5% pure gold back to Steph.

The CRA occasionally takes the position that Steph sold the scrap gold to the refiner, and then purchases the pure gold. Why this matters is if that was indeed the case, Steph would have to charge GST/HST on the sale of the scrap gold to the refiner.

If you are being audited for the sale of precious metals, contact us today to see how we can help!

Case Law

Michaud v. The Queen, 2014 TCC 83 Gold Prospecting

Payment Reporting When Buying Bullion Online

If you have bought bullion online, it is likely you have noticed various payment policies which deter customers from using large amounts of cash or cash equivalents in payment . The IRS requires businesses to file Form 8300 when large cash payments are involved.

There have been various now bankrupt, poor track record bullion dealers in the past who have got themselves into hot water by allegedly laundering drug dealer cash through bullion purchases. Even some established bullion mints have been accused in the past as well as also as recently as this year , for not having appropriate anti-money laundering policies in place.

Often law-abiding bullion dealers in the USA resort to only receiving cash equivalent payments in small quantities, if any at all. Typically online bullion dealers lean on established financial institutions as the first layer in their Anti-Money Laundering and Know Your Customer compliance policies.

Typical online bullion dealer payment methods like personal bank checks, bank wire transfers, ACH, credit / debit cards, PayPal, etc. are exempt from IRS Form 8300 filings by bullion dealers as these payment methods are coming through financial institutions which should have already executed legally required KYC and AML due diligence on their respective customers.

Recommended Reading: Where Do You Mail Federal Tax Returns

How To Sell Gold Without Paying Taxes: Is It Possible

You can claim a tax exemption on long term capital gains from the sale of gold assets under Section 54F of the IT Act, 1961. Section 54F provides an income tax exemption on capital gains earned from selling capital assets such as shares, gold, bonds etc., other than a house property.

If you sell gold and reinvest the entire sale proceeds towards purchasing or constructing a house property, the capital gains you earn are allowed as a tax exemption under Section 54F.

Explosion at centre of Istanbul captured on video: Watch

For example, if you had purchased physical gold for 6 Lakh in FY 2012-13 and sold it for 10 Lakh in FY 2018-19, your long term capital gains are 1.6 Lakh . If you invest the entire sale proceeds of 10 Lakh from gold in a house property, the capital gain of 1.6 Lakh will not be taxed in your hands.

However, you have to use the sale proceeds from gold in the following manner to claim this tax exemption:

- You have to purchase a new residential property one year before the sale of the capital asset. OR

- You have to purchase residential property within two years from the sale of the capital asset. OR

- You have to construct a residential property within three years from the date of sale of the capital asset.

Taxes On Physical Gold And Silver Investments

Many investors prefer to own physical gold and silver instead of exchange-traded funds that invest in these precious metals. While the tax implications of owning and selling ETFs are very straightforward, not many people fully understand the tax implications of owning and selling physical bullion. Below is a description of how these investments are taxed, as well as their tax-reporting requirements, cost basis calculations, and ways to offset any tax liabilities from the sale of physical gold or silver.

Recommended Reading: How Do I Pay My Payroll Taxes

Selling Gold Without Paying Taxes

The IRS is always looking for its fair share of the gold profits you make. However, you have the chance to twist and check whether your profits are income or capital gains.

Selling and buying investment gold comes with short or long-term gain taxes. In case you are a regular buyer and seller, you fall under the retail dealer category. The IRS treats your earnings as income tax.

But, if you are a hobbyist collector, you have a 28% tax rate.

But, with the self-directed Roth retirement account, the IRS will not enforce taxation on any amount of gold you sell!

Physical Gold And Silver

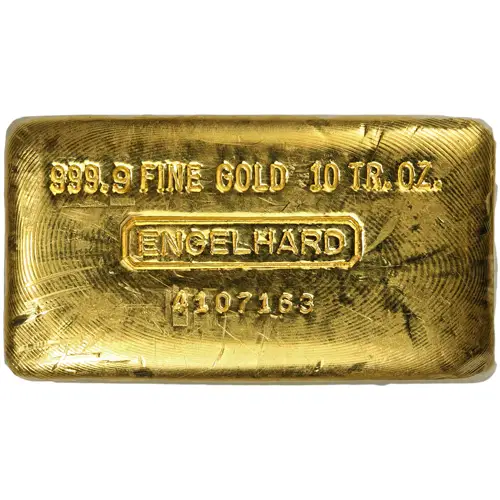

Physical gold investors are generally looking for items that are considered fine gold . Several products fit this description, and one of the most preferred is gold bullion coins, such as the South African Krugerrand or the American Gold Eagle.

Another option is gold rounds, which are similar to coins, but are not legal tender. Both gold coins and gold rounds come in various sizes, usually ranging from 1/10 of an ounce to 1 ounce, though other less common sizes are available. Gold bars are another popular option for yellow metal exposure. They also come in a variety of sizes, ranging from 1 gram bars to 400 ounce bars.

When the objective is to get the most metal for the least money, its generally best to shop for gold rounds and gold bars, which tend to be cheaper than gold coins of the same weight. The premium for gold coins is higher because they are fabricated by government mints and have detailed designs.

Another factor to consider is the amount to be invested. Sizeable investments are best made in large gold bars. Further, it is often easier to manage large bullion bars than an array of smaller gold coins.

These principles also hold true when investing in physical silver purchasing silver products such as silver bars, silver coins and silver rounds are popular ways to invest in silver.

It is worth noting that the 28 percent maximum is applicable to long-term capital gains, since short-term capital gains on precious metals are taxed at ordinary income rates.

Read Also: How To Get Tax Return Information