Apply Generic Tax Code

If you enable generic tax code, it will mean that all your transactions will go into your QuickBooks/Xero with the specified tax code. However, you can choose if you want the tax code to override existing taxes from your payment processor or if you want it to be applied only to transactions that are not taxable using settings 4 and 5:

- Apply generic tax: If a transaction contains taxes

If you specify the tax code in this field, Synder will override the tax amount from your payment processor with the tax rate you specified. This setting can be used to correct tax amounts recorded in the payment processor.

- Apply generic tax: If the transaction does not contain taxes

If you specify the tax in this field Synder will apply a tax only to the transactions that do not have tax on the payment platform side.

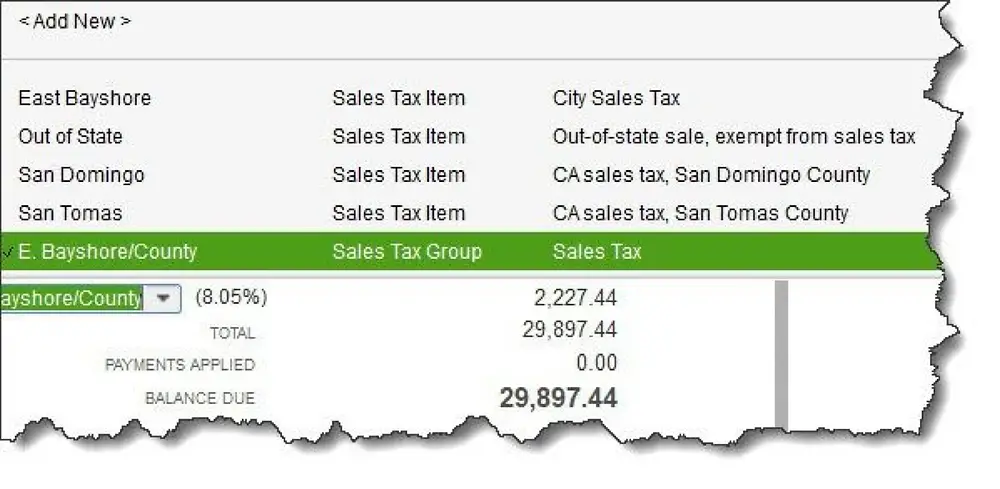

Save Your Sales Tax Group

Repeat this process until all of your sales tax rates are successfully created, and youre in business . Once youve added your sales tax rates you can begin creating invoices and running your business!

If you have any troubleshooting issues, check out the QuickBooks Community or . Or, if you want to learn more about sales tax, read our complete Small Business Sales Tax Guide. And as always, if you have any further questions, leave a comment below and well do our best to help you.

Dont forget to check out the rest of our QuickBooks Desktop Pro 101 Series to learn how to create invoices, customize invoices,run sales tax reports, and more.

Overwhelmed by QuickBooks Pro? Maybe its time to switch to QuickBooks Online. QBO is easy to use, cloud-based, and affordable. Best of all, you can easily import your QuickBooks Desktop data into QuickBooks Online. Check out our full review on QuickBooks Online for more details.

Outgrown QuickBooks Pro? Switch to QuickBooks Premier. Its the same QuickBooks Desktop software you love but with more users and advanced, industry-specific features, which we cover in our QuickBooks Premier review.

The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation.

Select The Tax Agency

Use the drop-down menu to select the appropriate sales tax agency. The sales tax agency is the legal entity for which you collect sales tax. If you need help finding the right sales tax agency, refer to our Small Business Sales Tax Guide.

You most likely will need to create a brand new vendor for your tax agency. You can do so by clicking < Add New> . Then, fill in the appropriate information and press OK to save your new tax agency.

Don’t Miss: Where Can I Mail My Tax Return

Tracking Sales Tax Liability Via Quickbooks Reporting

If you need to see where QuickBooks is getting its sales tax payable numbers, or you require more detailed sales tax information for filling out your sales tax forms, QuickBooks provides some reports that may be useful for this.

We can find the Sales Tax Liability and Sales Tax Revenue Summary reports in a few places:

- From the Reports > Vendors & Payables menu

- From the Vendors > Sales Tax Menu

- From the Vendors > Manage Sales Tax menu

On the Sales Tax Liability report, youll see each of your sales tax vendors listed, and nested below them each sales tax item associated with that vendor. The columns show your Total Sales, Non-taxable and Taxable Sales, the Tax Rate for that item, the Tax Collected for the dates the report is set for, and the Sales Tax Payable as of the end of the selected date range. This may be higher than the tax collected if there are unpaid prior amounts. You can double click on any of these totals to drill down for details about the transactions that make them up.

The Sales Tax Revenue Summary report gives you a simple total of the sales by sales tax vendor, broken down further to sales tax item, and columns by tax code, typically taxable or non-taxable and totals. This can be handy for quickly finding totals of each tax in the chosen period, which youll likely need for filling out your sales tax forms.

How To Adjust Sales Tax In Quickbooks

Every state except Alaska, New Hampshire and Oregon has some form of sales tax. Consequently, small businesses face the challenge of adhering to local and out of state sales tax regulations. Sales tax compliance requires businesses to track taxable and non-taxable sales separately. In addition, businesses calculate tax on each transaction and then report summaries on each periodic sales tax return. QuickBooks has enabled business managers to manage their sales tax reporting requirements in a single accounting system and offers the user the ability to adjust sales tax due.

1.

Start QuickBooks and navigate to the home screen. Open the chart of accounts by clicking on the lists button on the top menu bar, and then selecting chart of accounts.” Access the QuickBooks shortcut to the chart of accounts by holding control and clicking a on your keyboard.

2.

Expand the chart of accounts window by clicking the box in the upper right had corner of the new window. Click the edit button on the top menu bar and select new account. Check the other account types option at the bottom of the account type list. Select the drop down bar and choose other current assets. Name the account Sales Tax Adjustments.” Close the chart of accounts.

References

Also Check: Do Seniors Have To File Taxes

Things You Need To Know About Sales Taxes In Quickbooks Online

If you sold only one type of product to customers in one city, collecting and paying sales tax would be easy. But most businesses have a wider reach than that.

QuickBooks Online offers tools that allow you to set up sales tax rates and include sales tax on sales forms. Further, it calculates how much you must pay to state and local taxing agencies.

This is one of the most complicated areas in QuickBooks Online because you may have to deal with numerous taxing agencies. If youre not already working with sales taxes, we strongly recommend you let us help you get everything set up correctly from the start. Taxing agencies can audit your recordkeeping and you want to make sure it is set up correctly.

That said, here are five things we think you should know.

QuickBooks Online calculates sales tax rates based on:

Customer records for exempt organizations should contain details for that exemption. Youll need to see their exemption certificate or at least know its official number.

Intuit now offers a revamped version of QuickBooks Onlines sales tax features.

At some point, youll be asked if you want to switch to the new, more automated system. The actual mechanics of the process are simple, but youll be moving historical and in-process data to a new structure. If you have sales tax set up right now and your situation is at all complicated, youre going to want our help with the transition.

This enhanced feature only supports accrual accounting.

How Do I Enable Taxes In Quickbooks Online

Rocket Matter features the ability toapply Taxes and Surcharges to any Matter. Regardless of whether you apply Taxes to the Matters in your Rocket Matter account, in order for your RocketMatter/QuickBooks Online sync to be effective, ‘Sales Tax’ must be enabled in your QuickBooks Online Account.

For a quick overview, view our QuickBooks short video:

Following is an Intuit/QuickBooks link with instruction on enabling Sales Tax in QuickBooks Online:

To enable sales tax:

Note: Please verify that these instructions are current before modifying your QuickBooks Online Account by contacting Intuit/QuickBooks.

Recommended Reading: What Is Hawaii State Tax

Setting Up Sales Tax In Quickbooks Desktop

If you are transferring your sales tax information through Commerce Sync, you’ll need to have your Sales Tax enabled in QuickBooks.

Below are instructions on how to enable Sales Tax in QuickBooks Desktop, how to add or edit your Sales Tax Rate, and how to add or edit a Combined or Group Tax Rate. After you have made these changes in QuickBooks, you’ll need to turn on the Transfer Sales Tax feature in your Commerce Sync account. See steps below.

To enable Sales Tax within QuickBooks Desktop:

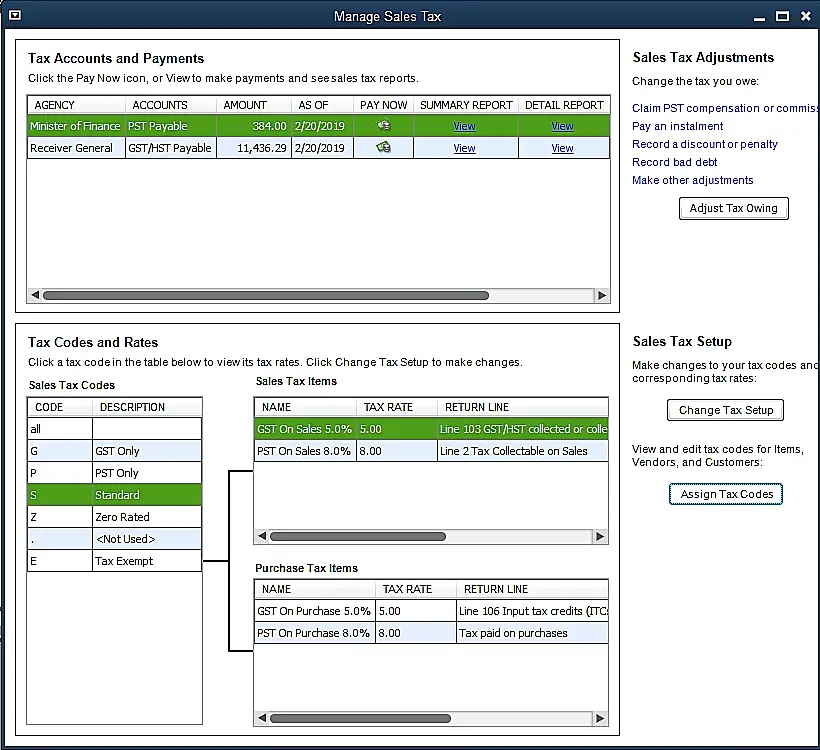

After initial setup, you can access your Tax settings easier by selecting the Manage Sales Tax icon that now appears in Vendors > Sales Tax > Manage Sales Tax.

Steps to Create a Sales Tax Group

When creating a Tax Rate in the Preferences dialog, select the Sales Tax Group item. From there, select your tax items to make your combined rate in the group.

Turn on Transfer Sales Tax Feature in Commerce Sync

How To Set Up Sales Tax

- Enter your QuickBooks, select the edit menu and then click on preference.

- From the preference window, select sales tax.

- Then click on the company preferences tab.

- Then click on the add sales tax item and then enter the tax rate into the field for your state.

- To select your states revenue click on the tax agency from the drop-down list and then click ok.

- To add a sales tax for a particular city, click on the add sales tax item again and enter the required information.

- Then go ahead and select taxable item code and choose the appropriate option from the drop down to show that an item is taxable. The check the box to display the taxable amount.

- Then click on the option to collect taxes. If you charge for your products using invoice, then use the invoice date otherwise the cash basis option is the option to click.

Also Check: When Do You Need To File Taxes 2021

How To Set Up Sales Tax In Quickbooks Online

The right method to set up a Sales Tax in QuickBooks is by adding a tax rate and agency in QB Sales Tax:

- The very first, go to the left menu and select the Taxes option

- Next, choose the add/edit tax rates and agencies

- Now, select the New button

- Moving forward you have to choose either a combined or solitary tax rate

- After that, add a name for the agency and tax

- Once done with that then you need to add the percentage for the rate

- At last, hit Save.

In case, if you are required to track sales tax for more than one tax entity, then it is mandatory to set up a combined tax rate. Heres how:

- Initially, go to the left menu and select Taxes

- Next, select Edit/Add agencies along with tax rates

- Now, choose the New option

- After that, select the option Combined tax rate

- Add the name for the combined rate along with different criteria for sales tax

- Pick a choice for additional components

- In the end, choose Save.

It is true that next to your payroll, state sales taxes represent probably the most complex element of your accounting tasks. This blog mainly focuses on how to set up Sales Tax in QuickBooks and you can easily do the same with the above-provided steps. Once the setup is done then itll be easy for you to collect and pay sales tax to agencies. Hope the complete process of setting up sales tax in QuickBooks Desktop as well as in Online is clear to you.

Paying Sales Tax Liability

Now that youve set your preferences, created your sales tax items and groups, and learned to apply them to customers as well as use them on transactions, youre well on your way to successfully managing the collection of sales taxes in QuickBooks. But collection is only half the equation. Youll also need to pay your sales tax liabilities to the appropriate agencies, and QuickBooks has some tools to assist you on that side of things as well.

All the time that youre recording sales using these sales tax items, QuickBooks is taking the amount of sales tax you owe and collect and posting these balances to a sales tax payable liability account, associated by name to the appropriate vendors. Writing a regular check to your sales tax vendor, while it will record that you sent the agency funds, wont properly clear out this account. This could lead to your sales tax payable reports containing bad data, and potentially throwing off your books. Instead youll want to use the Pay Sales Tax function, available either from the Manage Sales Tax window or directly from the Vendors > Sales Tax menu. Unless your bank and QuickBooks are set up to send e-checks through QuickBooks, this wont actually pay the vendor, of course. But it is a necessary step in QuickBooks even if you already paid the vendor completely outside QuickBooks with a handwritten check, for balances owed to be tracked properly.

You May Like: How Do I File My Unemployment Taxes

Setting Up Sales Tax In Quickbooks Online

Most business owners hear the words sales tax and go running for the hills . Do we blame them? Of course not. While it can be intimidating, theres no need to break into a sprint! Im going to walk you through the details of setting up sales tax in QuickBooks Online.

Sales tax is a state tax on goods and services sold and varies from place to place. If youre not sure what that rate is for your state, find out here.

Note: Not all customers are required to pay a sales tax. Look and see what qualifies your customer to pay or not, and then you can set them up as tax-exempt if necessary.

Now, where to start?

Double-check your business address. This is important because QuickBooks uses this info to set up the right tax agency and rates for you.

Tell QuickBooks if you pay other tax agencies. QuickBooks needs to know this if you sell products outside of your city/county/state since there are different rates for different locales. Note: If youre not sure if you need to or currently file with other tax agencies, reach out to your accountant or tax adviser.

Aligning Sales Tax Items With Sales Tax Preferences

Back on the Sales Tax preferences screen, once youve got at least one sales tax item created, you can select your most commonly-used sales tax item or group. QuickBooks requires that you choose a most common item so that it knows what tax rate to default to on transactions for customers who are listed as taxable.

Below this, youll select the sales tax codes that determine if items on your transactions are taxable or non-taxable. Typically, these will just be Tax and Non, respectively. Its uncommon to use more than these two sales tax codes, so if you have more than that you may want to check with your bookkeeping or accounting professional to confirm which you should set here.

Finally, youll tell QuickBooks about how to handle some of your sales tax dates. Youll choose whether you owe sales taxes as of the date of a customer invoice , or the date you receive payment from a customer . Youll also tell QuickBooks whether you pay your sales taxes monthly, quarterly, or annually.

Don’t Miss: Does Llc Pay Self Employment Tax

Configure Sales Tax Settings

You can turn sales tax on or off by editing sales tax settings.

For additional information: