How To Register And File A Tax Return Online

The reasons that nearly 94% of tax returns are filed online are because, according to HMRC, it is easy, secure, available 24 hours a day, and you can sign up for email alerts and online messages to help you manage your tax affairs.

If you have not completed a tax return online before, you will need to register for an HMRC online account.

When you have signed up, HMRC will post you an activation code. This can take 10 working days to arrive or up to 21 days if you are abroad so do this well in advance. You will also receive a user ID and Unique Taxpayer Reference .

If you have filed a return before but not last year, you will need to register again.

Before applying online for Self Assessment, gather all the information you need in advance. You will need your UTR, National Insurance number and employer reference, if you have one. You may need your P60 end of year certificate, P11D expenses or benefits, P45 details of employee leaving work, payslips and or your P2 PAYE coding notice.

Now you are ready to tackle the online form itself.

You will need your bank or building society statements at hand, and if you work for yourself, you may need your profit or loss account or other business records too.

The first section asks for personal details. The next asks about where you have received income or gains from, for example, from employment or self-employment, from a company or partnership, properties, trusts, capital gains, or from the UK or overseas.

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Get A Copy Of Your Notice Of Assessment

- Online:

-

View your notices of assessment and reassessment online. Sign in to access and print your NOA immediately.

Alternative:MyCRA web app

- Get a copy by phone

- Before you call

-

To verify your identify, you’ll need:

- Social Insurance Number

- Full name and date of birth

- Your complete address

- An assessed return, notice of assessment or reassessment, other tax document, or be signed in to My Account

If you are calling the CRA on behalf of someone else, you must be an

- Telephone number

-

Yukon, Northwest Territories and Nunavut:1-866-426-1527

Outside Canada and U.S. :613-940-8495

-

8 am to 8 pm Sat 9 am to 5 pm Sun Closed on public holidays

Recommended Reading: What Cars Qualify For Federal Tax Credit

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Recommended Reading: How Fast Can You Get Your Tax Refund

Kansas Customer Service Center

Using the Kansas Customer Service Center you can securely manage your tax accounts online. With one login â the email and password, you can securely access Kansas Department of Revenue accounts. You can make electronic payments, view your online activity and file various returns and reports including your sales, use, withholding, liquor drink and liquor enforcement tax returns.

A Step By Step Guide On How To E

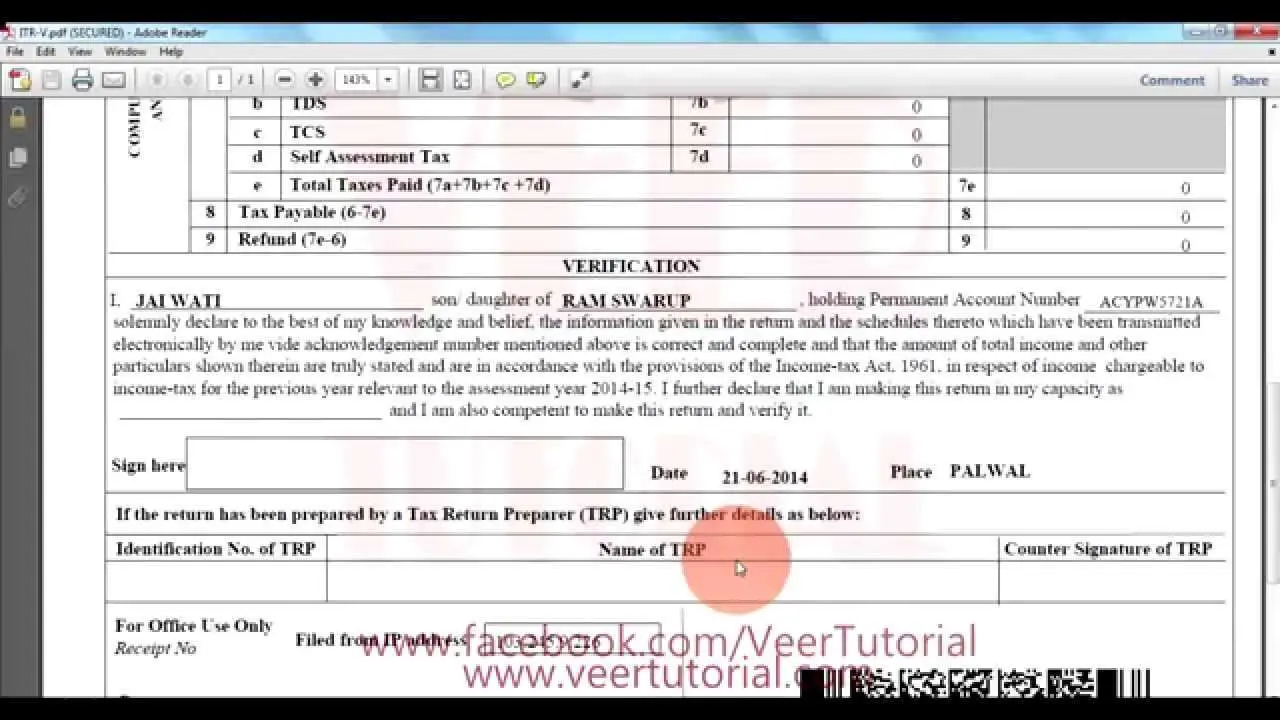

Calculate your income tax liability as per the provisions of the income tax laws. Use your Form 26AS to summarise your TDS payment for all the 4 quarters of the assessment year. On the basis of the definition provided by the Income Tax Department for each ITR form, determine the category that you fall under and choose an ITR form accordingly.

Follow the steps mentioned below to e-file your income tax returns using the Income tax e filing portal:

Step 1: Visit the official Income Tax e-filing website and Click on the Login button.

Step 2: Next, Enter Username then Click continue and After enter your Password.

Step 3: Once you have logged into the portal, click on the tab e-file and then click on File Income Tax Return.

Step 4: Select the Assessment year for which you wish to file your income tax returns and click on Continue.

Step 5: You will then be asked whether you wish to file your returns online or offline. In this case you need to choose the former which is also the recommended mode of tax filing.

Step 6: Choose whether you wish to file your income tax returns as an individual, Hindu Undivided Family , or others. Choose the option individual.

Step 7: Choose the income tax returns you wish to file. For example, ITR 2 can be filed by individuals and HUFs who dont have income from business or profession. Similarly, in case of an individual, they can choose the option ITR1 or ITR4. Here you will have to click Proceed with ITR1.

You May Like: What Address To Send Tax Return

How An Accountant Helped Strategist Kerry Needs Focus On Her Core Strengths

Kerry Needs, a writer and marketing strategist at kerryneeds.com, set up her business as a sole trader in 2015 and works remotely with clients around the world.

She did her own tax return in the first year but then started using an accountant from the second year.

I could do it myself but I like to focus on my craft rather than things that Im not strong at, says Needs. And as my business gets more complex, its a lot easier to outsource and one less administrative task to do.

My accountant is knowledgeable. I send my books to him and he completes my Self Assessment and submits the returns for me. He keeps on top of things, chases up information and provides me copies of everything.

The cost is reasonable at £250 and it pays for itself in saved time. Using an accountant also minimises the risk of making a mistake.

Doing her own Self Assessment in the first year also means she has a good understanding of the process. To anyone doing it themselves, she recommends doing HMRCs free training and webinars on Self Assessment.

Its important to get to know HMRC and what they require in as much detail as possible, including allowable expenses and things like how to record mileage, she says.

Make sure that you document everything, file your receipts carefully, and pay for as much as you can on your business card. You must keep copies of receipts as HMRC can ask for them.

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Our partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose adjusted gross income is $72,000 or less qualify for any IRS Free File partner offers.

- Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

About IRS Free File Partnership with Online Tax Preparation Companies

The IRS does not endorse any individual partner company.

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Income and Receipts

Other income

ACA Filers

File Electronically

Contact Information

Don’t Miss: When Are Alabama State Taxes Due

What Are The Objectives Of The Free File Agreement

- Provide greater access to free, online tax filing options with trusted partners only through IRS.gov

- Make federal tax preparation and filing easier for and reduce burden on individual taxpayers, and

- Continue to focus free governmental services for those least able to pay for tax preparation services

Tax Situations Requiring A Specific Return Or Form

There are exceptions, such as if you had residential ties in another place, where you would need a specific tax return.

You will also need to file a provincial income tax return for Quebec.

For details: What to do when someone has died

For details: Leaving Canada

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

do not

You may be considered a deemed resident of Canada if you:

- do not have significant residential ties with Canada

- are not considered a resident of another country under a tax treaty between Canada and that country

Use the tax package for non-residents and deemed residents of Canada.

If you are not a factual resident of Canada, or a deemed resident of Canada, you may be considered a non-resident of Canada for tax purposes. Use the tax package for non-residents and deemed residents of Canada.

If you earned employment income or business income with a permanent establishment in a certain province or territory, complete the following instead:

Don’t Miss: How Are Property Taxes Calculated In Texas

Can I File My Taxes Online For Free If Im A Non

Yes. TurboTax makes it easy to file your Candian tax return as a non-resident. In fact, if youre a non-resident you can use any of the TurboTax Online products, including TurboTax Free. For more info, read about How Residency Status Impacts Your Tax Return

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

How To Pay Your Tax

When filing online, once you have completed your Self Assessment return, HMRC will tell you how much tax you owe.

Each of the two payments on account is half your previous years tax bill. If you still owe tax after making your payments on account, you must make a balancing payment by midnight on 31 January the following year.

If youre paying your tax bill by debit card, allow two working days for the transaction to clear.

If you prefer to pay more regularly throughout the year such as weekly or monthly you can use HMRCs budget payment plan, but only if your previous payments are up to date and if you are paying in advance.

Read Also: Which State Has The Lowest Tax Rate

Do You Need To File A Tax Return

For employees and pensioners, tax is typically deducted automatically at source from wages and pensions. But people and businesses with other income not deducted at source, and above a certain level, must report it in a Self Assessment tax return.

If, in the last tax year , you were self-employed as a sole trader and earned more than £1,000, you must file a tax return. You must also file one if you were a partner in a business partnership or director of a limited company whose income was not taxed at source and/or you have further tax to pay.

Even if your main income is from your wages or pension, you may still need to send a return if you work in certain sectors, were paid more than £100,000 via a PAYE salary scheme or have any other untaxed income, such as from:

- Renting

- Savings, investments and dividends

- Foreign income.

You can also file a tax return online to claim some income tax reliefs or prove you are self-employed, for example, to claim Tax-Free Childcare or maternity allowance.

HMRC offers this if you are still not sure whether you need to file a return.

Nick Levine, former Head of Enterprise at the Institute of Chartered Accountants in England and Wales , offers some further advice: If HMRC has sent you a notice to file a return, you must complete one.

Guide On How To File Itr Offline For Super Senior Citizens

Super senior citizens are given the option to file ITR offline during the financial year. Another instance where the ITR can be filed offline is if an individual or HUF has an income of less than Rs.5 lakh and is not entitled to receive a refund.

The step-by-step procedure to file returns offline is mentioned below:

Recommended Reading: Can You File Taxes For Unemployment

Documents You Need To File Your Taxes Online

Start by gathering all the required financial paperwork youll need to file. This includes any W-2 forms youve received from employers you worked for in the past year, as well as any Form 1099s you received for work with clients as a self-employed worker or for miscellaneous income you earned.

Other paperwork you may have and would need for your tax return includes interest you earned on bank accounts , investment income , student loan interest paid , mortgage statements of interest paid and information on contributions youve made to an IRA or a health savings account . While you can gather all the required paperwork for your tax return as you move through the e-filing process, collecting this information early can save you time later on.

File Your Self Assessment Tax Return Online

You can file your Self Assessment tax return online if you:

- are self-employed

- are not self-employed but you still send a tax return, for example because you receive income from renting out a property

This service is also available in Welsh .

You can also use the online service to:

- view returns youve made before

- check your details

You must register for Self Assessment before using this service if:

- youre filing for the first time

- youve sent a tax return in the past but did not send one last tax year

Don’t Miss: Are Property Taxes Paid In Advance

Can I File My Taxes Online For Free

In Canada, TurboTax makes it simple for anyone with any tax situation to file their taxes for free. These are just a few of the tax situations you could have and use TurboTax Free to file your taxes with the CRA:

- Youre working for an employer and/or are self employed

- Youre a student looking to claim tuition, education, and textbook amounts

- You were unemployed for part or all of 2020, including if you claimed CERB

- Your tax situation was impacted by COVID-19, including if you had to work from home and want to claim related expenses

- You have dependants and want to ensure you claim all related credits and deductions

- Youre retired and receive a pension

- You have medical expenses to claim, including amounts related to COVID-19

- Its your first time filing your taxes in Canada

There are a few situations where youll need to print and mail your return instead of filing online using NETFILE. Dont worry though, you can still enter all your tax info online and well guide you through the process of mailing your return to the CRA.

Adjustable Tax And The Amount Of Tax Deducted

- Fill out Tax Chargeable, Tax Reductions, Adjustable Tax and Tax Credits field

- On Adjustable Tax screen you need to fill out the details of the taxes that have already been taxed or charged to you during your tax year

- If you are a federal government employee, then enter tax amount against 64020001 code

- For provincial government employees, enter the tax amount against 64020002

- If you are a corporate sector employee, then enter your tax amount against 64020003 code

- You can also adjust the tax deducted by your bank on various sections like when you withdraw cash from bank in 64100101. Other banking transactions like any bonds or savings should be entered in the code 64151501.

- You can also adjust the tax deducted by your bank on motor vehicle registration fee, transfer fee, sale and leasing against their respective codes

- A dialogue box shall appear asking for vehicle details like E& TD Registration No. and provide further details related to its make, model and engine capacity. Once you are done with it then click on Calculate Tab button

Also Check: How Do I Paper File My Taxes