What Is Irs Free File

The IRS Free File Program provides two ways for taxpayers to prepare and file their federal income tax online for free:

Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. IRS partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose Adjusted Gross Income ; is $72,000 or less qualify for any IRS Free File partner offers.

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose AGI is greater than $72,000.

What Could Cause Delays On Your District Of Columbia Refund

If the department has to confirm the information provided on your return or ask for more information, the process may take longer.

Incorrect math in your tax return or any other adjustments.

You may have used more than one type of form to submit your returns.

The information you provided on your return was not included or was incomplete.

The protection against identity theft and tax refund fraud can cause extended processing times for individual tax returns and refunds. The processing time for certain tax returns may be extended at least 25 days.

Heres How Taxpayers Can Track The Status Of Their Refund

COVID Tax Tip 2021-39, March 30, 2021

Tracking the status of a tax refund is easy with the Where’s My Refund?;tool. It’s conveniently accessible at IRS.gov or through the IRS2Go App.

Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.

Don’t Miss: How To Claim Inheritance Money On Taxes

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors such as an incorrect Recovery Rebate Credit amount

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.;

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return.

How To Check Check The Status Of Your Tax Refund

Online

Visit Refund Status on MassTaxConnect.

You will be asked;to:

- Choose the ID type,

- Choose the tax year of your refund, and

- Enter your requested refund amount.

To check the status of your tax refund by phone, call 887-6367 or toll-free in Massachusetts 392-6089 and follow the automated prompts.

Read Also: How Much Is Tax In Georgia

Tracking Your Tax Refund With An App

What Information Is Available

You can start checking on the status of your refund within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Wheres My Refund? will give you a personalized refund date after we process your return and approve your refund.

The tracker displays progress through three stages:

To use Wheres My Refund, you need to provide your Social Security number, filing status and the exact whole dollar amount of your refund.

Also Check: Do Your Own Taxes Online

Use The Irs2go Mobile App

You can download the free IRS2Go mobile app for iPhone or Android and check the status of your return from your smartphone or tablet. Enter your Social Security number, your filing status and the amount of your refund and youll be able to see where your return is in the processing chain. Instructions for the IRS2Go app recommend waiting 24 hours after you file your return electronically and four weeks after you mail a paper return to check the status.

Tax Refund Status Faqs

The IRS usually sends out refunds within three weeks, but sometimes it can take a bit longer. For example, the IRS may have a question about your return. Here are other common reasons for a delayed tax refund and what you can do.

At H&R Block, you can always count on us to help you get your max refund year after year. You can increase your paycheck withholdings to get a bigger refund at tax time. Our W-4 calculator can help.

The IRS usually sends out most refunds within three weeks, but sometimes it can take a bit longer if the return needs additional review.;

The IRS’ refund tracker updates once every 24 hours, typically overnight. That means you don’t need to check your status more than once a day.

Your status messages might include refund received, refund approved, and refund sent. Find out what these;e-file status messages;mean and what to expect next.;

Having your refund;direct deposited on your H&R Block Emerald Prepaid Mastercard® ;Go to disclaimer for more details110 allows you to access the money quicker than by mail. H&R Block’s bank will add your money to your card as soon as the IRS approves your refund.;

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your;amended return;and how we can help.;

Recommended Reading: Do You Pay Income Tax On Unemployment

What You Can Do To Help Us Stop Fraud

If we suspect fraud is being committed against you, we will send you a letter requesting verification of your identification. Please respond to our letter as soon as possible. The quickest way to respond is to visit myVTax and click Respond to Correspondence.

Learn more aboutidentity theft and tax refund fraud, how to detect it, how to avoid it, and how to report it if you believe you are a victim.

How To Check The Status Of Your Income Tax Refund

Waiting for your tax refund from the Canada Revenue Agency can seem like an eternity.; Instead of checking your mailbox daily, or looking at your bank account online every day, the CRA has other options you might want to consider.; Before going through them, however, we must look at the NETFILE process to ensure you have successfully filed your tax return the first time around.

No filed return means no tax refund! You can usually expect your refund within two weeks after you successfully NETFILE, but may take longer if your return is selected for a review. For more information on your refund status, please see this CRA link: Tax Refunds: When to expect your refund.

You May Like: When Does Income Tax Have To Be Filed

Should You Call The Irs

Expect delays if you mailed a paper return, had to respond to an IRS inquiry about your e-filed return, claimed an incorrect Recovery Rebate Credit amount or used 2019 income to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- “Where’s My Refund” tells you to contact the IRS

Do not file a second tax return.

Paycheck Checkup: you can use the IRS Tax Withholding Estimator;to help make sure your withholding is right for 2021.

When We Issue A Refund We Will Deliver One Of The Following Messages

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on . If your refund is not credited to your account within 15 days of this date, check with your bank to find out if it has been received. If its been more than 15 days since your direct deposit issue date and you havent received it yet, see Direct deposit troubleshooting tips.

- Your refund check is scheduled to be mailed on . If you have not received your refund within 30 days of this date, call 518-457-5149.

Read Also: What’s The Sales Tax In Florida

How Long Does It Take For My Tax Refund To Appear In My Bank Account

If you’ve e-filed and opted to receive your refund via direct deposit, it generally takes the IRS no more than three weeks to send your refund. How long it takes to show in your account will vary by bank. Once the IRS sends your refund electronically, it typically takes between one and five business days for your deposit to show up. If you opted for a paper check, your return could take six to eight weeks to arrive.

Required Documentation To File Your Tax Return

Personal information

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Proving your AGI: income and receipts

- Social Security benefits documentation

- All receipts pertaining to your small business, if applicable

- Income receipts from rental, real estate, royalties, partnerships, S corporation, trusts

Other income

- W-2s, showing your annual wages from all of your employers

- Form 1099-INT, showing interest paid to you throughout the year

- Form 1099-G, showing any refund, credit or offset of state and local taxes

- Forms 1099-DIV and 1099-R, showing dividends and distributions from retirement and other plans paid to you during the year

Affordable Care Act filers

- Form 1095-A, Health Insurance Marketplace Statement. For more information see Affordable Care Act Tax Provisions.

- Form 8962,Premium Tax Credit

File electronically

- Verify your identity by using your 2019 AGI. If you created a 2019 personal identification number, that will work too. The personal identification number required that you create a five-digit PIN that could be any five numbers that you choose which serves as your electronic signature.

- Can’t find your AGI or PIN? If you do not have a copy of your 2019 tax return, you may use the IRS Get Transcript self-help tools to get a tax return transcript showing your AGI. You have two options:

Also Check: How To File Taxes At H&r Block

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For; U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

Request Electronic Communications From The Department

The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive future;communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next;return.;

Read Also: Where Can I Get 1040 Tax Forms

Check Where’s My Refund

Whether you filed a paper or an e-filed return, if youre expecting a refund, the IRS offers the Wheres My Refund? site. Youll need your Social Security number, your filing status and the amount of the refund you are due to receive. If you filed a joint return, you can use either spouse’s Social Security number. The IRS advises you to wait three weeks before checking the status of mailed returns and 72 hours before following up on e-filed returns.

Read More:When Can You Get That Tax Refund?

How Should You Contact The Irs For Help

The IRS received;167 million calls this tax season, which is four times the number of calls in 2019. And based on the recent report, only 7 percent of calls reached a telephone agent for help. While you could try calling the IRS to check your status, the agency’s;live phone assistance;is extremely limited right now because the IRS says it’s working hard to get through the backlog. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the;Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can;contact your local IRS office;or call to make an appointment: 844-545-5640. You can also contact the;Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.;

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the;Where’s My Refund;tool tells you to contact the IRS. You can call: 800-829-1040 or 800-829-8374 during regular business hours.;

Read Also: Is Doordash Worth It After Taxes

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 4 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks;

The Wheres my Refund application;shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.;

See how our;return process works:

Fast And Easy Refund Updates

Taxpayers can start checking on the status of their return within 24 hours after the IRS acknowledges receipt of an electronically filed return or four weeks after the taxpayer mails a paper return. The tool’s tracker displays progress in three phases:

To use ;Where’s My Refund?, taxpayers must enter their Social Security number or Individual Taxpayer Identification Number, their filing status and the exact whole dollar amount of their refund. The IRS updates the tool;once a day, usually overnight, so there’s no need to check more often.

Don’t Miss: Are Taxes Due By Midnight May 17

Make Small Investments For Bigger Returns

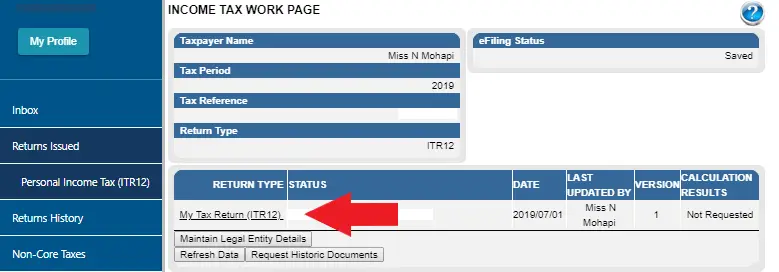

ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 2.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

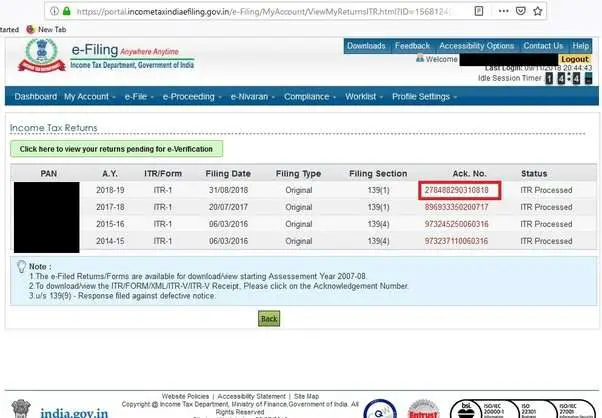

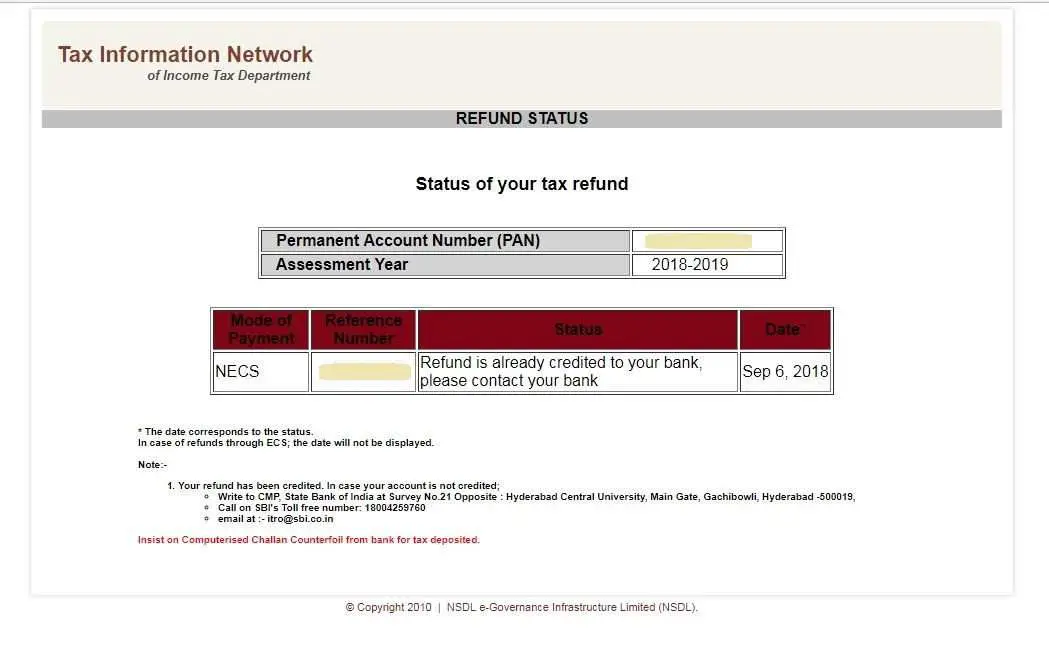

Efiling Income Tax Returns is made easy with ClearTax platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with ClearTax GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with ClearTax by investing in tax saving mutual funds online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download ClearTax App to file returns from your mobile phone.

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return.;We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.;

Tax refund offsets – applying all or part of your refund toward;eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills;and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies,;the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim,;and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to,;you’ll need call the agency that made the claim.;;

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Read Also: Where To File Georgia State Taxes