How Long Do You Need To Keep Your Logbook For

It’s a good idea to keep records and supporting documents such as receipts for a period of six years. This will allow you to back up your claims should you ever undergo an audit. Make sure to keep a record of your full logbook as long as you’re using it, and for six years after you stop using it. In other words, if you established a full logbook in 2010 and used it to establish your annual driving percentage until 2016, you will need to keep a record of that logbook until 2022. If you use more than one vehicle for your business activities, make sure to keep a separate logbook for each vehicle. When claiming a vehicle expense deduction for multiple vehicles, you must calculate each vehicle separately.

How To Track And Keep Records Of Your Mileage

The IRS defines adequate records. For all transportation, the IRS asks that you log the following:

- “the mileage for each business use”

- “the total mileage for the year”

- the time , place , and purpose

The record must also be “timely” – in other words, recorded at or near the time of the expense . Weekly diaries, logs, trip sheets, account books, or similar records are deemed adequate.

In addition, you need to be able to show the business vs. personal use of your vehicle as a percentage. That means keeping a log of all trips and then calculating the share used for business. See how to do the calculation in the section below.

In today’s digital world, you can take advantage of a mileage tracking app to save a lot of time. Driversnote and other similar apps not only log your miles for you but also store and generate adequate records whenever you need them.

Claiming Mileage: Business Vs Personal

It goes without saying that only mileage used for business purposes may be claimed on your taxes, not mileage used for personal trips. Commuting to and from your office is considered a personal trip, and so is that cup of coffee you stopped for on the way, even though many of us may need a daily dose of caffeine to do our jobs.

This can make things complicated when it comes to mileage tracking as many of us do run personal errands, like picking up our dry cleaning or making a stop at the grocery store, at the same time we may be driving for business reasons.

Everlance offers an easy solution for distinguishing between business and personal driving trips, even if they are blended into the same drive. Each time you get into your car to your next destination, open the Everlance app.

If youre heading to a meeting with a client at their office, just swipe right for business. If youre heading to meet a friend for dinner after a client meeting, just swipe left for personal. This way, all your business mileage is recorded separately, and Everlance will even calculate your deduction immediately, based on the standard mileage rate.

Everlance also allows you to track other types of business expenses. Just take a picture of your receipt and the app will store it securely in the cloud. You can even link your credit card or bank account directly to track expenses that way, as well.

Recommended Reading: How Much Does H & R Block Charge For Taxes

Why Do You Have To Keep A Mileage Log

If you want to deduct mileage on taxes and claim back the money you spend on business travel, you have to keep a mileage logbook.

You will need to document your deductible miles properly so that you provide sufficient evidence to the IRS for entitled deductions and to avoid a possible tax audit.

Your business miles equal dollars, remember?

What Kind Of Tracking Does The Irs Require Of Delivery And Rideshare Drivers

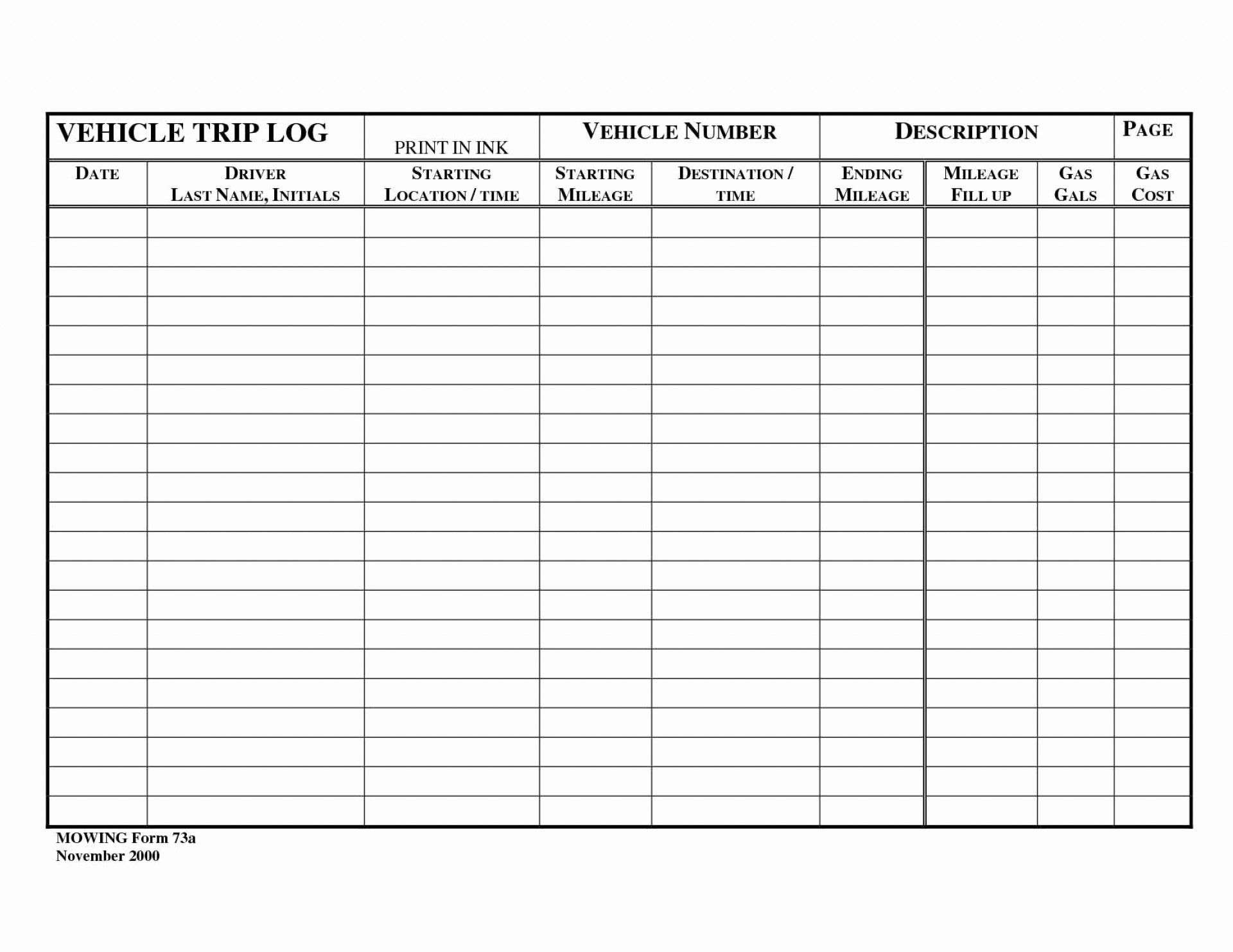

The IRS requires a written record four specific things of your record.

- The date. This means you need a written record for every single day that you have business miles. You cannot lump several days together.

- A general description of where you went.

- How many miles you went.

- The business purpose of your trip.

On top of this, you need a record of the total miles driven for the year. This is best handled by taking an odometer reading at the start of the year and at the end of the year.

You May Like: How Can I Make Payments For My Taxes

Can I Claim Mileage On My Tax Return

One of the most important things to understand is that your mileage is used to figure out your percentage of business drives. Because personal commutes are almost never considered a business drive, it is unlikely that any vehicle will be used for business 100% of the time. If you use your vehicle for business 80% of the time, that means you will be able to claim 80% of your total vehicle expenses on your taxes. In other words, the number of miles you drive does not result in a deduction the money you spend does. Knowing this, make sure to keep a record of all of your receipts! This includes expenditures for the following:

Set Up Reimbursable Expenses

To write off your S Corp mileage, your company should reimburse you for the business use of your personal car. The vehicle is registered under your name and you pay all expenses such as gas, repairs, and insurance from your personal account. The S Corp is claiming the reimbursement as a vehicle deduction, which reduces the taxable profit of the business.

Youre probably thinking, Wait, the S Corp doesnt pay taxes. I do! Thats true, and the reduced taxable income passes through to you, the S Corp shareholder, who is then taxed individually.

And whats exciting about this deduction is that the reimbursement isnt reportable as taxable income to you or reported on your W-2. The caveat? You need to submit reimbursement requests to your business in a routine, timely fashion via an accountable plan. Accountable plan is just a fancy term for an expense reimbursement process- dont worry we can help you set yours up.

Every month, youll submit expense reimbursements from your S Corp. The S Corp will then issue you reimbursement checks for your expenses.

Youll need a mileage log to prove your expenses for your reimbursement request. This log needs to show the:

- Date

- Business purpose of the trip

- Number of miles driven

If this task seems daunting, thats because it can be! But now, theres an easier way to track your business miles.

Don’t Miss: How Much Taxes Do You Pay On Slot Machine Winnings

The Standard Mileage Deduction

This deduction is a variable rate determined by the IRS each year. For 2021, the standard rate is 56 cents per mile. Using this deduction requires only that you keep a log of all qualifying mileage driven. The easiest way to calculate business-related mileage is to use a mileage tracking app every time youre on the road. Making it a habit will ensure you dont miss out on anything.

Record Odometer At End Of Tax Year

At the end of the tax year, the taxpayer should record the ending odometer reading. This figure is used in conjunction with the odometer reading at the beginning of the year to calculate the total miles driven in the car for the year. The information, including what percentage of miles driven were for business purposes, is required on Form 2106.

Recommended Reading: How Much Is H& r Block Charge

What Is The Best Type Of Gps App

Some were free, some had a cost to use. Some would track automatically. I mentioned some of the accuracy issues above, and those issues seemed worst with the automatic tracking.

Here’s what you want to look for:

I HIGHLY recommend that you get an app that shows the path that you drove. Some apps only show a starting point and an end point. The problem with that is that on delivery you can often have the same start and end point, a lot of miles, and nothing that seems to back those miles up. It just looks odd.

Choose an app style that works for you. With one exception that I found, the manual tracking apps were more accurate because they didn’t have the start lag that the automatic tracking apps had. However, that’s only true if you’re really good at remembering to start and stop your tracking.

In my evaluation, Triplog was easily the most accurate. The best thing about Triplog is an innovative idea that solved the accuracy issue that other automatic trackers had. Triplog will record any time your delivery apps are active. They also had some options to tap into what’s happening with your car or to use an external device to track mileage .

What Is The Best App For Tracking Mileage

All of the mileage tracker apps listed above come highly recommended. However, the best mileage tracking app for you will be one that fits your needs.

If youre just looking for a simple app to track your mileage without added features like bank integration or money-saving tools for drivers, then Stride may be the one for you.

If youre an independent contractor and would like your app to make it easier for you to nail down mileage deductions for filing quarterly taxes, try Hurdlr or QuickBooks Self Employed.

If you run a small business with a fleet of multiple vehicles, you might consider Everlance or TripLog.

Reviewing the features of each app listed above will help you determine which will be the best mileage tracker for you.

You May Like: How To Buy Tax Lien Properties In California

Types Of Expenses Allowed Under The Actual Expense Method

Why does the actual expense method provide most taxpayers with more savings? It adds up quickly for small business owners when you consider all the expenses that qualify.

These include:

- Most lease payments

- Interest on a car loan

Remember, you can only deduct expenses you actually incur. Estimates or approximations of expenses won’t fly with the IRS.

You’ll want to keep all records that support the business expenses you deduct from your tax return. This can be credit card and bank statements, bills, cancelled checks, or even paper receipts that show the dollar amount, date, location, and the reason for the expense.

The IRS asks you to hang on to these records for three years after you file your return.

What Is A Mileage Log

A mileage log is a record of your vehicle miles traveled for business over a particular period kept in a spreadsheet, form, logbook or online application that you use to claim a tax deduction or collect reimbursement from your employer.

A mileage log serves as proof and may also be used to keep track of other deductible miles, e.g. those traveled for medical, charitable or moving purposes.

To deduct miles on your tax return, you need to keep meticulous and accurate records of your driving on a daily basis in case of an IRS audit.

Also, you must clearly distinguish between your business and personal trips.

Also Check: How Much H And R Block Charge For Taxes

Tracking Your Miles With A Mileage Log

Keeping thorough records will help you document your business expenses. Car-related expenses are no different. If you plan on writing off your car expenses, you can do that with a mileage log.

The truth is, logging your miles this way isnât required to deduct your car-related expenses. Tracking your actual car expenses instead will generally yield you a bigger tax break. We’ll dive into this some more below, but you can also learn more in our comprehensive guide to deducting car expenses.

Still, if you drive a lot, or like to keep super-detailed records for your own peace of mind, youâll benefit from logging all your business mileage by following these steps

To make things easier for you, keep a mileage log book right in your car. That way, you can easily jot down your starting and ending readings for each trip while itâs still fresh.

What Qualifies As Business Mileage

First things first. âCommutingâ doesn’t qualify as business miles.

Say you have an office, shop, or other location where you normally conduct your business. In that case, driving from your home to that location is considered commuting and isn’t deductible. It’s no different than if you were a W-2 worker and commuted to an office each day.

Some freelancers have tried to think of workarounds to turn those commuting miles into actual business miles â say, by making business calls while driving.

Unfortunately, that won’t cut it with the IRS. In their eyes, the commuting rule is black and white.â

However, if your office is in your home, then any miles you drive to visit clients or customers does count as business mileage.

Hereâs a cheatsheet to help you figure out whether your miles count:

Also Check: How Do I Get My Pin For My Taxes

What Qualifies As A Tax

If you go to the grocery store to buy a cake for your assistants birthday, is that technically a business expense? Kind of.

Business transportation would be:

- Traveling to work between two different places e.g from your office to a clients home

- Going on customer visits and client meetings away from the office

- Running business errands. This could be a trip to buy office supplies.

You cant claim deductions on:

- Your commute to work

- A trip where your work equipment happens to be in the car but you are not actually traveling to work

- Driving a branded car. Just because your logo is on the car does not make every trip a business trip

How To Track Tax Deductible Mileage For Uber & Lyft Drivers

Related Content

Posted by:Sergio AvedianFeb 27, 2020Updated Feb 27, 2020

I have recently written about helpful apps for Uber & Lyft drivers. They range from navigation, to towing, to mileage tracking and to filing taxes. It is a couple of months before tax filing season. Most drivers received their 1099s and should start gathering documents in order to maximize their deductions.

Tax Deductions for Uber & Lyft Drivers

As a self-employed worker, tax deductions for business expenses are the best way to prepare an accurate tax return and receive the largest possible rebate. You can deduct common driving expenses, including fees and tolls that Uber and Lyft take out of your pay. However, your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks and water for passengers, USB chargers/cables and monthly cell phone bills. If you dont take these deductions, more of your income will be subject to both income and self-employment taxes.

Make sure to track tax deductions as you go, it is much harder to recreate records later! Compile a list of these tax deductions and a mileage log so youre prepared to file. Tracking business expenses can also help you determine whether your driving is profitable.

Here are some tips to help you prepare your tax deductions for filing:

I use the Standard Mileage Deduction for tax filing purposes.

How to track your mileage for tax filing purposes

Why do you need to Track Your Mileage?

Don’t Miss: How Can I Make Payments For My Taxes

Who Can Claim Mileage

You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 7.5% of your adjusted gross income . You can deduct your mileage at the standard rate of 17 cents per mile for 2020 and 16 cents per mile for 2021, or you can deduct your actual costs of gas and oil. Deducting parking costs and tolls is also allowed.

Youre allowed to deduct mileage for your own treatment, but also if youre transporting a child to receive treatment or if youre visiting a mentally ill dependent as part of a recommended treatment.

What Does The Irs Accept For Mileage Logs

There are often questions about what the IRS will accept when it comes to proof of mileage. The documentation can often have many names: mileage log, mileage log book, mileage sheets or mileage books. Whatever you call it, know the IRS will accept digital versions, as long as it has the information covered previous section.

We advise maintaining digital mileage sheets because you may have to keep this up to five years after you file a deduction. A physical mileage book can easily get lost or damaged, which may cause trouble down the road.

Don’t Miss: Form 5498 H& r Block

What Does The Irs Consider A Business Drive

- Errands/supplies for example, visiting the post office, going to the bank, getting supplies from the local store, etc. Most business owners forget these little trips, but they can add up to a huge deduction at the end of the year.

- Business meals and entertainment If you drive to meet a vendor or a client, the IRS considers this a business drive. Examples include meeting a client over lunch, getting coffee with a vendor, entertaining your business colleagues, etc.

- Airport/travel When you travel to and from the airport for business reasons, the IRS considers this a work trip and hence it is an allowable deduction.

- Odd jobs If you drive to side jobs such as babysitting, lawn mowing, and pet care you can deduct the miles from your taxes.

- Customer visitsDriving from your office to a client site to meet a customer or client qualifies for mileage deduction.

- Temporary job sites If you drive from home to any temporary job, you qualify to log the mileage for tax deduction purposes. The IRS considers any job that lasts less than one year as temporary.

- Job seeking If you are driving to and from home looking for a job in the same industry as your previous job, then you can deduct the mileage from your taxes.