The Child And Dependent Care Tax Credit

The Child and Dependent Care Credit, which helps parents pay for child care, was boosted under the American Rescue Plan, which raised the credit to up to $8,000 per family.

But that tax credit has also reverted to its pre-pandemic level. Under the current law, parents can receive a credit on their 2022 taxes for up to 35% of up to $6,000 in qualifying child care expenses for two or more children. That means the maximum credit is $2,100 for the current year.

The Expanded Child Tax Credit Is Gone The Battle Over It Remains

A pandemic-era program that sent monthly checks of up to $300 per child to most families drove down poverty rates. Amid new research about its merits, some Democrats are vowing to bring it back.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

WASHINGTON When the history of American hardship is written in some distant decade, two recent events may capture the whipsaw forces of the age.

Child poverty fell to a record low. And the program that did the most to reduce it vanished.

The story of that temporary program technically, a tax-credit expansion but more plainly a series of monthly checks to most families with children was extraordinary in every way. A guaranteed income in a country long resistant to one, the expanded child tax credit emerged from obscurity to win support from most of the Democratic Party, aided millions of low- and middle-income families during the pandemic and helped cut child poverty nearly in half.

Then it died, as President Bidens efforts to preserve it drew unified Republican opposition and the defection of a crucial Senate Democrat. Critics called the monthly payments of up to $300 per child an expensive welfare scheme that would deter parents from working by providing cash aid regardless of whether they had jobs.

To Get The Expanded Child Tax Credit

- File your taxes, even if you dont file them normally. This will tell the IRS where to send your payment and how many children you take care of. Also, if you dont file, you might miss out on other tax credits.

- To self-file or make an appointment for free tax preparation help, visit GetTheTaxFacts.org.

Don’t Miss: When Do You Need To File Taxes 2021

What Would Keep An Expansion From Happening

The main point of disagreement is whether the child benefit should be available to families with little or no income, as it was in 2021. Heres how that works: Most tax credits are known as nonrefundable, which means people cant claim credit for more than the amount of taxes they owe. And people who dont pay any income tax receive no credit. When tax credits are refundable, on the other hand, any amount larger than taxes owed is paid directly to the person.

Part of the existing child tax credit is refundable, but for very low earners, the maximum they can receive is $1,500, and people with no income receive no credit. Many Democrats would like to include more families.

I think full refundability is critical, because otherwise youre punishing the poorest kids in America just for being poor, and that makes no sense to me, Mr. Bennet said.

Theres Still Time To Get The Child Tax Credit

If you havent yet filed your tax return, you still have time to file to get your full Child Tax Credit.

Visit ChildTaxCredit.gov for details.

Under the American Rescue Plan of 2021, advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

The Child Tax Credit Update Portal is no longer available, but you can see your advance payments total in your online account.

You May Like: How Many Tax Forms Are There

How Does The New Bill Expand The Child Tax Credit In 2021

The new bill, known as the American Rescue Plan, includes the following changes to this tax credit for tax year 2021:

1. It increases the credit amount. It increases the credit amount from $2,000 to $3,000 for children 6- 17. The credit is increased to $3,600 for children less than 6 years old.

2. It eliminates refund limitations and provides advanced payments of credit. It makes the entire credit refundable, meaning parents will receive a refund for any portion not used to offset federal income tax liability. Under the new bill, the tax credit will be paid in advance. The IRS may begin advanced payments in July on a monthly basis if feasible.

- $3,000 tax credit could be paid in $250 monthly installments

- $3,600 tax credit could be paid in $300 monthly installments

3. It lowers the adjusted gross income limits. For 2020, the credit amount is reduced by $50 for each $1000 of a taxpayers AGI exceeds the income limit. This rule makes high-income earners ineligible for the CTC. The income limit for Married Filing Jointly was $400,00 and for all other filers, it was up to $200,000.

Under the new bill the 2021 CTC will be phased out for taxpayers who exceed the following threshold amounts:

- $150,000 for joint filers

- $112,500 for head of household filers

- $ 75,000 for all other filers

Who Qualifies For The Child Tax Credit

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

Generally, there are seven tests you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child youre claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people .

Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child youre claiming must have lived with you for at least half the year .

Financial support: You must have provided at least half of the childs support during the last year. In other words, if your qualified child financially supported themselves for more than six months, theyre likely considered not qualified.

Citizenship: Per the IRS, your child must be a “U.S. citizen, U.S. national or U.S. resident alien,” and must hold a valid Social Security number.

Also Check: How Much Is New York State Tax

Expanding The Credit To Families With The Lowest Incomes Would Not Meaningfully Reduce Employment And Would Advance Equity

As part of any year-end tax bill, Congress should prioritize expanding the Child Tax Credit in particular for the 19 million children who stand to benefit most from such an investment because they currently receive a partial credit or none at all because their families incomes are too low. Research links additional income, like money from the Child Tax Credit, to better outcomes for children in families with low incomes. The added income can significantly improve their long-term health and their school performance, making it more likely they will finish high school and attend college, as well as boost their earnings as adults.

Under current law a familys Child Tax Credit amount is tied to their earnings and income tax liability, which denies the full credit to children in households with the lowest incomes. This withholds help from the children who need it most, hurting their long-term health, educational, and economic outcomes while doing virtually nothing to boost parental employment:

New research on the response to the fully refundable Child Tax Credit in 2021 bolsters earlier evidence and should ease concerns about the risk of substantial downside labor force participation risks. One University of Michigan study noted:

EITC Expansion Needed for Adults Not Raising Children at Home

c Ibid.

The Build Back Better Framework Is Fully Paid For:

Combined with savings from repealing the Trump Administrations rebate rule, the plan is fully paid for by asking more from the very largest corporations and the wealthiest Americans. The 2017 tax cut delivered a windfall to them, and this would help reverse thatand invest in the countrys future. No one making under $400,000 will pay a penny more in taxes.

Specifically, the framework:

You May Like: Can You File Taxes If You Did Not Work

How Much Will I Receive In Child Tax Credit Payments

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

This amount may vary by income. These people qualify for the full Child Tax Credit:

- Families with a single parent with income under $112,500

- Everyone else with income under $75,000

These people qualify for at least $2,000 of Child Tax Credit, which comes out to $166 per child each month:

- Families with a single parent with income under $200,000

- Everyone else with income under $200,000

Families with even higher incomes may receive smaller amounts or no credit at all.

How A New Credit Would Look With A Pandemic

Democrats say they are modeling a new child tax credit proposal after the 2021 expansion, but their proposal is likely to be more modest.

Note: Income levels shown for a single parent filing as a head of household.

The New York Times

The result was a nearly 30 percent decrease in child poverty, research suggests. The average credit for the lowest fifth of earners before 2021 was about $1,200. In 2021, it was about $4,500, according to the Tax Policy Center. Black and Latino children in particular became much more likely to receive the full credit.

Overall, Black and Hispanic workers earn less, so when benefits are tied to earnings, you end up excluding a disproportionate share of Black and Hispanic children, said Elaine Maag, a senior fellow at the Tax Policy Center.

Recommended Reading: Can I File My Taxes Online

When Will I Get The Monthly Child Tax Credit Payment

The IRS will automatically issue payments on the following dates to families who qualify:

If you have direct deposit, the payment should show up as pending in your bank account on that date. If the IRS does not have your bank information, you will have to wait for a paper check in the mail.

Later this summer, the IRS will release an update to its online portal where you can opt out of the automatic monthly payments if you prefer. In that case, you would be able to claim the remaining amount of your credit on your 2021 tax return next year.

What If I Received More Money Than I Should Have As Part Of The Advance Payments For The 2021 Child Tax Credit

Congress enacted a repayment protection for families with lower incomes if the IRS overpays you. If your 2021 income is less than $40,000 , you are not required to repay anything back.

This protection only applies if you are overpaid because there were changes to the number of children you claim, not changes in income. The protection amount gradually decreases as your income increases. If your 2021 income is $80,000 or above , you are required to repay the full excess amount.

If you earn more than the protection allows and received more money than you should through advance payments in 2021, the IRS may require you to pay back the excess amount when you file your 2021 tax return . This means that you will either owe more taxes or see a decrease in your tax refund.

An example is if you received advanced payments for a child who lived with you in 2020 but moved in March 2021. Once you file taxes in 2022 , you will have to pay the money back if your income is over $40,000 , $60,000 , or $50,000 .

The CTC Update Portal provided the opportunity to opt out of advance payments if you were unsure if you wereeligible for the 2021 CTC . The portal also allowed you to update your income, which would help the IRS to pay you the correct amount.

Also Check: How To Get Past Tax Returns

Treatment In The National Income And Product Accounts

Refundable income tax credits are classified as government social benefits to persons whether those credits are prepaid, reduce tax liabilities or are paid as tax refunds. Government social benefits to persons are included in personal income.

Prepaid refundable tax credits are recorded as government social benefits in the months in which they are paid. For the expanded child tax credit for 2021, prepayments will be recorded in July 2021 through December 2021 based on data from the Department of Treasurys Monthly Treasury Statement.

The remaining portion of the expanded credit that will be claimed as part of tax filing in 2022 will be recorded as government social benefits to persons in 2022. This portion of the credit will be allocated evenly across the 12 months of calendar year 2022.

1 Tax credits are nonrefundable if taxpayers can only claim the credit up to the amount of their tax liability. In contrast to refundable and nonrefundable tax credits, tax allowances, exemptions, and deductions are subtracted in the calculation of taxable income, reducing the amount of the original liability.

Also Check: What Happens If You Cannot Pay Your Property Taxes

What About The Monthly Payments Mentioned Earlier

Since the American Rescue Plan was meant to help families financially impacted by the pandemic the thinking was that each element in a COVID relief package should benefit people while the pandemic is still raging the federal government is allowing eligible families with children to receive monthly payments that will be subtracted from the value of the new child tax credit. Another difference is that the tax credit is now fully refundable. Heres how it works: Lets say a family with one child under 6 qualifies for the $3,600 credit. They can elect to receive monthly payments of $300 from July to December. That means theyll collect $1,800 in monthly payments over the next six months. Then, come tax time next year, lets say the family owes $200 in taxes. Since they have $1,800 of value left on their tax credit , theyll receive a check for $1,600 . The system would work the same way for a family with a child between the ages of 6 and 17, except the monthly payments would be $250 and the total tax credit value would be $3,000. And remember, eligible families can receive these tax credits for each child. That means families with several children will get a lot of financial assistance through this new system.

Recommended Reading: Where’s My Income Tax

Million Children Receive Less Than The Full Child Tax Credit

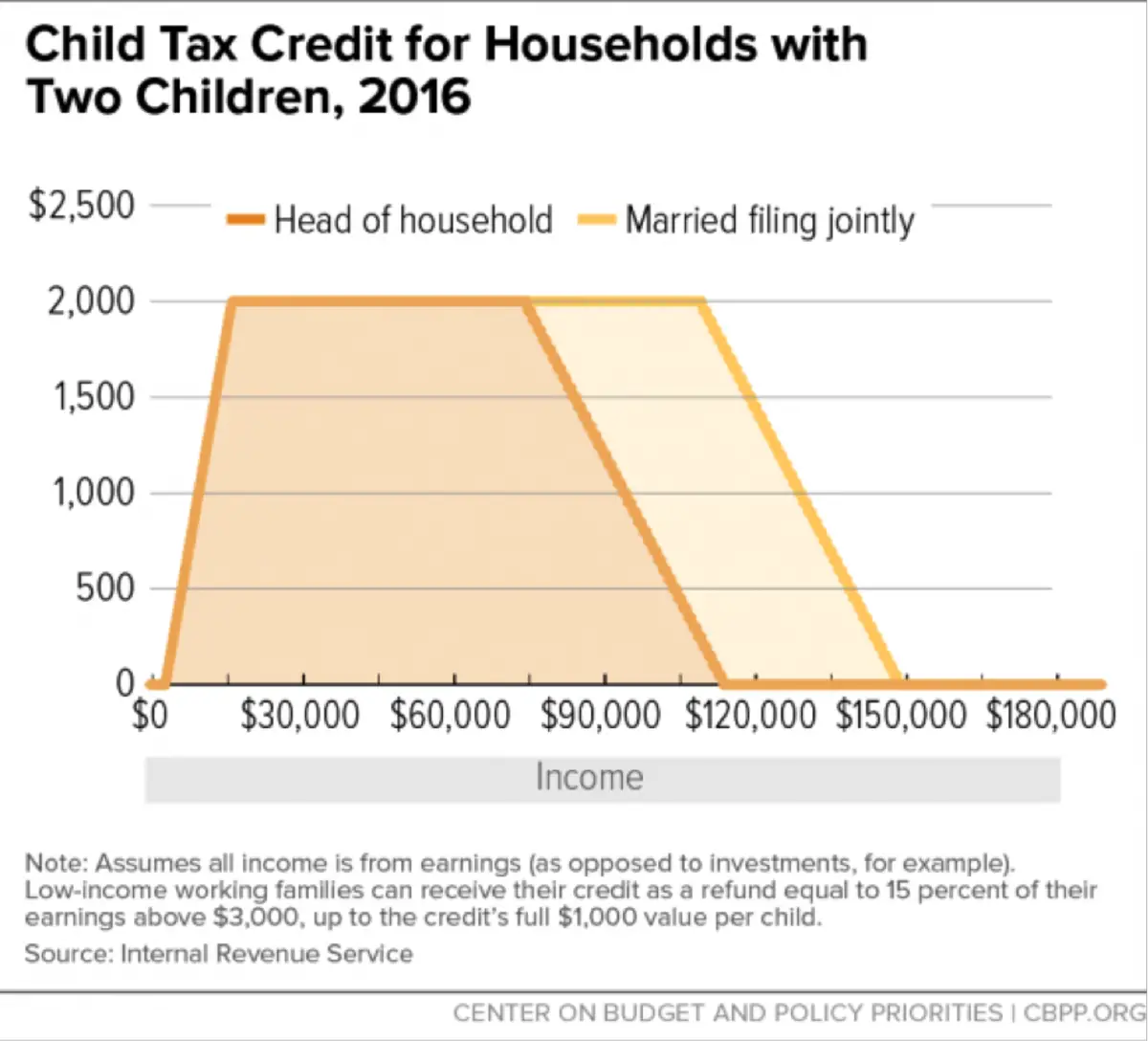

Under current law an estimated 19 million children under 17 receive less than the full credit or no credit at all because their families incomes are too low. This is because the credit phases in with earnings at 15 cents per dollar, for earnings above $2,500, and the refundable portion of the credit is capped at $1,500 per child. This slow phase-in rate results in the children whose families most need the credit receiving a smaller credit than children in families with higher incomes, or no credit at all. Furthermore, the credit phases in largely based on income, not the number of children a family has. So, a family with low income often receives the same total credit whether they have one, two, or more children, whereas families with higher incomes receive $2,000 per child.

For example, a single mother with a toddler and a second grader, who earns $15,000 as a home health aide helping older adults meet their basic needs, would receive a total of $1,875 in Child Tax Credit, less than what other families would receive for just one child. In contrast, a family with two children and earnings of $150,000 would receive the full $2,000 per child, or $4,000 in total. In fact, families with much higher incomes including married couples with incomes of up to $400,000 get the full credit for each child, while the lowest-income families are partially or completely shut out of the credit.

Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions

These updated FAQs were released to the public in Fact Sheet 2022-32PDF, July 14, 2022.

There have been important changes to the Child Tax Credit that will help many families receive advance payments. The American Rescue Plan Act of 2021 expands the Child Tax Credit for tax year 2021 only.

Recommended Reading: Can I Pay 1099 Taxes Online

Irs Letter 6419 On Monthly Payments

Question: I don’t remember the amount of advance child tax credit payments I got in 2021. Will IRS send me a letter letting me know how much I received?

Answer: Yes. You should have received Letter 6419 in the mail from the IRS. This notice includes the total amount of advance child tax credit payments you received in 2021 and the number of qualifying children that the IRS used to calculate the advance payments. If you filed a joint return with your spouse last year, then both of you should have received Letter 6419 listing one-half of the payments. That means joint filers will have to combine the amounts on the two letters when they file their return. Make sure you keep this letter with your tax records to help you fill out your 2021 return. If you use a paid preparer, give the letter to the preparer.

The IRS warns that if the amount of advance child tax payments you report on IRS Schedule 8812 doesn’t match the figures reported on Letter 6419, then the processing of your return will be delayed. That means any refund you are entitled to will also be delayed.

If you didn’t receive Letter 6419, you can check your IRS online account on the tax agency’s website. Once you have gone through all the steps to create an account and log on, you will be able to verify the amount of child tax credit payments you received for 2021. Alternatively, you can call the IRS at 800-908-4184 to get the information needed before completing Schedule 8812.