Can You Write Off Life Insurance If You Are Self

The booming gig economy and pandemic-induced economic downturn have encouraged many people to turn to self-employment.

While tax-deductible life insurance premiums are available as a business expense, this deduction is generally reserved for business owners who provide group policies for their employeesnot self-employed individuals.

Is Life Insurance Tax Deductible For Self Employed

If you are making money running your own business and you see great success you will want to know is life insurance tax deductible for self employed?

Similar to is life insurance tax deductible for self employed:

To answer the question, typically, life insurance coverage premiums arent deductible by self employed individuals or companies for tax purposes.

Nevertheless, there are a few exceptions that are discussed below.

Speak to a tax professional to see how you can use this to your advantage.

The rich get richer every day because theres always a way!

Personal Health Care Costs Are Increasing

Its no secret that personal health care costs are on the rise in Canada. According to the Canadian Institute for Health Information, the average Canadian spends more than $1,500 per year on prescription drugs, and this number has increased by 12% since 2005.

Although you are provided with health care coverage through OHIP, there are many health services that OHIP doesnt cover, which means you must pay for medical expenses out of pocket if you do not have health insurance coverage through your employer.

Without group insurance or private health insurance, you might need to pay out of pocket for unexpected medical expenses if you become ill or are diagnosed with a condition that requires regular medical care and medication.

For this reason, an increasing number of Ontario residents are opting for personal health insurance to help pay for health care expenses that are not covered by OHIP. Private health insurance gives you the peace of mind in knowing that you are covered for dental fees, doctor and hospital visits, prescription drugs and even travel insurance.

However, there is one additional and commonly overlooked benefit of investing in personal health care insurance: the premium you pay is an eligible tax deduction under the Income Tax Act in Canada.

Recommended Reading: How To Know If Your Taxes Are Filed

Type Of Insurance Policy

Its possible to use individual term insurance or a permanent insurance policy as security for a loan and qualify for the collateral insurance deduction. However, creditor insurance premiums arent deductible under this provision since the borrower isnt the owner of the policy.

In the next article, well explore the tax treatment of policy loans under a participating life insurance policy.

Also read:

How Can Protection Matters Help If Im Self

Life cover is essential financial planning for everyone whose partner and children depend on you and the income generated by your business to survive financially. We can help you choose the provider and the policy that is right for you, your business and your family.

We can also guide you through the terms and conditions and submit the application on your behalf. In addition we can advise you on other insurances that are crucial when youre Self-Employed, such as income protection, critical illness cover and health insurance.

This will save you a great deal of time and money. To discuss all your protection needs, call us today.

Recommended Reading: Why Am I Owing Taxes This Year

Is Life Insurance Tax Deductible For A Business

If your company purchases life insurance for its employees, policy premiums may be tax deductible if the following conditions are met:

- Policies are offered as an employee benefit

- The business is an LLC, sole proprietorship or S corporation

- The company or its owner cannot be the beneficiary or otherwise benefit monetarily from the policy

If these conditions are met, premiums for the first $50,000 of each employees life insurance coverage are considered tax deductible. Premiums for coverage in excess of $50,000 are still considered taxable income by the IRS.

Are Life Insurance Premiums Tax

Life insurance premiumsthe monthly or yearly fees for your policyare intended to be affordable. After all, you buy it to protect your loved ones financial future.

But what if you can take that security further by finding more ways to save, like deducting those premiums from your taxes? Wouldnt that make life insurance that much more attractive?

But not all premiums are deductible. In this post, we explore situations where CRA will allow you to write off the cost of life insurance from your income tax.

- You can’t write off your life insurance premiums unless a bank requires the policy as collateral for a loan.

- Even then, you can usually only deduct a portion of the cost.

- Incorporated business owners have more opportunities for deductions.

Recommended Reading: When’s The Last Day To Do Taxes

Life Insurance Policy Owned By An Employee

If the employer pays for a personally-owned policy by an employee, the employer can deduct premiums against business income. As long as they are a reasonable business expense, CRA wont have a problem with it.

In turn, the employee must report the benefit on his tax return. For example, suppose you pay your staff $900, plus $100 for their life insurance premium. In this case, you must remit payroll tax and income tax to CRA since your employee technically earned $1,000.

Private Health Insurance Benefits For Self

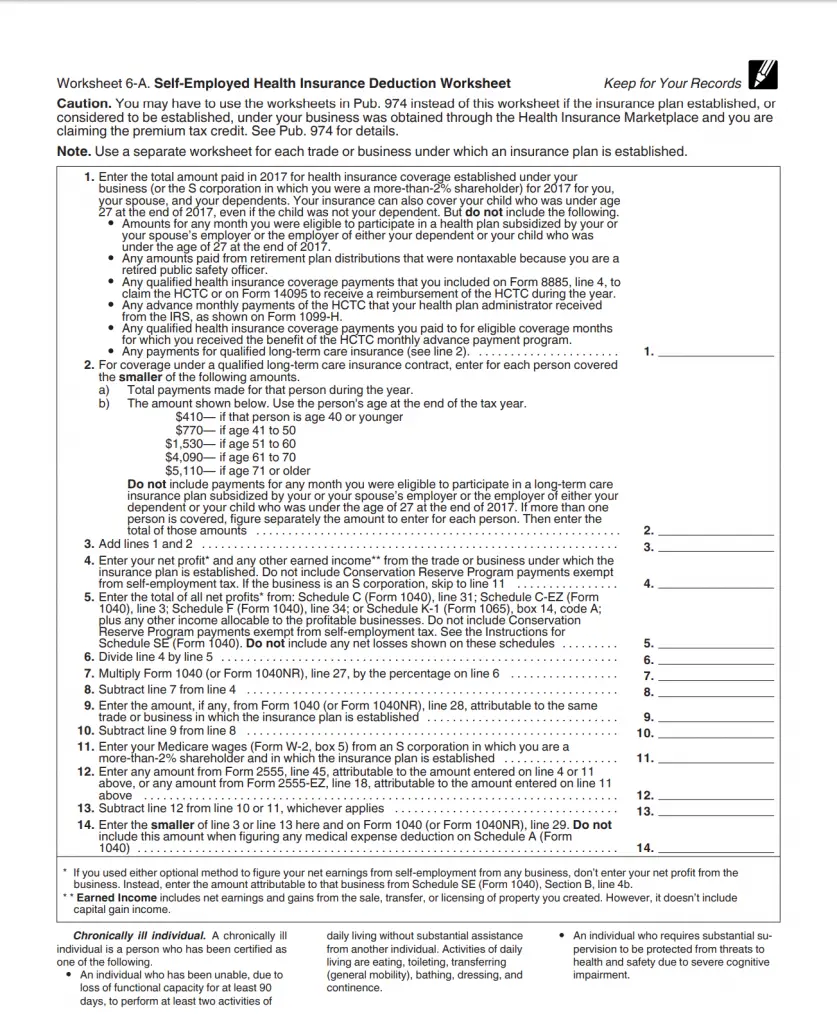

Private health insurance is an important consideration for the self-employed. As a self-employed individual, you do not have a health plan through an employer, and you are limited to the medical coverage you receive through OHIP. Rather than paying out of pocket, consider private health insurance to provide you with the coverage and peace of mind you are looking for.

As outlined on TaxTips.ca, If a person is self-employed, the premiums paid for a private health services plan can be deducted from self-employment income, instead of being claimed as a medical expense. This would result in greater tax savings, and is a way to provide a tax-free benefit to employees of a small business.

Also Check: When Are Irs Taxes Due

Free Income Tax Advice

We offer a free 10 minute income tax consultation with one of our students. We will identify your tax problem and advise you if you need assistance from a tax lawyer to solve it and if so we will suggest a one hour consultation with one of our lawyers, the fees if you wish to consult and a rough estimate of the legal fees if you choose to retain us.

Is Life Insurance Tax

Because there are no state or federal mandates that require you to purchase a life insurance policy, life insurance premiums are considered a personal expense. According to the Internal Revenue Service , when you buy life insurance for yourself, its equivalent to purchasing any other consumer product.

Personal expenses are generally not deductible premiums are no different in this regard. However, some aspects of life insurance are tax-deductible, including the instances listed below.

Don’t Miss: Can I Track My Unemployment Tax Refund

Fees Deductible Over Five Years

You can deduct certain fees you incur when you get a loan to buy or improve your business property. These fees include:

- application, appraisal, processing and insurance fees

- loan guarantee fees

- loan brokerage and finder’s fees

- legal fees related to financing

You deduct these fees over a period of five years, regardless of the term of your loan. Deduct 20% in the current tax year and 20% in each of the next four years. The 20% limit is reduced proportionally for fiscal periods of less than 12 months.

However, if you repay the loan before the end of the five-year period, you can deduct the remaining financing fees then. The number of years for which you can deduct these fees is not related to the term of your loan.

Deducting The Cost Of Life Insurance

Part five of a series on tax and insurance

Note: This is part five of a series on tax and insurance.

In part one we talked about the general tax attributes of life insurance. Part two looked at transactions resulting in a policy disposition, and how the proceeds and policy gain are determined. In part three we discussed the adjusted cost basis of an insurance policy and how its determined. Part four reviewed how the net cost of pure insurance is calculated, and its impact on an insurance policys ACB and the collateral insurance deduction.

In this article well delve deeper into the collateral insurance deductionwhen it can be claimed and how its determined.

Recommended Reading: Do You Pay Taxes On Life Insurance Payment

Business Tax Fees Licences And Dues

You can deduct any annual licence fees and some business taxes you incur to run your business.

You can also deduct annual dues or fees to keep your membership in a trade or commercial association, as well as subscriptions to publications.

You cannot deduct club membership dues if the main purpose of the club is dining, recreation or sporting activities.

Can I Pay For Life Insurance Through My Business

Business owners and directors can usually pay for their life cover through their business using the policy types listed above.

Rather than taking out a standard life insurance policy, such as level term or whole of life insurance, youll need to take out a relevant life insurance policy or keyman insurance for the policy to be seen as a business expense.

It can be hard thinking about what will happen to your business if you were no longer around, but securing life insurance can help to ensure the financial future of your business.

If you choose to provide a life cover benefit to your employees you should also be able to claim this as a business expense.

Also Check: Should I Efile My Taxes

Is Homeowners Insurance Tax Deductible

In general, you can deduct a portion of your home insurance premiums if youre self-employed and use part of your residence as a home office. But if your income comes from an employer, sadly, youre not eligible. Its also worth noting that if your home is damaged in a natural disaster, you can often write off expenses that arent covered by your home insurance.

How To Help Offset Or Recoup The Cost Of Health & Dental Coverage

If youre reading this article, you already know that the cost of medical and health expenses, which may not be covered by public plans, has been rising. And without a company health plan, unexpected and expected health expenses can easily derail your budget.

And yet with so little disposable income left over at the end of every month, you may wonder how you can afford private Health and Dental Insurance.

Flexible insurance plans such as Manulife Flexcare® Health and Dental Insurance Plans* – prescriptions, eyeglasses and more. Plans are customizable and affordable.

You May Like: How To Buy Tax Lien Properties In California

Tax Tips Voluntary Disclosure For Unpermitted Life

While many taxpayers know that the Income Tax Act permits a deduction for life-insurance premiums, some fail to understand the restrictions on this deduction. As a result, taxpayers may underreport income and thereby expose themselves to significant monetary penalties if they fully deduct life-insurance costs when:

- The lender isnt a bank or similar financial institution

- The lender didnt require life insurance as collateral for the loan

- The loan wasnt for a business purpose

- The deducted insurance cost includes amounts from the policys savings plan or

- The deducted insurance cost doesnt account for repayment of the loans principal.

If you deducted life-insurance costs under any of these circumstances, you risk triggering the Income Tax Acts various monetary and criminal penalties.

An application under the Canada Revenue Agencys Voluntary Disclosures Program may offer a remedy. But you lose this option if the CRA discovers your mistake beforehand.

So, speak with one of our experienced Canadian tax lawyers today. We can review your situation and discern whether youre indeed non-complaint. If so, we will carefully plan and prepare your disclosure application. A properly prepared disclosure application not only increases the odds that the CRA will accept your disclosure but also lays the groundwork for a judicial-review application to the Federal Court should the CRA unfairly deny your disclosure.

Is Life Insurance Tax Deductible For Self

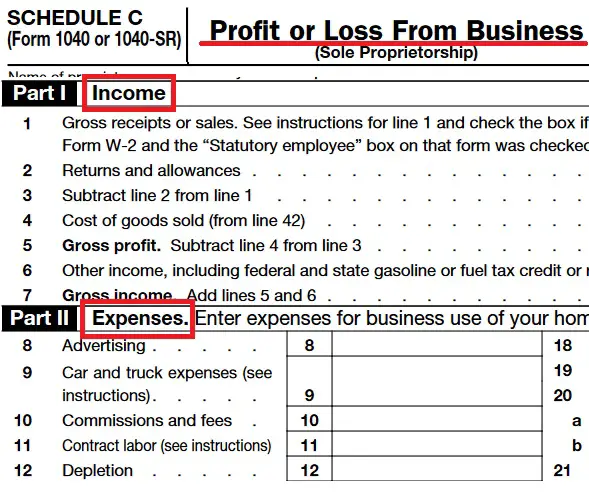

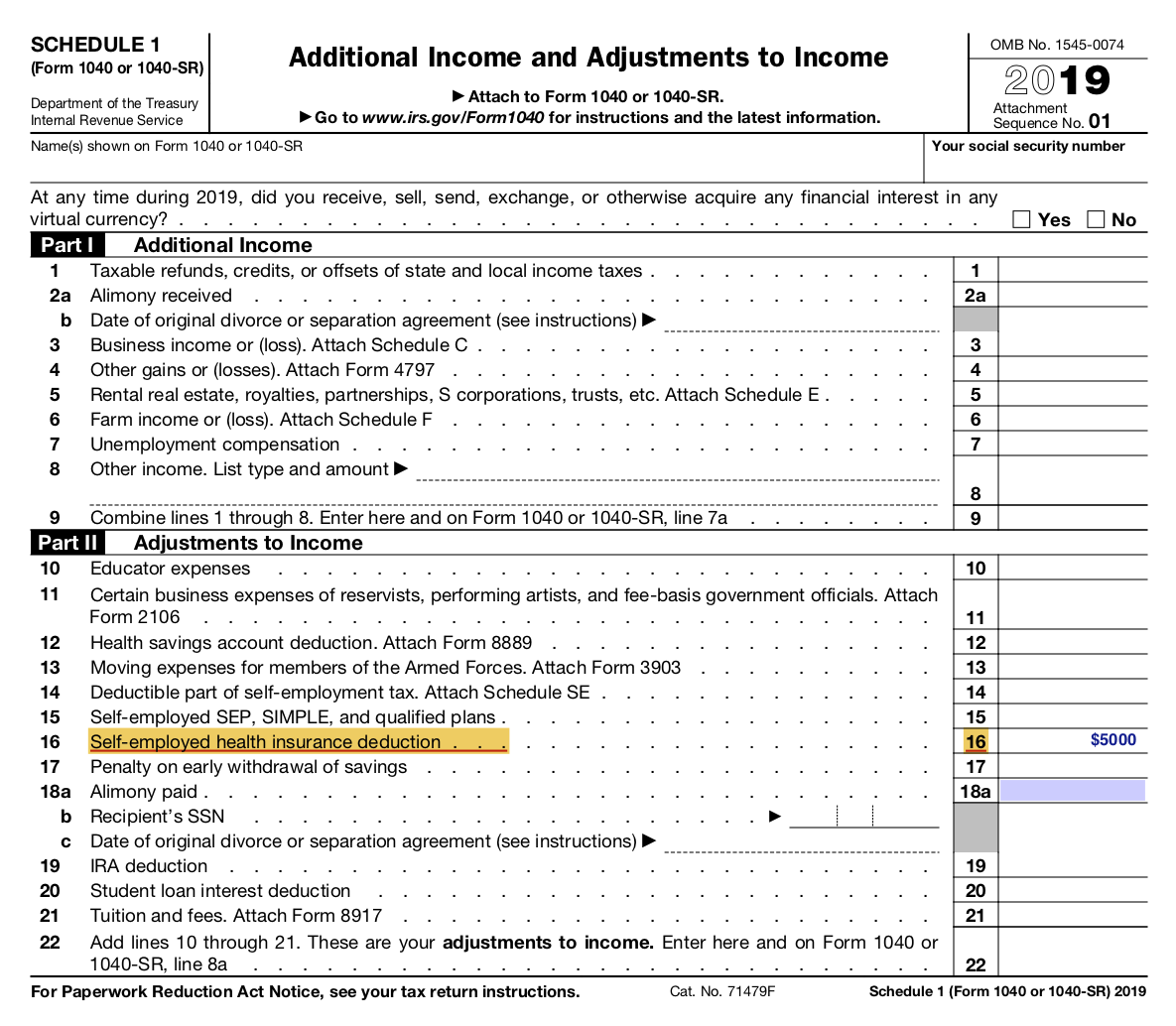

Most business-related expenses are tax deductible, which lowers your taxable income and ultimately saves you money. This is especially helpful when youâre self-employed because you pay both income tax as well as self-employment tax that covers your Social Security and Medicare contributions. Business-related subscriptions, supplies, marketing costs, and even health insurance all count as tax deductions.

Unfortunately, however, you typically canât deduct life insurance premiums when self-employed.

The exception is if you offer life insurance as an employee benefit as part of your business. Your company would need to be classified as either an LLC or S corp, which disqualifies sole proprietors from this strategy. In this instance, all eligible employees would be in a group policy. But businesses can only deduct $50,000 in premiums each year.

The good news is that while the life insurance premium isnât deductible for most self-employed individuals, the death benefit is tax-free for your beneficiary. That means they receive the full amount and donât have to pay state or federal income tax on these funds. Thatâs one of the reasons why so many people choose life insurance as part of their estate planning strategy.

You May Like: How Long To Keep Tax Records

Interest And Bank Charges

You can deduct interest incurred on money borrowed for business purposes or to acquire property for business purposes. However, there are limits on:

- the interest you can deduct on money you borrow to buy a passenger vehicle or a zero-emission passenger vehicle. For more information, go to Motor vehicle expenses.

- the amount of interest you can deduct for vacant land. Usually, you can only deduct interest up to the amount of income from the land that remains after you deduct all other expenses. You cannot use any remaining amounts of interest to create or increase a loss, and you cannot deduct them from other sources of income.

- the interest you paid on any real estate mortgage you had to earn fishing income. You can deduct the interest, but you cannot deduct the principal part of loan or mortgage payments. Do not deduct interest on money you borrowed for personal purposes or to pay overdue income taxes.

Writing Off Premiums As A Charitable Contribution Or Part Of An Alimony Agreement

If you purchase a life insurance policy and make a charitable organization the beneficiary, Fidelity Life said “the premiums you paid into the policy or the policy’s overall cash value, whichever is less, is considered a tax deduction.”

In certain states, life insurance is required as security for child support or spousal support, Kimberly A. Cook, principal mediator at Dovetail Conflict Resolution, told Insider. Cook suggests not only talking to your divorce lawyer, but also including your estate planning attorney and accountant in these discussions because if life insurance is required in your state that would extend for several years.

If you have a spousal support or alimony agreement that is pre-2019, where the judge ordered life insurance as part of the agreement, you may be able to write off those premiums according to IRS rules. Unfortunately, alimony and spousal support agreements after December 31, 2018 are not eligible.

Recommended Reading: What Is The Last Day To File Taxes

Life Insurance For The Employee

If a business has employees and offers them group life insurance as a benefit of employment, the business may deduct those premiums, up to the first $50,000 in life insurance coverage for each employee.

Whether employee insurance is calculated as a flat amount for each employee, or as a percentage of annual salary, the employer-paid premiums for the first $50,000 of group life insurance are tax-deductible to the employer.

If the company group plan offers policies greater than $50,000, the premiums paid for the additional amount are considered by the IRS to be a taxable benefit to the employee.

If the company covers employees dependents, it can deduct the premiums for the first $2,000 in life insurance face value for each dependent. Beyond the first $2,000, the tax burden shifts to the employee.

The same rules apply if the company offers employer-paid individual life insurance to a few executives or some other class of employees at the firm. In this case, the employer pays the premiums, but the employee owns the policy.

And if the employee leaves the company they can assume payment of the premiums and retain the policy.

Up to the first $50,000, the company can deduct the premiums, and the employee benefit is free of taxes to the employee. If this employee later leaves and takes over the premium payments, the full tax deduction would then go to the employee.

Life Insurance As Collateral For A Loan & Key Person Insurance

Generally, a lender requires that a borrower put up collateral for the loan. Sometimes, the lender stipulates that the collateral be in the form of a life-insurance policy to the lenders benefit should a particular individual die.

A lender may stipulate this sort of collateral when, for instance, a single persons skill dictates the viability of the borrowers entire business. Should that person die, the viability of the borrowers entire business evaporatesalong with the borrowers ability to repay the loan. This concern often arises with businesses that depend on the service of one or a few professionalse.g., sole-practitioner or small-sized law firms, accounting firms, and medical practices.

But numerous businessesnot just those providing professional servicesface the same concern. The demise of a key owner, founder, or employee might sink the entire company. To this end, insurance companies offer key-person insurance, which serves to compensate the business should a key person die or become disabled.

Read Also: Do You Claim Unemployment On Your Taxes