What If Youre Using Employer

If you are using your employer-sponsored insurance, that is not considered taxable income at the state or federal level.

Additionally, if your employer reimburses you for your payments on your health insurance, that is not taxable income, either. Your employer can do this in one of three ways under Section 125 of the federal tax code:

- Your employer can help lower your income tax payments by using your pre-tax dollars to pay on your health insurance.

- You can use a flexible spending account plan to pay for eligible out-of-pocket expenses .

- You can enroll in a cafeteria or flexible benefits plan. With this arrangement, you can choose between taxable pay and nontaxable benefits.

However, your employer must specify that the extra money they gave you was a health insurance reimbursement.

On the flip side, any payments for the coverage your dependents and opposite-sex spouse enjoy may be taxable, even if they are on your employer-sponsored health insurance. California expands this to same-sex spouses and domestic partners.

When Should You Take An Itemized Deduction Rather Than Standard Deduction

Taking the itemized deduction may make sense if you had many unreimbursed medical or dental expenses during the taxable year. But keep in mind that those expenses must exceed 7.5% of your AGI, as well as the standard deduction for your filing status, to reap the benefits.

For 2022, the standard deduction for a single taxpayer is $12,950 and $25,900 for joint filers.

Lets look at an example. Imagine that your AGI for the taxable year is $90,000. You were diagnosed with cancer and the combination of treatment, surgeries, medication and hospital stays cost $150,000. In this case, it would make sense to take the itemized deduction because the cost of treatment would well exceed 7.5% of your AGI and is greater than the current standard deduction.

On the other hand, imagine that you had the same AGI for the taxable year but only accrued $5,000 in unreimbursed medical expenses for the year. In this case, taking the standard deduction would be a better way to lower your taxable income because your medical expenses would not exceed 7.5% of your AGI.

Remember that you can only deduct qualifying medical expensesif you accrue thousands of dollars or more in medical expenses but they dont meet the requirements, taking the standard deduction would still be the better option.

Maybeif Your Healthcare Costs Are High Enough

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

A Tea Reader: Living Life One Cup at a Time

Health insurance is one of their most significant monthly expenses for some Americans, leading them to wonder what medical expenses are tax-deductible to reduce their bill. As healthcare prices rise, some consumers seek to reduce their costs through tax breaks on their monthly health insurance premiums.

If you are enrolled in an employer-sponsored health insurance plan, your premiums may already be tax-free. If your premiums are made through a payroll deduction plan, they are likely made with pre-tax dollars, so you would not be allowed to claim a year-end tax deduction.

However, you may still be able to claim a deduction if your total healthcare costs for the year are high enough. Self-employed individuals may be qualified to write off their health insurance premiums, but only if they meet specific criteria. This article will explore tax-deductible medical expenses, including the requirements for eligibility.

Don’t Miss: How Do I Find Last Years Tax Return

Does Private Health Insurance Need To Be Reported To Hmrc

At the end of the financial year, you will need to fill out a P11D form (known as an expenses and benefits form for each of your employees. This itemises any benefits that they have received from your business in addition to their salary, and health insurance must be included in this if it has been provided.

Also Check: Does Insurance Pay For Home Health Aides

Deducting Premiums Paid For A Private Health Insurance Plan

While the Medical Expense Tax Credit can significantly reduce your taxes, it is not always obvious which medical expenses are eligible. Payments of premiums for private health service plans may qualify if they meet certain criteria, while others are excluded. It is important to know if any of your payments are eligible towards this credit.

Don’t Miss: How Can I Make Payments For My Taxes

Should You Chose The Standard Deduction Or Itemized Deduction For Personal Medical Expenses

Employees will need to consider their income and medical expenses when deciding whether to take the standard deduction or to itemize their deduction.

To determine which deduction to take, you must calculate the deductible amount. Remember, you can only deduct medical expenses greater than 7.5% of your adjusted gross income.

For example, if your AGI is $56,000, you can only deduct medical expenses greater than $4,200 on your tax return. If your out-of-pocket medical expenses and other expenses exceed the standard deduction, then choosing the itemized deduction will allow you to get more money back on your tax return.

Its a good idea to consult with your tax advisor to determine which filing method is best for you.

What Medical Expenses Are Tax Deductible

Many people arent aware that some expenses can be deducted from your federal income taxes. Besides your health insurance premiums, other deductible medical expenses may include the following:

- Long-term care insurance premiums

- Equipment needed for a medical disability

- Mental health services

- Travel and lodging expenses for medical appointments

Its important to remember that you can only deduct the cost of qualifying medical expenses if the total amount you paid exceeds 7.5% of your AGI and you choose to itemize your deductions. You cant deduct the amount paid for by a health plan or employer.

Hunsaker explains that this tax deduction can be powerful for people with disabilities or chronic illnesses or who experience major medical events. But the deduction is hard to claim for those who visit the doctor only a few times per year for basic and preventive care.

Heres why: The 2020 U.S. Census says the median household AGI is $67,521 and 7.5% of that is $5,064.

That means you can only deduct expenses after the first $5,064 and, if you meet the criteria, it makes sense for you to itemize deductions, Hunsaker says.

Read Also: Do Non Profits Pay Property Taxes

The Threshold Doesn’t Apply To All Your Income

The good news is that this percentage doesn’t apply to your total gross income but only to your AGI. This is the number that’s arrived at after you’ve taken certain above-the-line deductions on Schedule 1 of your Form 1040 tax return, reducing your gross income to your taxable income.

Your AGI appears on line 11 of your 2021 Form 1040 before you subtract your itemized deductions or the standard deduction for your filing status on line 12.

Above-the-line deductions include things like certain retirement plan contributions, tuition, and student loan interest. Your AGI will typically be less than your overall income if you can claim any of these deductions. For example, you might have earned $60,000, but your AGI would be just $54,000 if you contributed $6,000 to your IRA in that year. Your 7.5% threshold would drop from $4,500 to $4,050 in our example.

Health Insurance Premiums That Aren’t Tax

Not all health insurance premiums are tax-deductible. You can’t deduct the portion of your premiums that your employer pays, for example, or any premiums that come out of your paycheck pretax.

If you are enrolled in Medicare under Social Security, your Medicare A premiums are paid by Social Security and aren’t tax-deductible.

Does a tax subsidy cover part of your premiums for health insurance through a state or federal insurance marketplace? If so, you can’t deduct that portion of your premiumsjust the amount you pay out of pocket.

Recommended Reading: Is Us Tax Shield Legit

Care Treatment And Training

This section identifies most types of care, treatment and training you can claim as medical expenses.

Bone marrow transplant reasonable amounts paid to find a compatible donor, to arrange the transplant including legal fees and insurance premiums, and reasonable travel, board and lodging expenses for the patient, the donor, and their respective attendants.

Cancer treatment in or outside Canada, given by a medical practitioner or a public or licensed private hospital.

Cosmetic surgery generally, expenses solely for cosmetic procedures are not eligible.

An expense for a cosmetic procedure qulifies as an eligible medical expense if it is necessary for medical or reconstructive purposes, such as surgery to address a deformity related to a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease. For more information, see Common medical expenses you cannot claim.

Fertility-related procedures amounts paid to a medical practitioner or a public or licensed private hospital to conceive a child. Generally, amounts paid for a surrogate mother are not eligible. See also In vitro fertility program.

Group home see Attendant care and care in a facility.

In vitro fertility program the amount paid to a medical practitioner or a public or licensed private hospital. Fees associated with obtaining eggs or sperm from a donor or a donor organization are not eligible. See also Fertility-related procedures.

Is Health Insurance Tax Deductible The Bottom Line

In short, your health insurance policy payments are tax-free at the federal and state level if you use your employers health insurance. However, there are different criteria for the self-employed.

Ultimately, be aware of your health insurance and tax situation because you could save money on your health insurance every year. Also, keep abreast of the Medicare, Medicaid, and Marketplace rules in your state.

Since you now know whether your health insurance is tax-deductible, are you ready to look at health insurance rates from top companies in your area? Just enter your ZIP code into our free quote tool below and get started.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

|

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina.He has also earned an MFA in screenwriting from Chapman Univer… |

Don’t Miss: Do I Pay Taxes On Social Security

Can You Claim Health Insurance Premiums On Your Taxes As An Employee

As an employee, you can deduct any health insurance premiums that you pay out of pocket, which hasnt been reimbursed through a stipend or an HRA. COBRA and Medicare premiums can also be tax-deductible.

You can reimburse Medicare Part B, Part C, and Part D on your tax return.

You can also write off Medicare Part A premiums if you arent enrolled in the plan under Social Security and if youve never paid Medicare tax as a government employee. Most Medicare Part A recipients dont pay premiums, so theres often no expense to deduct.

Employees can also deduct long-term care insurance premiums on their tax returns.

You can only deduct Medicare and out-of-pocket medical expenses that exceed 7.5% of your adjusted gross income as itemized deductions on your personal tax returns.

If you receive premium tax credits, you cant deduct the amounts that your advance premium tax credits paid for. You can only write off the out-of-pocket expenses that you paid.

You May Like: Are Funeral Expenses Tax Deductable

Are Non Covered Medical Expenses Tax Deductible

The IRS allows you to deduct unreimbursed payments for preventative care, treatment, surgeries, dental and vision care, visits to psychologists and psychiatrists, prescription medications, appliances such as glasses, contacts, false teeth and hearing aids, and expenses that you pay to travel for qualified medical care.

Also Check: How To Avoid Taxes On Stock Gains

Why Is Private Health Insurance A Good Investment For Business

During sickness or after an accident, providing private healthcare to workers assures them that they will have quick access to high-quality treatment, resulting in less time off work, more productivity, and long-term cost savings.

Private health insurance is a veryalluring advantageto potential employees throughout the hiring process. There are non-financial incentives in an organisational setting that value wellbeing and work-life balance more than ever. This means thatbenefits like private health insurancemay help you attract and keep the finest employees in your business.

Health Insurance Tax Credits Deductions & More

Learn how to take advantage of financial help and avoid tax penalties when enrolling for health insurance. You may be leaving money on the table!

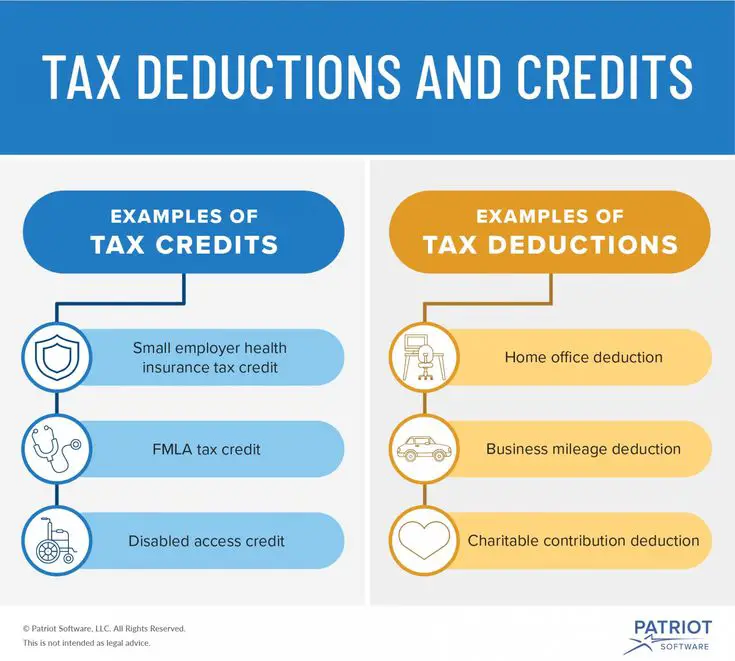

When the government wants to encourage you to do something, they often offer you a tax credit. Examples include everything from buying energy-efficient appliances to purchasing health insurance. The bonus is that tax credits actually lower how much you owe and, even better, health insurance tax credits are actually refundable. Consider this, if you owe $2,000 in taxes and have an unused tax credit of $2,500, youâll get a check for $500.

Financial Help, Health Insurance & Your Taxes

Health insurance tax credits are financial help from the federal government that lowers your monthly premium. Thatâs why they are specifically referred to as premium tax credits. Applying for insurance through Covered California is the only way to receive this help.

If you qualify, you can receive financial help as a reduction to your monthly insurance premium. You can also choose to receive this money as one lump sum come tax time. Financial help is based on your household income. That means, if you end up making more or less money than when you applied, then the amount of your financial help could change. To avoid any surprises come tax season, report these changes to Covered California.

Applying for Financial Help

Self-Employed and Small Business Owner Tax Deductions

Avoid Tax Penalties

Read Also: What Is The Property Tax In New York

Group Health Insurance Tax Benefits For Employers:

As an employer, the health insurance premiums you pay on behalf of your employees are deemed as fringe benefits and may be considered as a business expense. So, if you pay the total premium payment, you can avail of group mediclaim policy tax benefit on the entire amount.

How does it work?

Here, section 17 of the Income Tax Act that deals with âsalary,â âperquisite,â and âprofit in lieu of salaryâ comes into play. It states that the premium you pay for your employees is a benefit, so it falls under the âProfit in lieu of salaryâ category. It communicates that your company can claim the entire amount as a business expense in your profit and loss account irrespective of the amount of premium paid.

This clause also allows different business categories like companies , partnership firms, and sole proprietorship to enjoy benefits.

In simple words, group health insurance premiums are an additional benefit to employees thatâs why you can use them to get taxable income benefits. Therefore, group medical insurance for employees helps organizations reduce their overall tax liability.

Are Health Savings Accounts Tax Deductible

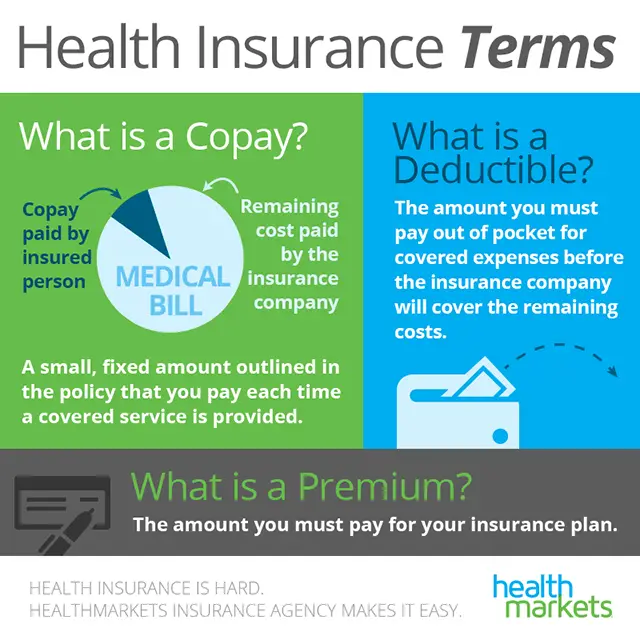

Health savings accounts , connected to high-deductible health plans, are tax-deductible, even if you take the standard deduction.

If you are covered under a high-deductible health plan, you may qualify to exclude your HSA contributions from your gross income, depending on your filing status and personal circumstances, says Adams.

For 2022, the maximum HSA contribution is $3,650 for individuals and $7,300 for families. Individuals over age 55 can contribute an additional $1,000 per year as a catch-up contribution.

For 2023, the maximum HSA contribution will be $3,850 for individuals and $7,750 for family coverage.

You May Like: What States Do Not Tax Social Security

Deduction Available Under Section 80d Of The Income Tax Act

Under Section 80D, you are allowed to claim a tax deduction of up to Rs 25,000 per financial year on medical insurance premiums. This limit applies to the premium paid towards health insurance purchased for you, your spouse, and your dependent children.

However, if either you or your spouse is a senior citizen , then the 80D deduction limit goes up to Rs 50,000. Similarly, tax deductions for members of HUF are Rs 25,000 and Rs 50,000 if your age is less than 60 years and above 60 years respectively.

When Health Insurance May Be Tax Deductible

One thing that makes your health insurance deductible is if you are self-employed. Your health insurance premiums that you pay for yourself as well as your dependents are tax deductible.

But they can only be a tax deduction if you are getting your own health insurance without subsidies from your spouses employer or your employer if you have another job aside from your own. Self-employed people can only deduct the amount they pay for their premiums.

Another way you can get can some tax benefits is through contributing to a Health Savings Account or HSA. Your HSA may be established by your employer or you can set it up on your own.

Either way, your contributions to your HSA are 100 percent tax deductible. But there is a limit. The limit is $3,600 if the High Deductible Health Plan only covers you and $7,200 if it covers at least one other family member in 2021.

However, the portion that is tax deductible is just the part that you contribute. You cannot include any money your employer may put into the account for you.

Donât Miss: Protesting Property Taxes In Harris County

You May Like: How To Find Tax Delinquent Properties In Your Area