Are Political Contributions Tax Deductible For A Business

Its true that businesses often have an interest in the outcomes of elections, and it shows when looking at their financial involvement in the political landscape. However, the tax code is very clear about political donations not being tax deductible specifically stating in most cases no business expense deduction may be claimed for any amount paid or incurred in connection with influencing legislation.

This rule is so strict that it prevents political candidates from deducting their own out-of-pocket expenses incurred while running for office. Campaign expenses of an individual running for any political office or for re-election to any political office cannot be deducted. These expenses include registration fees, qualification and legal fees, as well as advertising.

What Is The Difference Between Political Contributions And Charitable Donations

Unlike political contributions, charitable donations are typically tax deductible. To deduct these donations on your return, you are usually required to itemize your deductions. The amount that you can claim for qualified cash contributions depends on your tax filing status. Examples of charitable donations that you may be able to deduct include:

- Qualified nonprofit hospitals and schools

- Contributions for a public purpose to local, state or federal governments

- Qualified nonprofit organizations like United Way and the American Red Cross

- Donations to qualified religious organizations, such as churches, synagogues, temples and mosques

Along with donations to political candidates or groups running for public office, examples of contributions you cannot deduct include those made to groups with the purpose of lobbying for law changes, groups run for personal profit, civic leagues, labor unions or country clubs.

When you claim a charitable donation as a tax deduction, you will typically list this deduction on Schedule A . This is the form on which you can claim your itemized deductions. The IRS includes a list of qualifying organizations via a Tax Exempt Organization Search tool. If you need further assistance with determining whether the organization you want to donate to qualifies as tax deductible, a tax professional can help.

What About Personal Time Spent Volunteering And Money Spent Out Of Pocket

Volunteering ones time for a political campaign does not qualify for a tax deduction, either the time given or the expenses expended. This includes things like transportation to and from campaign events as well as the transportation of supplies. When it comes to filing taxes, the regulations of the IRS make it abundantly clear that neither the amount of time spent volunteering nor the out-of-pocket expenses paid to political candidates and parties can be deducted from the taxpayers gross income.

Don’t Miss: When Do I Get My Federal Tax Refund

Political Contribution Caps And Restrictions

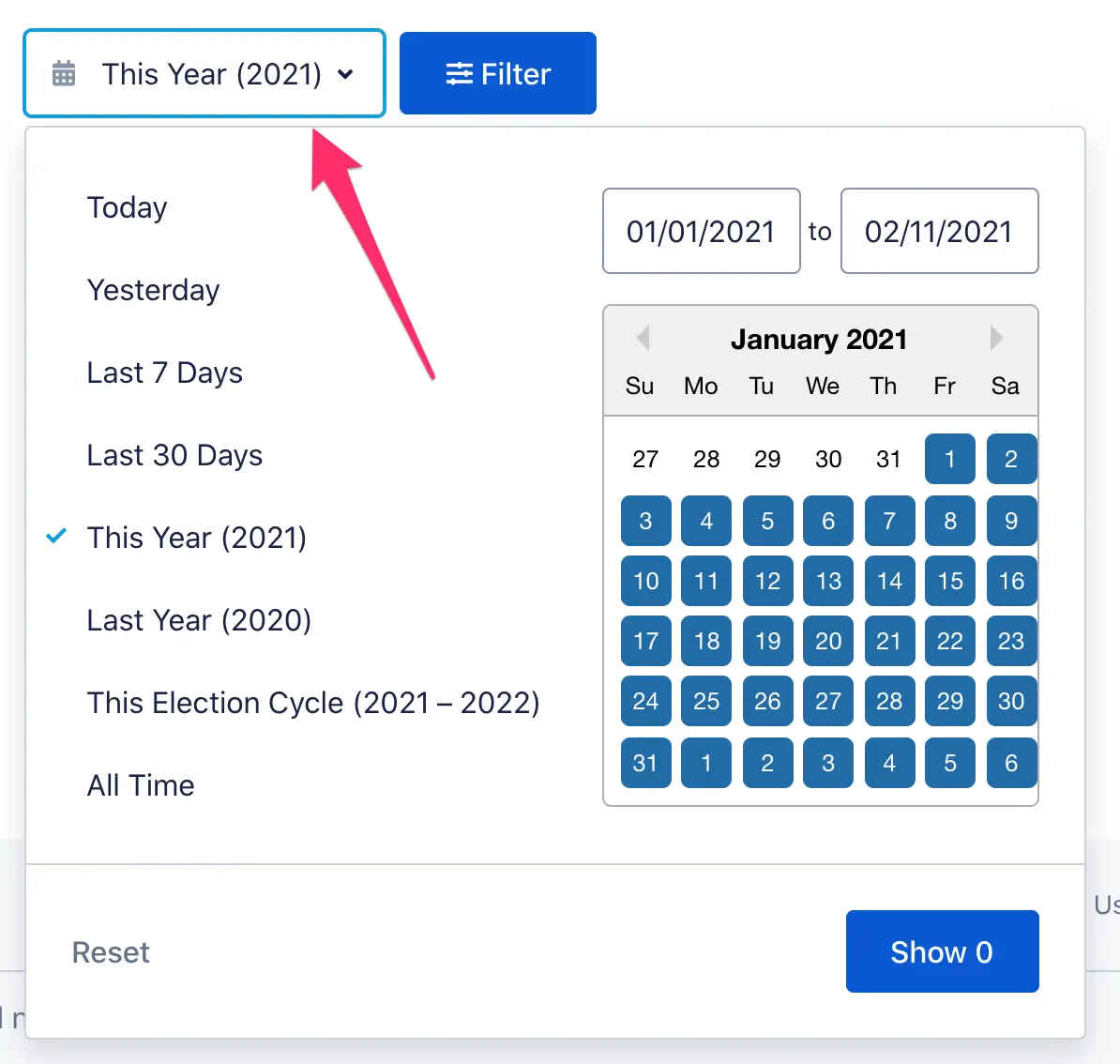

Even though donations to political campaigns are not tax deductible or eligible for a tax deduction, there are still limits placed on the amount of money that people can give to political campaigns. An individual is permitted to contribute a maximum of $2,900 to a candidate committee during each election cycle, up to $5,000 annually to a political action committee , and up to $10,000 annually to a district or local party committee.

A person may give a maximum of $35,000 per year to a national party committee if they are donating to that committee. These limits are established by the Federal Election Commission. If a donor exceeds these limits, the campaign will not be able to use the additional funds contributed.

Why Cant I Deduct A Political Contribution

While you might think a political donation should fall under the category of a charitable contribution, thats not what the tax code says. In fact, the IRS specifically calls out political donations as something you cant take as a charitable deduction on your federal return.

Thats because political parties, organizations and candidates arent considered charities for purposes of federal income taxes. You can only take a charitable deduction for contributions to qualifying organizations such as

- Religious organizations, including churches, synagogues, temples, mosques and others

- Federal, state and local governments, but only if your donation is solely for public purposes

- Nonprofit schools and hospitals

Read Also: Where Do I Report 1099 Q On My Tax Return

How Is The Amount I Get Calculated

The amount of credit depends on how much you give. The rate is:

- 75 per cent on the first $437 of donations in 2022

- 50 per cent on the portion of your donation between $437 and $1,457 in 2022

- 33.33 per cent on the portion between $1,457 and $3,315 in 2022.

Political Contributions Tax Deductible

* Please keep in mind that all text is summarized by machine, we do not bear any responsibility, and you should always get advice from professionals before taking any actions.

* Please keep in mind that all text is summarized by machine, we do not bear any responsibility, and you should always get advice from professionals before taking any actions.

You May Like: Appeal Property Tax Cook County

You May Like: Why Do I Owe Money On My Taxes

How Do I Determine What Is A Political Contribution

There are a few rules that govern the definition of a political contribution.

First, it must be made to a candidate or campaign committee.

Second, it must be a gift. This includes gifts of money, goods, services, or anything else that may have value.

Third, it must be an expenditure. This means that it must be used to further a specific purpose.

Fourth, it must be made within a certain period of time before the election.

The IRS defines the following categories as political contributions:

- Donations to a candidate or his or her campaign committee.

- Contributions to a party committee that is controlled by a candidate.

- Contributions to a political party.

- Contributions to a political action committee .

- Contributions to a candidates or candidate committees independent expenditure committee.

- Contributions to an individual who makes independent expenditures.

- Contributions to a party for its general election campaign.

- Contributions to a party for its primary campaign.

- Contributions to a committee that makes independent expenditures.

- Contributions to a committee that makes independent expenditures for a candidates general election campaign.

- Contributions to a committee

What Is The Political Party

Political party means a group of persons organized to acquire and exercise political power. In our country, there are several political parties that stand for the election. The presence of the political party is actually a healthy situation for the nation. It gives people a choice to make a more evolved and effective decision.

You May Like: How To Do Your Taxes As An Independent Contractor

Political Contribution Tax Credit

The Political Contribution Tax Credit allows individuals or corporations that make donations to qualifying political parties or election candidates to claim a tax credit.

The tax credit amount is:

- 75% of the first $400 donated

- 50% of the next $350 donated and

- 33 1/3% of the next $525 donated.

The following restrictions apply:

- The maximum annual tax credit available to a donor is $650

- The tax credit is non-refundable and non-transferable and

- Unused amounts cannot be carried forward for future use.

Donations To Charities Vs Political Contributions

People who give money to political campaigns frequently believe that their donations qualify as charitable contributions. Donations to charities are typically eligible for a tax deduction however, financial support given to political candidates or parties is not. The Internal Revenue Service provides a tool known as the Tax-Exempt Organization Search that can assist individuals and corporations in determining whether or not a particular expense can be deducted from their taxes. You can search for the organization you would like to donate to by Employer Identification Number , name, or location to find out if the monies they plan to gift will be tax-deductible. If you have any questions about this, you can contact them directly.

It is crucial to be aware that any payments to charity organizations that you make must be itemized on your tax returns, regardless of whether you are filing a personal or company return. As a result of this, you ought to keep paperwork for every single political contribution that you make. When you are preparing your tax return, you will locate the itemizations on Schedule A of Form 1040. During the tax season, if you use Form 1040, it will be easier for you to manage your deductions and have a better understanding of what is and is not deductible.

Don’t Miss: Can You File For Previous Years Taxes

Can A Business Deduct Political Contributions

The short answer is no. While businesses, business owners and self-employed people often have more tax deductions available to them than individual taxpayers, in this case the same rules that apply to individuals apply to businesses.

Businesses are only permitted to deduct charitable contributions made to qualifying organizations and, as we stated earlier, political campaigns, organizations and individuals dont qualify as charitable organizations.

Political Contributions Arent Tax Deductible

A tax deduction allows a person to reduce their income as a result of certain expenses. There are five types of deductions for individuals work-related, itemized, education, healthcare, and investment-related deductions. Each of the types of deductions has subcategories such as charitable contributions, student loan interest, and capital losses. For example, capital losses have deduction limits.

According to the IRS, If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the less of $3,000 or your total net loss shown on line 16 of Schedule D . However, political contributions and tax deductions are another story. According to Intuit by TurboTax, political contributions arent tax-deductible, While charitable donations are generally tax-deductible, any donations made to political organizations or political candidates are not.

Charitable donations that can be considered tax-deductible are those made to churches such as tithes, ones made to governments that dont influence legislation, and non-profit schools and organizations .

So, if a person is making donations to a campaign or political leader with the hope of being able to use it as a tax deduction, they should instead opt to make donations to other qualifying organizations and businesses.

Don’t Miss: Where To File Georgia State Taxes

Political Contributions Are Tax Deductible Like Charitable Donations Right

Its not uncommon to mistake the tax deductibility of political contributions. We hear this question from time to time. The confusion usually arises over the difference between political contributions and charitable contributions. Just the word donation can be misleading because only some contributions, or donations, are actually tax deductible.

Typically, deductible charitable contributions are those made to organizations that are tax-exempt under §501 of the Internal Revenue Code. This type of organization is specifically barred from attempting to influence legislation, or participating in any political campaign. Because of this, a political campaign or party will never fall under §501. Therefore, political contributions cannot be treated as tax deductible charitable contributions.

Who Can Claim Tax Deduction

Tax benefits on donations to political parties are available under two sections – namely 80GGB and 80GGC.

Deduction under Section 80GGB – Eligible Tax payer Any Indian company that contributes to a political party or an electoral trust registered in India is eligible for a deduction for the amount paid.

Deduction under Section 80GGC – Eligible Tax payer All taxpayers, other than an Indian companies, local authorities, and artificial juridical persons wholly or partly funded by the government.

Note: The person claiming tax benefit should not be associated with a local authority or be a legal person that receives funds from the government.

You May Like: What Can You Claim On Your Taxes

What Modes Of Payment Can Be Used To Make Contributions

Tax benefits on donations to political parties under both 80GGB and 80GGC are not available on cash or kind contributions. This means a cheque, demand draft and electronic transfer should be your preferred mode for donating if youre looking for a tax deduction. This ensure transparency in funding during the elections.

Can I Deduct Political Contributions On My State Income Tax Return

In most states, you cant deduct political contributions, but four states do allow a tax break for political campaign contributions or donations made to political candidates. Arkansas, Ohio and Oregon offer a tax credit, while Montana offers a tax deduction. All four states have rules and limitations around the tax break.

Many of the states that dont offer a deduction for political contributions follow IRS guidelines for deducting charitable contributions.

Don’t Miss: How To Pay Ky State Taxes

So Political Donations Arent Tax Deductible What Is

If you are looking for potential tax deductions, you may want to look elsewhere. Retirement, medical, and charitable contributions are a few opportunities to reduce your overall taxable income. The Tax Pros at H& R Block can help. We can look at your situation and help you determine the deductions that apply to you.

Visit your local H& R Block office for more details.

Related Topics

Mike Slack

Mike Slack, JD, EA, is a senior tax research analyst at The Tax Institute. Mike leads research teams focused on business and investment tax issues.

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

Are Political Donations Tax Deductible What You Should Know

To put it another way, financial donations to political campaigns are not tax deductible. Donations to political campaigns, political parties, and other organizations that have an impact on the political landscape are actively promoted among American citizens. However, when it comes time to pay taxes, there is a good chance that many people may not have a complete understanding of what constitutes a tax deduction.

You may be reading this because you intend to vote for your preferred candidate and are curious about whether or not the money you give to political campaigns is tax-deductible. Well then, you are definitely in the right place.

Despite the possibility that your political donations would not reduce your tax liability, it is still beneficial to have a sophisticated awareness of the other areas of your donations and spending in which you might gain tax deductions.

Don’t Miss: When Do You File Tax Returns

What About Volunteer Time And Out

Time spent and expenses incurred volunteering for a political campaign are also not deductible. This includes things like supplies and transportation to and from campaign events. IRS regulations make it clear that neither volunteer time nor out-of-pocket expenses donated to political candidates and parties can be deducted from gross income for income tax-filing purposes.

What Is Considered A Political Contribution

Contributions are the most common source of campaign support. A contribution is anything of value given, loaned or advanced to influence a federal election. … Contributions count toward the threshold that determines whether an individual has qualified as a candidate under the Federal Election Campaign Act .

Read Also: How Many Undocumented Immigrants Pay Taxes

Are Political Contributions Tax

Simply put, political contributions are not tax-deductible. Americans are encouraged to donate to political campaigns, political parties and other groups that influence the political landscape. When it comes time to file taxes, though, many people may not fully understand what qualifies as a tax deduction. So if you support your favorite candidate, you might be wondering if your political contributions are tax-deductible. Though your political contributions may not lower your tax liability, it pays to have a nuanced understanding of where else in your donations and spending you can secure tax deductions.

Do you have complex tax planning questions? Speak with a financial advisor today.

Individual Donations To Political Campaigns

Although political contributions are not tax-deductible, there is always a limit to the amount that can be contributed to a political campaign. Individuals can contribute up to $2,800 per election to the campaign committee up to $5,000 per year for PAC and up to $10,000 per year for local or district party committees.

If someone donates to the national commission they can donate up to $35,000 per year. Also, the Federal Election Commission sets this limit and if someone exceeds this donation, the campaign committees cannot use the funds.

The word donation itself can be misleading because only certain donations are actually tax-deductible. So, the question arises, Are donations to political campaigns tax-deductible? In general, deductible charitable donations are those made to organizations that are tax-exempt under section 501 of the Internal Revenue Code. It is especially forbidden for organizations of this type to try to influence legislation or participate in political campaigns. Therefore, political campaigns or parties will never be included in article 501. Then, political contributions cannot be considered as tax-deductible charitable contributions.

Don’t Miss: How Do I Pay Estimated Quarterly Taxes

Political Campaigns From National Down To Local Rely On Contributions To Operate So You Might Feel That You Deserve A Tax Break When You Support The Democratic Process By Making A Campaign Contribution

But the federal tax code doesnt allow you to take a deduction for any political donations you make. And the same is true for most states that have a state-level personal income tax.

Lets look at why political contributions are largely nondeductible, and some alternative deductions that you might be able to take instead to help reduce your tax bill.

Political Contributions Tax Credit

The Political Contributions Tax Credit is a non-refundable tax credit on contributions made to registered political parties, registered district associations or registered non-affiliated candidates, as defined under the Elections Act, 1991, of Newfoundland and Labrador.

The Political Contribution Tax Credit is equal to the lesser of $500 or the sum of

- 75% of the total contribution amount if the total amount does not exceed $100

- $75 plus 50% of the contribution amount by which the total amount exceeds $100 if the total amount exceeds $100 and does not exceed $550 or

- $300 plus 33 1/3% of the contribution amount by which the total amount exceeds $550 if the total amount exceeds $550

Official receipts for political contributions must accompany the corporations T2 Corporation Income Tax Return.

For more information on the Political Contributions Tax Credit, please refer to Section 47 of the Income Tax Act, 2000.

The Canada Revenue Agency can answer your corporate income tax questions. You can contact them at 1-800-959-5525.

Also Check: Is Real Estate Tax The Same As Property Tax